- Aptos just experienced a substantial surge in network activity.

- Is APT approaching its bottom range?

The Aptos [APT] blockchain stirred up some excitement lately despite the recent turmoil in the crypto market. Its latest report revealed a healthy spike in network activity, sparking inquiry into the potential impact on its native cryptocurrency, APT.

The Aptos network disclosed that it experienced a 27% surge in transactions last week, which peaked at 14.6 million. Total unique users soared above 20 million, while averaging at least 1 million active users.

This announcement came within days after the network announced USDY integration. A development aimed at attracting institutional-grade investors.

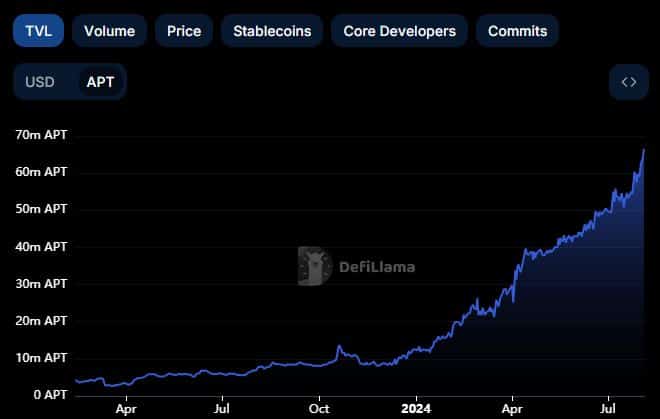

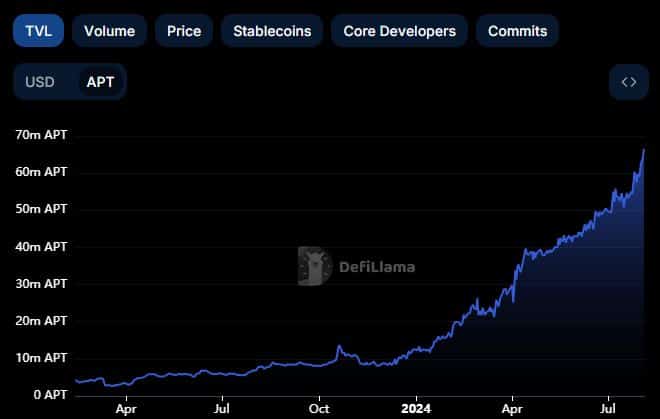

The reported outcome suggests a positive response from the Aptos community. An outcome that saw the Aptos TVL push briefly above the $400 million mark before price dilution due to the market crash.

However, Aptos TVL is currently at an all-time high of 66.51 million APT.

Source: DeFiLlama

A deeper dive into the network’s metrics revealed some interesting findings. According to DappRadar, Aptos’ daily transactions peaked at 580,690 on Sunday.

This was the highest daily transaction count recorded in the last 30 days. There was also a spike in the number of unique active wallets (UAWs) during the same session.

The number of UAWs surged by over 135,000 compared to the previous day.

Source: DappRadar

APT lends itself to the bears

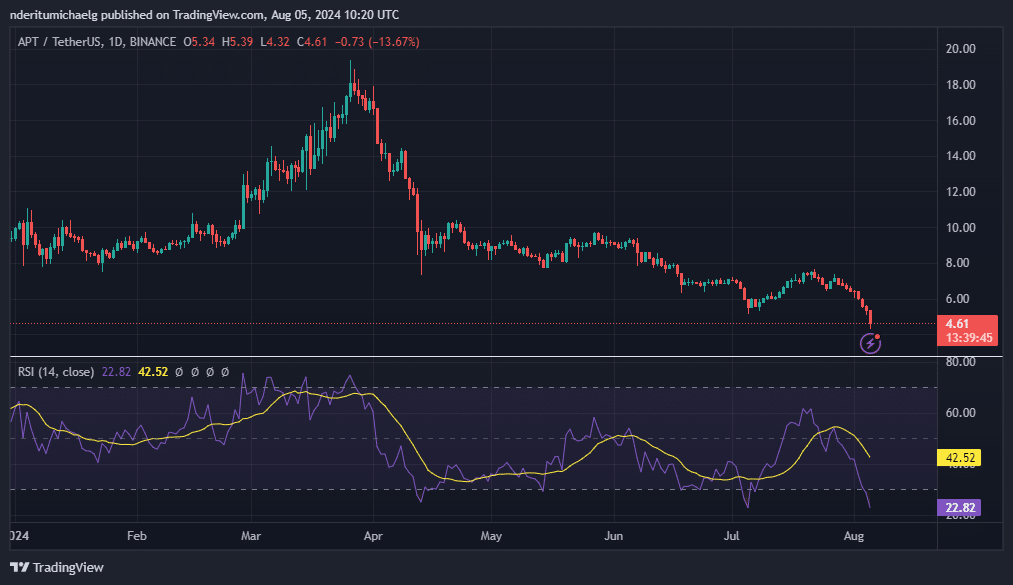

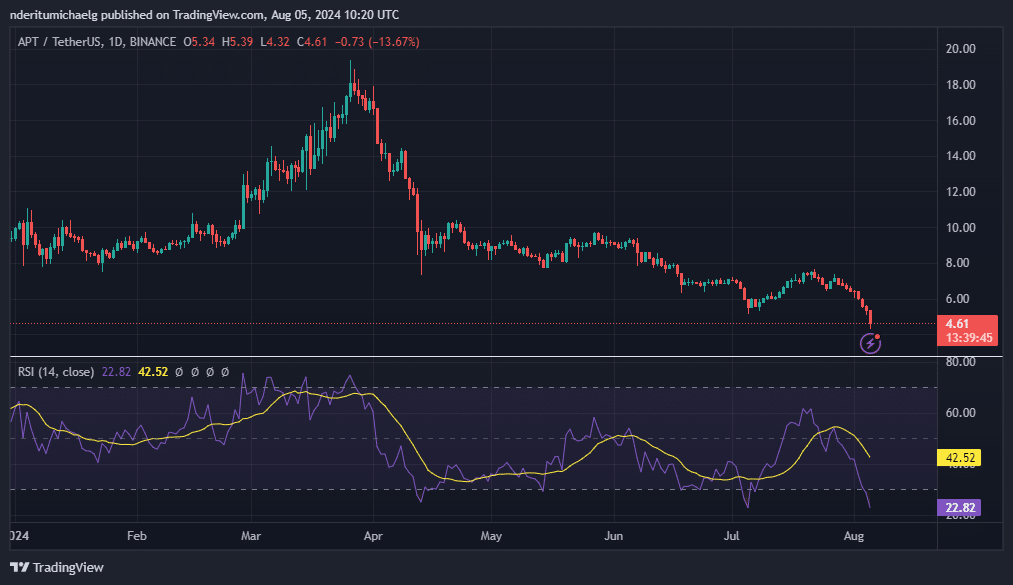

Although Aptos has been experiencing a surge in healthy activity and TVL, these developments failed to materialize in APT’s price action. The cryptocurrency concluded July on a bearish note and extended its downside during the weekend.

To put things into perspective, APT has been on a downward spiral for the last 9 days. It crashed by 43% from its July highs to its recent low of $4.32. APT exchanged hands at $4.61 at press time.

Source: TradingView

APT’s current position represents a 76% discount from its YTD high. Its press time levels signaled the possibility of a bullish recovery. This was further supported by the oversold price according to the RSI.

APT bulls have been struggling to rally since April. The recent developments in the network may shift things up and potentially favor its outlook in the coming months.

Read Aptos’ [APT] Price Prediction 2024-25

However, its present performance is heavily influenced by the overall bearish market conditions. This also meant that a possible extended bearish performance for the crypto market might result in lower APT prices.

It is worth noting that APT was close to its lowest historic range at the time of observation. A resurgence of bullish momentum may consequently yield a robust recovery.

Leave a Reply