- Toncoin continues to cool off after a 180% rally in 2024

- TON seemed massively undervalued, but has lost key support levels

Toncoin [TON] is perhaps one of the best-performing cryptocurrencies of 2024. On a YTD (year-to-date) basis, TON, at press time, was up 186%, jumping from $2 to over $8, eclipsing even Bitcoin’s [BTC] 61%.

However, after retesting above $8 in early July, Toncoin [TON] has erased part of its gains, sliding below $7 on the charts.

Its weak attempt to regain the $7 level at press time means that its +15% losses could compound further. This will open even more discounted buys for speculations seeking re-entry.

Are more TON bargains likely below $7?

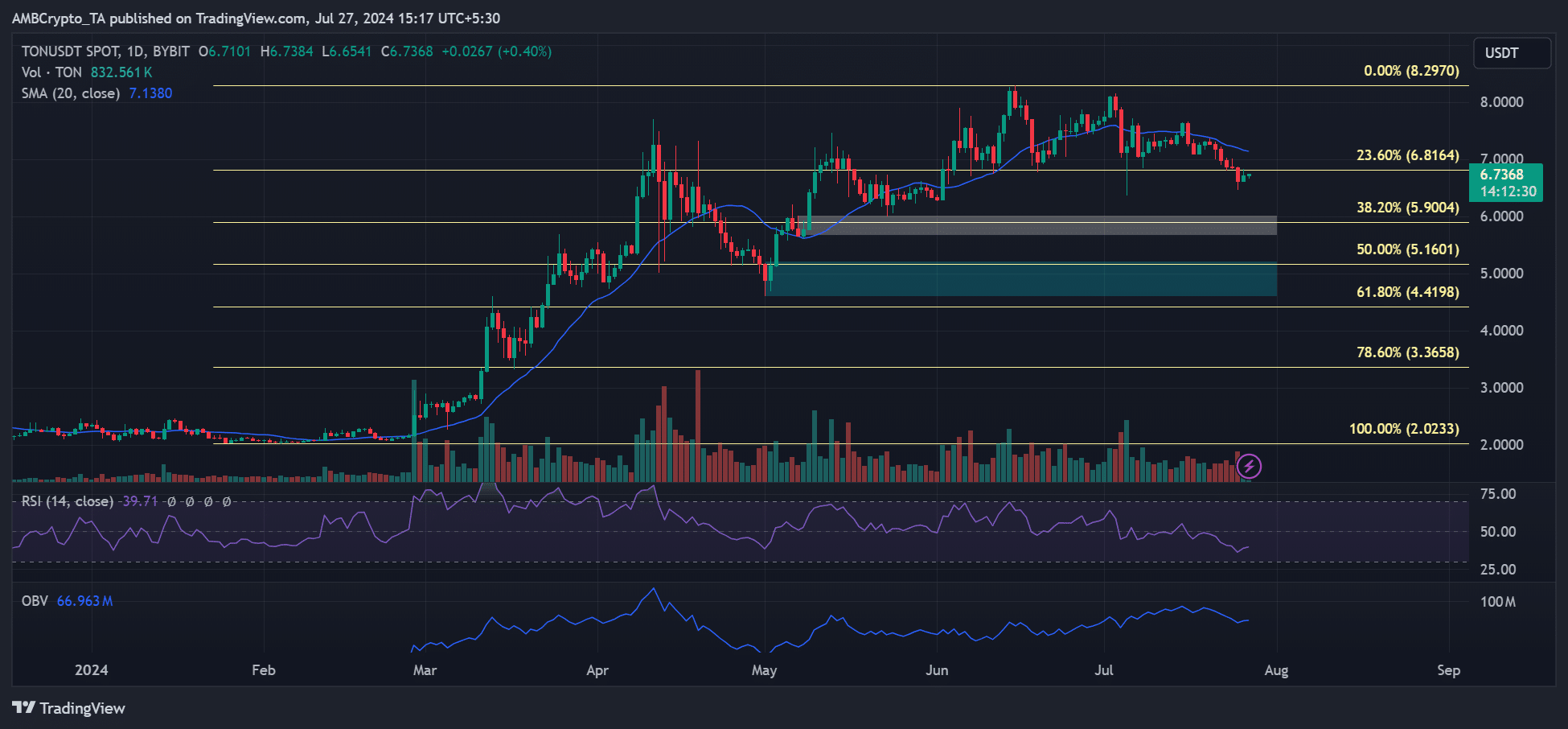

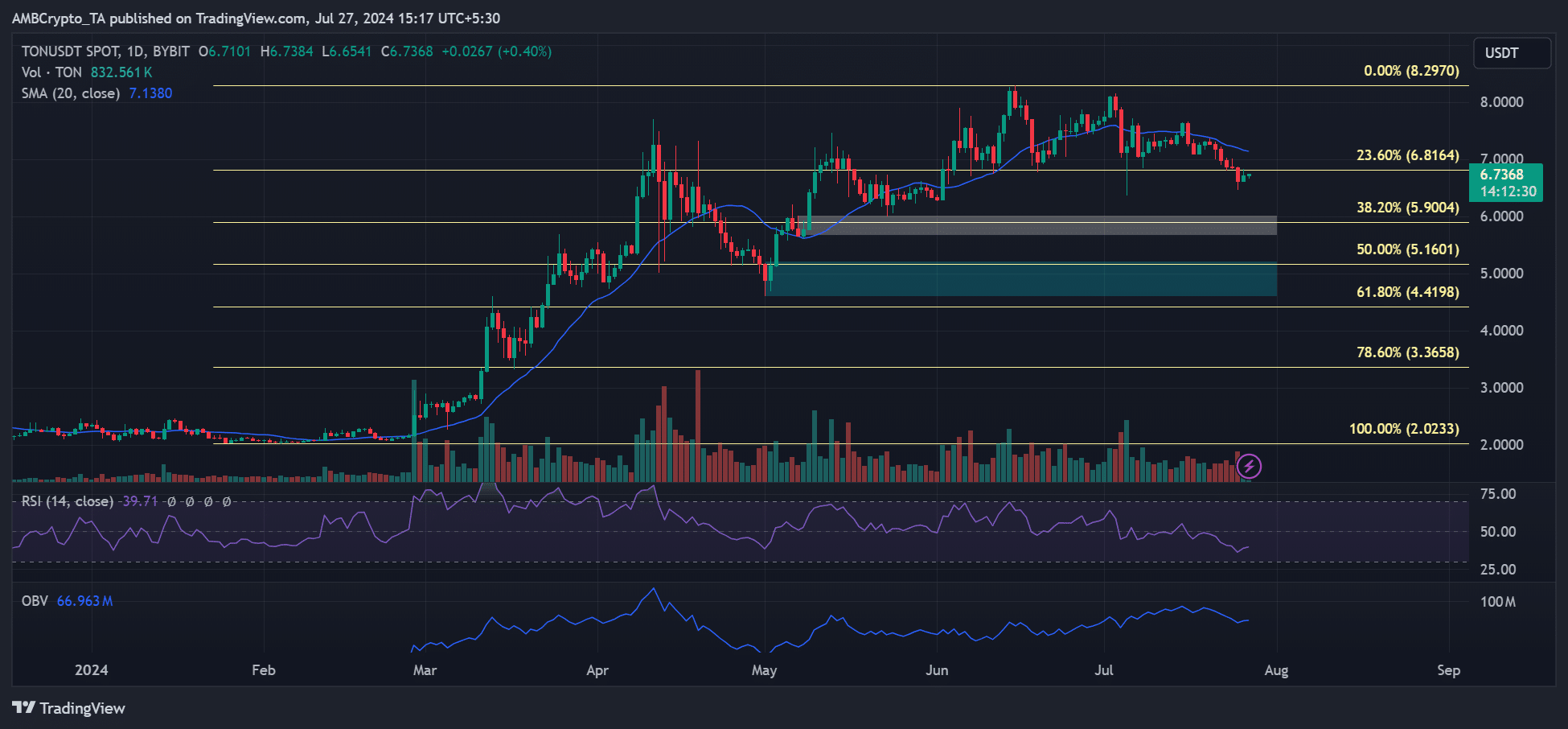

Source: TON/USDT, TradingView

Overall, the market saw a mid-week relief rally as Bitcoin [BTC] retested the $68k level. This feat happened just a few hours before Trump’s speech at the Bitcoin 2024 conference. This can be coupled with high bullish expectations from the Fed rate decision on 31 July.

However, TON seemed weak on the price chart, despite possible bullish momentum on the macro front. The retracement slid below the 20-day SMA (Simple Moving Average) and the 23.6% Fib retracement level. So, TON has lost two crucial short-term support levels.

That means short sellers could drag TON towards the two marked daily bullish order blocks (white and cyan), which coincided with the $5 and $6 levels. So, these two could be key demand levels to track if TON fails to climb past $7.

Additionally, the below-average readings on the RSI (Relative Strength Index) and OBV (On Balance Volume) also painted bearish sentiments for TON on the spot market.

TON – Undervalued?

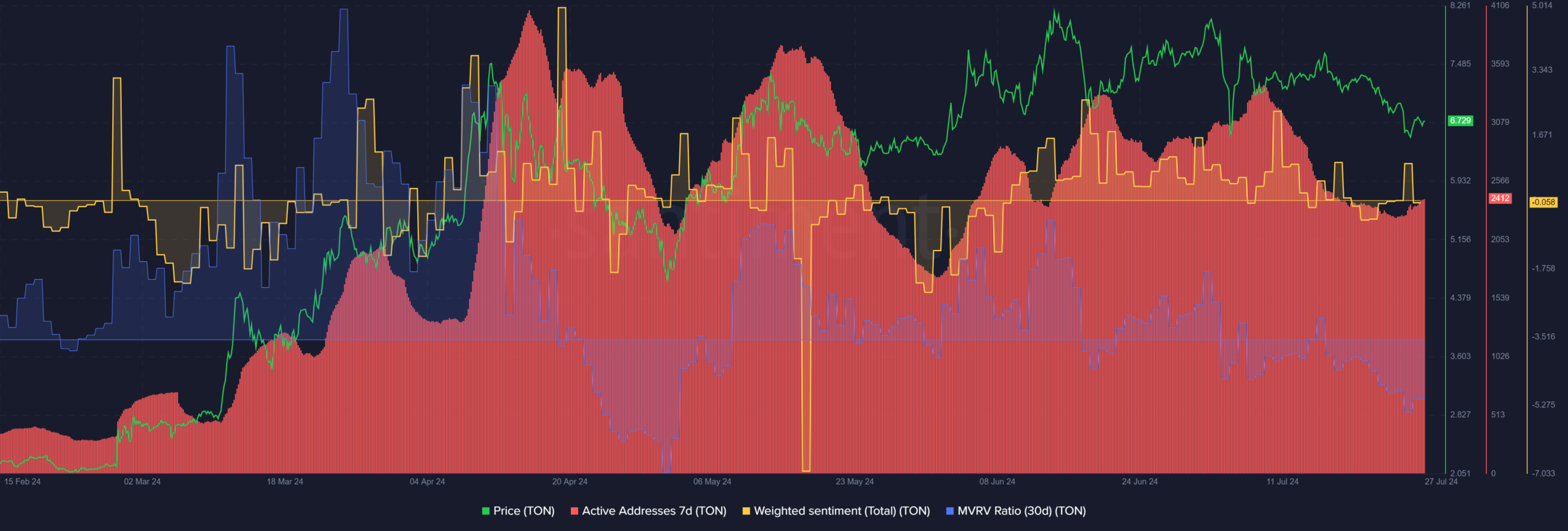

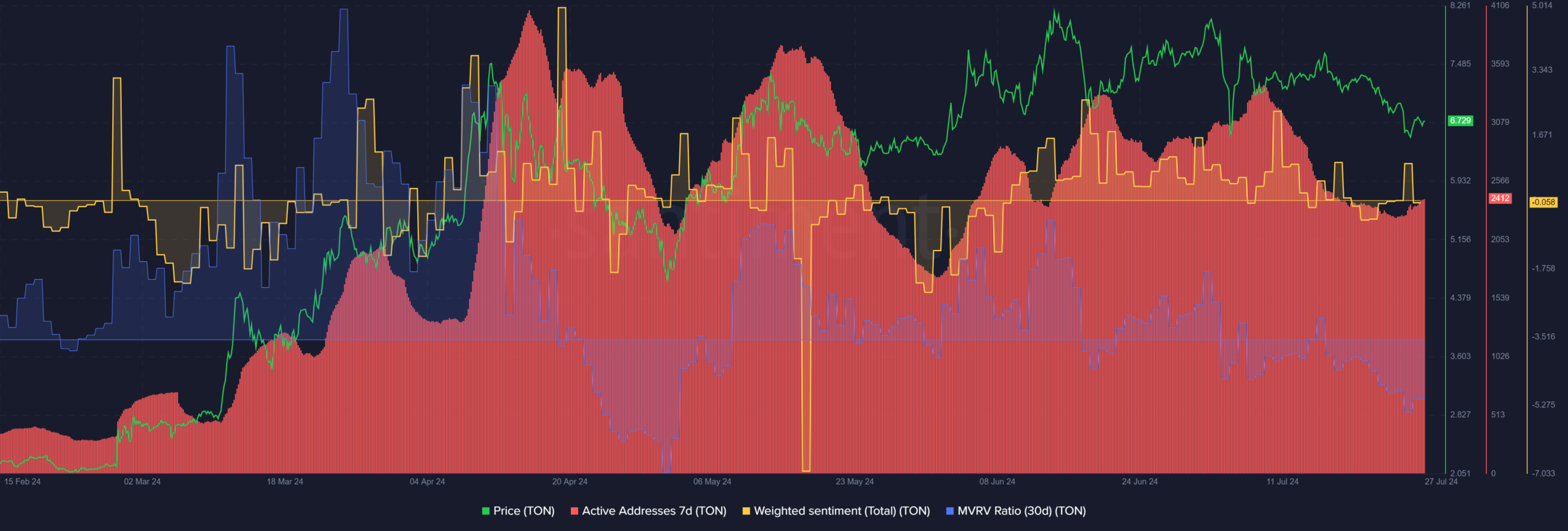

Source: Santiment

According to Santiment’s MVRV (Market Value Realized Value), the negative reading (-7%) suggested that TON was undervalued. This metric tracks the average cost of the token, with the press time reading showing that TON would be a great buy.

Read Toncoin [TON] Price Prediction for 2024-2025

However, there didn’t seem to be strong reversal in network activity, as shown by a slight uptick in daily active addresses. Finally, at press time, overall market sentiment had not strengthened to denote enough of a bullish reversal as the Weighted Sentiment’s reading was neutral.

Collectively, the above readings suggested that TON’s press time position was attractive for speculative bulls, especially when it drops to $6 or $5.

However, a sharp retracement by BTC after Trump’s speech or the Fed rate decision could delay TON’s recovery in early August.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply