According to data from cryptoquant.com, bitcoin reserves on centralized exchanges have plummeted to a level not seen since Nov. 19, 2018. The amount of bitcoin held by these digital trading platforms has been steadily declining since early June 2022.

Bitcoin Exchange Reserves Dip to 2018 Levels

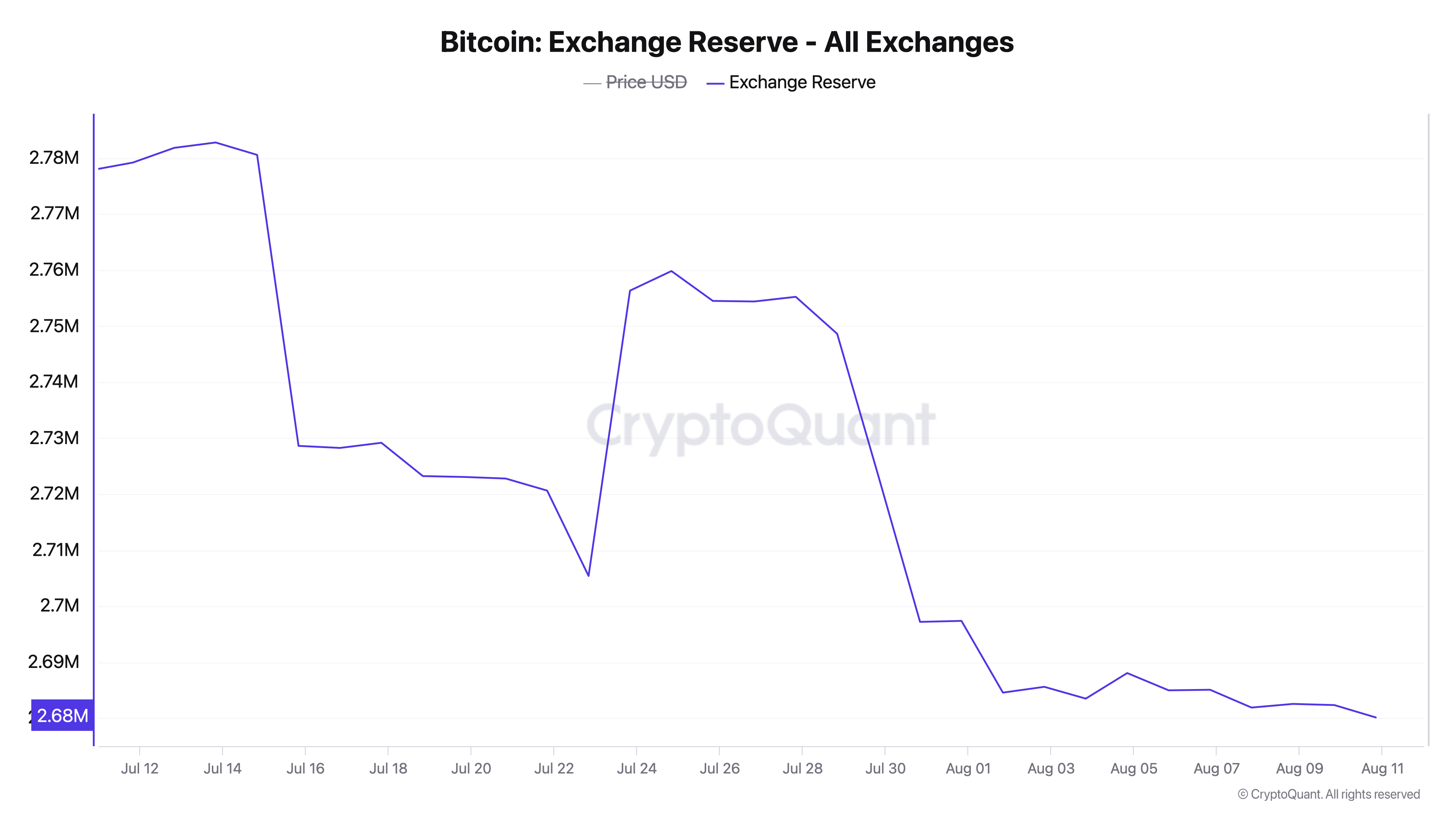

Over the past month, starting from July 11, 2024, a staggering 99,308 BTC, valued at $5.96 billion, has been withdrawn from exchanges. Currently, cryptoquant.com’s data shows that centralized exchanges are holding 2,679,880 BTC, worth approximately $161 billion based on bitcoin rates as of Sunday, Aug. 11. The last time reserves were this low was during the bitcoin bear market on Nov. 19, 2018.

Bitcoin exchange reserves over the last 30 days according to cryptoquant.com metrics on Aug. 11, 2024.

Following that date, the amount of bitcoin stored on exchanges surged, reaching an all-time high of 3,374,491 BTC on July 23, 2021. This figure gradually decreased over the next year, hitting 3,356,772 BTC on June 6, 2022. However, in the wake of the Terra and FTX collapses, the number of bitcoin held on exchanges dropped by 20.16%, settling at the current level of 2.67 million BTC.

In a trend echoing back to June 2016, ethereum (ETH) reserves too have dwindled to levels not seen in years. Currently, exchanges are holding 16.8 million ether, a steep drop of 18.64 million ETH from the record high of 35.44 million ETH set on June 4, 2020. Of that substantial decrease, cryptoquant.com shows a significant 11.44 million ether has been withdrawn from trading platforms since Sept. 15, 2022. With current ether rates as of Aug. 11, this 11.44 million ETH amounts to a whopping $29.97 billion value leaving the exchanges.

The continued decline in bitcoin and ether reserves on centralized exchanges underscores the growing preference for non-custodial solutions, a positive development for both security and scarcity. As more users prioritize self-custody, crypto assets like bitcoin become less liquid on exchanges, bolstering its scarcity and potentially strengthening its value over time, benefiting long-term holders and reinforcing the principles of securing your own keys and decentralized finance (defi).

Leave a Reply