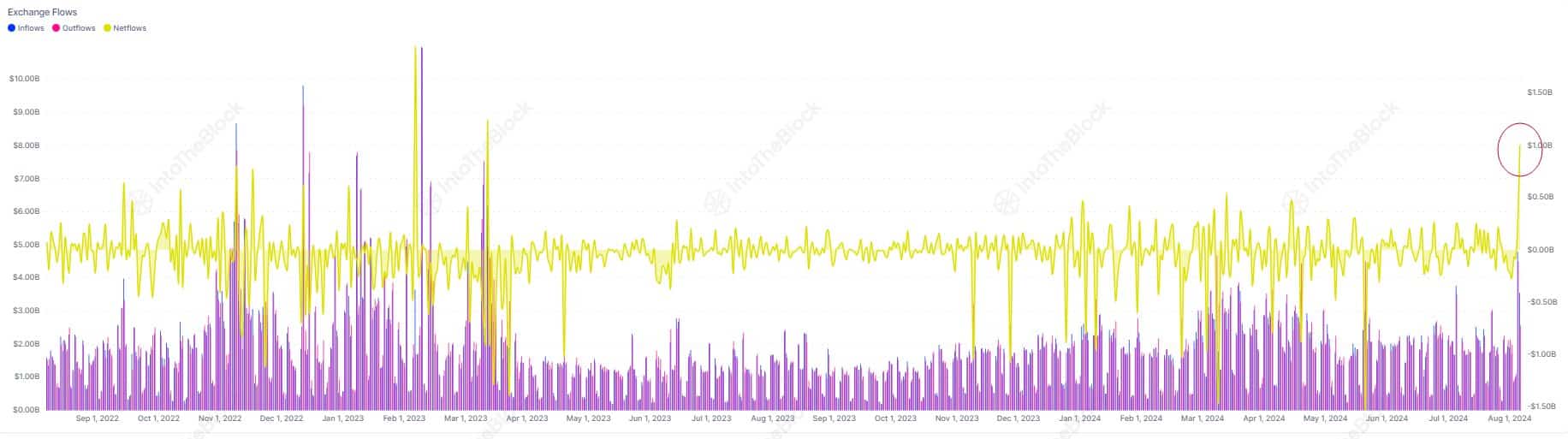

Crypto exchanges recently witnessed nearly $1 billion in stablecoin net inflow in just a day, marking the largest figure since April 2023.

This massive figure was recorded yesterday, according to on-chain data sourced by market intelligence resource IntoTheBlock. The accompanying chart shows an initial decline in stablecoin net inflows at the start of Q4 2023. Notably, in October 2023, net inflows persistently averaged below $300 million daily.

Stablecoin Netflows to Exchanges | IntoTheBlock

This drop coincided with the beginning of the pre-bull run phase for the ongoing market cycle, as Bitcoin (BTC) engineered a recovery from the $27,000. Stablecoin inflows recovered shortly after, as the bull market took shape from Q4 2023 to Q1 2024.

The metric remained fairly high until a drop in May before a rebound four months ago. However, the most significant spikes occurred in recent times. Crypto exchanges first witnessed a massive spike in stablecoin net inflows on Aug. 6, amounting to a peak of $978 million amid a hurdle to the latest market rebound.

Yesterday, another spike occurred, with stablecoin net inflows on exchanges hitting $957 million. These two spikes pushed the figure to the highest in sixteen months. However, the metric has collapsed dramatically at the reporting time, currently at $99 million. It remains to be seen if a recovery will come up in the following days.

Why This Matters

Notably, these spikes are seen as bullish signs as a massive increase in stablecoin net inflows into exchanges translates to a rise in investors’ purchasing power. Notably, market participants typically deposit more stablecoins into exchanges when preparing to enter the market.

For instance, shortly after the spike in stablecoin net inflows last April, the crypto market witnessed an impressive rebound. Bitcoin first recovered to a peak above $31,000 before eventually correcting. Shortly after, it observed a second rebound, which persisted until the all-time high above $73K in March 2024.

Now, with the latest spikes in stablecoin net inflows, investors could be preparing to enter the market again. The fact that this trend has picked up amid a market downtrend could suggest that market participants are preparing to take advantage of the recent dip.

As Bitcoin continues to hold above the $59,000, an influx of new capital could catalyze a recovery back above $60,000. CryptoQuant CEO Ki Young Ju recently asserted that Bitcoin’s potential to secure a new all-time high depends on its ability to retain the $45,000 support.

Leave a Reply