- Solana’s price spiked to $141.29 but may dip back to $130.

- Analyst suggests watching the $146 risk line; surpassing it could propel prices to $150-$166.

Solana [SOL] has recently exhibited a recovery, surging by approximately 15% within a single day to trade at $141.29. This uptick is particularly notable considering Solana’s recent performance, which saw it plummet to a low of $110 earlier in the day.

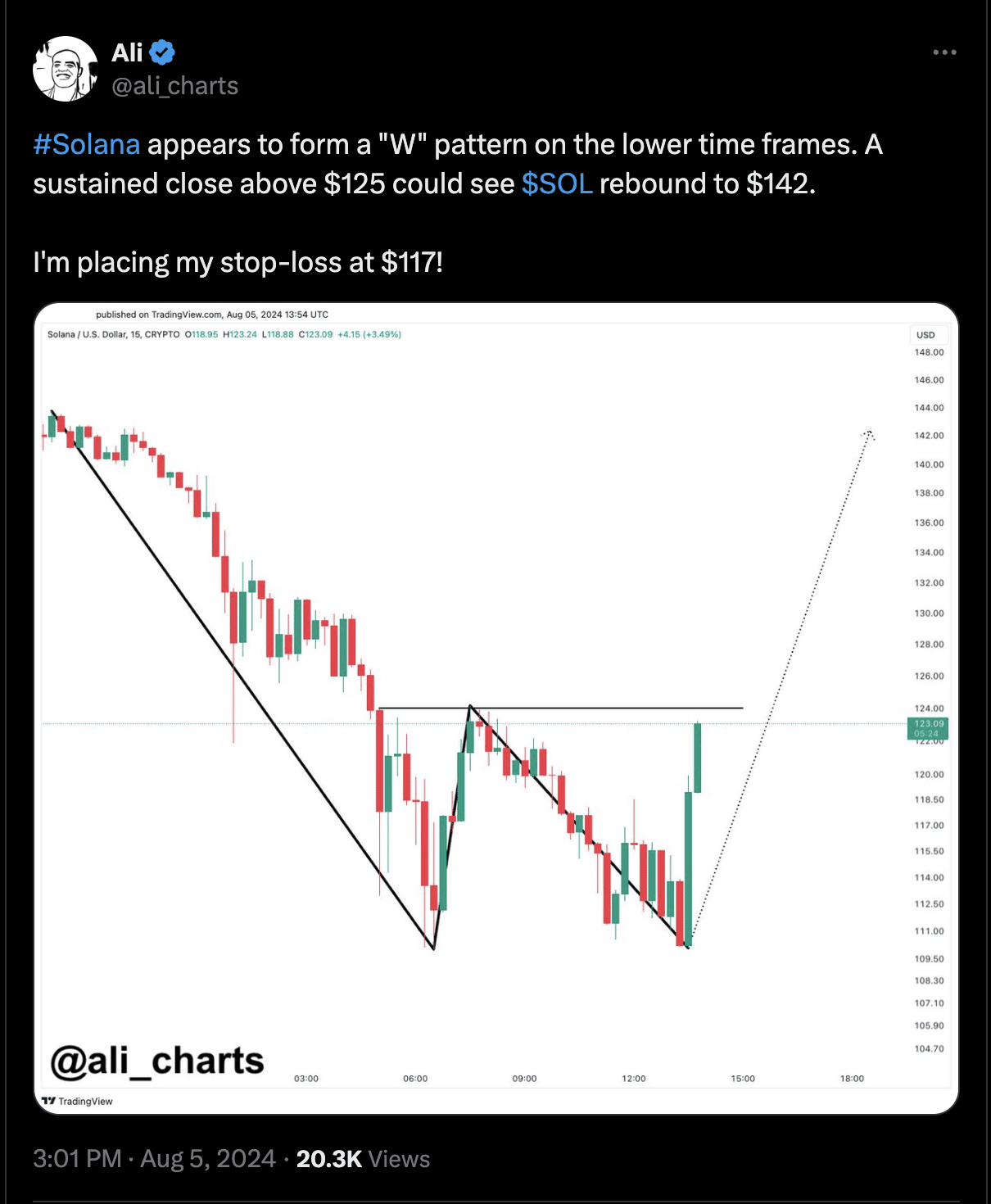

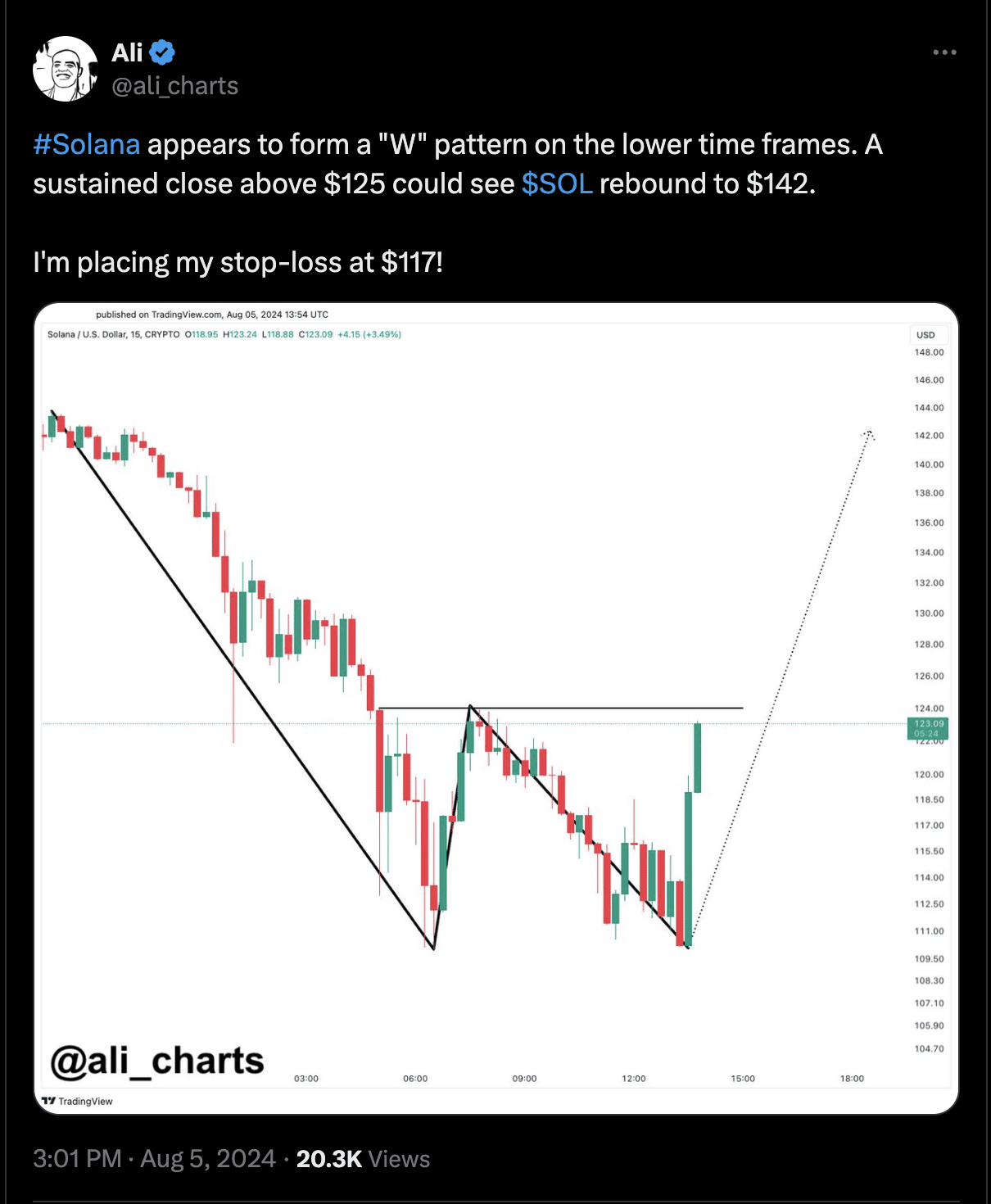

Despite the promising surge, caution remains among market analysts. A well-regarded figure in the cryptocurrency analysis community, Ali has hinted that the downturn for Solana might not be completely over.

The technical outlook on SOL

Utilizing the TD Sequential indicator, a tool popular among traders for identifying price trends, the analyst observed a sell signal on Solana’s hourly chart. This indicator suggests a potential retreat to the price levels between $135 and $130.

However, Ali pointed out a critical resistance level at $146. Should Solana break through this threshold, it could negate the bearish forecast and potentially propel its price towards the $150 to $166 range.

As of now, Solana has touched a high of $143 but has not yet surpassed the notable $146 mark.

The credibility of these predictions is bolstered by the analyst’s track record, having accurately forecasted Solana’s rebound to $142 from a previous low.

According to Ali’s strategy, maintaining a stop-loss at $117 could safeguard investments while capitalizing on potential gains.

Source: Ali on X

Solana fundamental outlook

To understand the likelihood of these predictions coming to fruition, it’s worth looking into Solana’s fundamental market indicators.

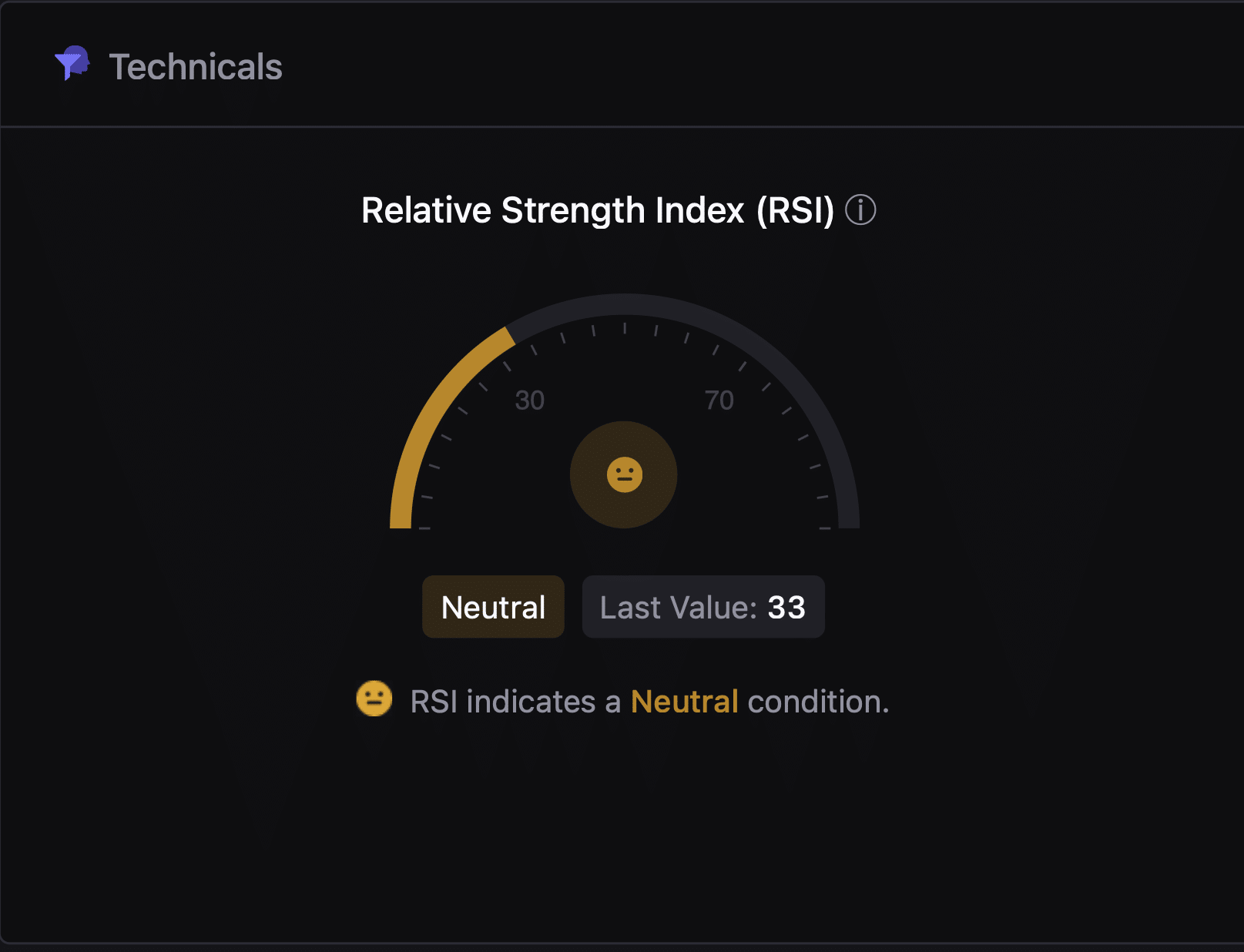

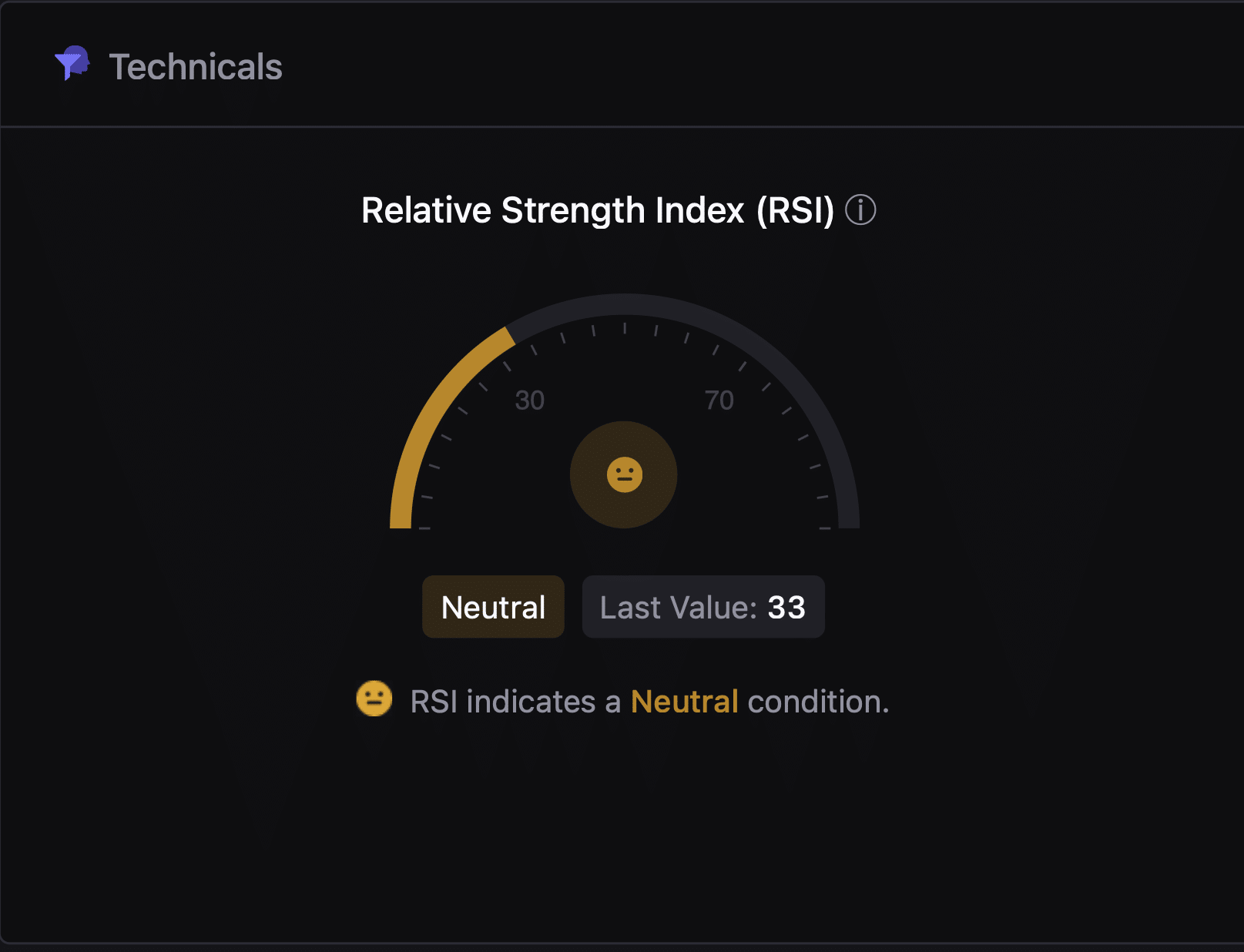

These indicators such as open interest and the Relative Strength Index (RSI) often give a hint on where the market is likely headed

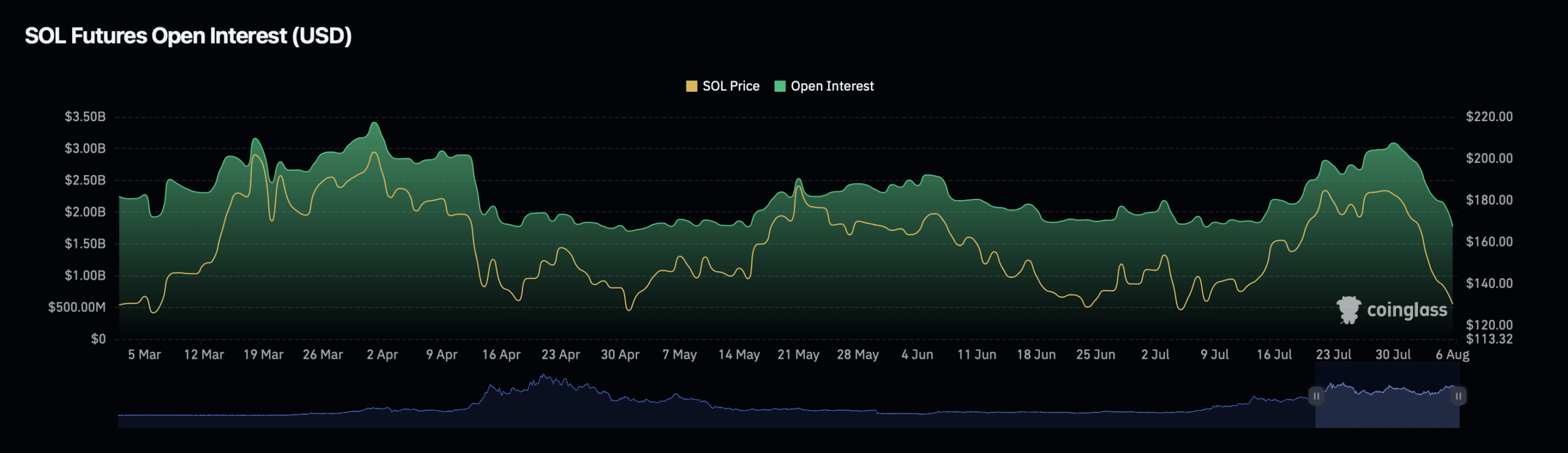

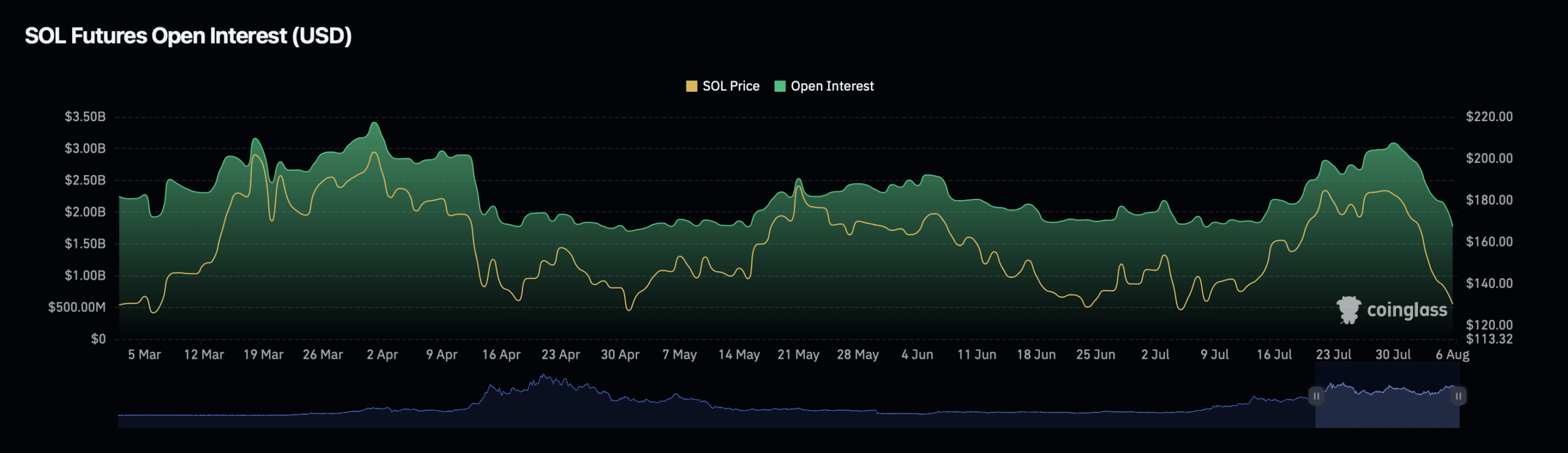

Source: Coinglass

According to data from Coinglass, Solana’s Open interest, which represents the total number of outstanding derivative contracts (such as futures and options) that have not been settled, has risen by 18.43% in the last 24 hours, reaching $2 billion.

Conversely, the asset’s open interest volume has seen a decrease of 14.338%, settling at $21.48 billion.

Source: CryptoQuant

Realistic or not, here’s SOL’s market cap in BTC’s terms

Furthermore, the RSI, a momentum oscillator that measures the speed and change of price movements, stands at a neutral 33 for Solana.

This value indicates neither overbought nor oversold conditions, suggesting that the price could stabilize unless external market factors exert influence.

Leave a Reply