- More institutions held and increased positions in the US spot BTC ETFs in Q2.

- Morgan Stanley and Goldman Sachs are now the top five holders of BlackRock’s IBIT.

Institutional investors’ appetite for US spot Bitcoin [BTC] ETFs hasn’t waned, despite the digital asset’s drawdowns and volatility in Q2.

According to Bitwise’s CIO Matt Hougan, the accumulation trend witnessed after the products debuted in Q1 remained ‘intact’ in Q2, with a 30% increase in holders.

“I count 1,924 holders ETF pairs across all 10 ETFs, up from 1,479 in Q1. That’s a 30% increase; not bad considering prices fell in Q2…Institutional investors continued to adopt bitcoin ETFs in Q2. The trend is intact.”

Institutions held BTC ETFs despite Q2 dump

Hougan also noted that 66% of professional investors who bought the products in Q1 either held or increased their holdings in Q2.

“Among Q1 filers, 44% increased their position in bitcoin ETFs in Q2, 22% held steady, 21% decreased their position, and 13% exited. That’s a pretty good result, on par with other ETFs.”

This went against the perceived notion that they would capitulate and dump upon any slightest volatility or plunge. For context, BTC plummeted 12% in Q2, dropping from $72K to $56K before closing above $60K.

As a result, the Bitwise exec called them ‘diamond’ hands for holding steady despite the headwinds.

Recent 13F filings also revealed that Goldman Sachs and Morgan Stanley were among the top five holders of BlockRock’s iShares Bitcoin Trust (IBIT).

As of the 30th of June, Goldman Sachs held $238.6M of IBIT, while Morgan Stanley held $187M.

It’s worth noting that Morgan Stanley and Goldman Sachs are part of the major wirehouses (large dealers), which were expected to drive the second wave of adoption for BTC ETFs from Q3 onwards.

Morgan Stanley has already begun recommending BTC ETFs to specific clients, which could drive further adoption.

The trend could also rally institutional investors’ contribution to the BTC ETF’s AUM (assets under management).

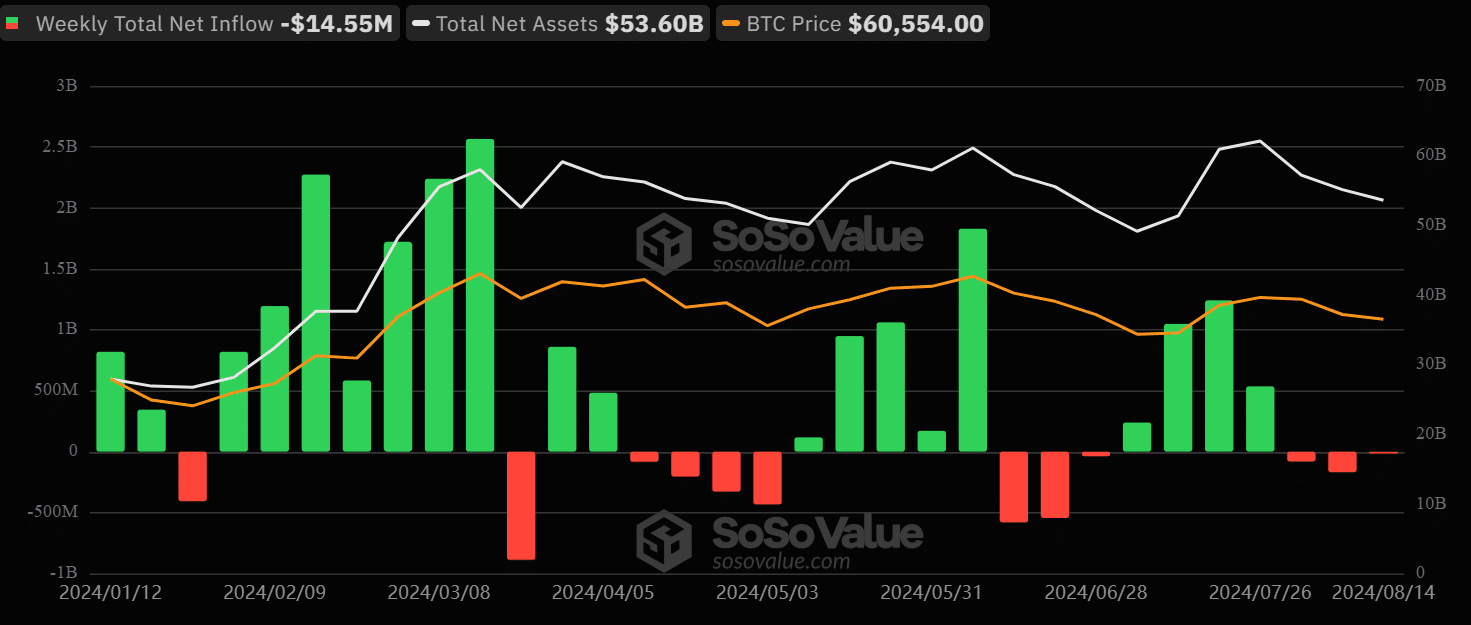

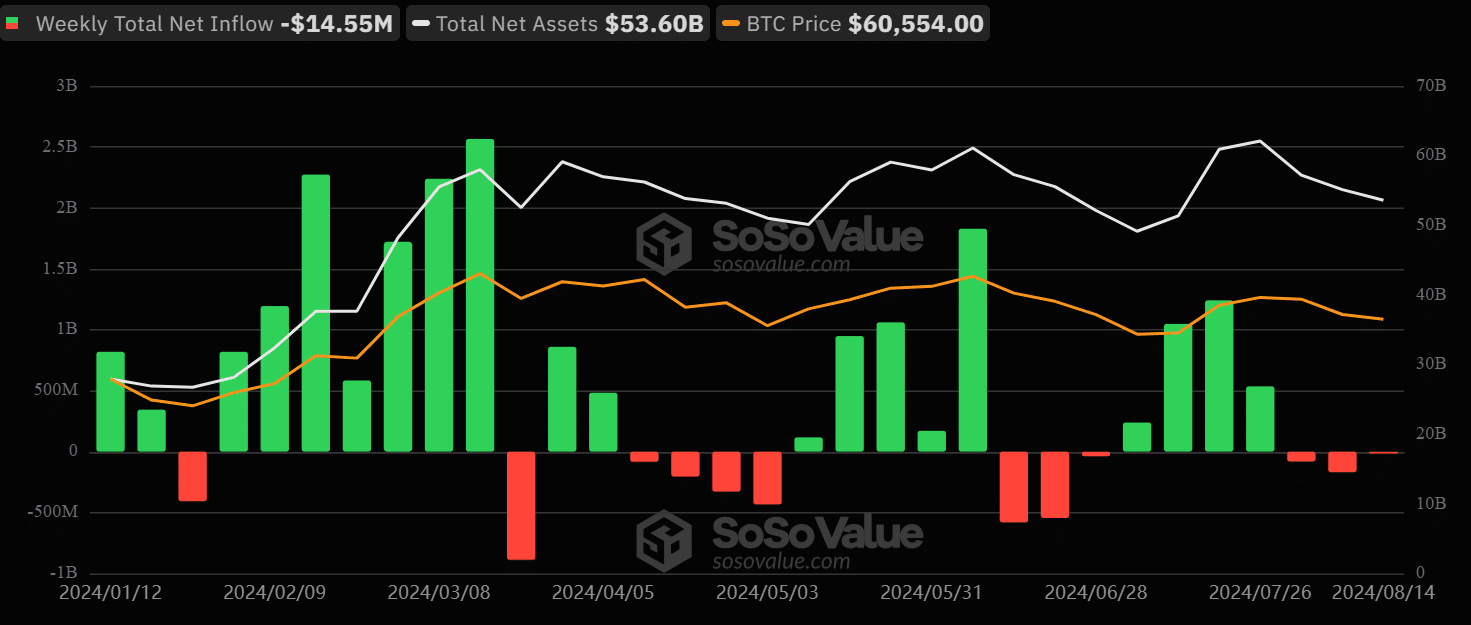

In Q1, institutions accounted for $3 — $5 billion (7%- 10%) of the BTC ETF’s total AUM, which stood at $50B then. At the time of writing, the total BTC ETF’s AUM was $53.6B.

Source: Soso Value

Interestingly, institutional investors’ accumulation of BTC ETF has picked momentum in Q3, too.

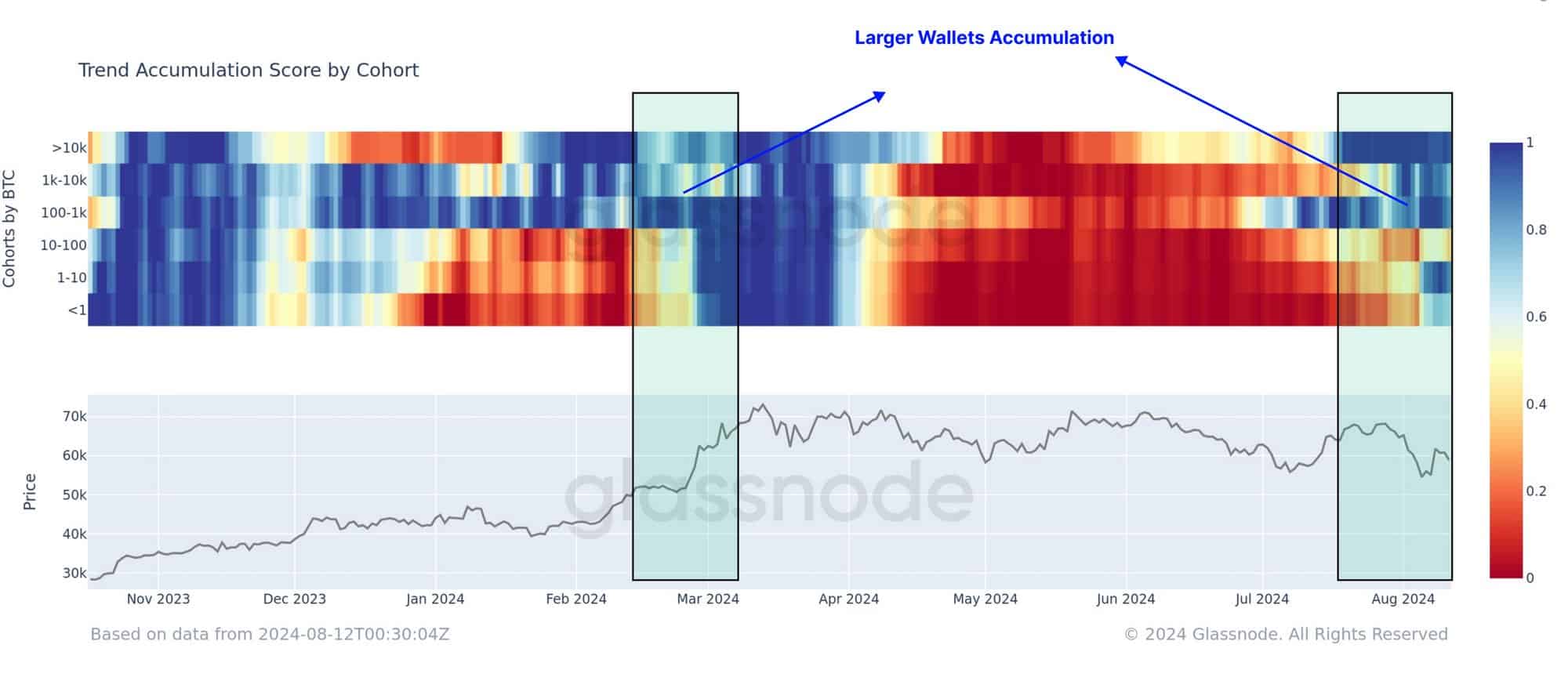

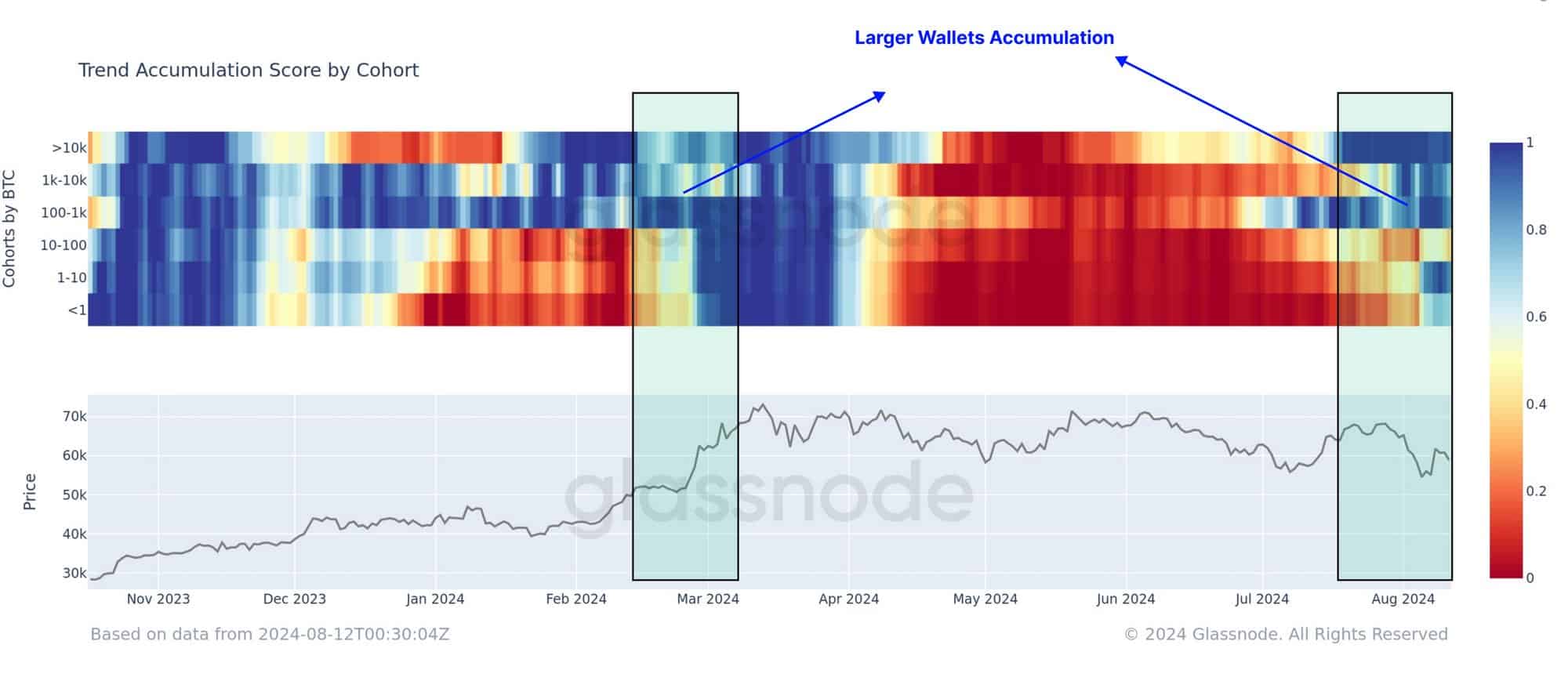

According to Glassnode data, major ETF wallets have ramped up accumulation, a trend witnessed in March that tipped BTC to hit an ATH of $73K.

“Recently, this trend (supply distribution) has shown signs of reversing, especially among the largest wallets, often linked to ETFs, which are now returning to accumulation.”

Source: Glassnode

Leave a Reply