- If NEAR overcomes selling pressure at its local resistance, it might set a trajectory towards $5.3.

- Market sentiment was bullish as NEAR showed positive reactions within a descending channel.

Near Protocol [NEAR] has demonstrated impressive market performance recently, with its price increasing by 11.51% to $4.28 over the last seven days.

Its trading volume followed suit, reaching $210 billion—a 4.21% increase.

This trend might not yet have peaked, as several factors could further advance NEAR’s price in the days ahead, according to our analysis at AMBCrypto.

NEAR is geared for a rally

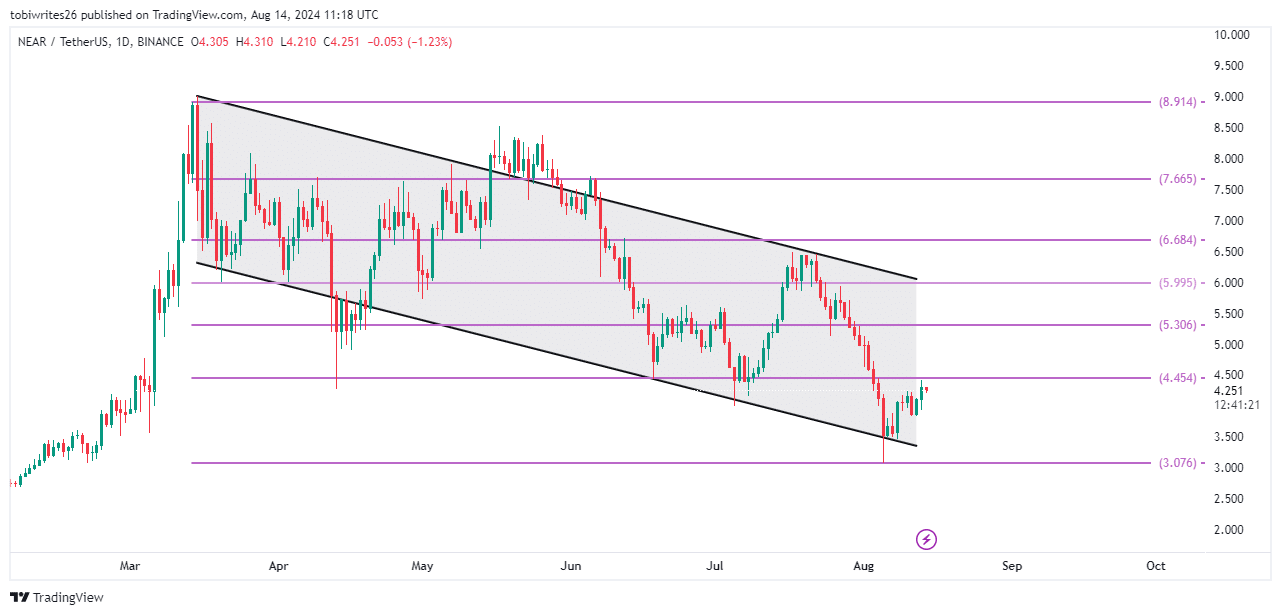

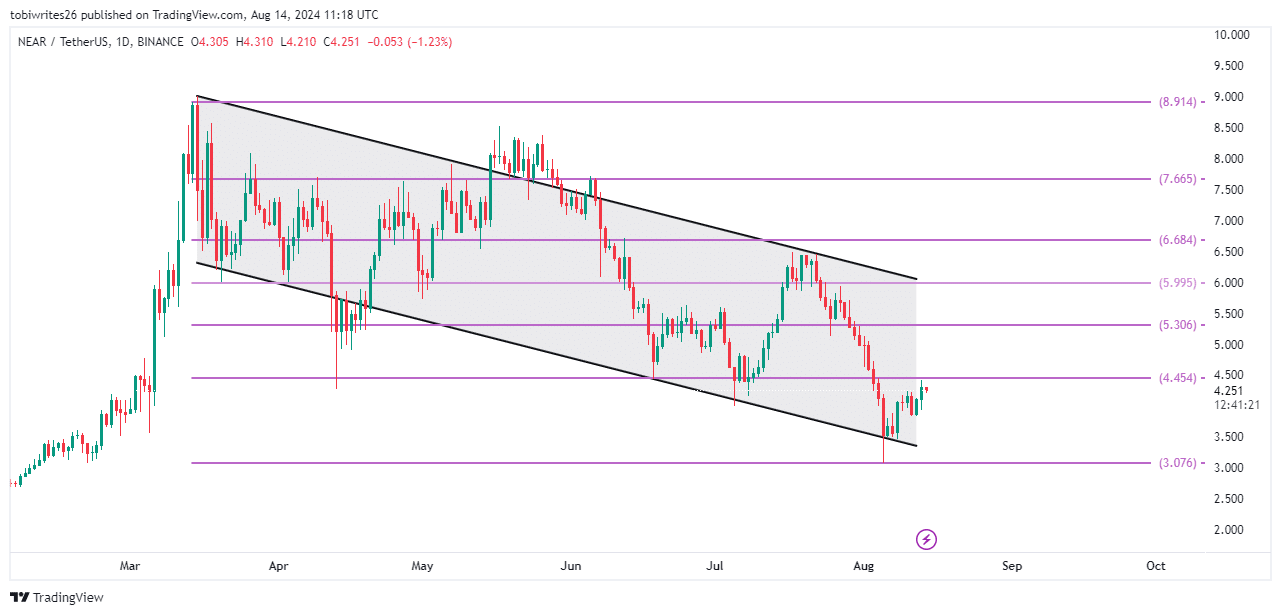

NEAR has been trading in a descending channel for weeks and may be close to breaking out. It recently rebounded from the channel’s lower boundary, prompting a rise in its trading price.

Source: Trading View

A descending channel is identified by parallel downward-sloping lines that connect lower highs and lower lows. When the price touches the lower line, as with NEAR, it often triggers a short-term rally.

NEAR’s potential rally is contingent on its ability to breach a resistance identified by the Fibonacci retracement line at $0.454.

Breaking this level could clear the path to $0.53, wherein lies notable selling pressure.

Should NEAR fail to breach the resistance at $0.454, we might see a further decline with the price forming a lower low.

However, the market is ripe for bullish action, indicating a strong presence of bulls ready to propel prices forward as shown by other indicators.

Bulls are gaining ground

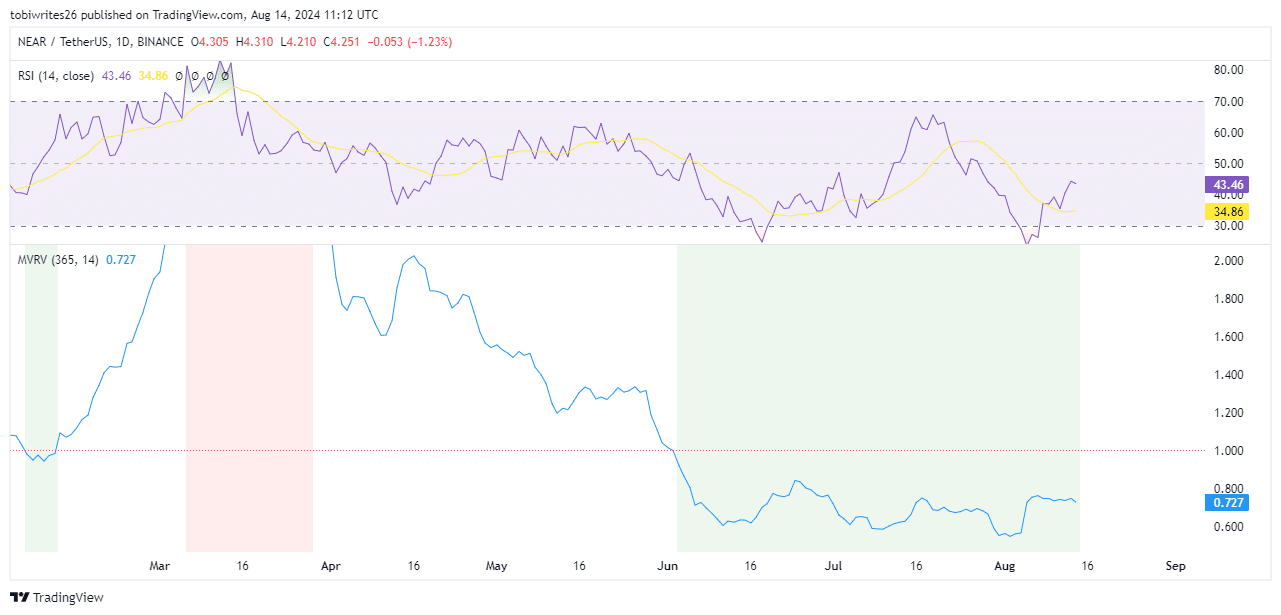

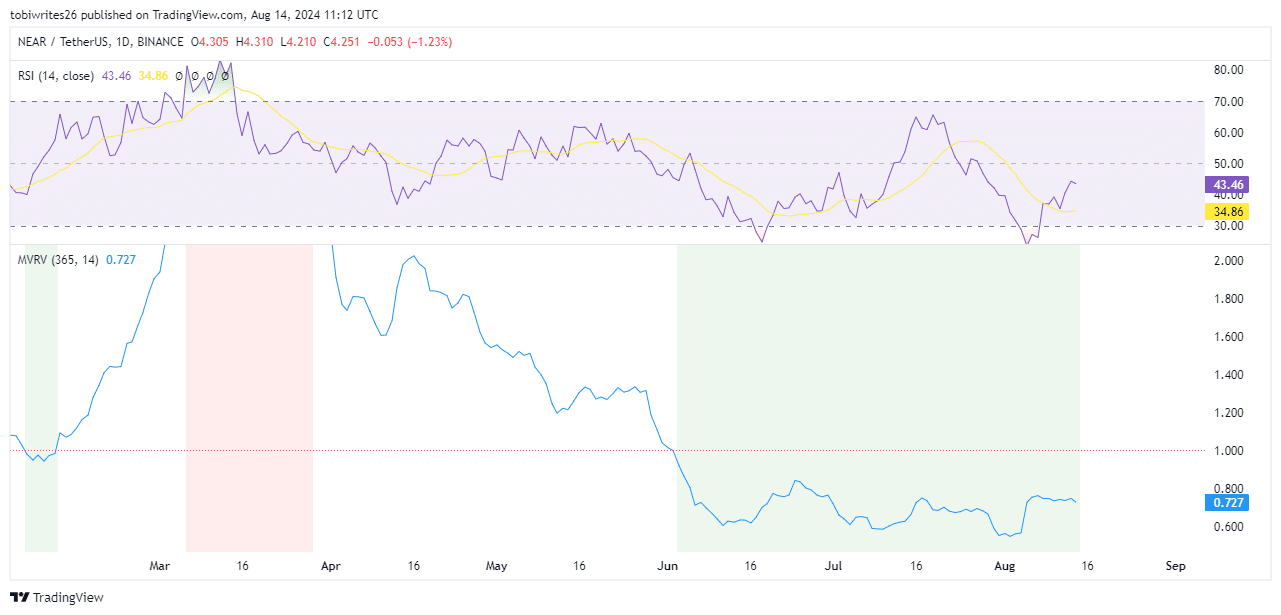

The Relative Strength Index (RSI) is a tool that identifies overbought conditions above 70 and oversold conditions below 30.

NEAR’s press time reading of 43.46 suggested that bullish momentum was building, potentially driving the price to the next major resistance level.

Source: TradingView

The Market Value to Realized Value (MVRV) ratio, which assesses whether an asset is overvalued or undervalued by comparing market capitalization to realized capitalization, stood at 0.727.

This indicated that NEAR was undervalued at press time, signaling a prime opportunity for bullish investments.

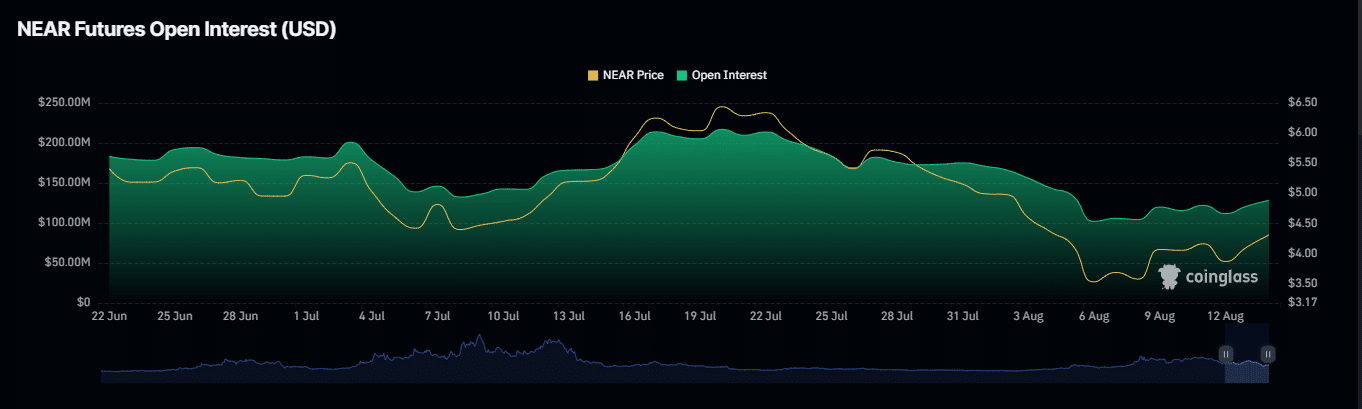

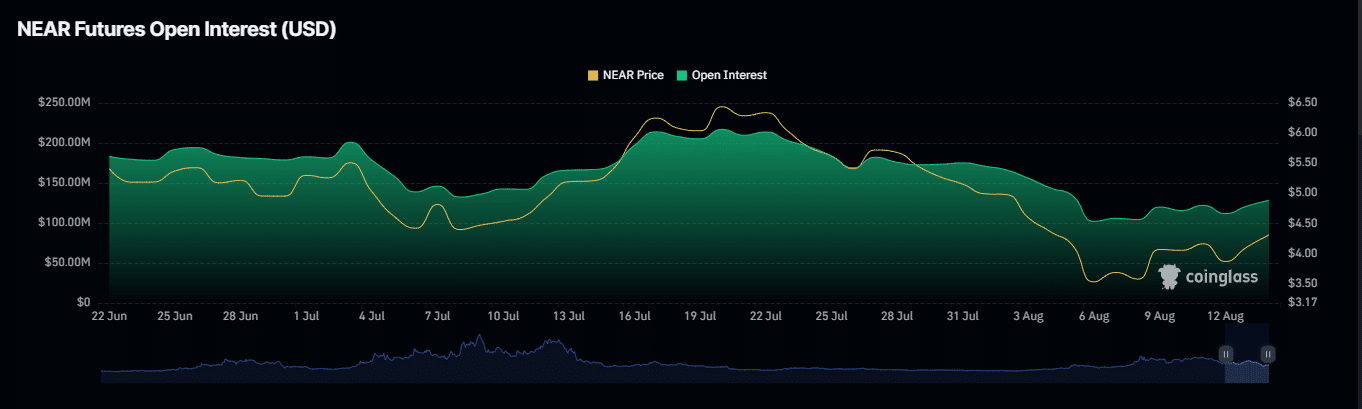

Increasing interest among bulls

NEAR has seen a substantial uptick in Open Interest, standing at $126.12 million at press time after a 7% increase, per Coinglass.

Source: Coinglass

Open interest, which measures the total number of unsettled derivative contracts such as Futures and Options, indicated market liquidity and investor sentiment by disclosing capital movements within the market.

Is your portfolio green? Check out the NEAR Profit Calculator

The consistent rise in Open Interest since its low on the 6th of August suggested high investor interest and a steady influx of capital. This trend was at its highest point at press time.

If this trend persists, it could significantly influence NEAR’s price, targeting the next resistance zone at $0.53.

Leave a Reply