- Drop in long-term holder active sales meant sellers might be exhausted

- Increase in the largest whales’ holdings while prices plummeted may be seen as a sign of confidence

Bitcoin [BTC] fell back rapidly from the $69k-$70k resistance zone. The weekly timeframe developed a bearish structure, and the FOMC meeting slashed bullish hopes of a Fed rate cut in September.

On top of this, the Sahm Rule appeared to confirm economic weakness and opened up the possibility of a recession. This sent the markets into a panic and BTC tumbled lower.

The $60k region is a significant support zone, but there are no guarantees that the bulls would successfully defend it. AMBCrypto looked closer at on-chain metrics to better understand the long-term holder sentiment.

Long-term holder sell pressure has fallen

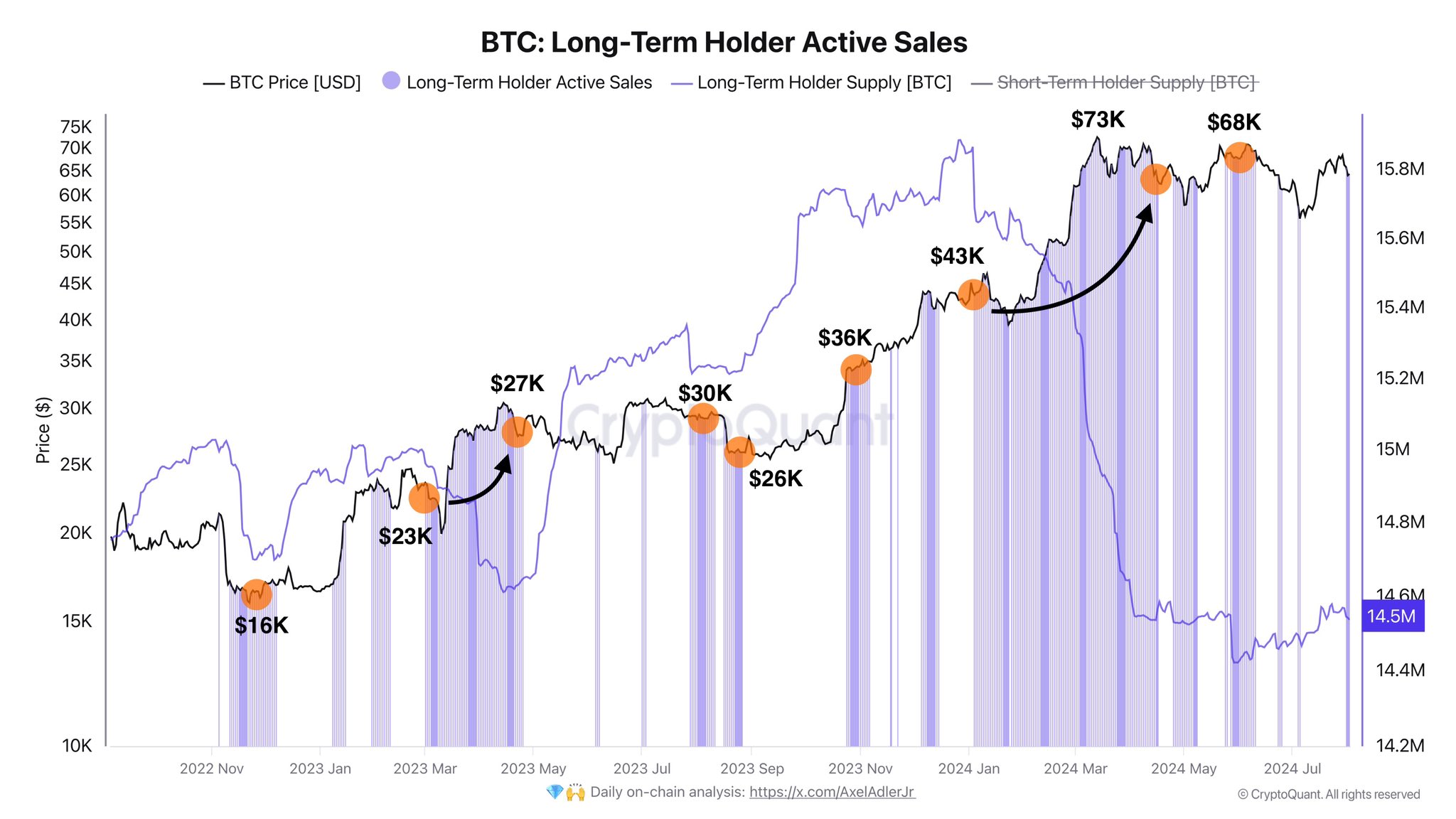

In a post on X (formerly Twitter) crypto-analyst Axel Adler observed that long-term holder active sales had reduced. Compared to early June, the selling pressure from this band of holders was “minimal.”

The long-term supply also fell dramatically. This suggested intense profit-taking activity when BTC was trading around the $68k-$70k levels. It pointed to a lack of conviction of a breakout past $70k.

On the other hand, this might also be positive news because this meant the selling pressure is likely exhausted.

Whale cohort’s behavior is exciting news

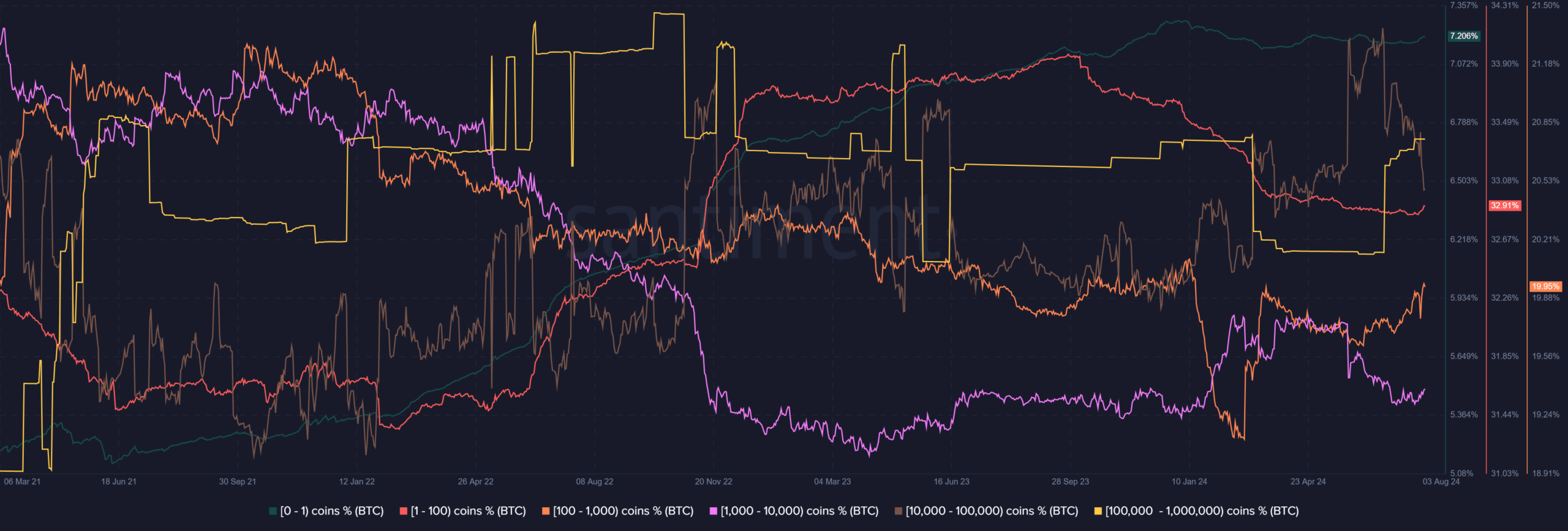

The cohort of wallets with 100k-1M BTC in their wallets climbed higher as a percentage of the total. The last time it jumped this rapidly was in May 2023, when Bitcoin began to poke its head above the $26k resistance.

While this whale accumulation is encouraging, other whale cohorts have been selling. The 1k-100k division saw a sharp drop in their holdings over the past two weeks, showing selling pressure from whales.

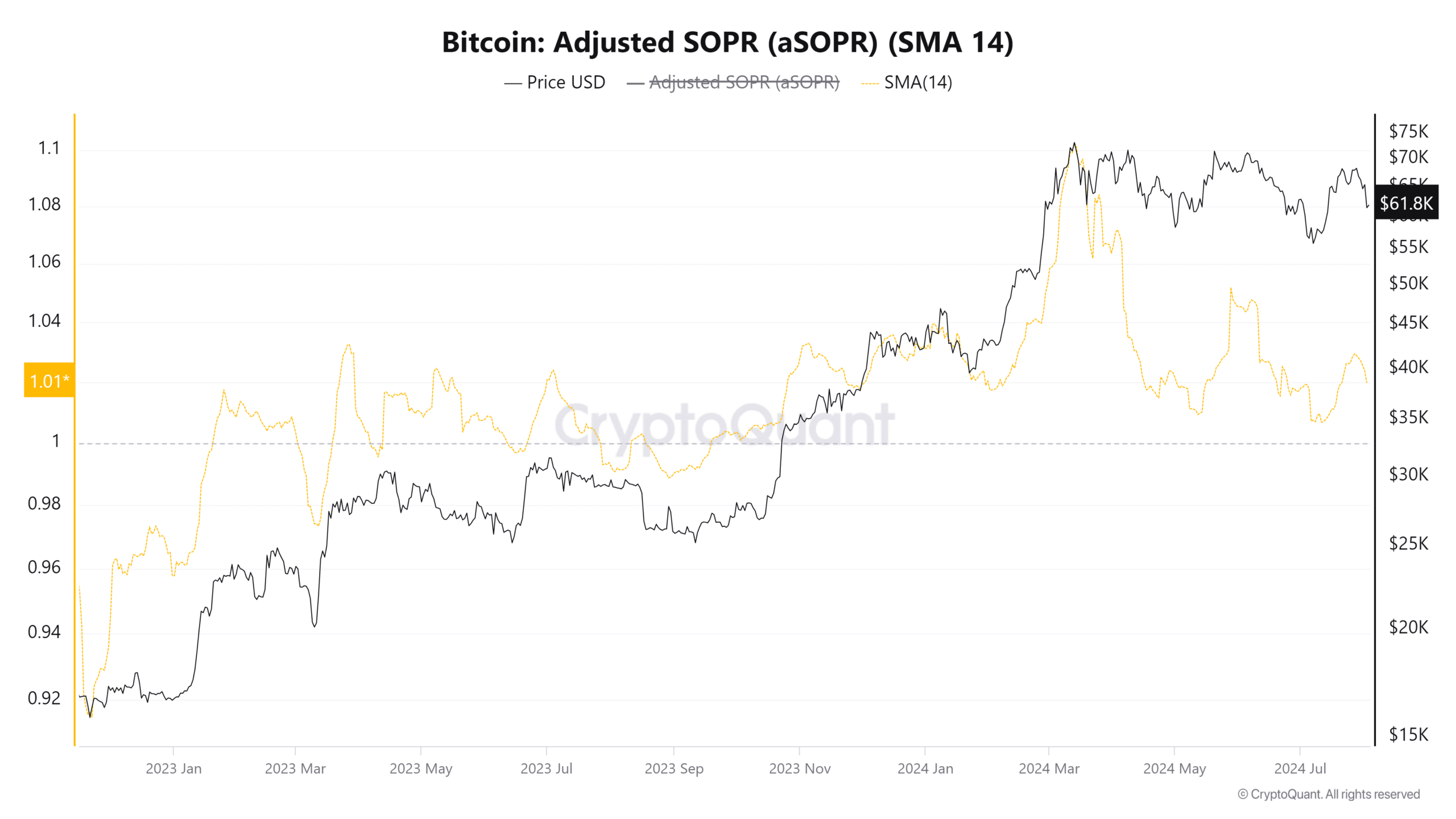

Evidence for bearish sentiment over the past few months was also seen in the adjusted SOPR. The value was above 1 to show that on average, coins were sold at a profit.

Alas, the falling aSOPR trend since March has been a bearish signal.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, the drop in LTH active sales, combined with accumulation from larger whales, is encouraging. Despite these positives, however, Bitcoin might struggle to recover in August due to the bearish market-wide sentiment.

Leave a Reply