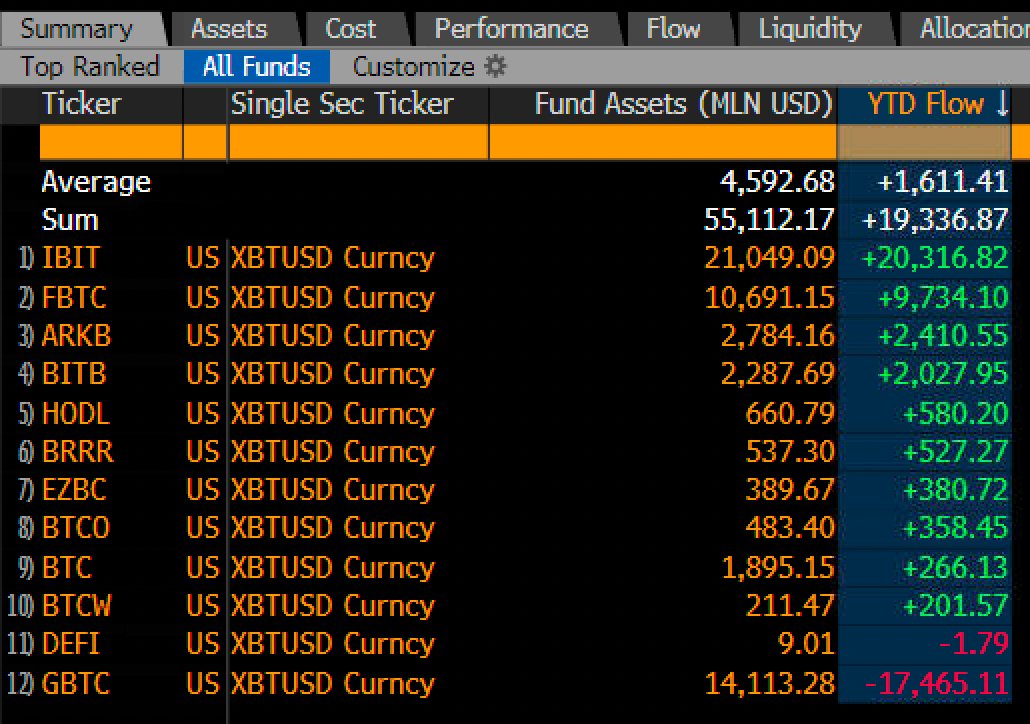

Spot Bitcoin (BTC) exchange-traded funds have witnessed more than $19.3 billion of net inflows this year, according to Eric Balchunas, a Bloomberg ETF analyst.

Balchunas tells his 319,100 followers on the social media platform X that the number is “surprisingly strong” and argues that it is the most important bellwether of success given Grayscale’s GBTC unlock and net price movement.

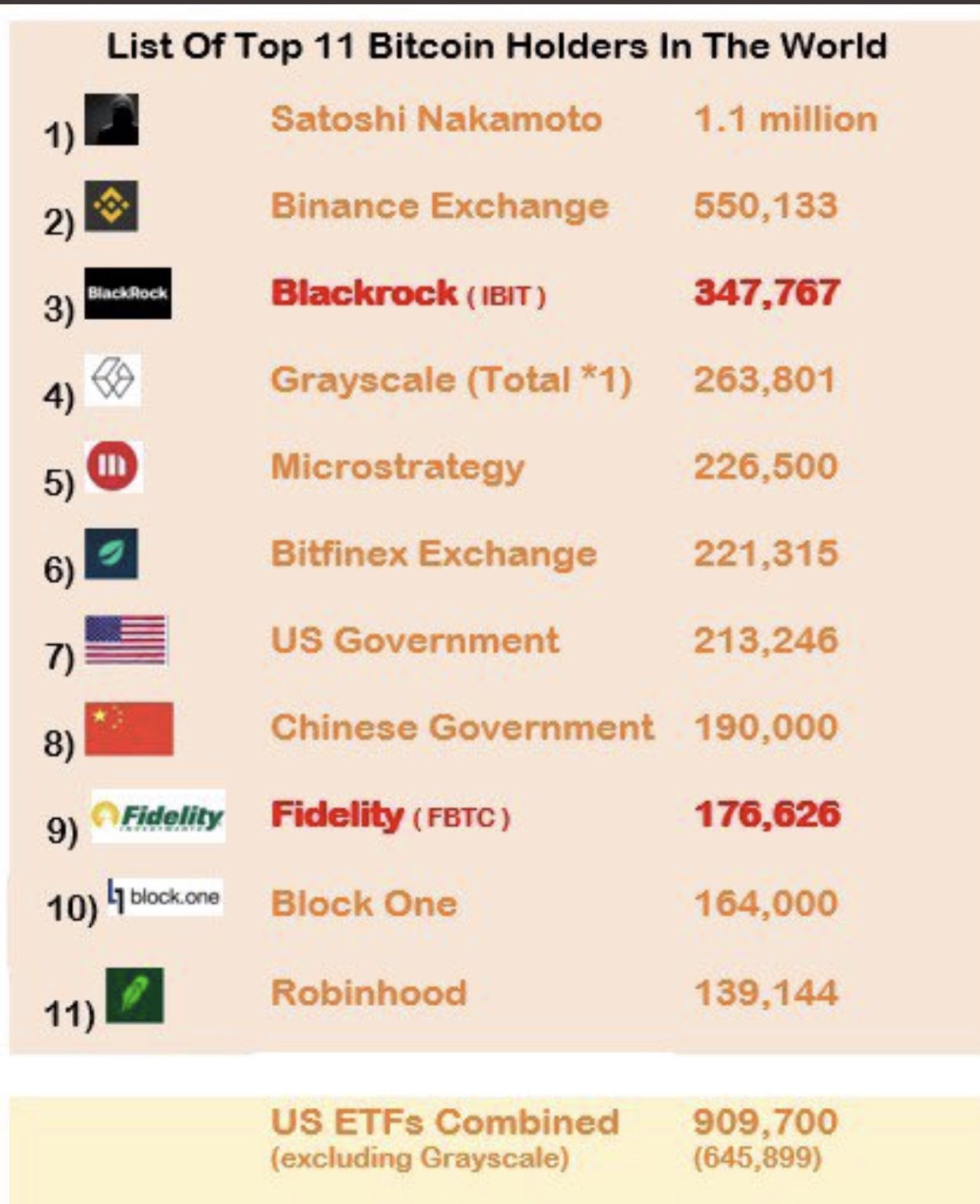

Balchunas also notes US ETFs are on pace to pace Satoshi Nakamoto, Bitcoin’s pseudonymous creator, as the top holders of BTC.

“BlackRock alone is already #3 and on pace to be #1 late next year, and will likely stay there for a very long time.”

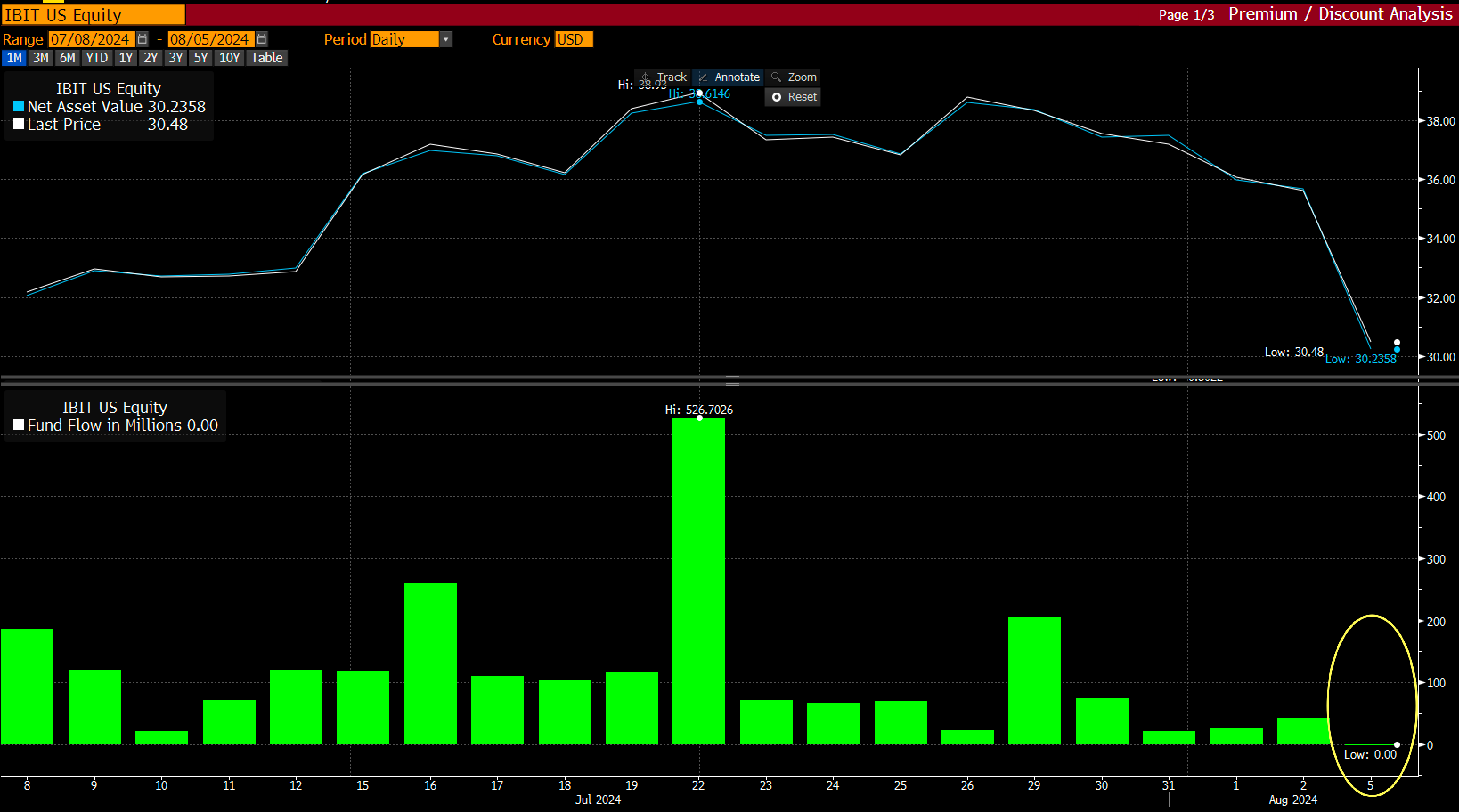

The Bloomberg analyst also argues that ETF holders offer the top crypto asset some stability in the face of volatility.

“So IBIT investors woke up on Monday to a -14% move over the weekend after stomaching an 8% decline the week prior and what did they do? ABSOLUTELY NOTHING. $0 flows. Compared to some of these degens these boomers are like the Rock of Gibraltar. You guys are so lucky to have them.”

IBIT is BlackRock’s iShares Bitcoin Trust.

BTC is trading at $60,719 at time of writing. The top-ranked crypto asset by market cap is up more than 1.5% in the past 24 hours and more than 8% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3

Leave a Reply