Bitcoin investment firm Metaplanet is expected to raise ¥10.08 billion (about $70 million) by offering its 11th series of stock purchase rights to all common shareholders.

In an August 6 rackthe Japanese company outlined plans to allocate ¥8.5 billion (about $58.76 million) of this raised money to purchase additional Bitcoin.

The company said it would distribute one stock acquisition right per common share to shareholders, as recorded on September 5. These rights allow shareholders to acquire Metaplanet shares at a price of ¥555 (approximately $4) between September 6 and October 15.

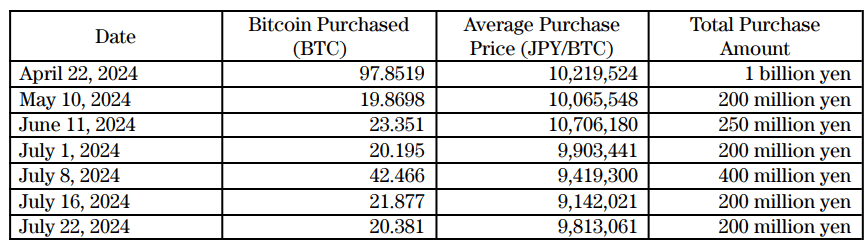

The new funding will enable the company to significantly expand its Bitcoin holdings, in line with its long-term growth strategy. Metaplanet currently owns approximately 246 BTC, worth approximately $13.4 million.

Meanwhile, Metaplanet’s move comes straight from the playbook of MicroStrategy, a business intelligence company that has raised more than 220,000 Bitcoins through debt and equity raises since 2020.

Bitcoin Pivot

Metaplanet plans to use the funds raised primarily to acquire Bitcoin and invest in related sectors.

The company reiterated its belief in the long-term potential of the flagship despite recent declines in Bitcoin prices.

Furthermore, it highlighted BTC’s power as a hedge against currency devaluation, especially the yen, which has recently depreciated dramatically against the US dollar.

Metaplanet stated:

“A rise in Bitcoin prices is expected to strengthen our balance sheet, increase asset values and contribute positively to our revenues.”

The company revealed that it was considering potential future business ventures within the BTC ecosystem, adding that it could generate additional revenue from its Bitcoin holdings by selling covered calls on the flagship digital asset.

Metaplanet’s shift to Bitcoin comes as it strategically exits most of its hotel business, which suffered from declining revenues and recurring losses for five consecutive periods.

Meanwhile, it suggested that the hotel division could be rejuvenated by transforming it to strategically cater to Bitcoin enthusiasts and businesses, while offering unique services and generating additional revenue streams.

Leave a Reply