Analysts at ARK Invest say that several on-chain indicators are currently reflecting positive market health for Bitcoin (BTC).

In a new report, ARK says that BTC is still in a state of being oversold after large-scale selling from the German government, which liquidated coins this month that it confiscated from an illegal movie streaming website.

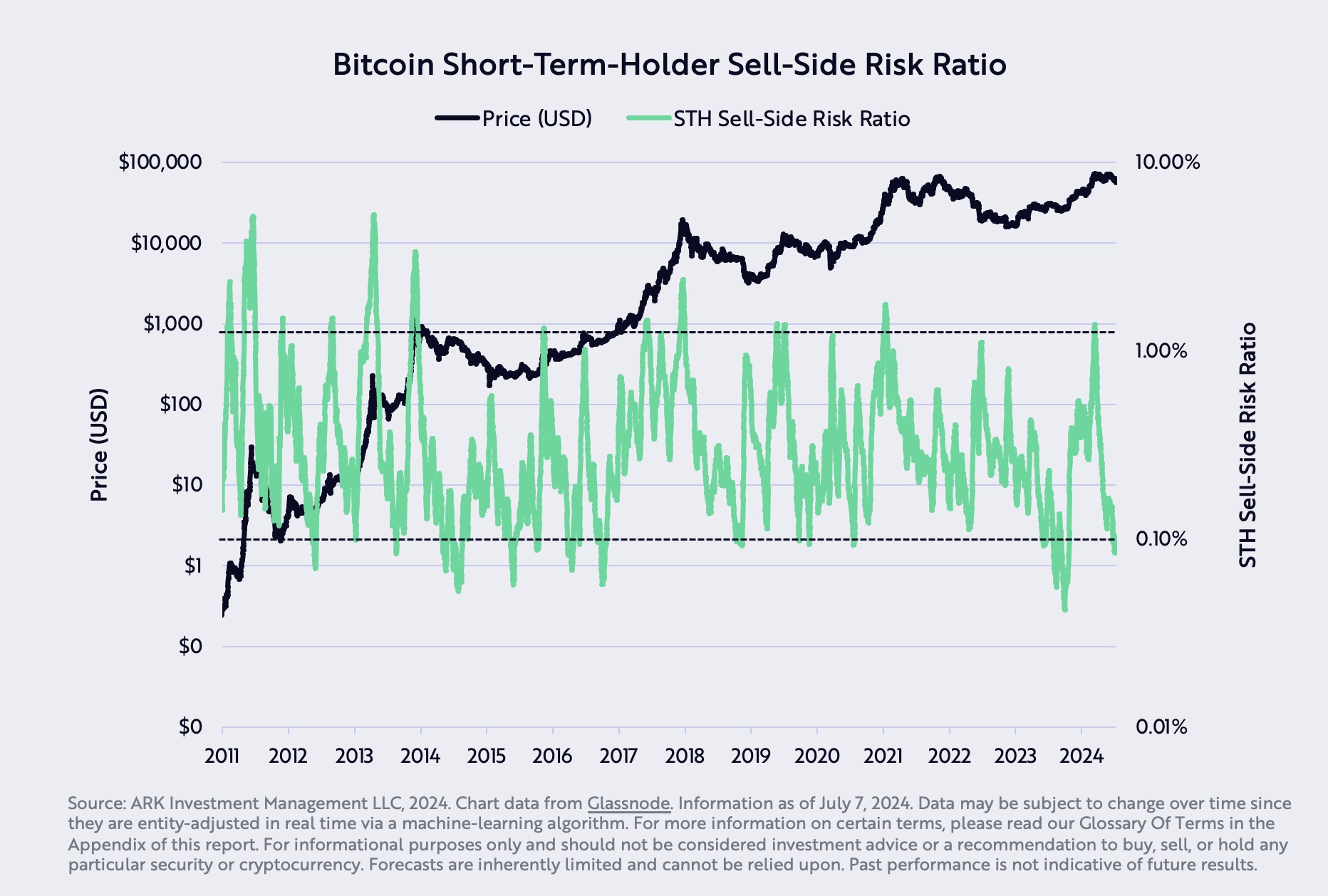

According to ARK analyst David Puell, Bitcoin’s sell-side risk ratio for short-term holders (STHs) is now in a “deep value” zone following the multi-month correction.

The short-term holder sell-side risk ratio indicator aims to predict whether STHs are about to unload their coins and potentially trigger a correction.

Says Puell,

“Another metric in apparent deep value was the sell-side risk ratio of short-term holders, printing values as oversold as in late 2023.”

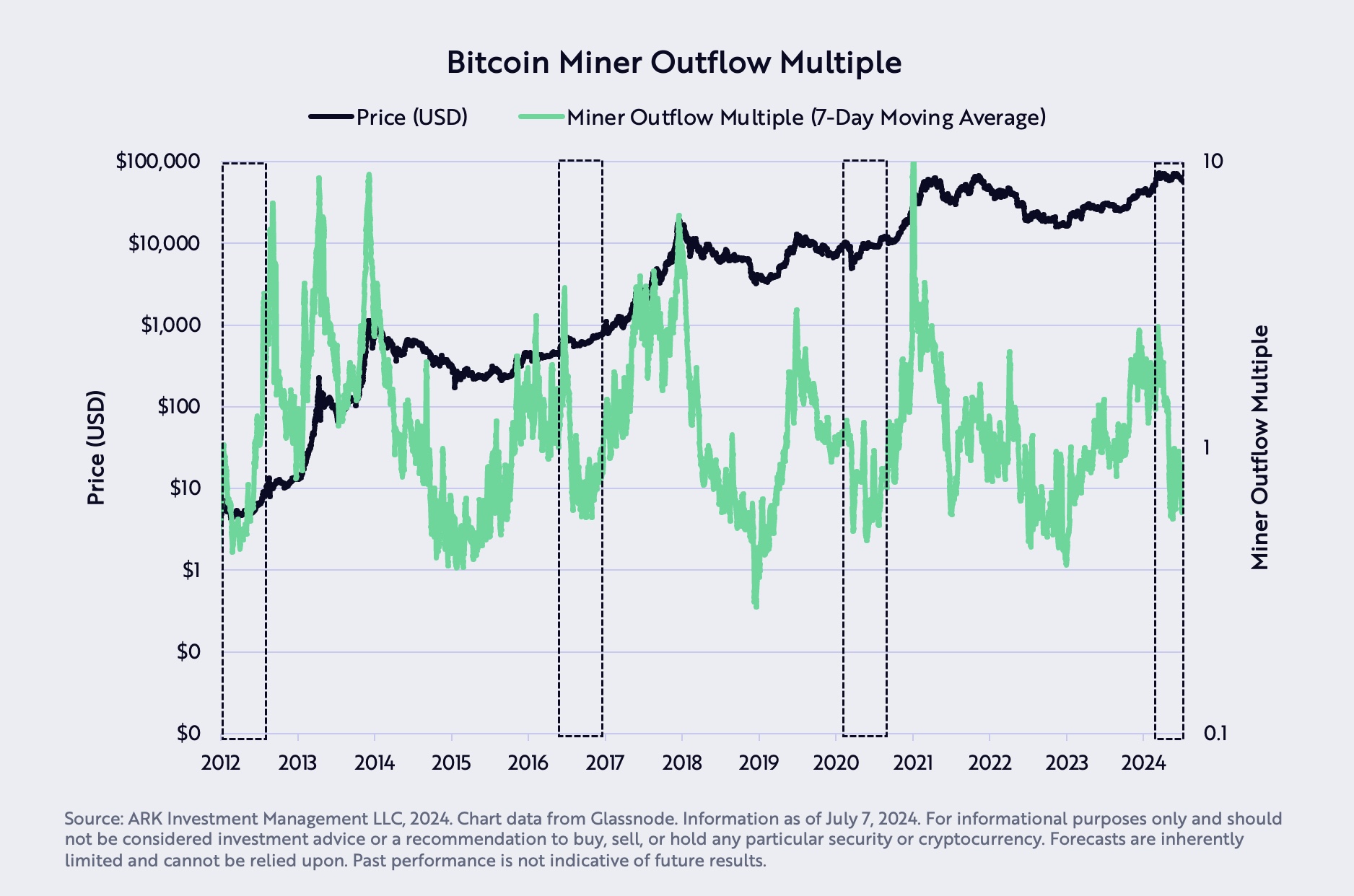

Puell also says that the miner outflow multiple indicator, which records periods where the amount of BTC flowing out of miner addresses is high relative to its historical average, is now at a level that has previously correlated with positive market moves.

“The miner outflow multiple, used to gauge miner capitulation in the Bitcoin ecosystem, traded at 80% its yearly average, usually correlated to positive market reversals.”

According to Puell, ARK believes that incoming economic data will likely force the Federal Reserve to cut interest rates and help boost Bitcoin, contrary to the Fed’s current hawkish sentiment.

At time of writing, Bitcoin is trading at $67,383.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Leave a Reply