- Bitcoin has stayed above $66,000 despite declines.

- BTC saw less liquidation with its recent rise.

Bitcoin [BTC] recently experienced a significant price spike, reaching into the $66,000 zone, which triggered a series of market liquidations. Despite this dramatic increase, the volume of liquidations was unexpectedly low, considering the substantial price movement.

Bitcoin experiences lower liquidation volume

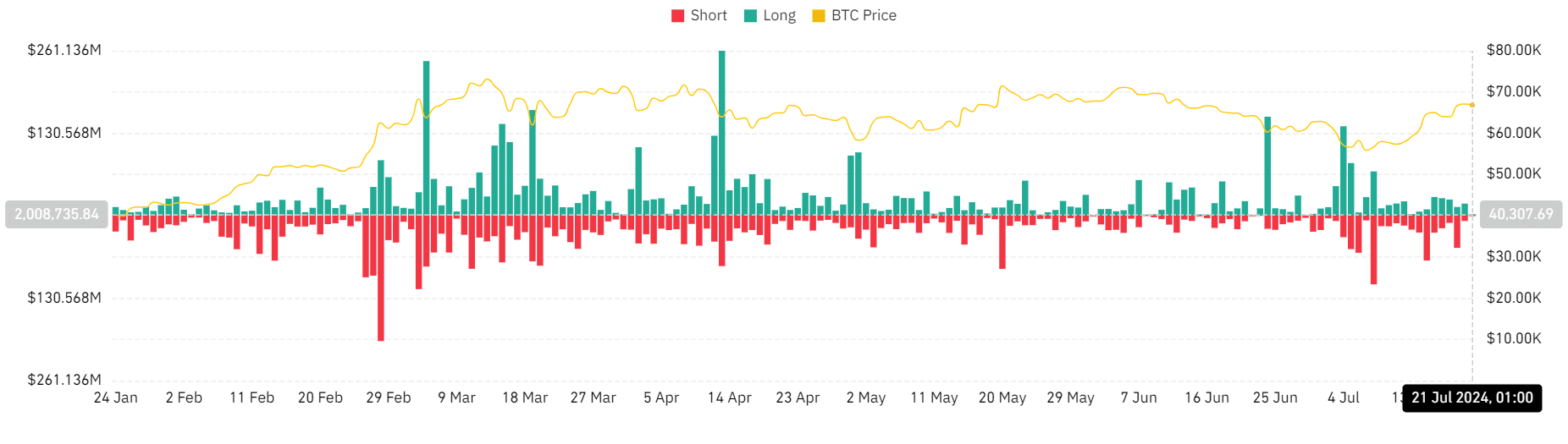

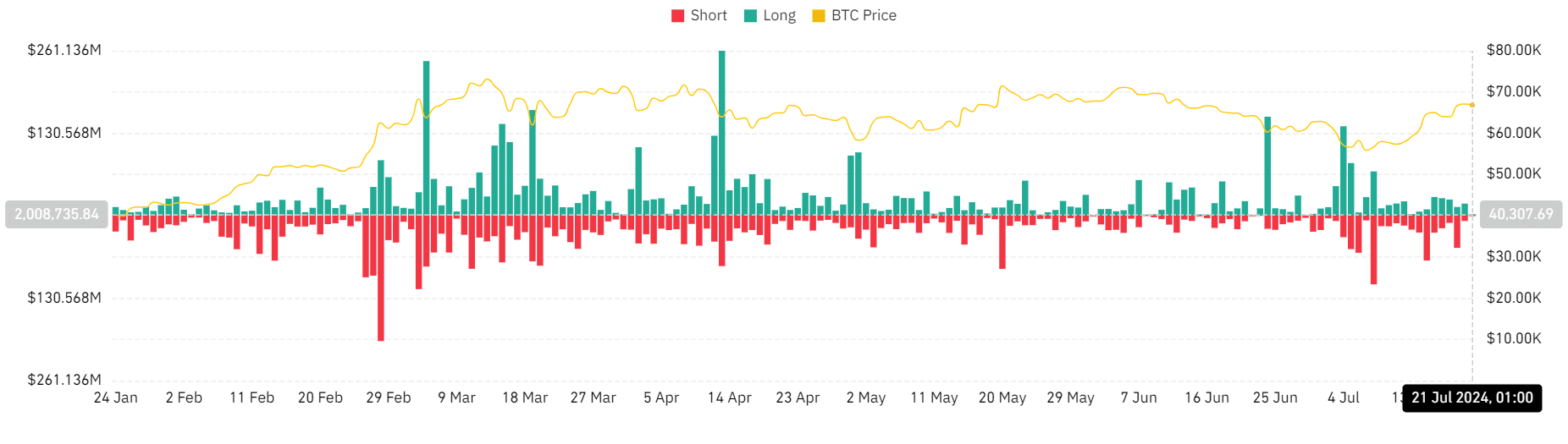

The analysis of the Bitcoin liquidation data from Coinglass for the recent price spike above the $66,000 mark on 19th July revealed some interesting dynamics.

The total liquidation volume recorded was just over $64 million, which, while significant, is comparatively low. Of this, short liquidations accounted for the majority, with approximately $51 million, while long liquidations contributed around $13.7 million.

Source: Coinglass

This relatively lower liquidation volume is particularly notable when compared to previous instances.

For example, when Bitcoin’s price reached around $56,000 on 8th July, the total liquidation volume was substantially higher at over $170 million, including $100 million from short liquidations.

Similarly, a rise to about $64,000 on 15th July resulted in around $80 million in liquidations.

Possible reasons for lower Bitcoin liquidation

This pattern suggests that the market was less leveraged or better prepared for volatility as Bitcoin approached and exceeded the $66,000 threshold.

Traders may have adjusted their strategies or positions in anticipation of potential price movements, leading to fewer liquidations despite significant price changes.

This could also indicate a shift in market sentiment or a different composition of market participants compared to earlier in the month.

Also, analysis of the Bitcoin weighted funding rate and open interest offers valuable insights into the current trading dynamics.

The weighted funding rate has been rising. This increase typically indicates that the demand to hold long positions is strong. It shows that traders are willing to pay more to maintain their positions in anticipation of further price increases.

Concurrently, the uptrend in open interest further underscores the increasing market involvement. With open interest now over $36 billion, it suggests that more capital is entering the market, possibly driving or sustaining the upward price movement.

BTC sees a slight knock-back

As of this writing, Bitcoin was trading at approximately $66,900.

According to an analysis by AMBCrypto, it experienced a slight decline of less than 1%, slightly offsetting the gains from the previous trading session.

Source: TradingView

Is your portfolio green? Check out the Bitcoin Profit Calculator

During that session, it saw an increase of about 0.6%, which had briefly pushed its price above $67,000.

Despite this minor pullback, its overall trend remained strong. This was indicated by its Relative Strength Index (RSI).

Leave a Reply