- Shiba Inu has a bullish daily structure but little volume to back that up.

- A large chunk of the February rally has been erased, and more losses are likely to follow.

Shiba Inu [SHIB] was forming a bullish pattern and threatened a breakout. On-chain metrics revealed that the meme coin might be overvalued. There was evidence for increased adoption, which was positive news.

Whale transaction activity was also growing, which could mean renewed interest and accumulation trends. Is this enough for a bullish Shiba Inu price prediction? Here’s what the technical analysis showed.

Volume indicators showed a tepid market sentiment

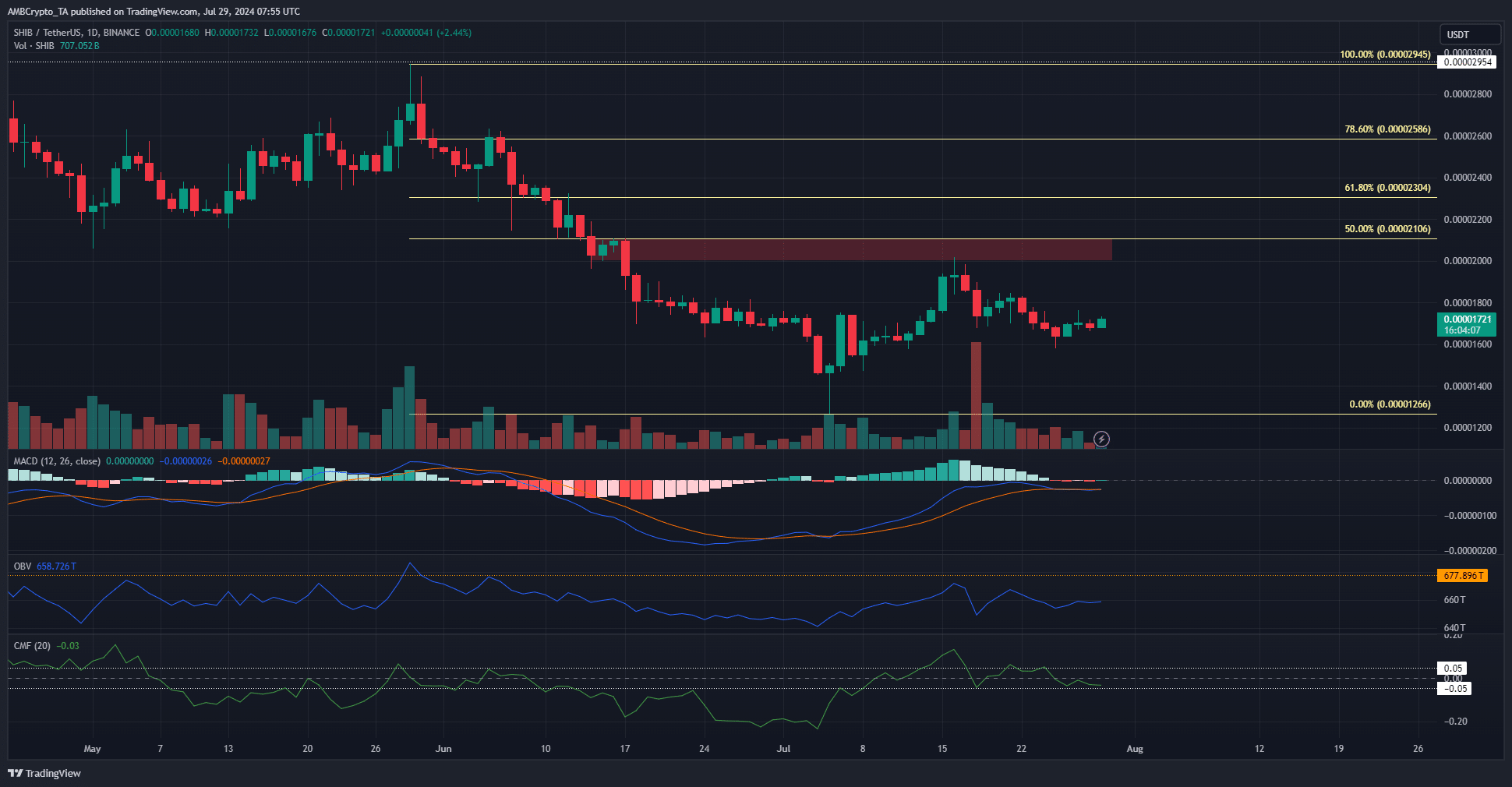

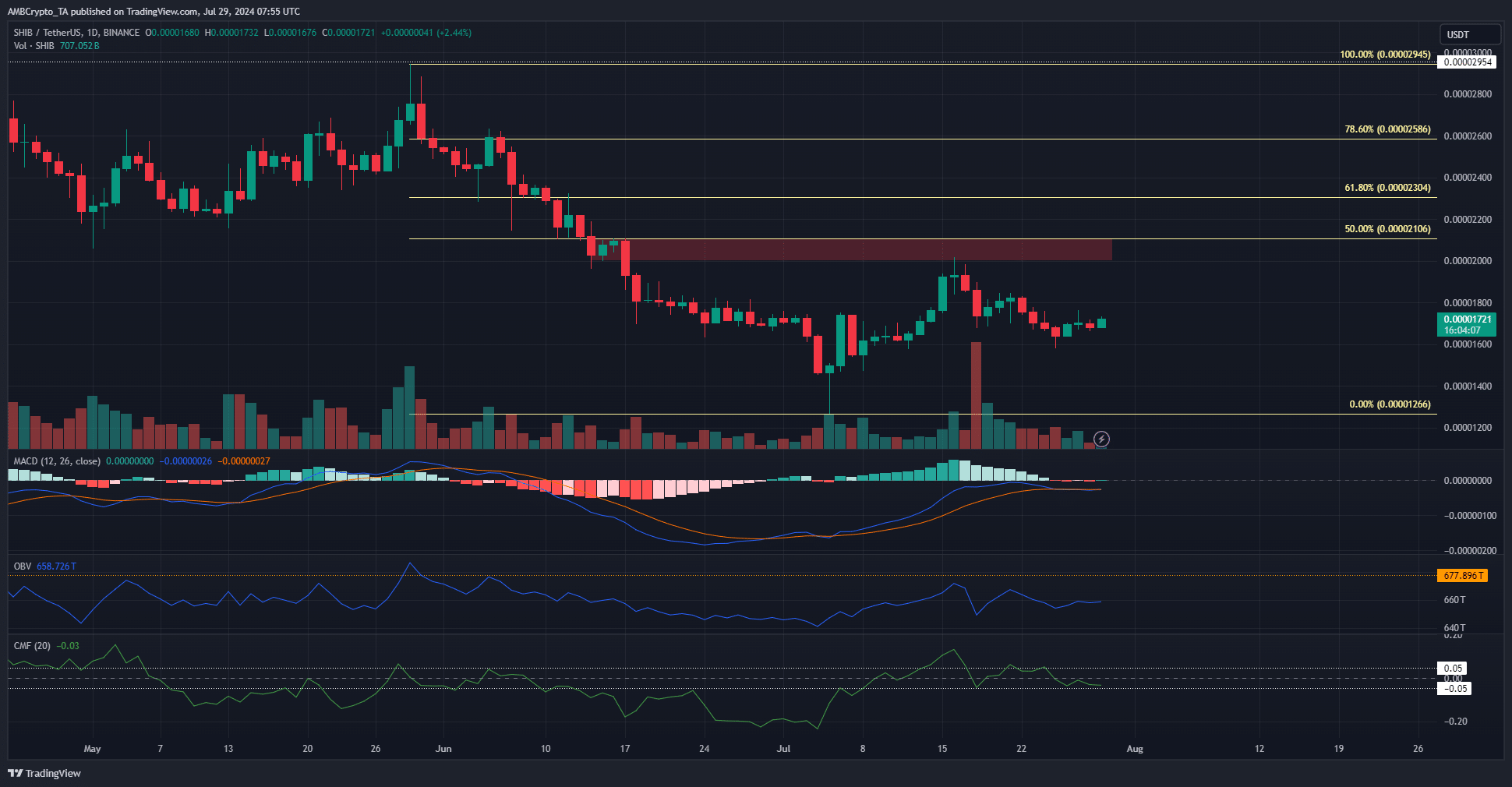

Source: SHIB/USDT on TradingView

The rejection at the $0.00002 level on the 16th of July saw Shiba Inu fall by 19% ten days later. In the past few days, an attempt at recovery has not been made.

The MACD was still below neutral zero and a bearish crossover had formed, showing strong downward momentum was likely.

The OBV could not breach the highs from May and June but has advanced higher in July. This is a slight encouragement but does not give bulls any significant advantage.

The CMF was at -0.03 and showed sell pressure could become hefty in the coming days.

The Fibonacci retracement levels showed where a bearish reversal could occur in the coming weeks. Unless SHIB bulls can spark a huge volume increase or show signs of accumulation, the Shiba Inu price prediction would lean bearish.

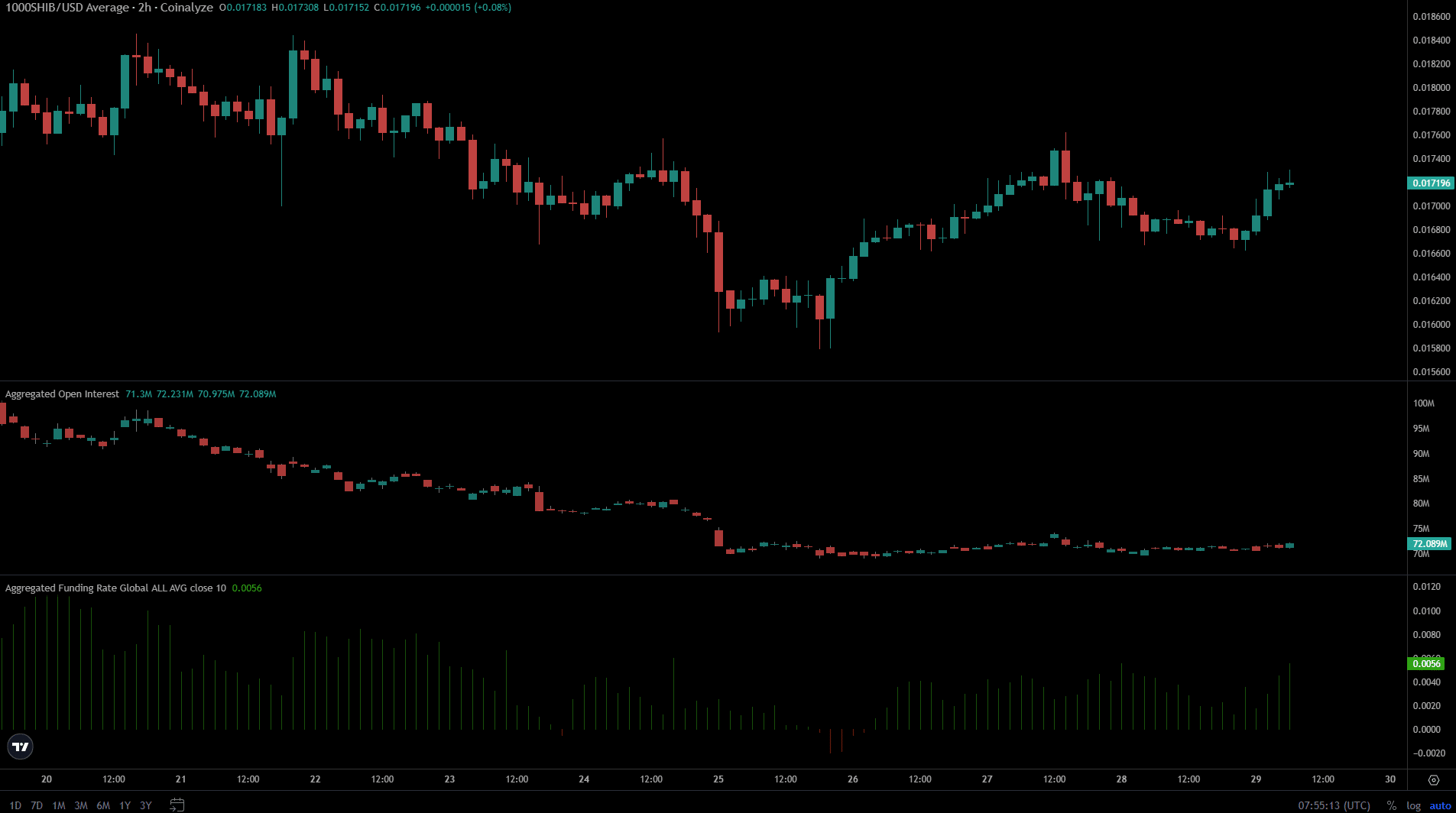

Futures markets showed speculators preferred not to participate

Over the past three days, the price climbed by 5.8% but the Open Interest rose from $70.2 million to $72 million only. This was a sign of bearish sentiment in the near term.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Speculators were not convinced that the meme coin would rally. The funding rate was positive, but the lack of OI combined with the volume metrics meant that Shiba Inu was not ready for a strong move.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply