- Toncoin is likely to fall closer to $5.

- The on-chain metrics gave a buy signal but conditions might be too risky to rely on them.

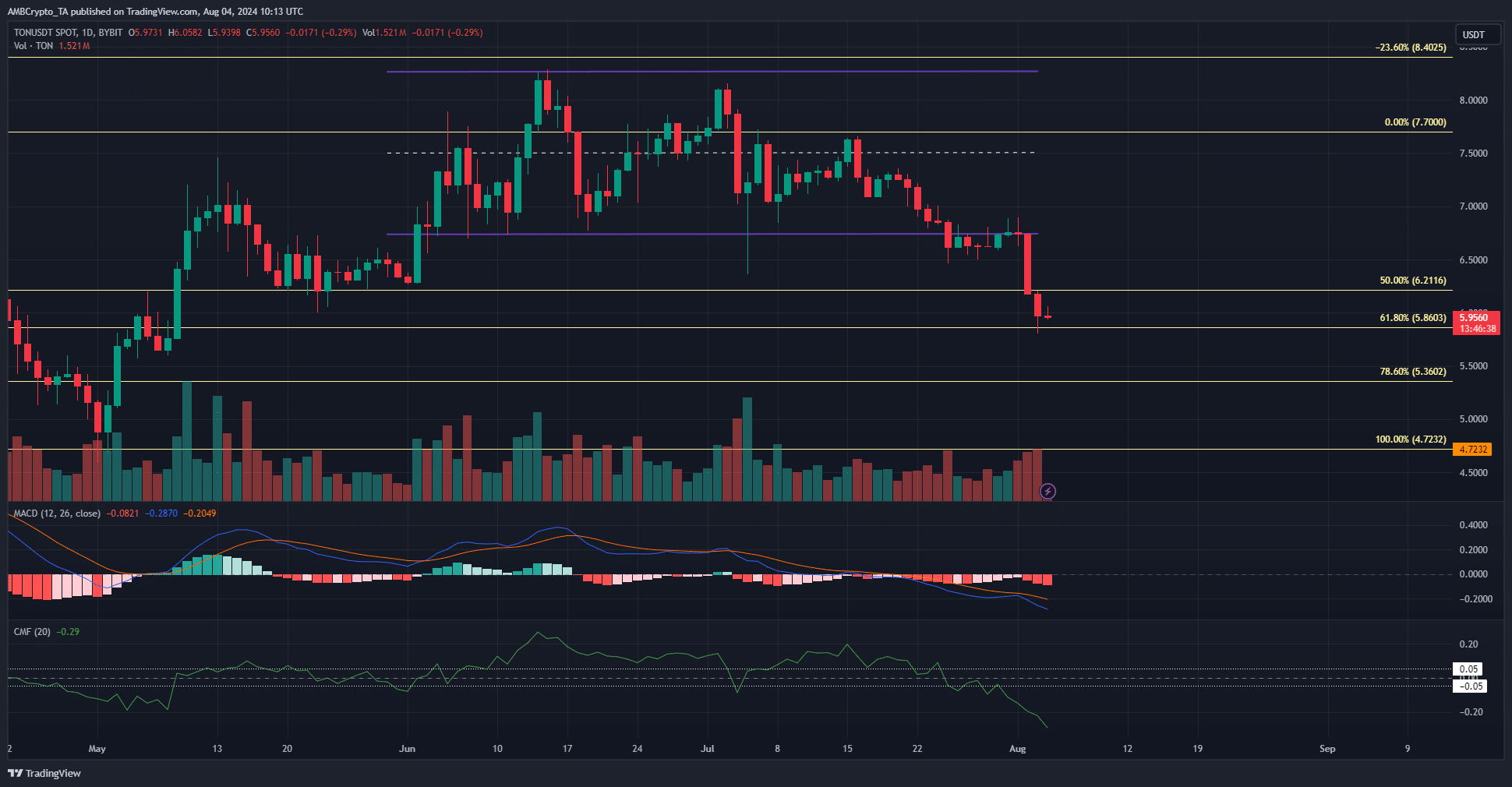

Toncoin [TON] maintained its bearish trajectory and fell below the $6 level as anticipated in an earlier report. The technical indicators showed strong selling pressure was prevalent. The Fibonacci retracement levels might help the bullish cause.

With Bitcoin [BTC] struggling near the $60k mark, the crypto market does not have a bullish outlook in the short term. A price bounce to hunt short liquidation levels might occur on Monday, and the downtrend might resume afterward.

The $5.8 and $5.36 levels under scrutiny

Source: TON/USDT on TradingView

The daily market structure was still bearish. There was a considerably large fair value gap around the $6.5 level. A price bounce to hunt liquidation levels could be rebuffed from this area.

The MACD has been trending downward throughout July and the CMF fell to a 4-month low. This showed extreme selling pressure and consistently bearish momentum for TON since the rejection at $7.7.

The 78.6% retracement level at $5.36 might be visited next week. Swing traders would be hopeful that the downtrend fades at that point and the market offers a buying opportunity.

Should traders wait for further price drops, or buy TON right away?

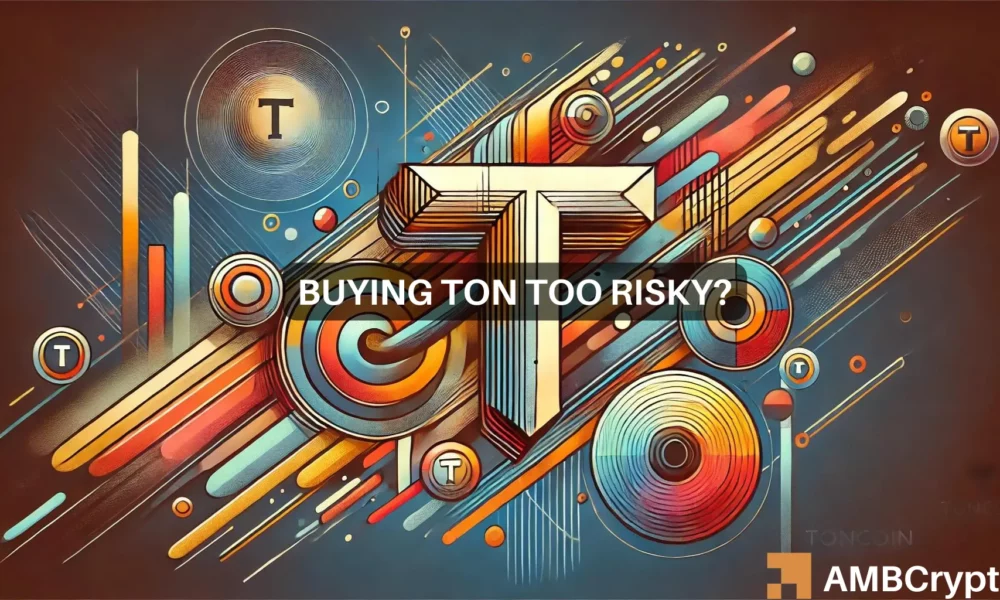

Despite the price drop of the past month, the mean coin age has trended higher. This was a sign of accumulation across the network.

Meanwhile, the MVRV ratio fell to lows not seen since early May. Short-term holders were at a deep loss and the token might be undervalued.

Is your portfolio green? Check the Toncoin Profit Calculator

The weighted social sentiment had been positive until recently, underlining belief. It presented a good case for traders to rely on the $5.86 support level, the 61.8% retracement level, but buying at these levels could be risky.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply