MicroStrategy, a prominent Bitcoin holder, is under scrutiny regarding its cash flows ahead of its earnings report.

On July 31, Michael Saylor, a prominent Bitcoin proponent, said: announced that the company would release its earnings after market close on August 1 and host a live webinar to discuss the results.

Concerns about cash flow

Bloomberg reported that MicroStrategy’s software business is attracting increasing attention as MicroStrategy’s performance could become more important to its cash flow.

Revenue from the company’s software business is expected to show minimal change from the last quarter. This stagnation is concerning, especially since the company has relied extensively on convertible bonds to acquire a large portion of its Bitcoin this year.

TD Cowen analyst Lance Vitanza emphasized that managing cash flow is critical to covering interest on the company’s convertible debt. He noted that the company must ensure its cash flows can absorb the additional interest expense from this debt.

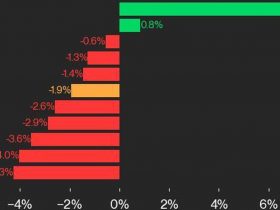

The company expects approximately $45 million in interest expense and $20 million in cash taxes this year. Meanwhile, Vitanza estimates its revenue before things like taxes at about $82 million.

Another development that could impact the company’s cash flow is the upcoming accounting changes scheduled for next year. MicroStrategy will have to value its digital assets at market rates and could face a 15% alternative minimum tax if its three-year average annual adjusted income exceeds $1 billion.

In particular, the company has recognized that these changes could have a significant impact on its financial results, including earnings and cash flow.

Despite these challenges, analysts pointed out that MicroStrategy has options to manage its financial obligations, as debt does not mature until 2027 or later. So the company could issue new convertible debt, take out a loan, issue additional shares, or even divest some of its Bitcoin holdings to generate cash.

Bitcoin Ownership Concerns

In addition to cash flow concerns, MicroStrategy’s Bitcoin ownership is also being questioned. The Michael Saylor-led company has grown its supply to more than 200,000 BTC, worth nearly $15 billion, making it the largest corporate Bitcoin holder.

However, Seeking Alpha analyst Michael Del Monte pointed out that most of MicroStrategy’s Bitcoin is owned by MacroStrategy, a separate entity. This separation means that MicroStrategy shareholders have no direct claims on the Bitcoin held by MacroStrategy.

Del Monte also noted that the company’s equity offering approach to acquiring Bitcoin could dilute shareholder value. He suggested that MicroStrategy acted as a capital raising vehicle to increase Bitcoin holdings at MacroStrategy, leading to equity and debt dilution without direct benefits from the Bitcoin assets.

Conversely, Baris Serifsoy, former Managing Director at UBS, refuted Del Monte’s concerns, saying he is more focused on MicroStrategy’s ability to monetize its Bitcoin position and efficiently transition to a cloud-based SaaS provider.

He noticed:

“It is a theoretical risk. It would only become relevant if operating cash flow cannot meet debt service AND Microstrategy can no longer roll over debt AND Macrostrategy is unwilling/unable (low Bitcoin price) to sell coins to service mothership debt. ”

Leave a Reply