- Solana ETFs could attract little demand from U.S. investors, per Sygnum’s exec.

- However, Syncracy Capital’s co-founder claimed that Solana could break out through DePIN.

U.S. spot Solana [SOL] ETFs might not see significant flows if approved, according to a crypto bank Sygnum executive.

Sygnum’s Head of Research, Katalin Tischhauser, recently told Cointelegraph that the flows would be ‘minuscule’, citing Grayscale’s low AUMs (assets under management) from SOL trust GSOL.

She added,

“The small AUM reflects the relative name recognition of Solana versus Bitcoin,”

Solana ETF flow outlook

At the time of writing, GSOL’s AUM was $67 million, which was way too little compared to GBTC’s nearly $30 billion before the ETF conversion in January.

Per Tischhauser, this demonstrated a likely weak demand for future SOL ETFs from U.S. investors.

The outlook comes weeks after asset managers like VanEck, Franklin Templeton, and 21Shares filed a U.S. spot SOL ETF application with the SEC (Securities and Exchange Commission).

However, BlackRock recently stated it would not apply for the SOL ETF, citing a lack of client demand in the near term.

Interestingly, Tishchhauser’s flow projections mirror Bloomberg ETF analyst Eric Balchunas’s ETH ETF outlook before they went live on the 23rd of July.

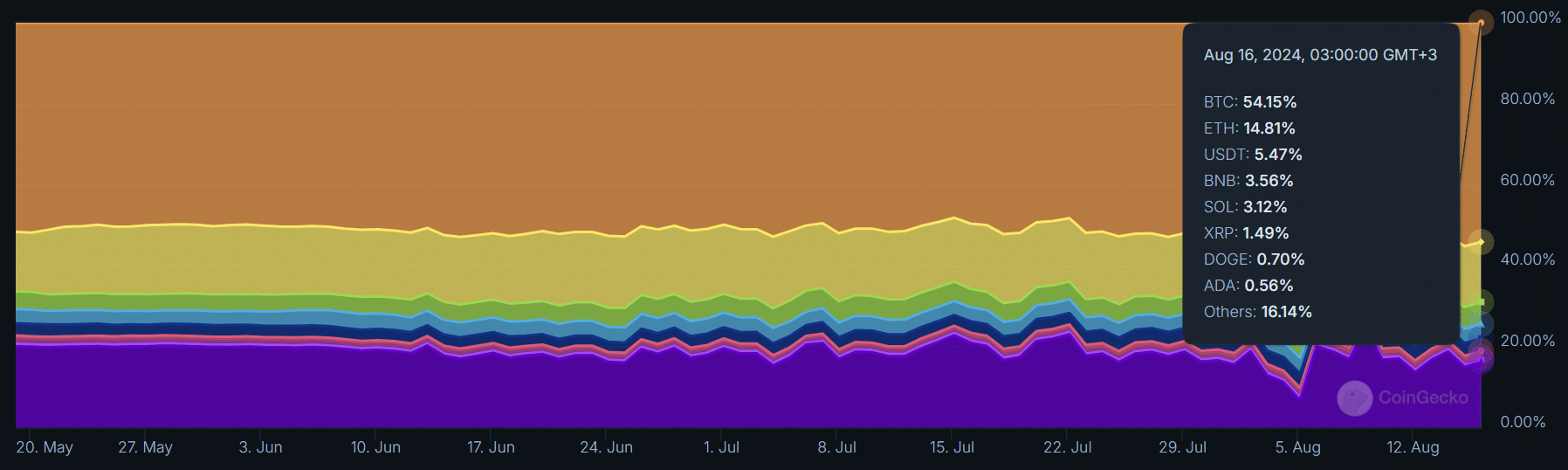

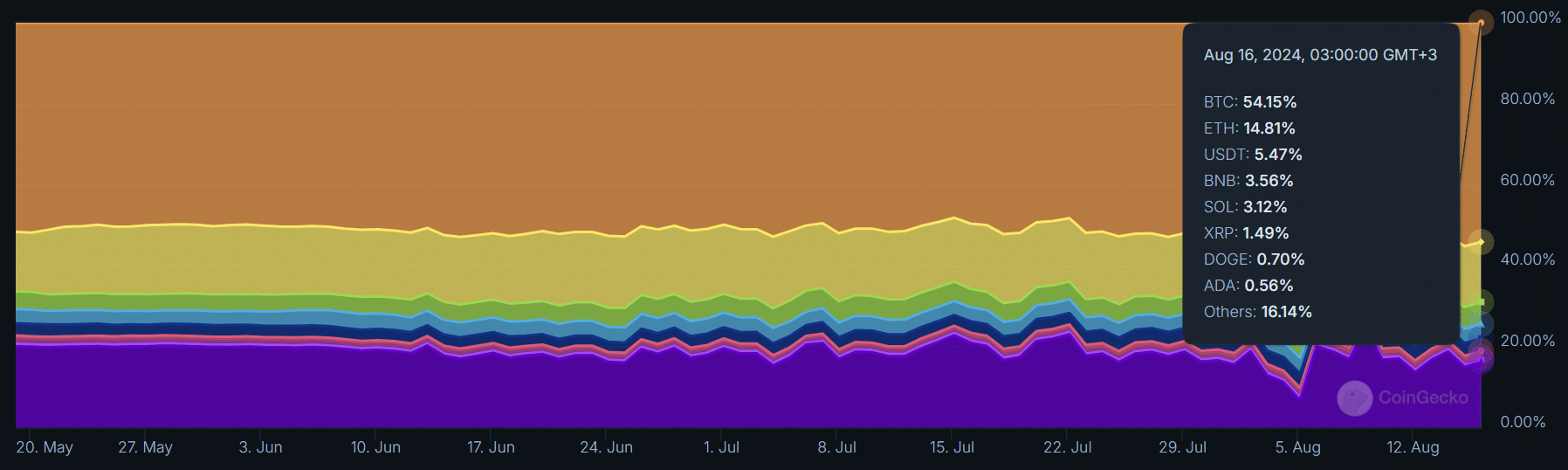

Balchunas estimated that the flows could follow the asset’s dominance based on market cap.

As a result, he projected 15%- 20% equivalent BTC ETF flows for day 1. ETH’s dominance was around 15% back then. However, the ETH ETF’s performance on its debut date was slightly higher, beating the estimates.

At the time of writing, SOL’s market dominance stood at 3.12%, per CoinGecko data.

Source: Coingecko

This meant that, as Tischhauser stated, it could see fewer flows for its ETF products if the trend followed market dominance and AUM.

Will Solana’s DePIN change the odds?

However, Ryan Watkins, co-founder of crypto hedge fund Syncracy Capital and former Messari Crypto analyst, believed SOL could see its breakout moment from DePIN (Decentralized Physical Infrastructure Network).

‘Starting to believe Solana will have a breakout moment with DePIN similar to what Ethereum had with DeFi in 2020.’

Watkins noted that DePIN could be the next segment with real-world adoption after stablecoins.

With remarkable traction from DePIN projects like Helium [HNT], Solana’s dominance in the segment could boost the network’s standing.

However, whether this would change U.S. investor sentiment towards SOL remains to be seen.

Leave a Reply