- Ethereum price mirrored Bitcoin, showing volatility, with recent staking inflows leading to price declines.

- Analysts predicted a potential rally for Ethereum, targeting a $3,000 price point amid market adjustments.

Ethereum [ETH], being the second-largest crypto by market cap, has continued to follow Bitcoin [BTC] closely in its struggles to achieve new highs. So far, Ethereum has declined 2.1% in the past week.

This decline appears to have extended to even the past day in which ETH dropped by a modest 0.2%— this price performance has now brought the asset to currently trade at a price of $2,619, at the time of writing.

Ethereum staking inflows soars

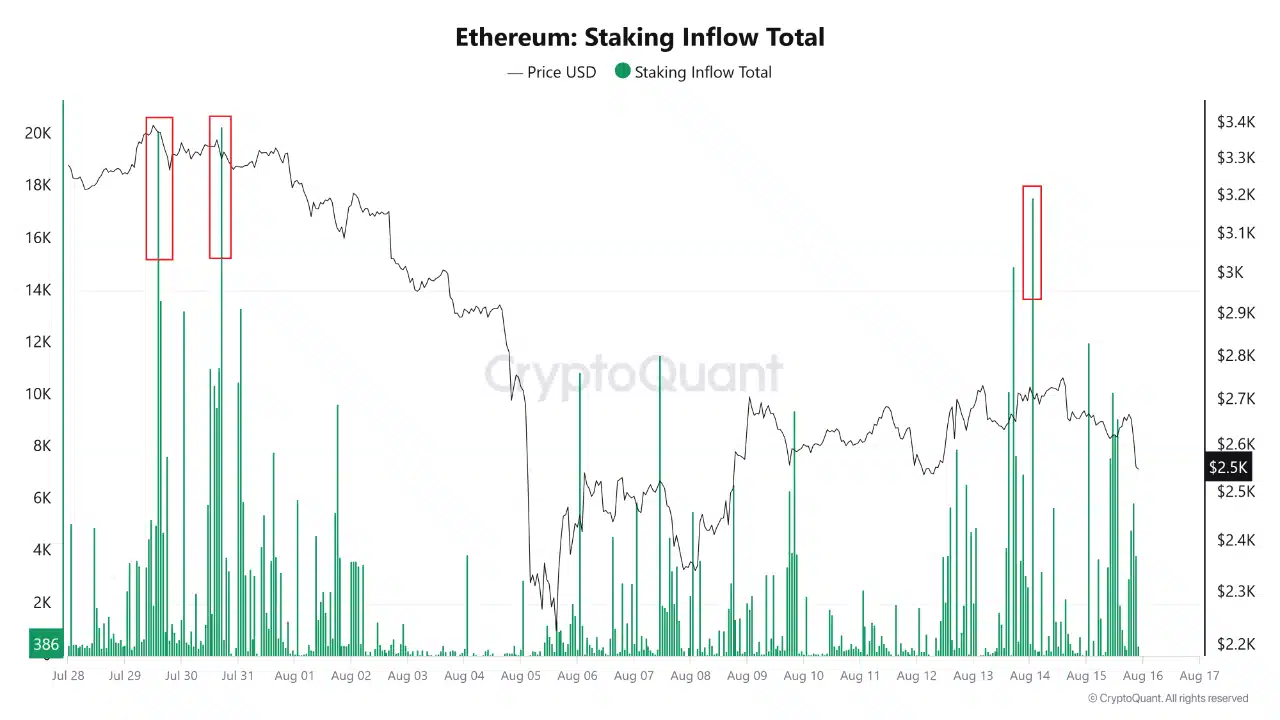

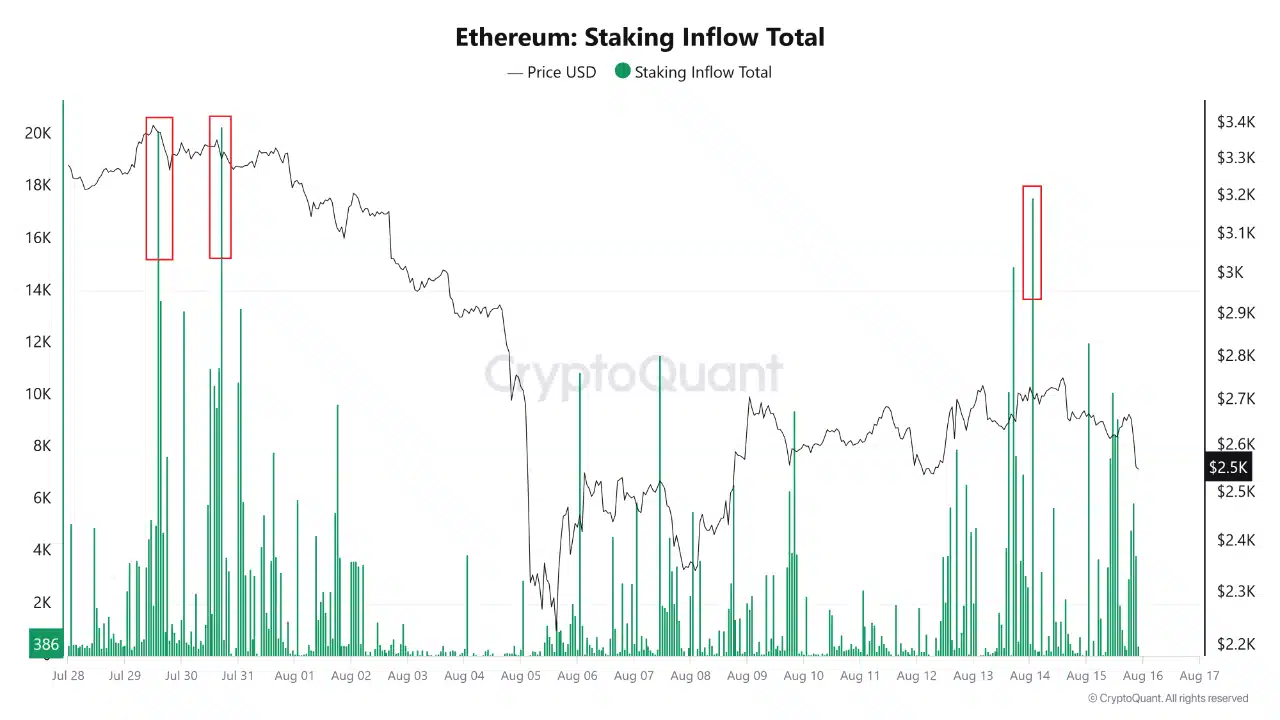

Ethereum has recently seen a surge in staking inflows, as reported by CryptoQuant, indicating a growing interest in securing the network through its Proof of Stake (PoS) mechanism.

This influx has pushed total staking volumes past 16,000 ETH. However, there appears to be a correlation between these inflows and subsequent price drops.

According to the CryptoQuant analyst reporting this surge in staking inflow, historical data from July and mid-August shows that significant increases in staked ETH often precede noticeable declines in Ethereum’s market price.

Source: CryptoQuant

These patterns suggested that while staking strengthened network security and stakeholder commitment, it also introduced short-term price volatility due to the locking up of liquidity.

Is a near-term surge to $3,000 still possible?

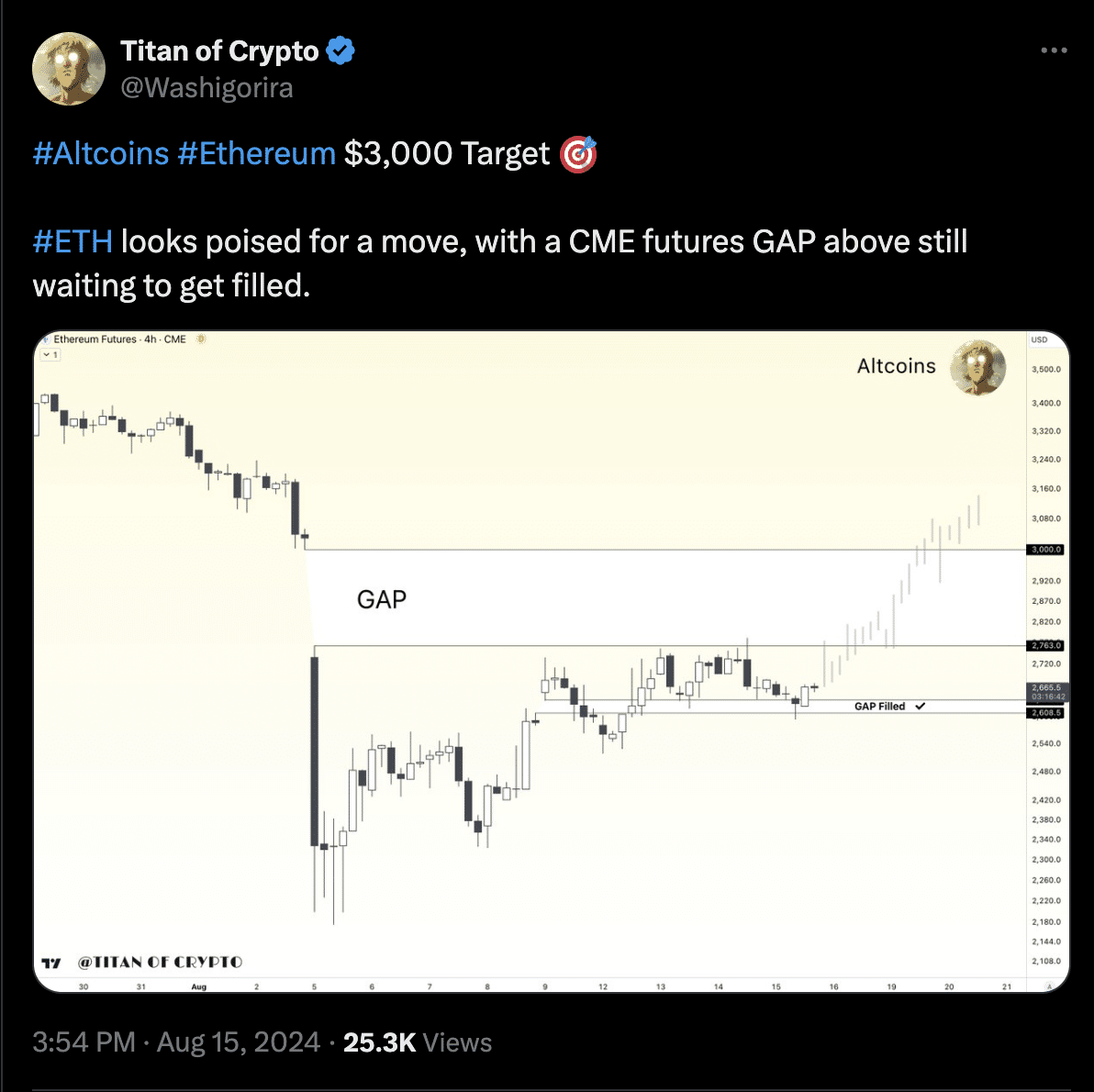

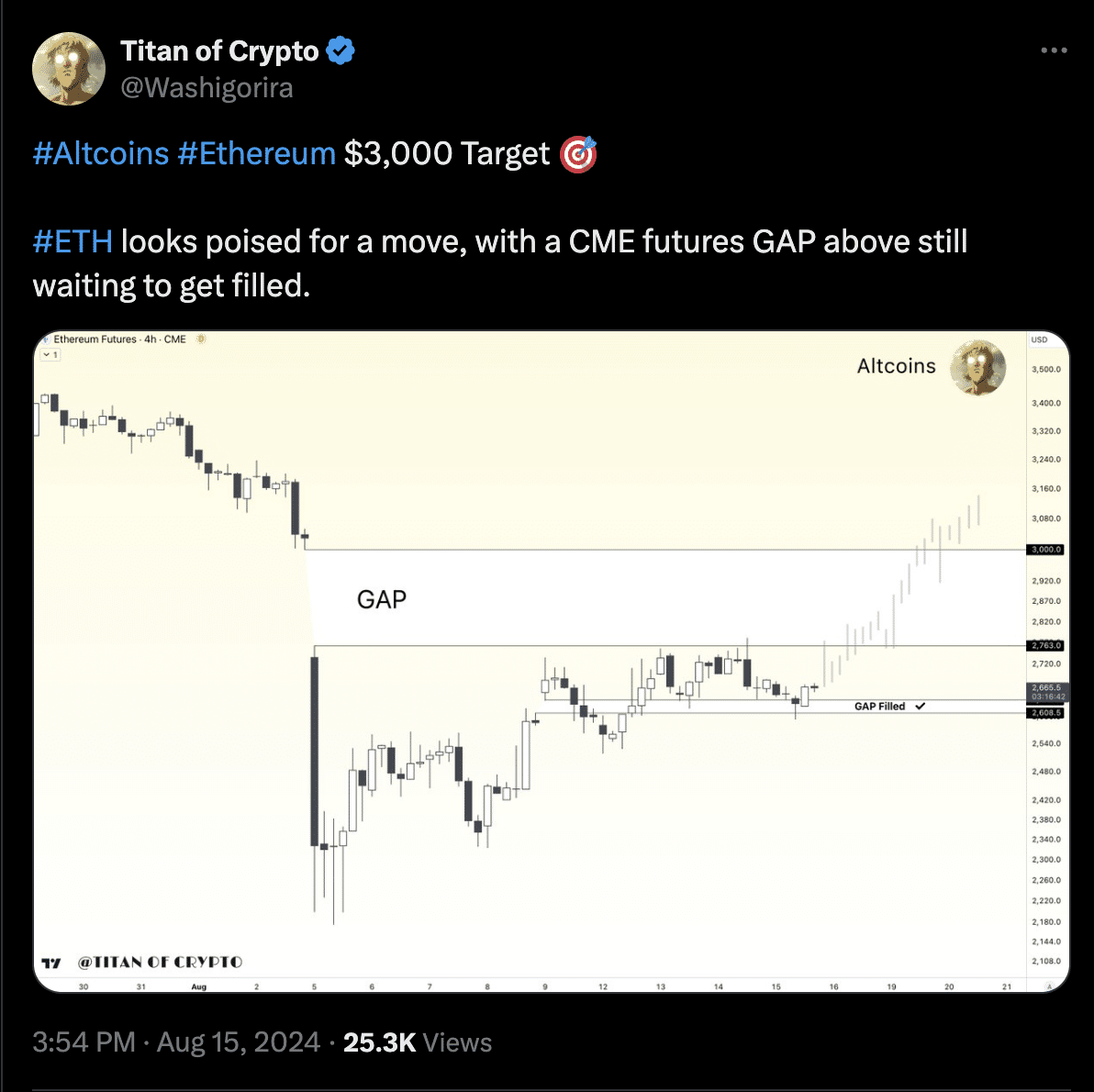

Meanwhile, some other analysts remained optimistic about Ethereum’s potential for recovery and growth.

A prominent crypto analyst, known on X (formerly Twitter) as “Titan of Crypto,” has projected a target price of $3,000 for Ethereum.

Source: Titan of Crypto/X

This prediction is partly based on the presence of an unfilled CME futures gap, which historically indicates a potential upward movement in price.

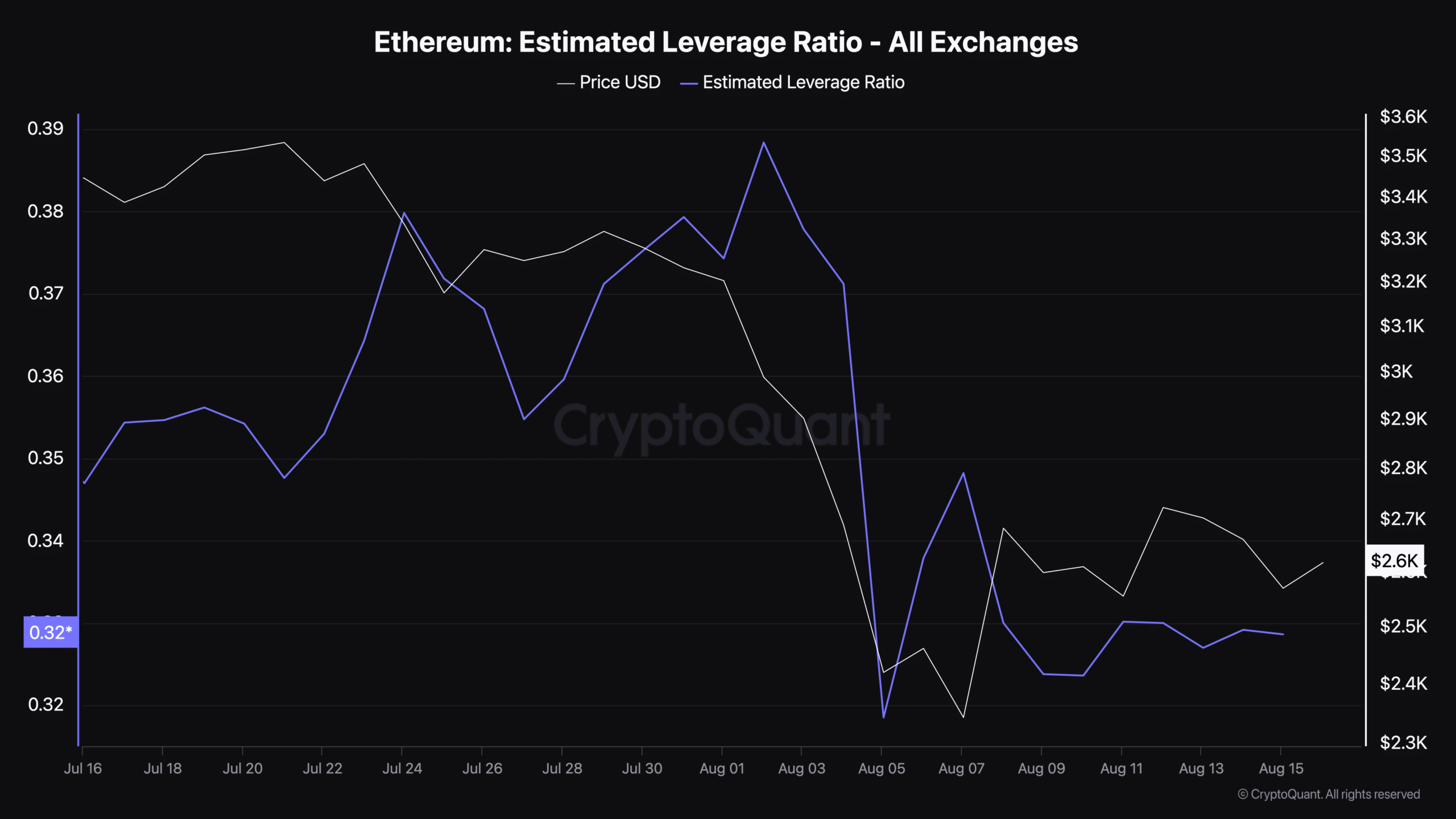

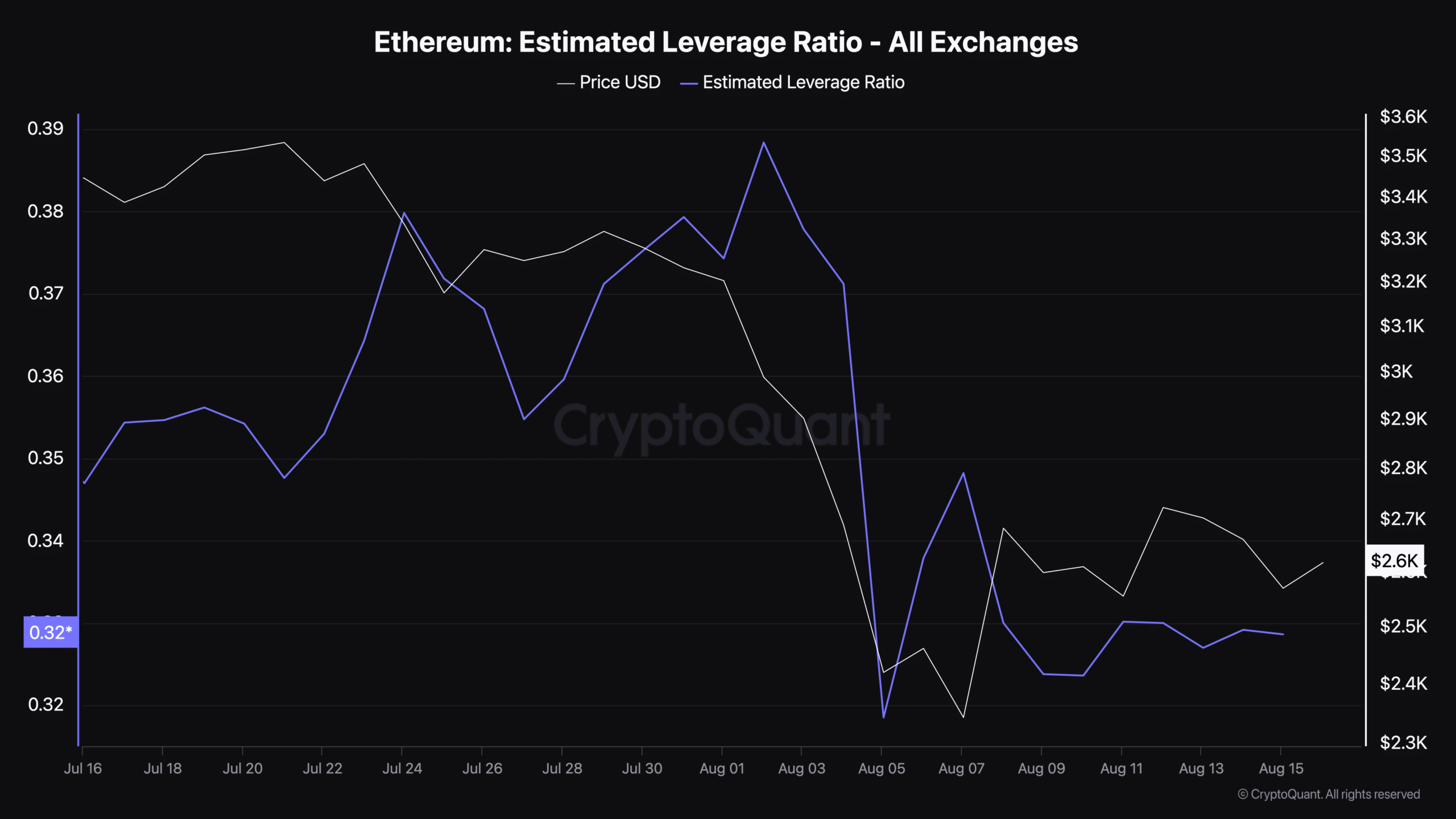

Moreover, Ethereum’s fundamental indicators, such as the estimated leverage ratio — at 0.328 at press time according to data from CryptoQuant — suggested a conservative yet stable market leverage situation.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024-25

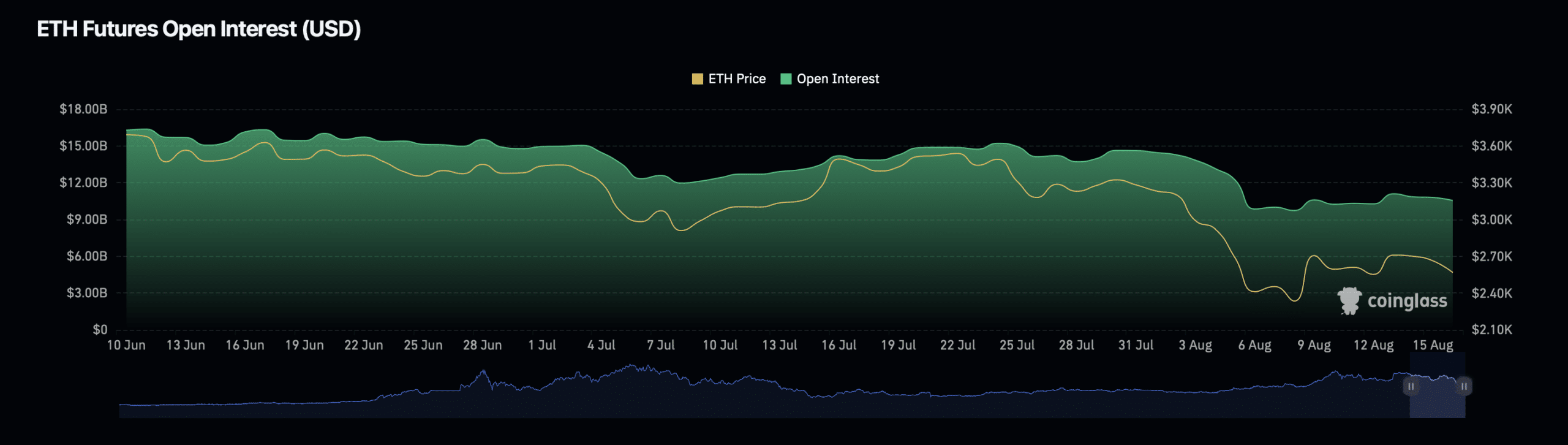

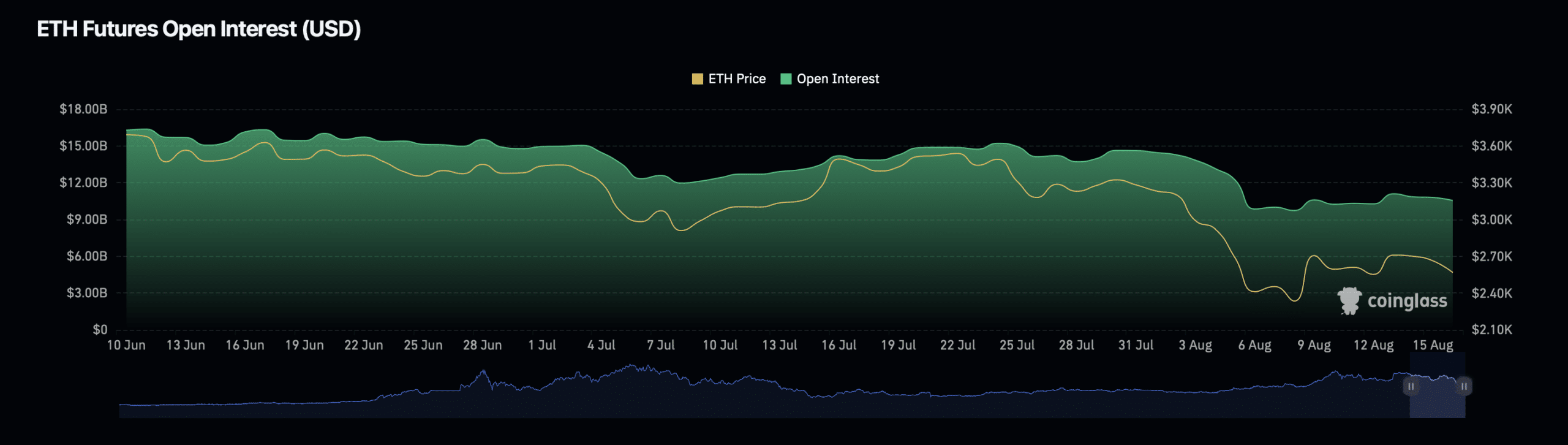

This ratio, when evaluated alongside the current decline in Ethereum’s Open Interest from Coinglass, hinted at a cautious market sentiment.

However, it also highlighted the room for bullish momentum should market conditions improve.

Source: Coinglass

Leave a Reply