- Bitcoin price volatility is triggering miner capitulation, signaling potential market shifts.

- CryptoQuant CEO suggests the current miner capitulation phase could persist, advising caution in market participation.

Bitcoin [BTC] price fluctuations continue to dominate the crypto markets, with the leading cryptocurrency experiencing both surges and declines over the past week.

Recently, Bitcoin showed signs of recovery, rising by 3.1% to press time trading price of $58,941. This uptick comes after a dramatic fall below $54,000 last week, a price point unseen since February.

Despite this brief resurgence, Bitcoin remains down 7.1% over the past week and has declined 21.9% from its March high of over $73,000.

Miner capitulation: A persistent concern

Ki Young Ju, CEO of CryptoQuant, a renowned cryptocurrency analytics firm, highlighted that Bitcoin miners are continuing to face challenges, a condition known as ‘miner capitulation’.

This term refers to a period where mining profits are squeezed due to falling Bitcoin prices, leading miners to sell their holdings to cover operational costs, potentially driving prices down further.

Ki Young Ju notes that miner capitulation typically concludes when the daily average mined value drops to 40% of the yearly average; currently, it stands at 72%.

This extended phase of capitulation suggests that the market may experience a lack of exciting movements for the next few months, emphasizing a strategy of long-term optimism but cautious trading in the short term.

In Ju’s words:

“Bitcoin miner capitulation is still ongoing. Historically, it ends when the daily average mined value is 40% of the yearly average; it’s now at 72%. Expect the crypto markets to be boring for the next 2-3 months. Stay long-term bullish but avoid excessive risk.”

Bitcoin fundamentals signal market stress

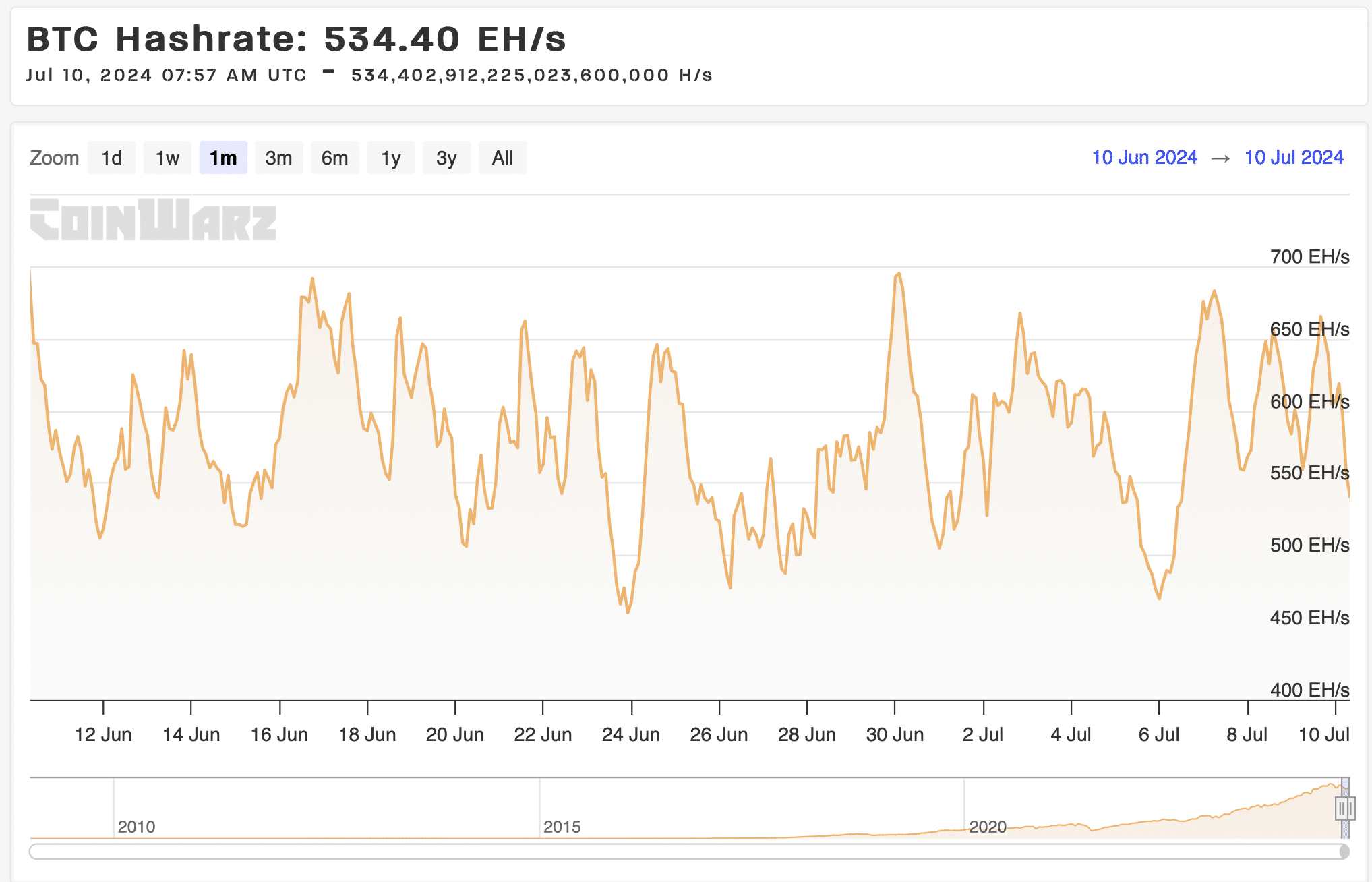

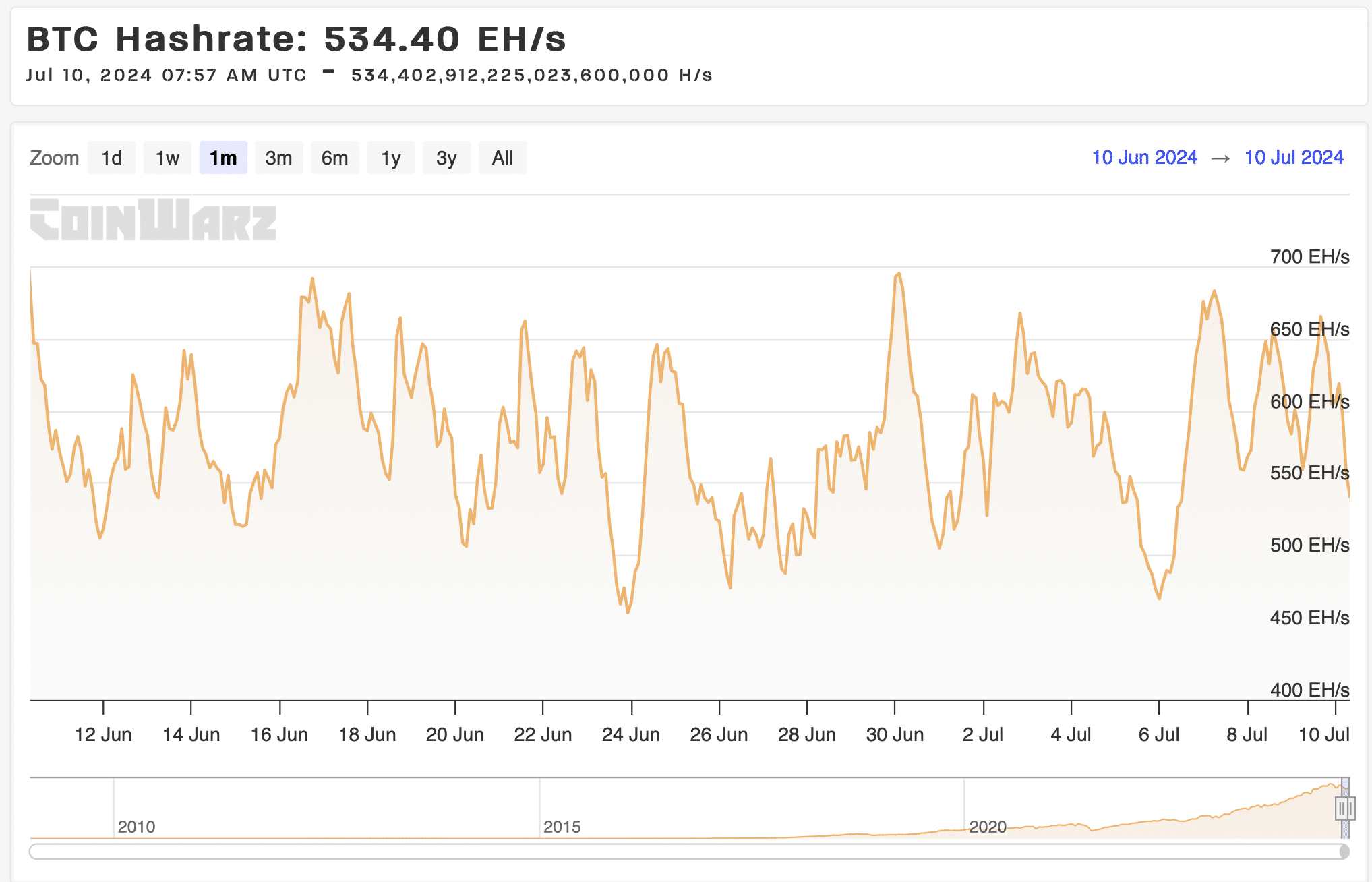

Amid the ongoing miner capitulation, the Bitcoin network’s total computational power or hashrate has recently decreased to 540 exahashes per second (EH/s) from a peak of 751 EH/s in April, according to CoinWarz data.

Source: CoinWarz

This decline indicates that several miners are turning off their equipment, likely due to profitability challenges.

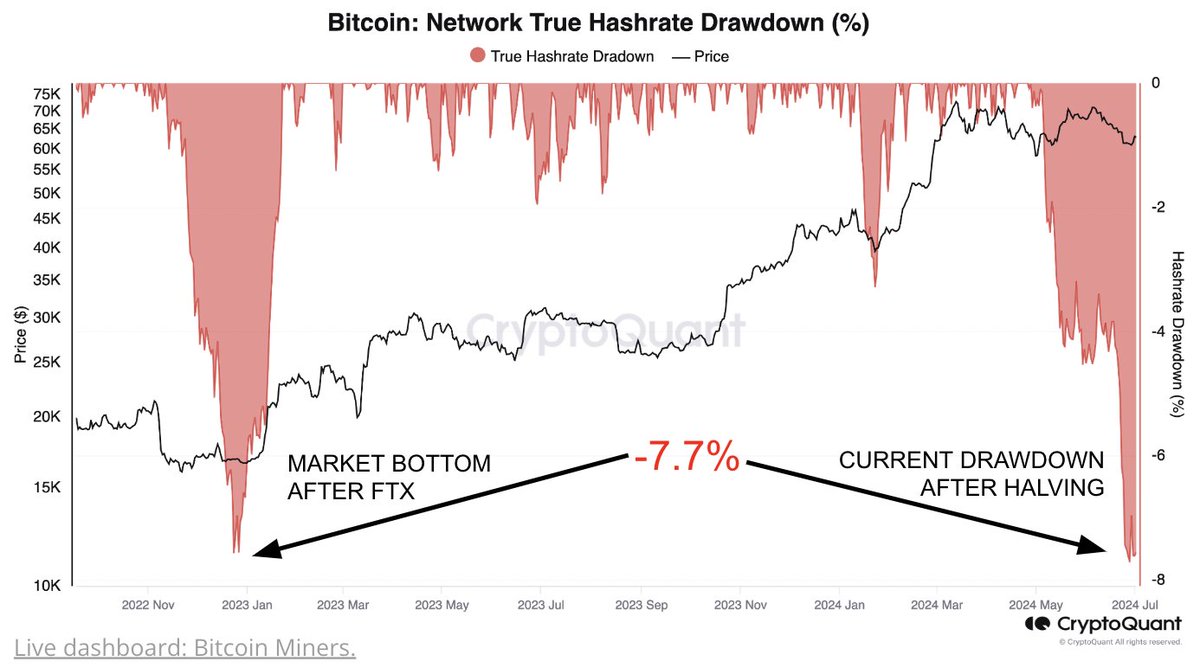

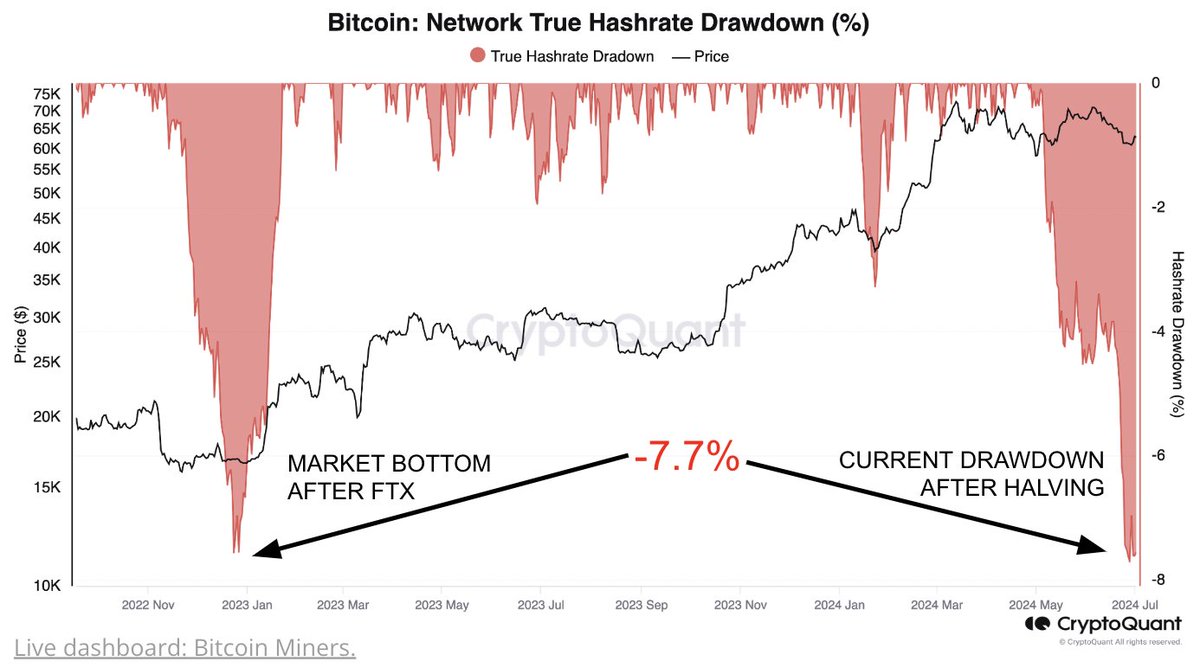

CryptoQuant has observed that significant drops in hashrate have historically aligned with market bottoms, suggesting that these could be indicative of turning points in market dynamics.

Source: CryptoQuant

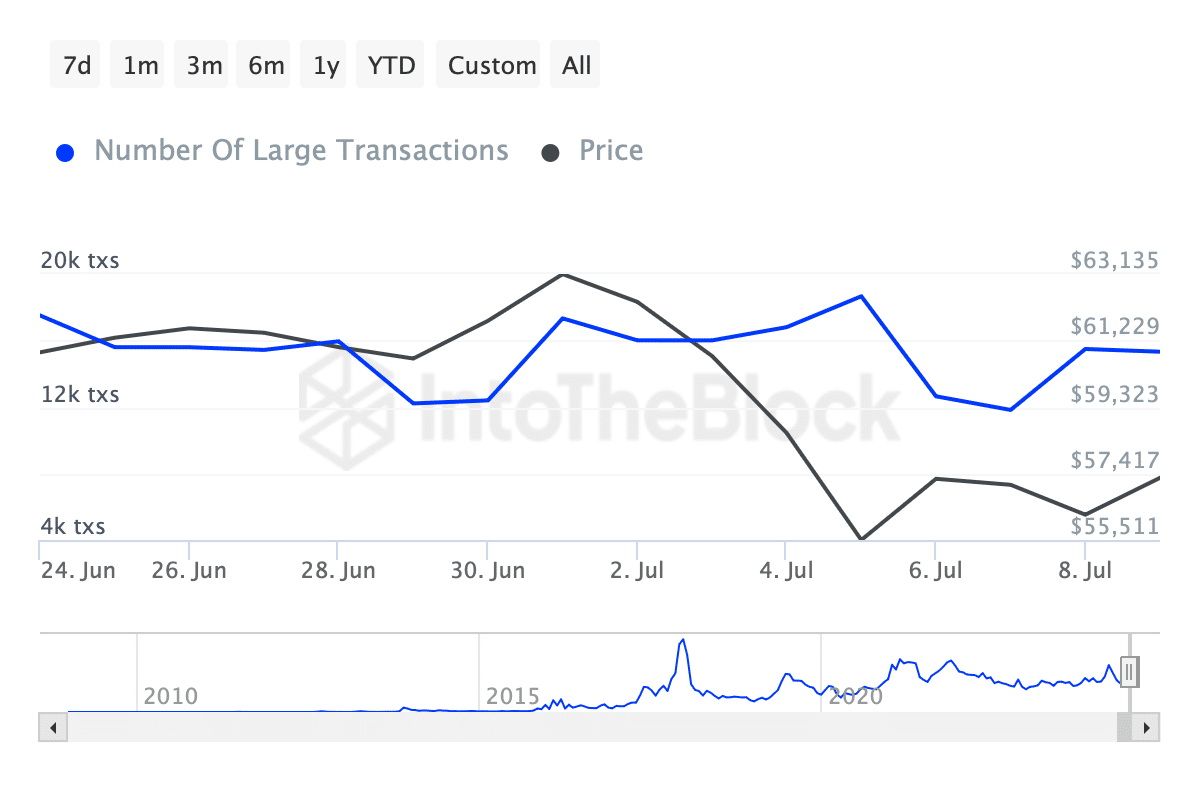

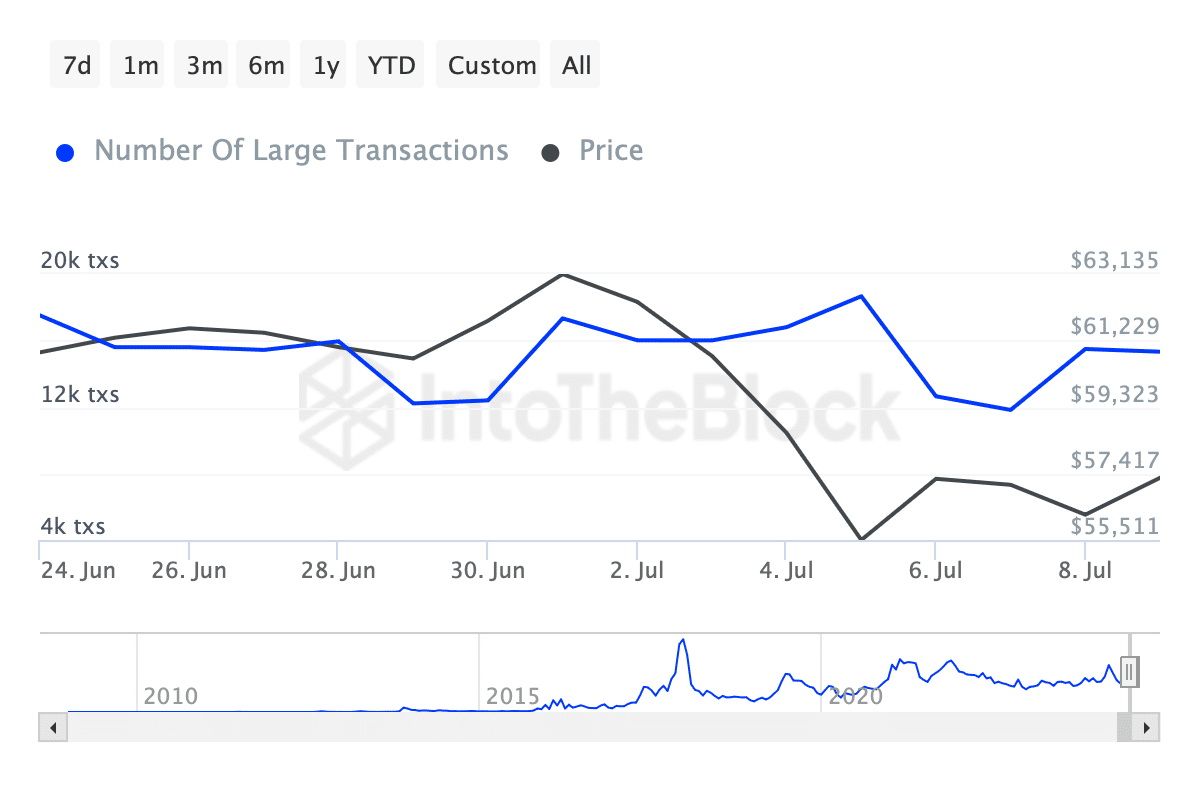

Furthermore, transaction data from IntoTheBlock shows a waning whale interest. Particularly, the number of Bitcoin transactions exceeding $100,000 has fluctuated alongside the price, reflecting the market’s volatility.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Currently, this metric has decreased to 15,330 transactions from over 17,000 in late June, underscoring the cautious stance many large-scale traders and investors are taking.

Source: IntoTheBlock

Regardless of all of these, AMBCrypto has recently reported that there is still a 25% likelihood of Bitcoin hitting a new all-time high (ATH) this year.

Leave a Reply