- An unprecedented move by the BOJ is causing a market shift.

- Bitcoin’s bearish sentiment supports overall crypto market decline but still not yet time to sell.

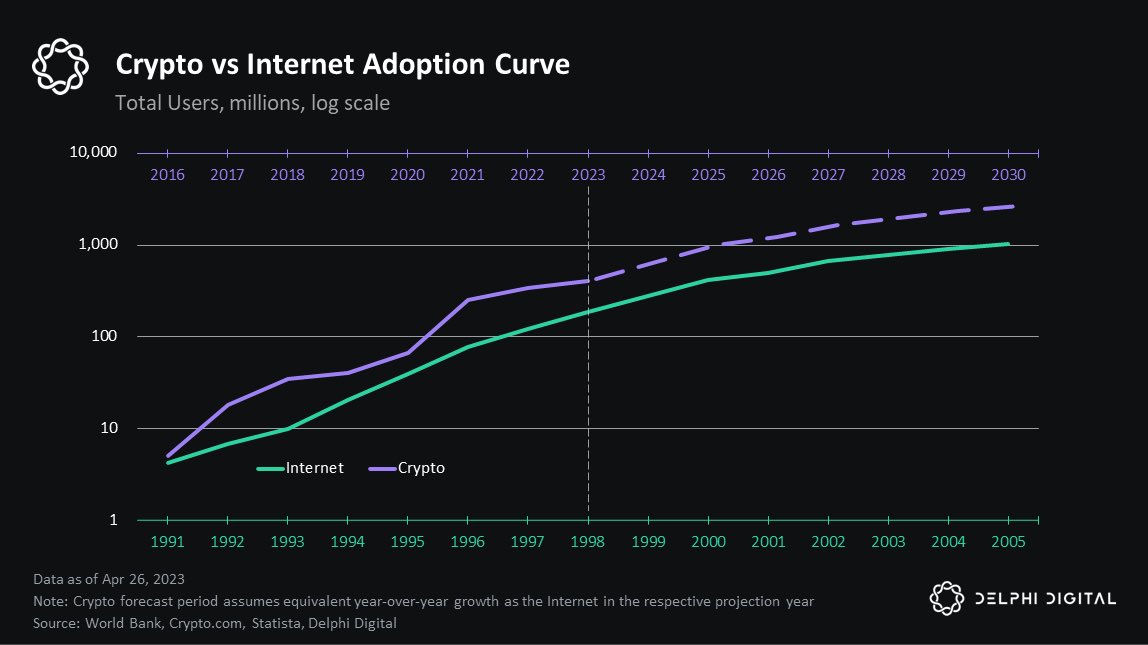

Crypto is growing faster than the internet, heralding Web 3’s arrival. Unlike the internet, whose value took time to recognize, cryptocurrency’s worth is immediately apparent as Crypto vs Internet Adoption Curve indicates.

As crypto surges, understanding its intricacies will ensure you stay informed and ready for the next big shift.

The future trend of cryptocurrency will undoubtedly surpass any investment, despite inevitable short term market declines due to interest rate hikes.

Source: Delphi Digital

Why crypto markets aren’t immune to interest hikes?

After 30 years of 0% interest, Japan’s rate hike made investors unwind $4 trillion in trades, impacting global markets as popular analyst Nicholas Mugalli noted, and crypto is not immune to the impact.

This unprecedented move by the BOJ is causing a market shift as Japanese investors, who previously used cheap bank money for global investments like crypto, began selling assets to repay loans, causing a sell-off that impacted global markets.

Historical context shows similar scenarios in 2001 and 2008 led to market downturns. While global tensions and Federal Reserve policies play a role, Japan’s interest rate hike is a significant catalyst for the recent market decline.

This unexpected move triggered widespread asset liquidation, creating ripple effects across international markets and contributing to the current downturn.

What’s happening with Bitcoin?

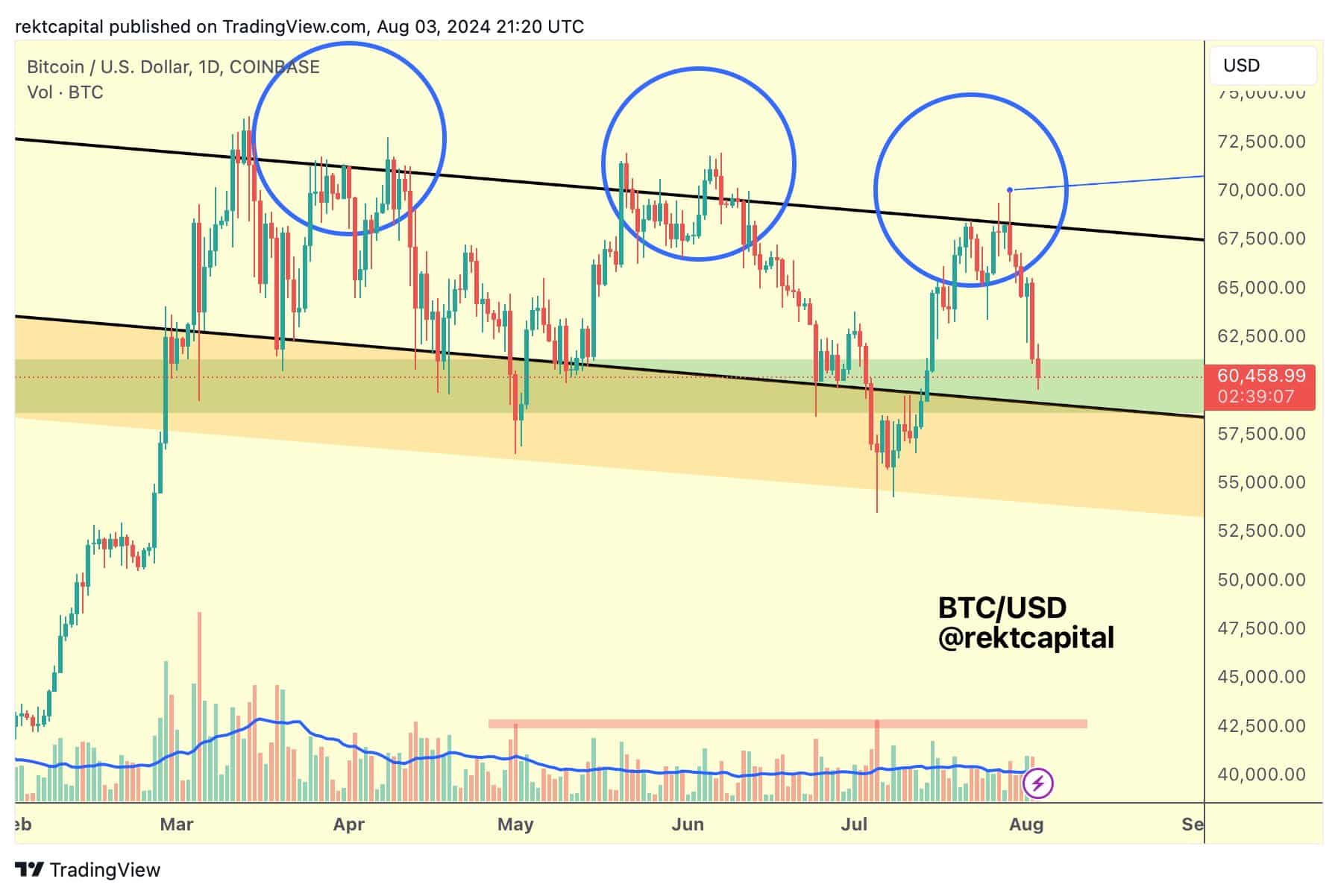

The previous two bottoms in Bitcoin’s price action formed when above-average sell-side volume occurred, indicating seller exhaustion.

This pattern, marked by red boxes on the volume chart, suggests a similar trend is needed before a price decline can occur. Bitcoin has not yet reached this level of sell-side volume, implying more selling pressure must come first.

The three tops in price action, combined with bearish sentiment, provide further insights into the anticipated sell-off for Bitcoin and other crypto assets.

This bearish pattern highlights the need for increased sell-side volume before the market can see a swift price decline, confirming a more profound bearish trend.

Source: TradingView

Leave a Reply