- The FED expected to cut rates from September to December monthly.

- Top assets to consider buying in response to delayed rate decisions pattern.

The Federal Reserve cut interest rates too late in 2020, raised them too late in 2022, and again they are cutting them too late in 2024, as market analyst Patric noted on X (formerly Twitter).

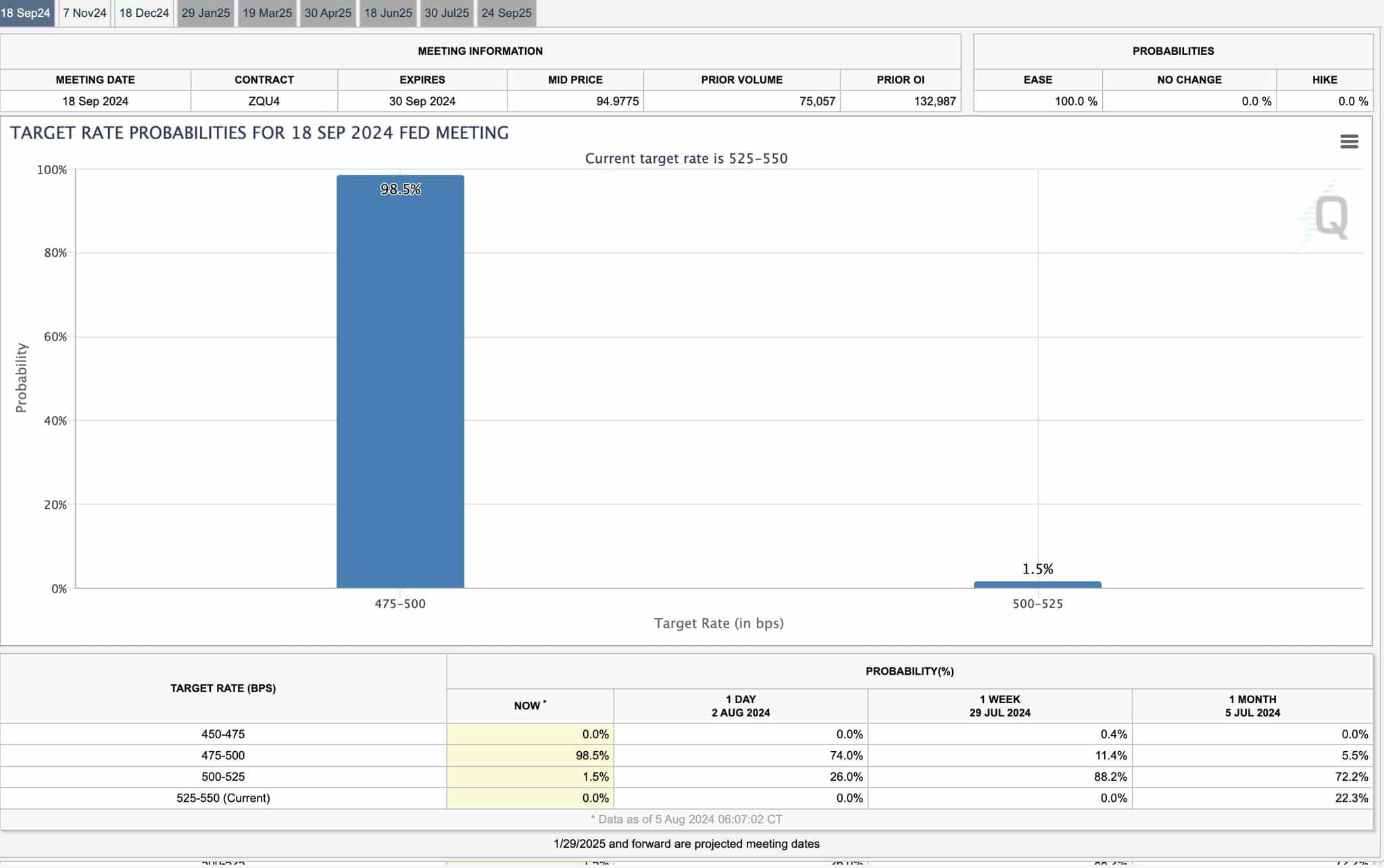

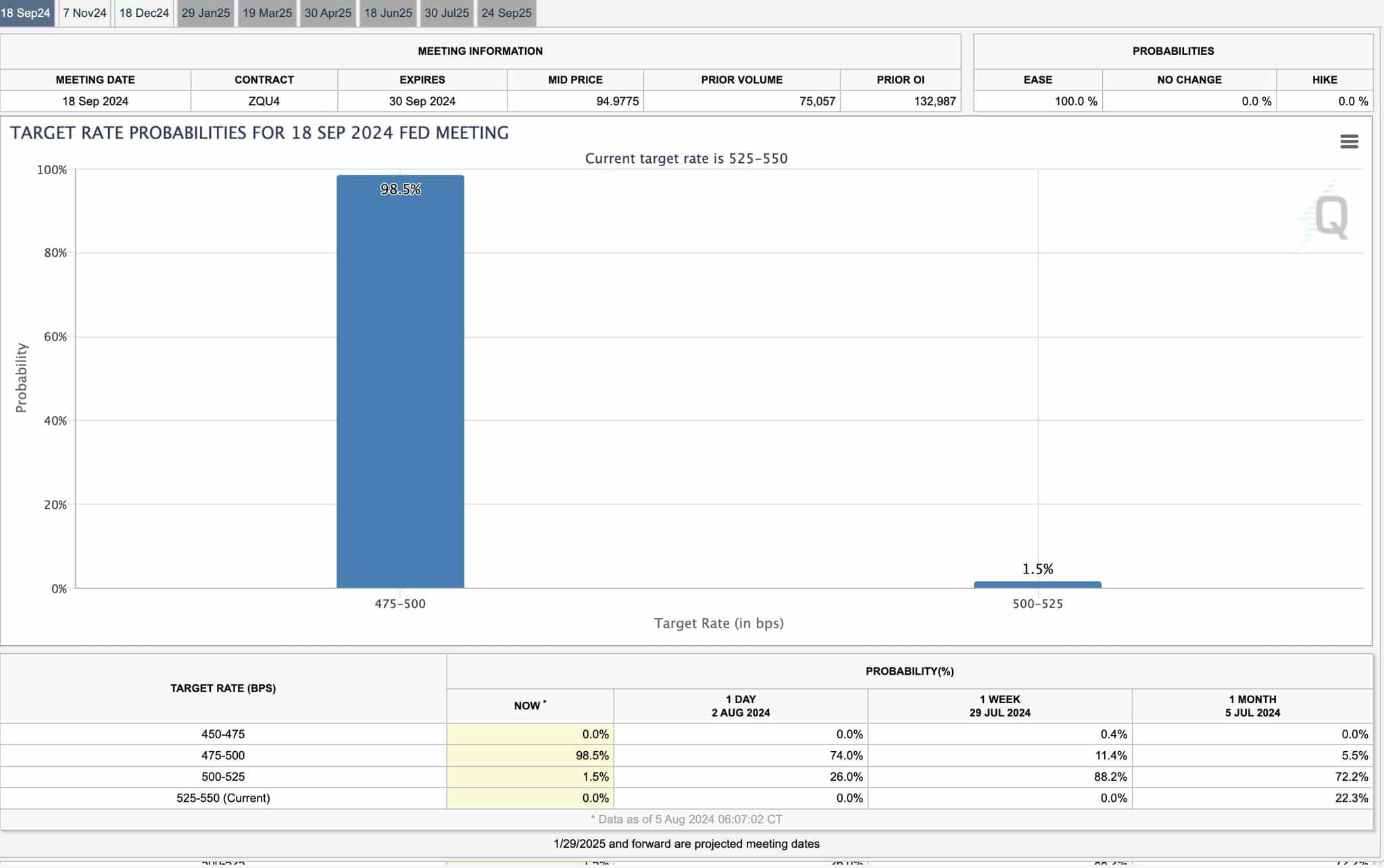

This consistent delay in decisions has impacted financial markets. It’s now expected that the Fed will cut rates from September to December monthly as per target rate probabilities.

This is challenging for the public but beneficial for cryptocurrencies. The Fed delayed these actions because cutting rates isn’t advisable when inflation is high, as it can harm the economy.

Now, with fears of a recession, inflation is no longer the only concern.

Source: CME Group

Cutting interest rates and potentially printing more money is a short-term fix for the economy.

However, it hurts ordinary people who only have cash because it causes inflation, making their money less valuable. This happened in 2020 as well.

This pattern of delayed rate decisions can create opportunities to buy certain assets. People need to be aware of how these changes impact their savings and consider investing in assets that can protect their wealth against inflation.

Here are the three assets to consider buying in response to this pattern:

BTC: Covid crash vs. recession crash

Before a big bull market, we often see a big crash or a long consolidation phase. Bitcoin’s price action in 2020 is similar to 2024.

After breaking out of a descending wedge in 2020, BTC rallied to a new ATH following the COVID-19 crash.

This raises the question: Will history repeat for Bitcoin? Currently, Bitcoin is still in a significant consolidation phase, and the big breakout has yet to happen, but it will, surely.

Source: TradingView

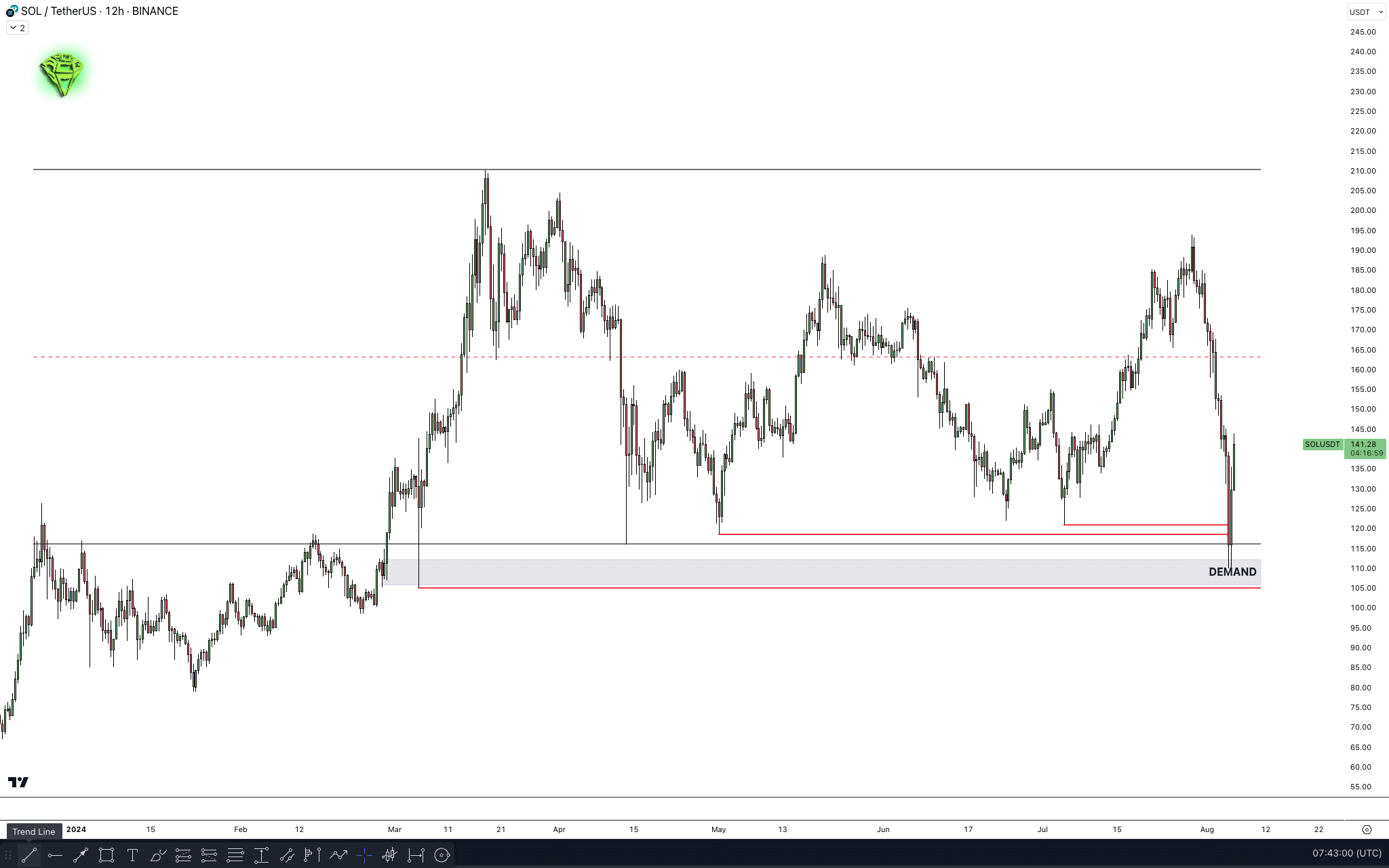

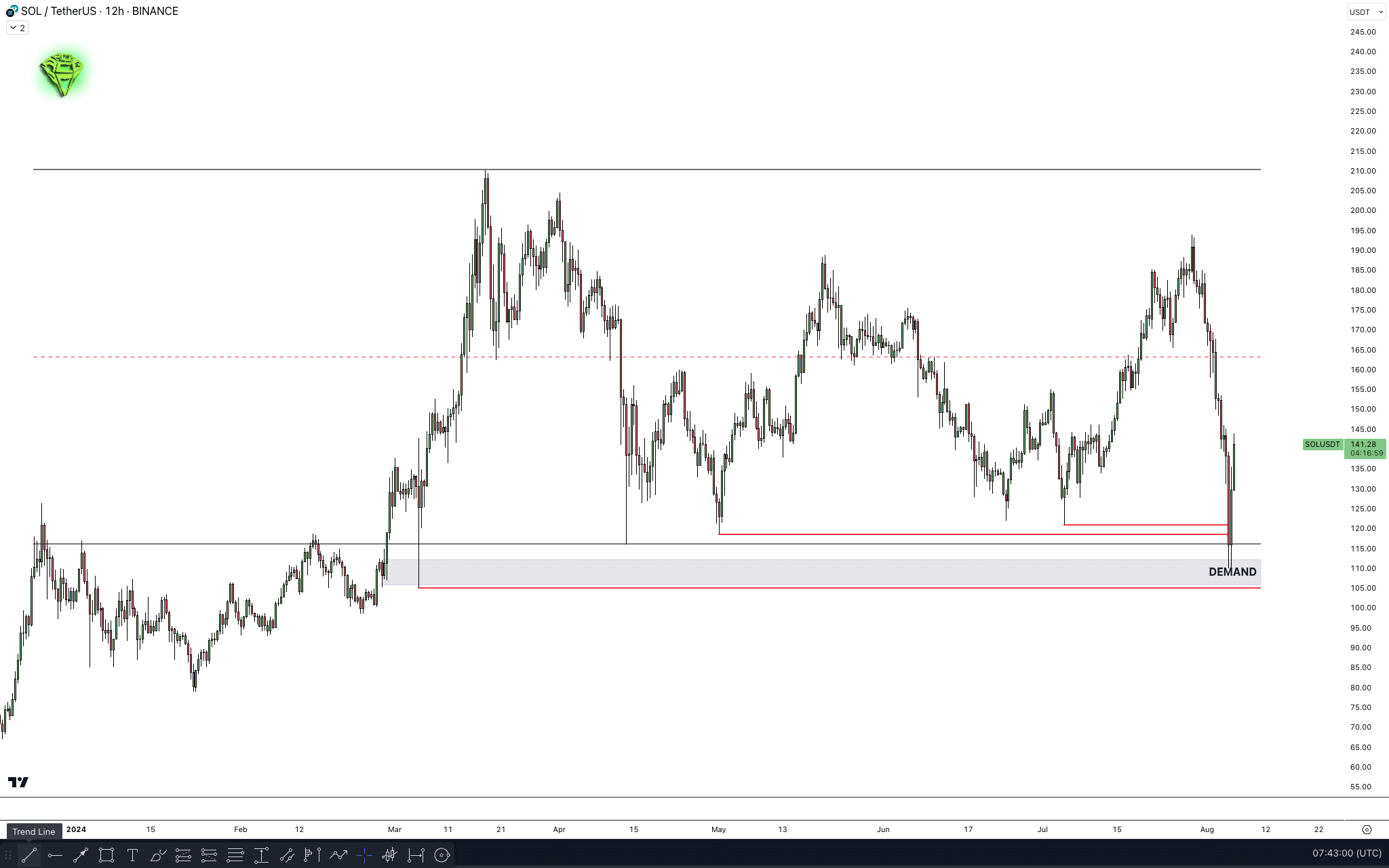

Solana rejected at $110 support

The SOL chart is looking promising. It tested the important $110 support and resistance level and then bounced back within the range.

This movement touched a key demand level and cleared many lower prices. There’s no need to buy immediately during a price surge, but if the price dips, Solana is a good option to consider.

Source: TradingView

Is your portfolio green? Check out the BTC Profit Calculator

DOGE tests resistance-turned support level

Dogecoin is bouncing back from a key support level, making it a good option for long-term gains despite the current market crash.

The price has shown a strong recovery at this level, and with the formation of a double bottom, it indicates potential for significant returns in the coming months.

Source: TradingView

Leave a Reply