- CANTO was outperforming the broader market at press time.

- The recent outage on the Canto blockchain sparked concerns.

CANTO was up 40% despite a series of outages that have rocked the network in the last few days. The chain went down on Sunday, the 11th of August, but developers later deployed a fix that brought it back online for around 90 minutes before halting again.

Per Canto Explorer, the last block production happened on 12th August at 14:02 UTC. The developers attributed the outage to “unforeseen secondary effects” caused by a recent network upgrade.

The team announced that block production will resume on 13th August once a new patch is deployed.

While such network outages tend to hurt prices, CANTO is witnessing a major rebound. The token is one of the top performers in the market in the last 24 hours amid rising interest and high volumes

What’s driving the rally?

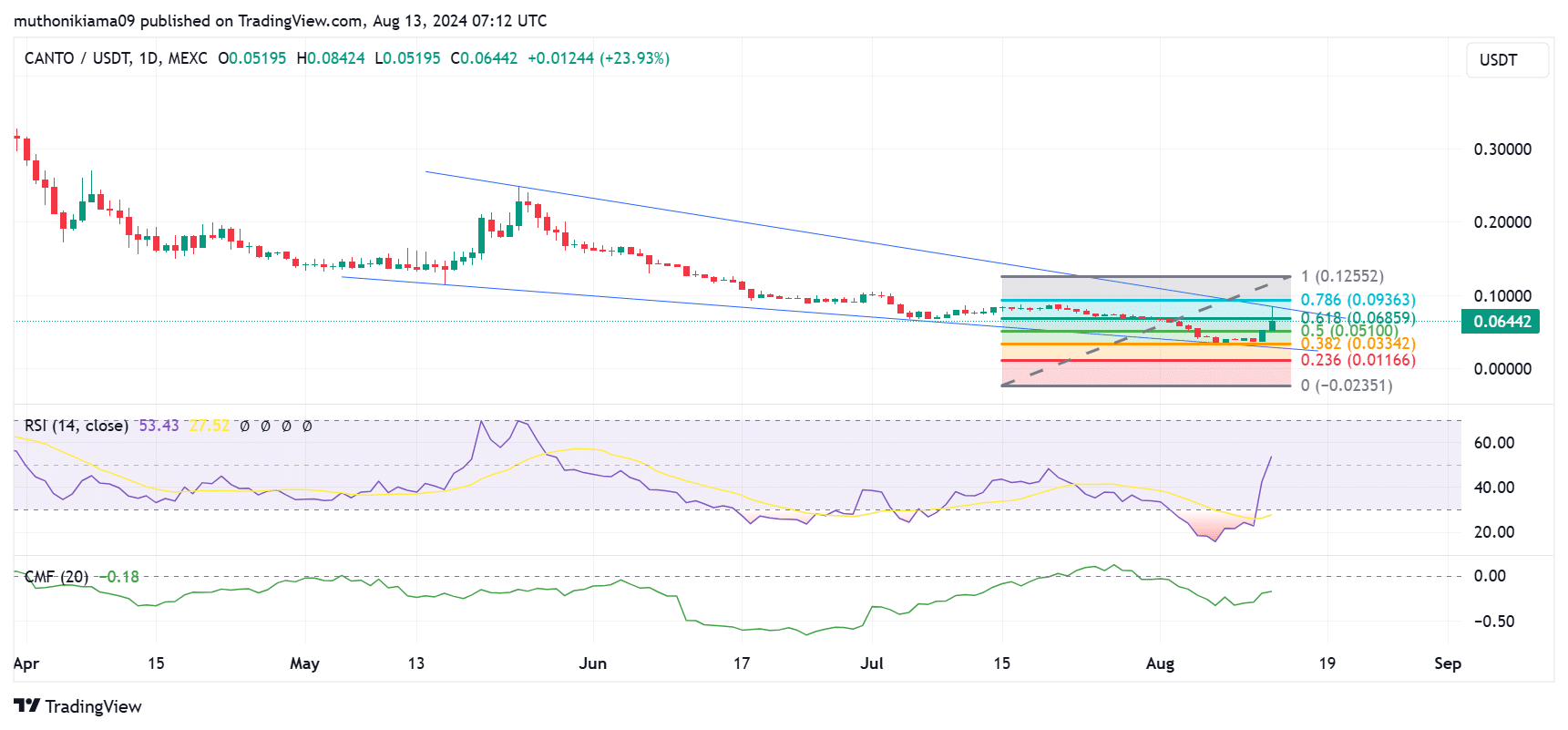

CANTO was trading at $0.064 at the time of writing after registering an over 40% gain. Data from CoinMarketCap showed that trading volumes have increased by 87%, likely driven by high buying pressure.

The Relative Strength Index (RSI) line was tipping north, showing a rise in buying momentum as the market becomes more bullish. The RSI crossing above the signal line further portrayed a buying signal.

The Chaikin Money Flow (CMF) has been making higher lows despite being in negative territory. This indicates that buying pressure is beginning to outweigh the selling pressure. However, buyers need to provide more support to sustain the uptrend.

Source: Tradingview

The formation of the falling wedge pattern further suggests the continuation of the uptrend as prices recover from the recent pullback that saw the price plunge to $0.036 on August 12.

If the price breaks out above the upper trendline of the falling wedge, CANTO will target the 1 Fib level ($0.12). Conversely, if the uptrend fails, the token will likely drop to the 0.236 Fib level ($0.0116).

Community raises concerns

Helius Labs CEO, Mert Mumtaz, has called out the Canto network team over the lack of community engagement.

“[I don’t care] if you go down but you have a duty to the people holding funds on your chain to keep them informed,” he stated.

Analyst Marty Party on X also noted that the network has been witnessing a slump in on-chain activity, posing a significant challenge to its future growth.

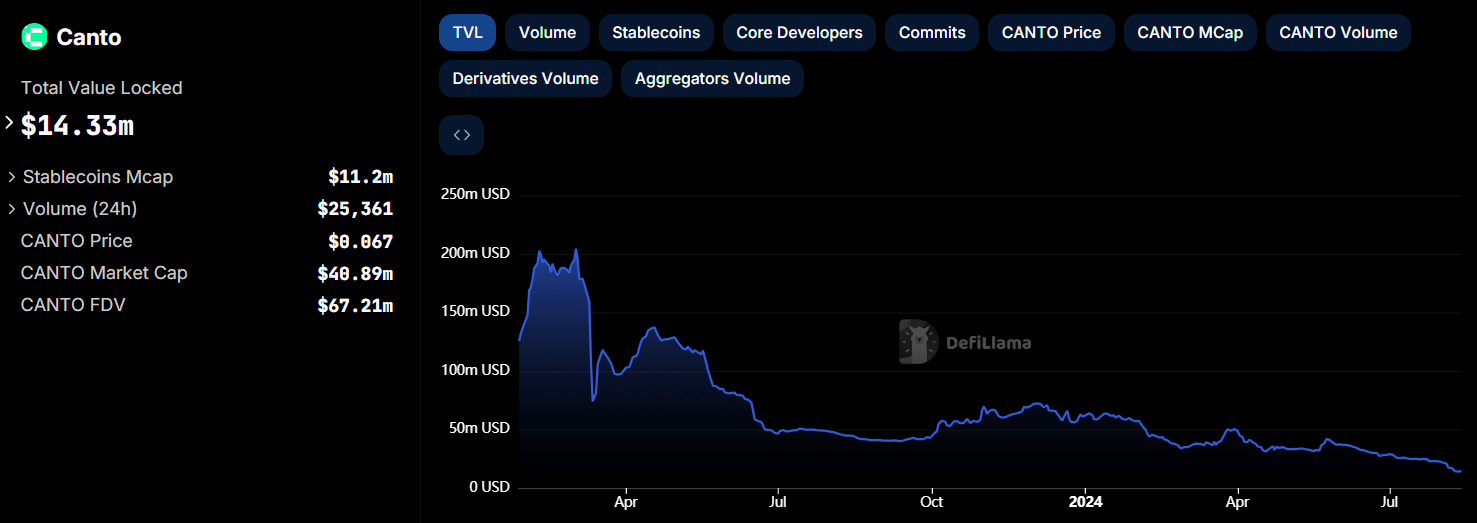

Data from DeFiLlama shows that the network’s Total Value Locked (TVL) has dropped from over $200 million in March last year to $14 million. The declining TVL points towards reduced demand and confidence in the project.

Source: DeFiLlama

Leave a Reply