- On the 25th of July, Marathon Digital purchased $100M worth of Bitcoin.

- The firm turns to a HODL strategy, reflecting the long term value of BTC.

On the 25th of July, Marathon Digital [MARA], the largest Bitcoin [BTC] mining company, announced the purchase of $100M worth of BTC. At press time, the firm held over 20,000 BTC, worth $1.3B.

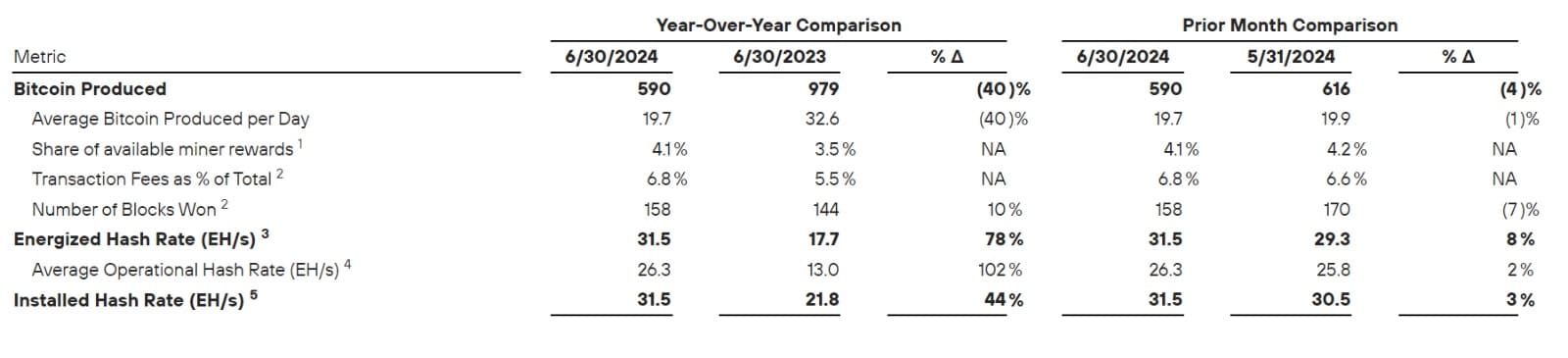

Source: MARA

In addition to continued mining and market purchases, the firm is committed to the HODL strategy.

The strategy implies that the firm continually accumulates its BTC without selling, anticipating future high demand and price hikes. Marathon expounded that,

“Adopting a full HODL strategy reflects our confidence in the long-term value of Bitcoin. We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold Bitcoin as a reserve asset.”

What this strategy means for Bitcoin

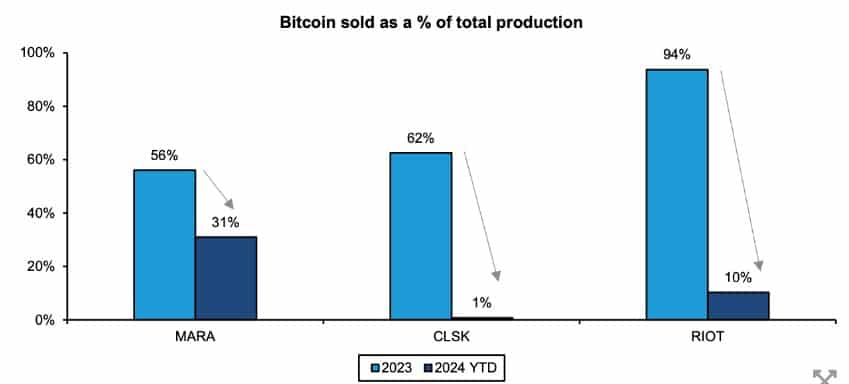

Over the past months, Mara worked hard to reduce its BTC sales. According to Bernstein, the firm has reduced total sales from 56% in 2023 to 31% in 2024.

With the HODL strategy in place, MARA will have zero sales, as it did prior to 2023.

Source: Bernstein

Coming to Bitcoin, the king coin is poised to gain 16% of its current value annually, pushing its market cap to over $60T.

With such anticipated growth, MARA’s stock will rise exceptionally as well, basing its current $1.3B worth of BTC on a 208% annual gain from its current 20k BTC holding.

Since the company will continue its strategic open market and mining activities, it could double its gains by over $500M annually.

This will directly reflect its stock value growth, which has declined by 11.56% YTD because of continued BTC sales.

Source: Google Finance

Read Bitcoin’s [BTC] Price Prediction 2024-25

If investors stick to Marathon Digital’s approach of simply HODLing, they could see profits as well, as Bitcoin is known for having the best gains for long-term investors.

However, do not take this as investment advice, and as with all cryptocurrencies, always remember to DYOR.

Leave a Reply