- DOGE’s price increased by more than 15% in the last seven days.

- A few metrics supported the sellers, but market indicators remained bullish.

Dogecoin [DOGE] has showcased a promising bullish rally over the last week as its value surged by double digits. The better news was that the bull rally might gain more momentum in the coming weeks as it was approaching a crucial resistance level.

Is the memecoin ready for a breakout?

CoinMarketCap’s data revealed that DOGE’s price increased by more than 15% in the last seven days. In the past 24 hours alone, the world’s largest memecoin’s price has surged by over 4%.

At the time of writing, DOGE was trading at $0.1312 with a market capitalization of over $19 billion.

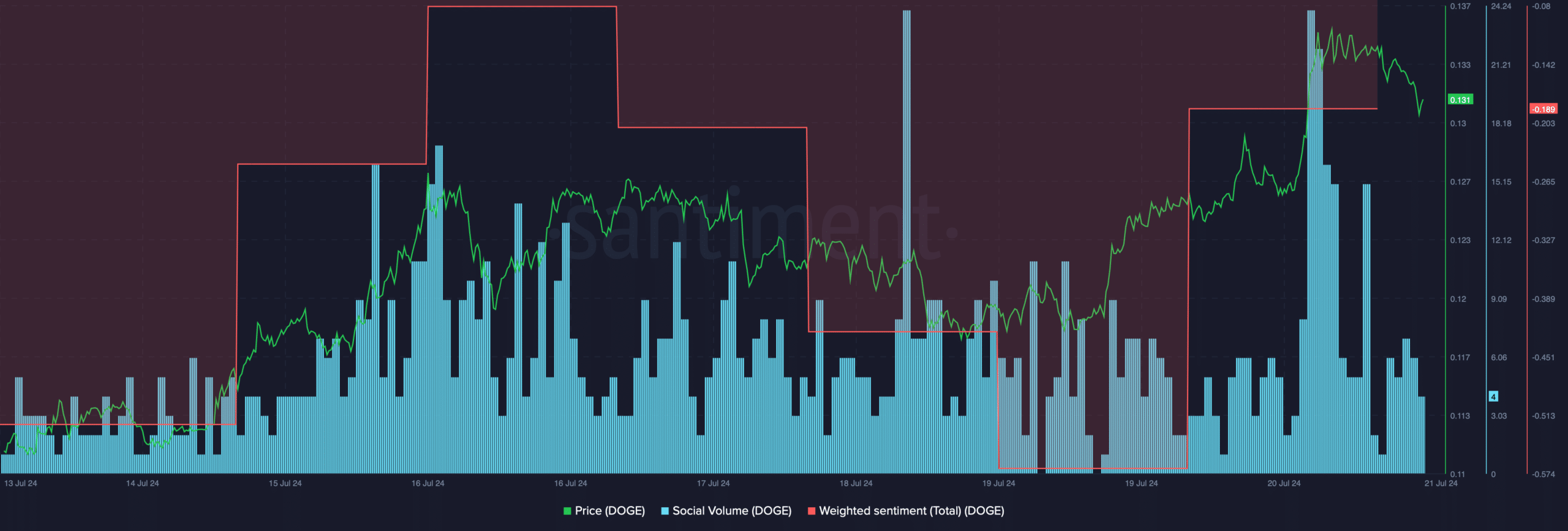

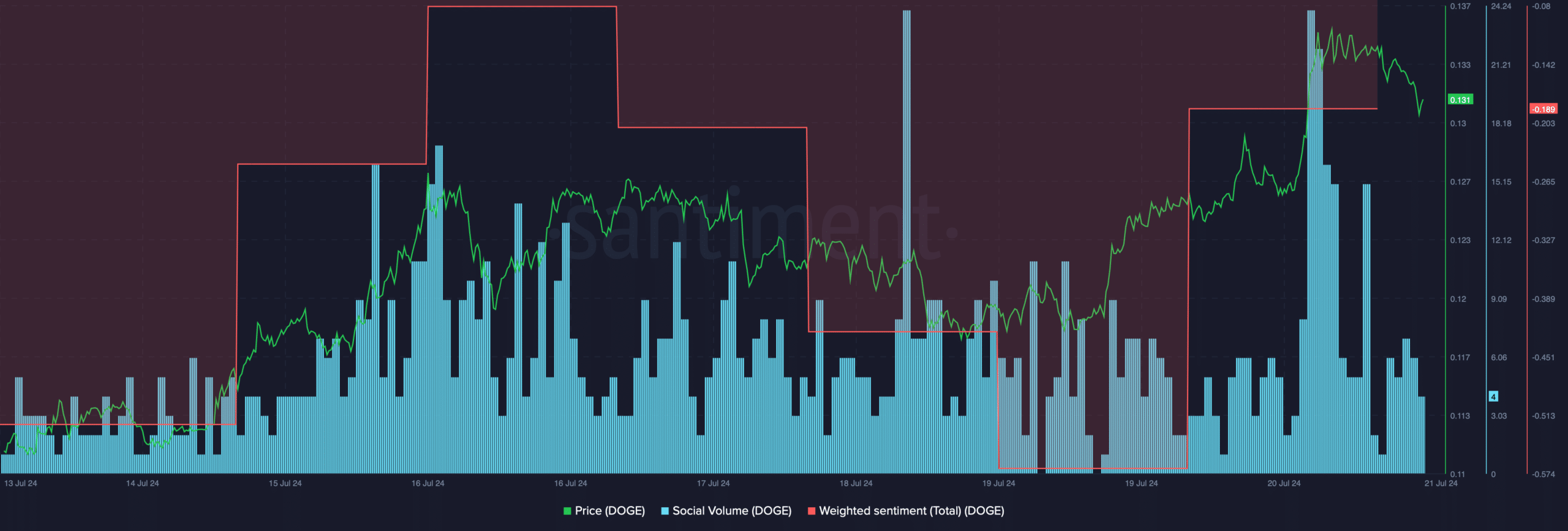

Thanks to the bullish price action, the coin’s social volume spiked, reflecting a rise in its popularity. Surprisingly, despite the recent price uptick, Dogecoin’s weighted sentiment remained in the negative zone.

This meant that bearish sentiment around the token was dominant in the market.

Source: Santiment

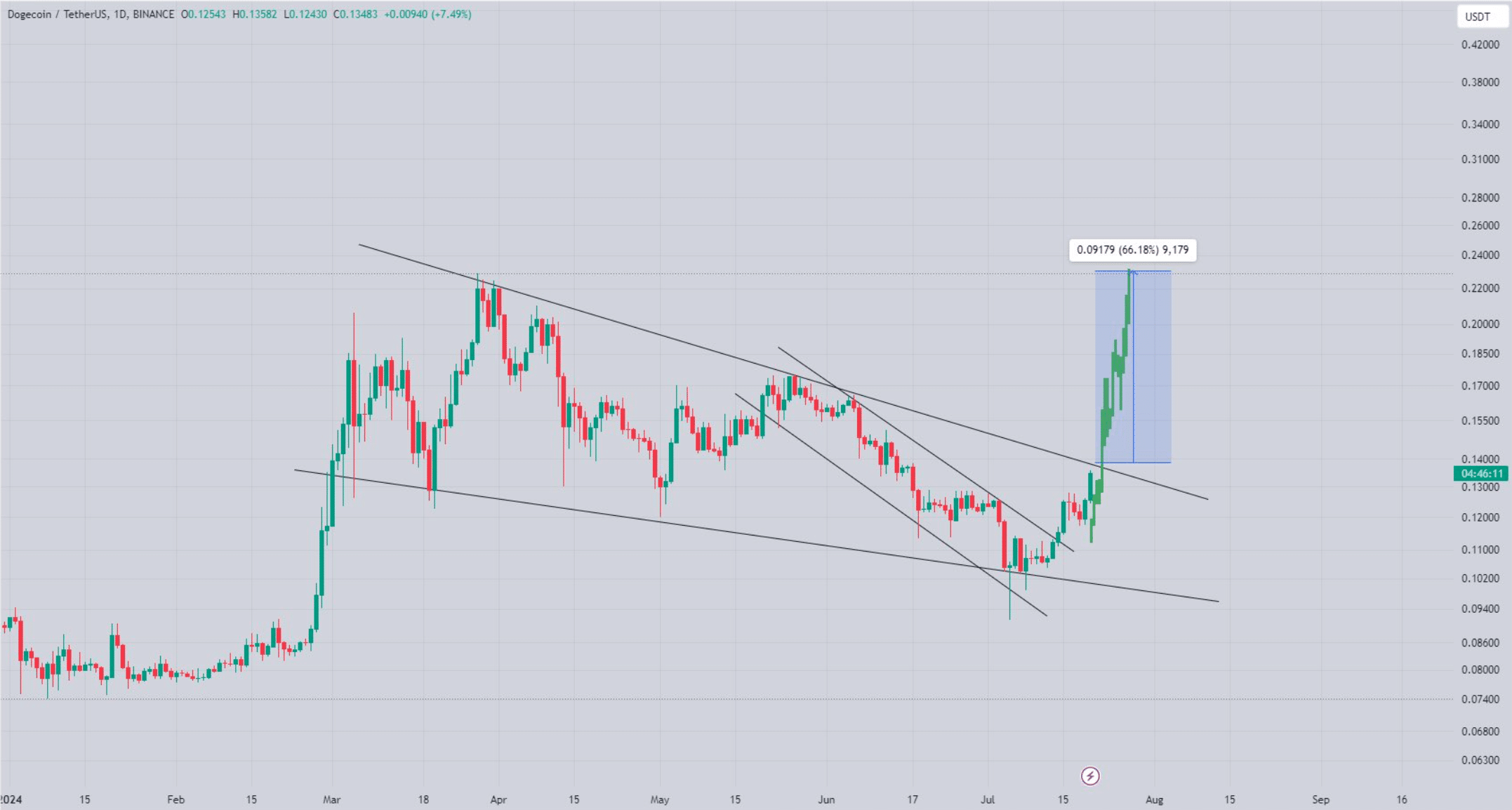

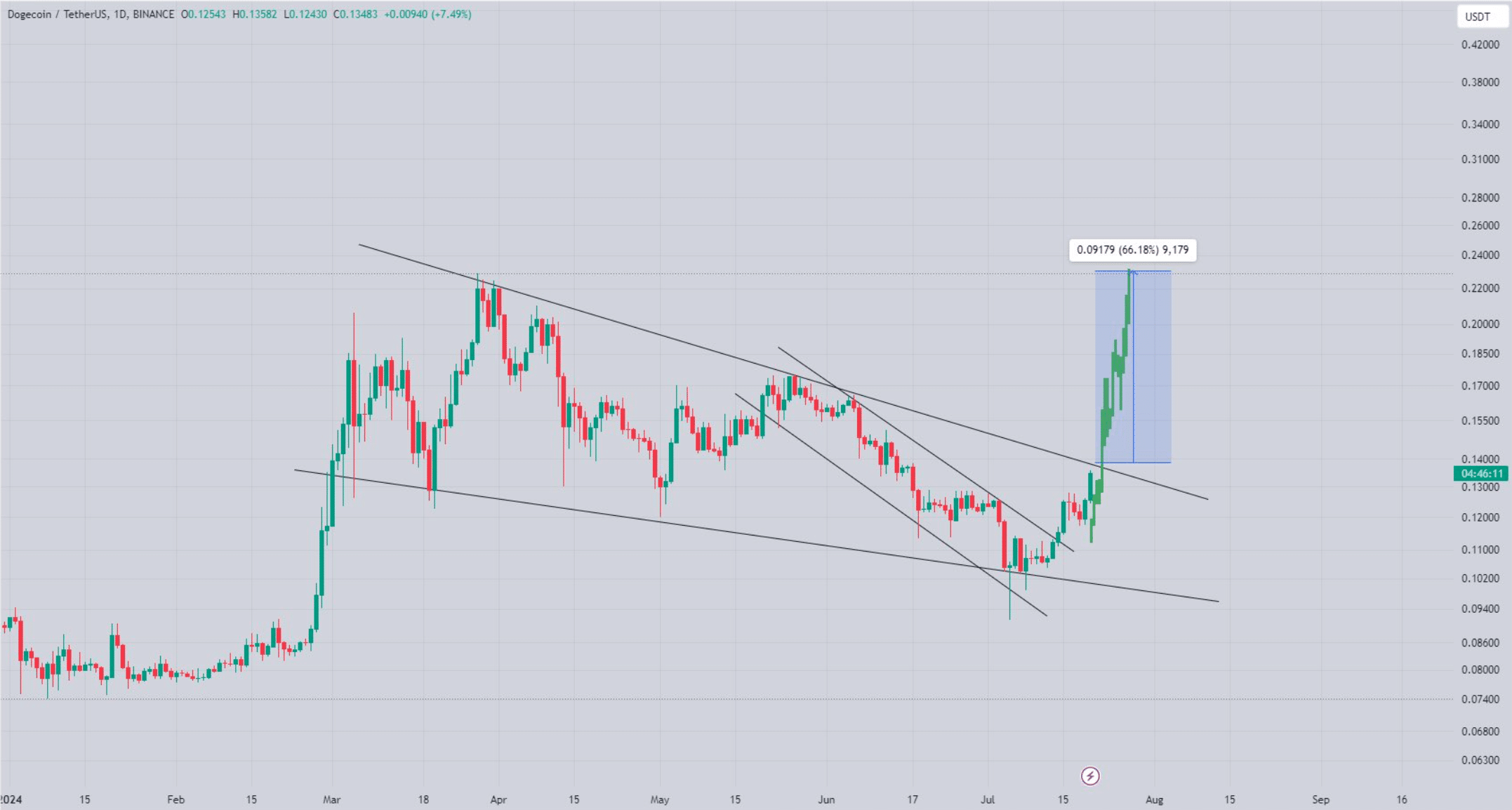

Market sentiment around DOGE can change soon, as World Of Charts, a popular crypto analyst, recently posted a tweet highlighting a bullish development.

As per the tweet, a bullish falling wedge pattern appeared on the memecoin’s chart. The pattern emerged in March, and since then, DOGE’s price has been consolidating inside the pattern.

At the time of writing, DOGE was approaching the resistance of the falling wedge pattern. In the event of a breakout, DOGE might begin yet another bull rally.

To be precise, a breakout might result in a 66% rally in the coming weeks. Therefore, AMBCrypto planned to check DOGE’s metrics to see the odyssey of a breakout.

Source: X

Odds of DOGE remaining bullish

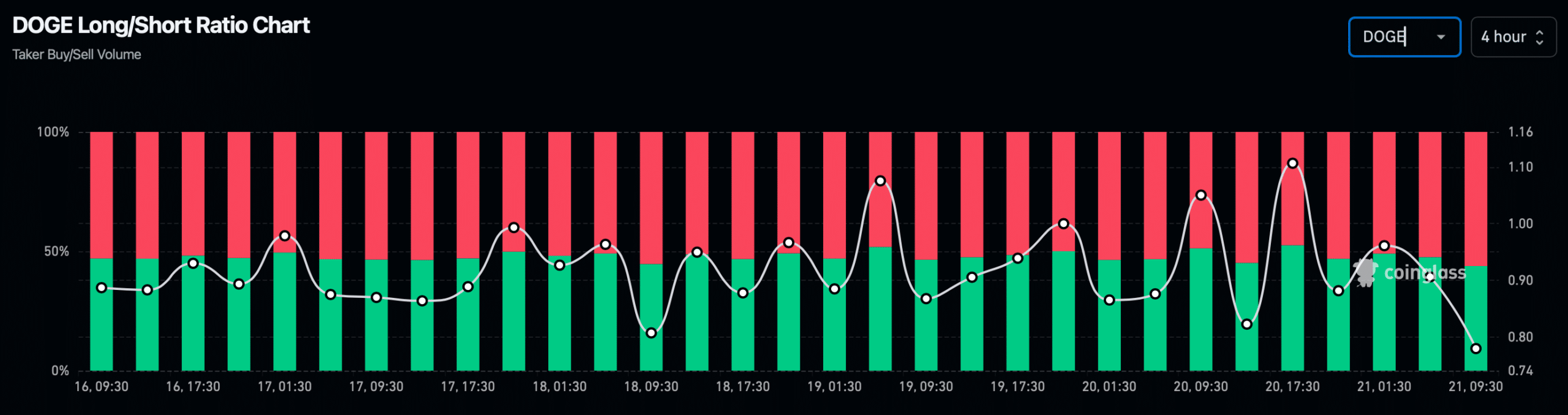

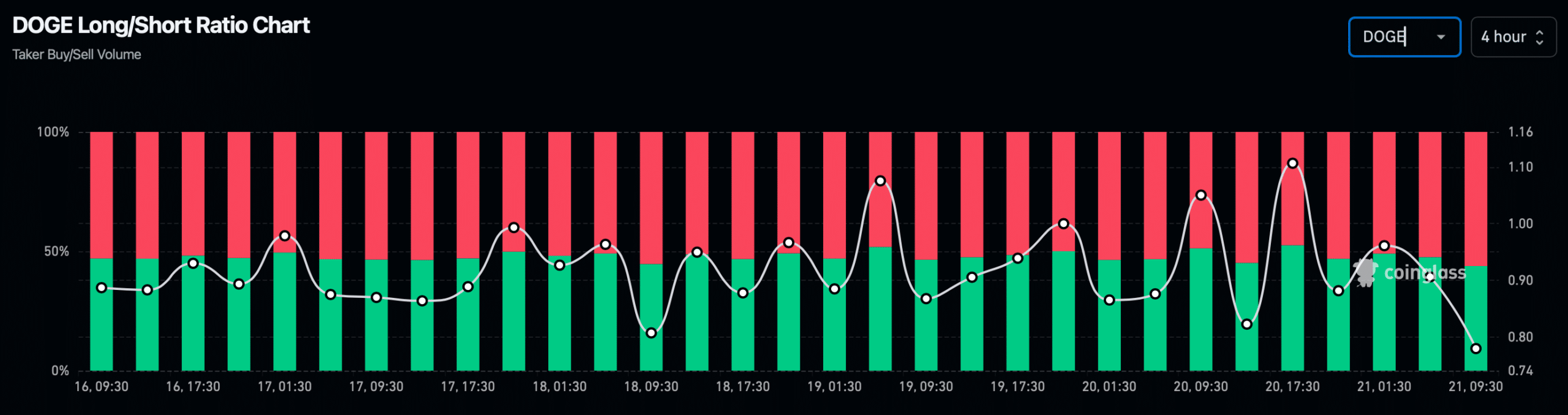

AMBCrypto’s analysis of Coinglass’ data revealed a bearish metric. For example, the memecoin’s long/short ratio registered a decline.

A drop in the metric means that there are more short positions in the market than long positions, indicating that bearish sentiment was dominant in the market.

Source: Coinglass

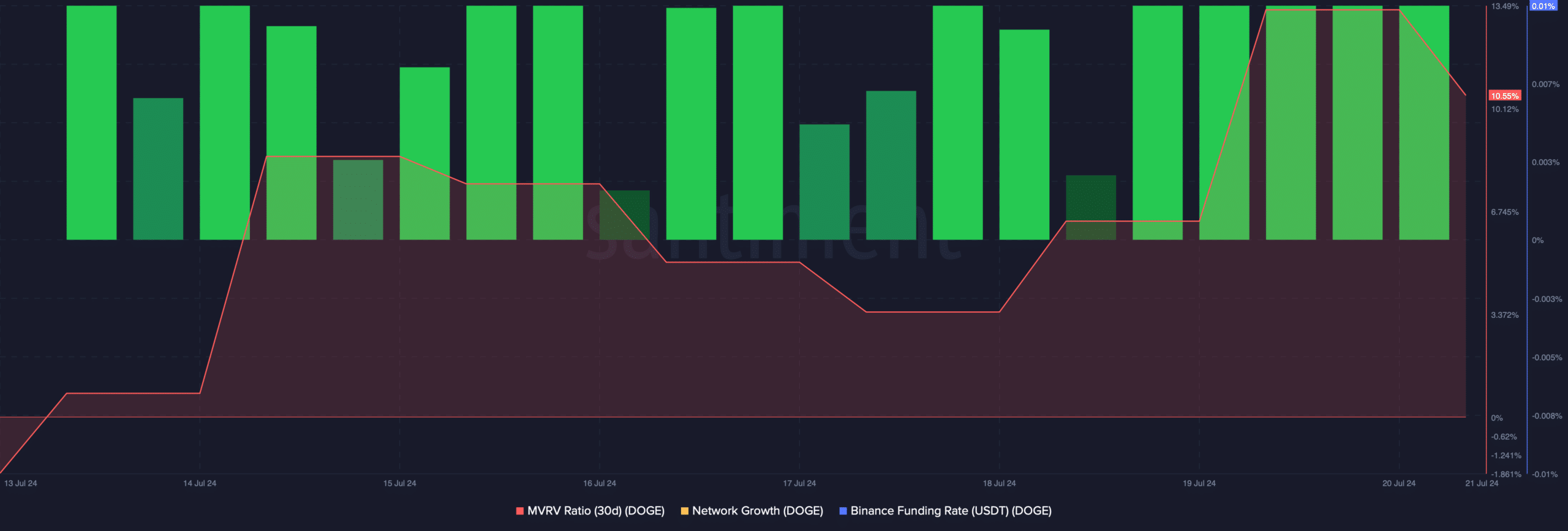

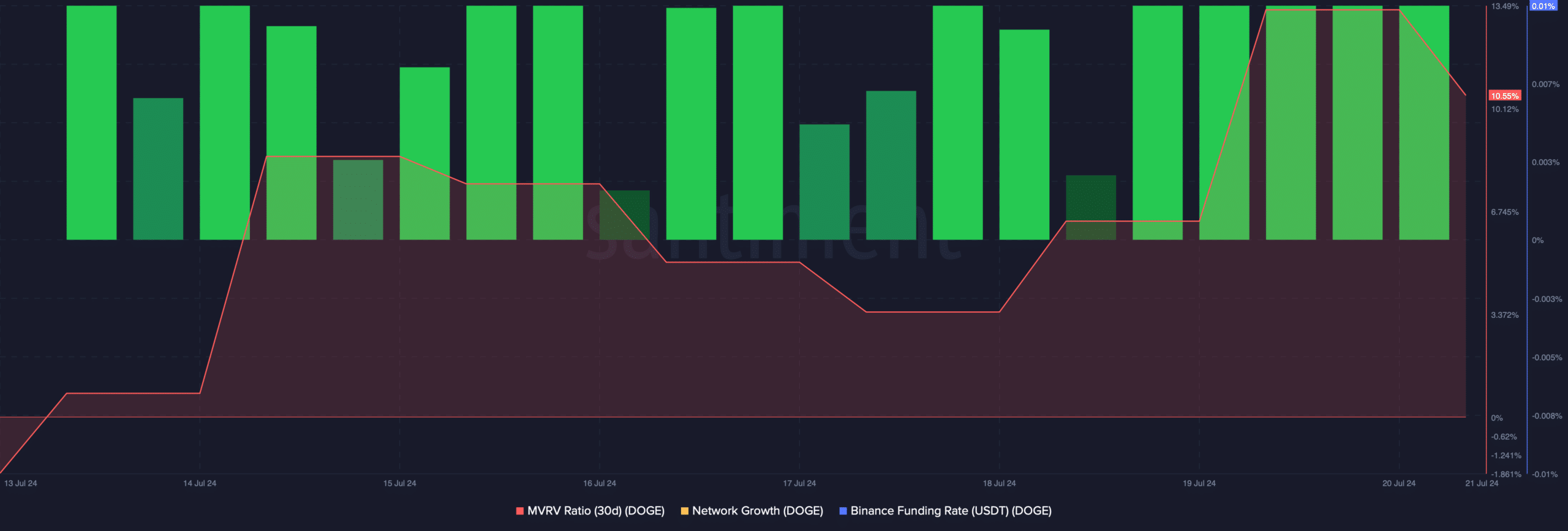

Its funding rate also increased sharply. Usually, prices tend to move the other way than the funding rate. Therefore, there were chances of DOGE turning bearish in the coming days, which could restrict a breakout above the falling wedge pattern.

Nonetheless, its MVRV ratio increased last week, which can be inferred as a bullish signal.

Source: Santiment

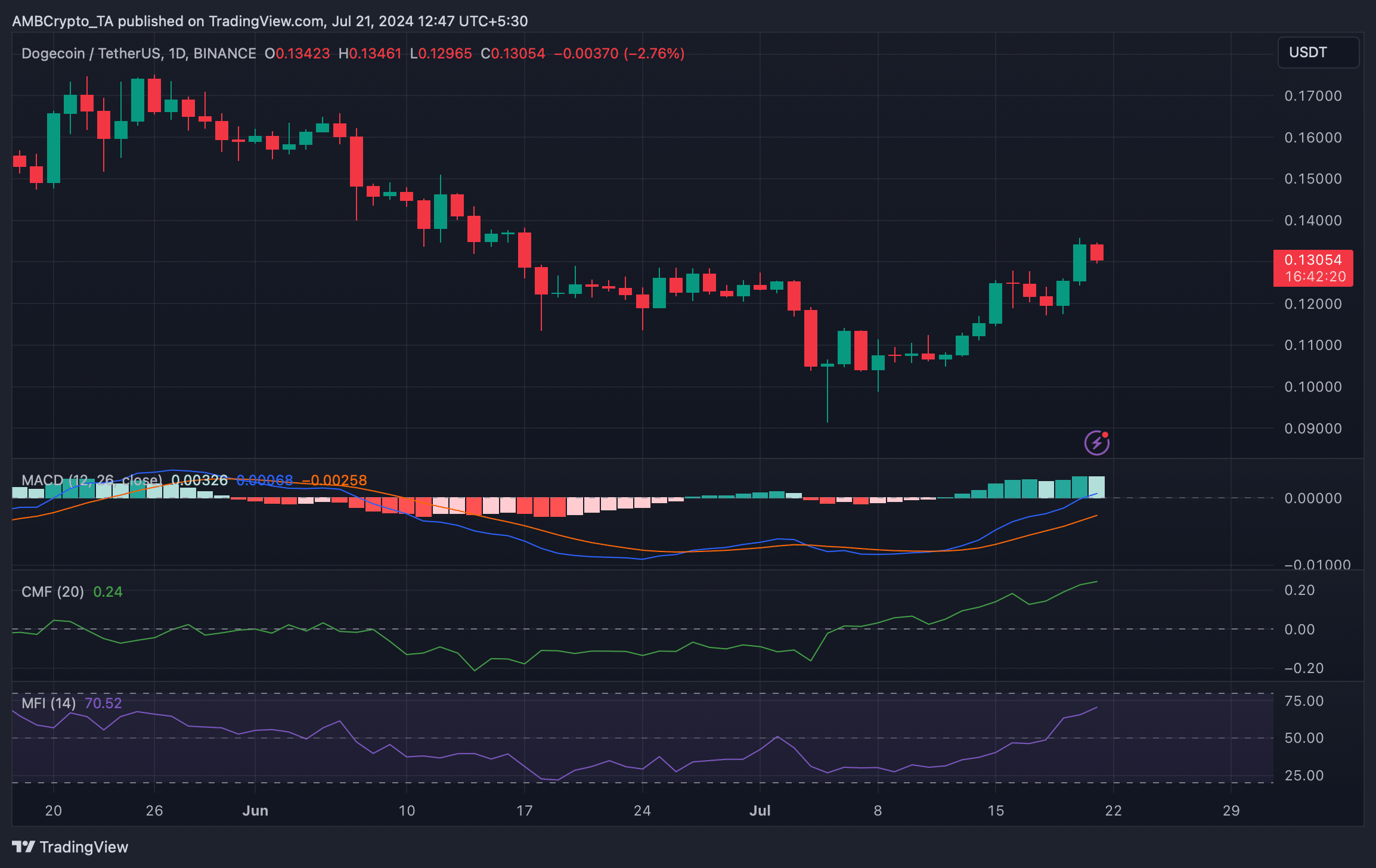

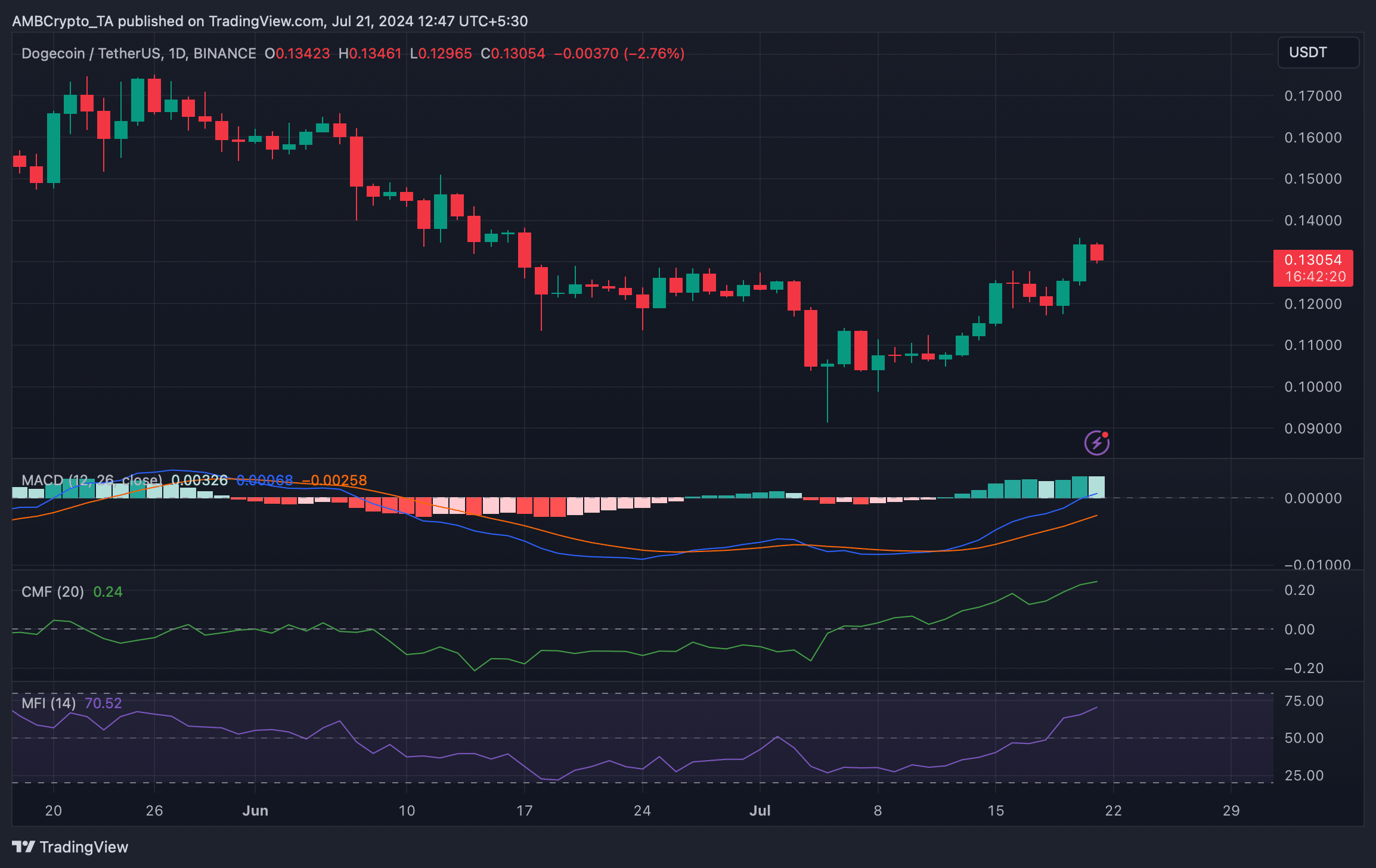

We then planned to check Dogecoin’s daily chart to better understand which way the coin is headed.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Interestingly, the indicators were bullish and suggested a successful breakout above the pattern.

The MACD displayed a bullish advantage in the market. Both its Money Flow Index (MFI) and Chaikin Money Flow (CMF) registered sharp upticks, hinting at a continued price rise.

Source: TradingView

Leave a Reply