In the ongoing volatile cryptocurrency market, traders have liquidated a significant $205.86 million worth of short and long positions within just 24 hours. This likely occurred as Bitcoin the world’s biggest cryptocurrency, experienced significant price fluctuation between $60,500 and $58,000 level.

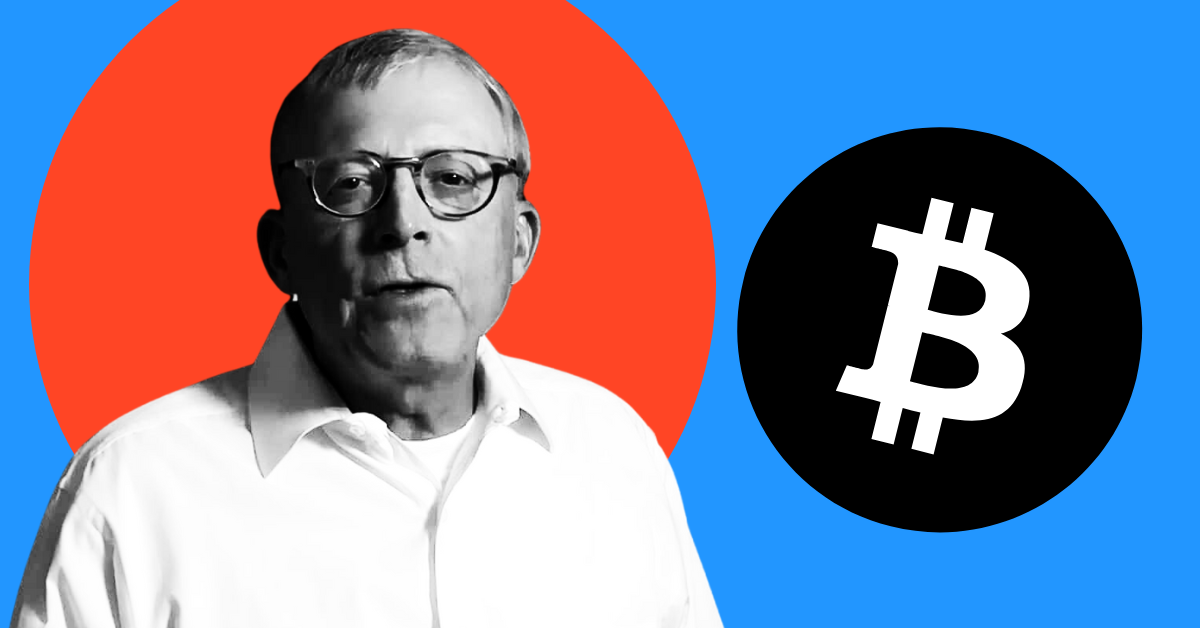

Peter Brandt’s Strategy

Amid these notable ups and downs, Peter Brandt, a veteran trader and chartist made a post on X (previously Twitter) stating that Bitcoin (BTC) is in range bound and noted that “No Breakout yet so no trade.” This post on X has gathered massive attention from the crypto community.

In his post, Peter shared his perspective on charting, stating “I trade set-ups via classical charting principles. I avoid trades when price is range bound. My entry is on completed patterns.”

Bitcoin’swhat Chart Analysis

As of now, BTC has been moving in a descending channel pattern since March 2024. In this pattern, mostly range-bound traders participate by buying at support and selling at resistance levels. However, based on Peter’s recent post, it appears that he is a breakout trader.

According to historical data or price action, whenever an asset’s price moves within a range for an extended period, it is often considered as a preparation for a significant upside rally. However, BTC has been in range bound for approximately 3 months.

Bitcoin Price Prediction

Expert technical analysis suggests that BTC is bullish, as it recently found support at the lower level of the channel pattern and is currently trading above the 200 Exponential Moving Average (EMA) on a daily time frame. Based on historical price momentum, there is a high possibility that Bitcoin could reach the $67,700 level in the coming days.

Whereas, Peter’s post on X hints that the ideal buy opportunity might be near the $73,800 level, which is Bitcoin’s all-time high.

At press time, BTC is trading near the $60,150 level and has experienced a price drop of 0.2% in the last 24 hours. However, during the same period, its trading volume increased by 103%, indicating higher participation from traders due to significant price fluctuations.

Leave a Reply