- Thanks to the price rise, SEI’s social volume also increased.

- However, some metrics were bearish on the token.

SEI, like several other cryptos, have showcased commendable performance over the last week. Since the token did well, let’s have a closer look at its current state to find out its metrics and other factors for SEI’s price prediction.

How is SEI doing?

CoinMarketCap’s data revealed that SEI bulls bucked up last week as they pushed the token price up in double digits. To be precise, the token witnessed more than a 20% surge over the past seven days.

In the last 24 hours also, the bulls carried out their operation as the token’s value increased by nearly 5%. At the time of writing, SEI was trading at $0.2927 with a market capitalization of over $929 million, making it the 68th largest crypto.

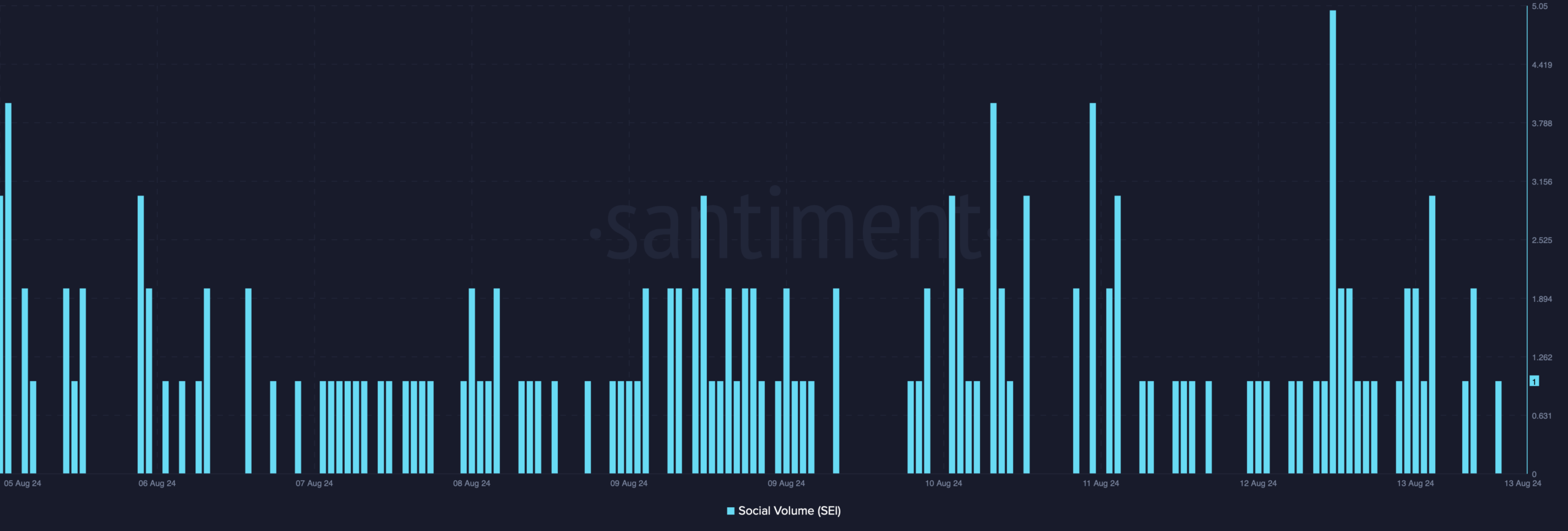

While the token gained bullish momentum, its social volume also increased. Rather, it spiked on the 12th of August, reflecting its popularity in the market.

Source: Santiment

SEI price prediction

Since the token has been performing well over the last week, AMBCryptoi planned to delve deeper into its state to find out the targets that investors could watch out for this week.

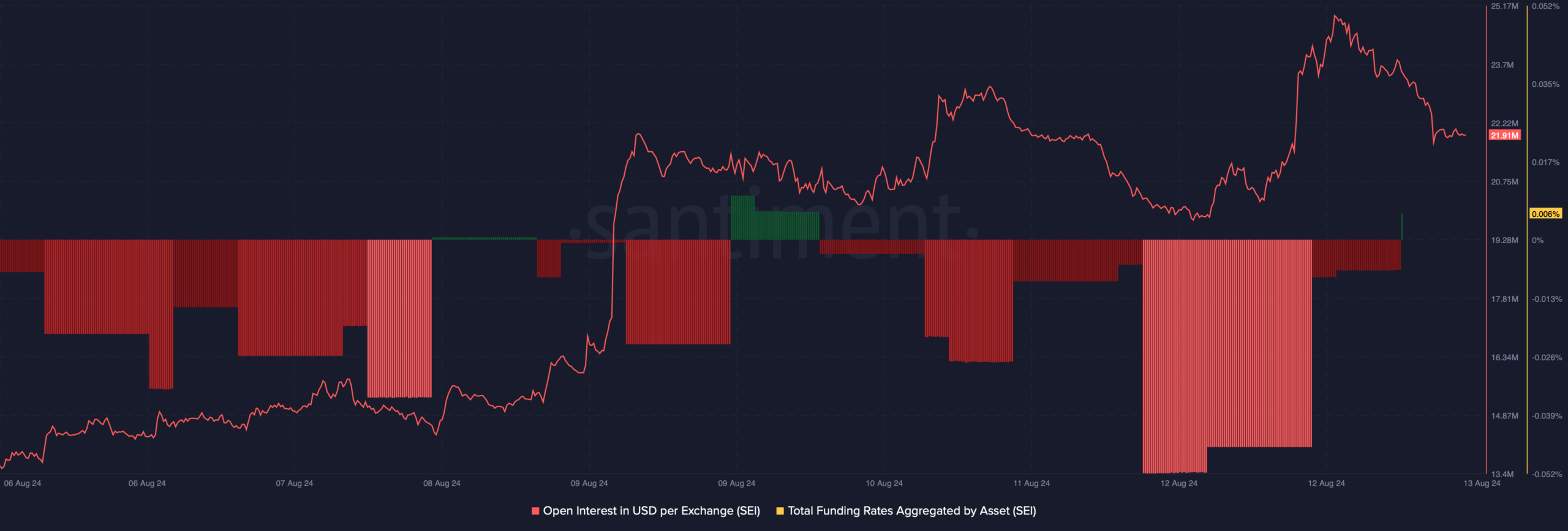

Our analysis of Santiment’s data revealed that the token’s open interest dropped while its price increased. A decline in the metric often indicated a trend reversal, which in this case was bearish.

Source: Santiment

However, its funding rate was red, which generally means a rise in price as values tend to move in the other direction than the metric.

Apart from that, AMBCrypto’s look at Coinglass’ data revealed yet another bearish signal. We found that its long/short ratio registered a sharp decline in the 4-hour timeframe, which can be inferred as a bearish signal.

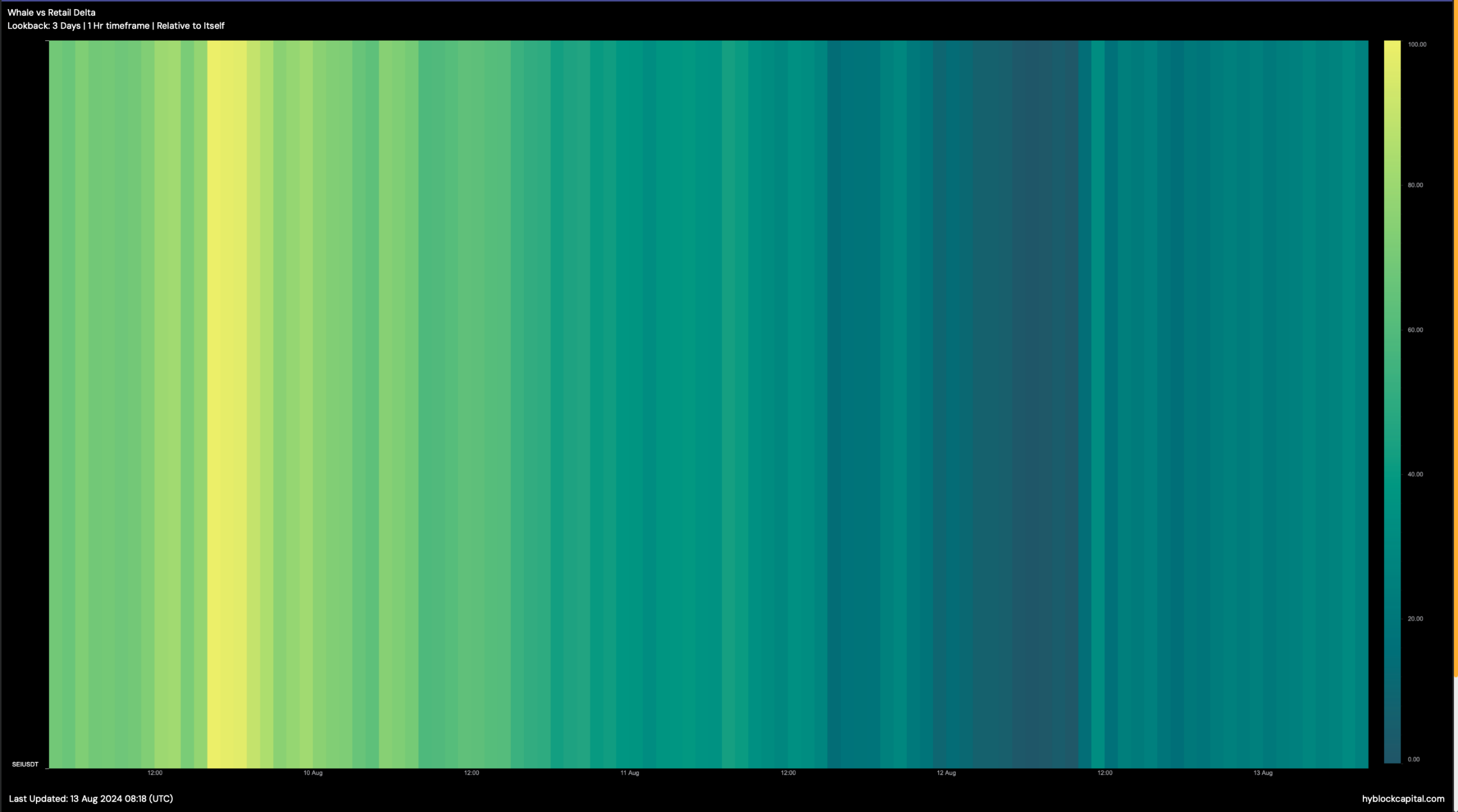

Notably, SEI’s whale vs retail delta had a value of nearly 25. This indicator ranges from -100 to 100, with 0 representing whales and retail positioned exactly the same.

A value closer to 100 represents that whales were active. Therefore, since the number was 25, it indicated that retail investors were slightly less dominant in the market compared to the whales.

Source: Hyblock Capital

Realistic or not, here’s SEI’s market cap in BTC terms

We then checked its daily chart to better understand price targets for this week. We found that SEI was testing its $0.3 resistance level. In case of a bullish breakout, the token might soon touch $0.39.

A further northward movement would allow it to eye at $0.5. However, if the bears take over, then the token might plummet to $0.22 this week.

Source: TradingView

Leave a Reply