Closely followed quant analyst PlanB believes that Bitcoin (BTC) is gearing up for a big bounce based on key indicators.

In a new strategy session, the analyst, known for popularizing the stock-to-flow (S2F) model, tells his 169,000 YouTube subscribers that on-chain data indicates BTC remains in a bull market.

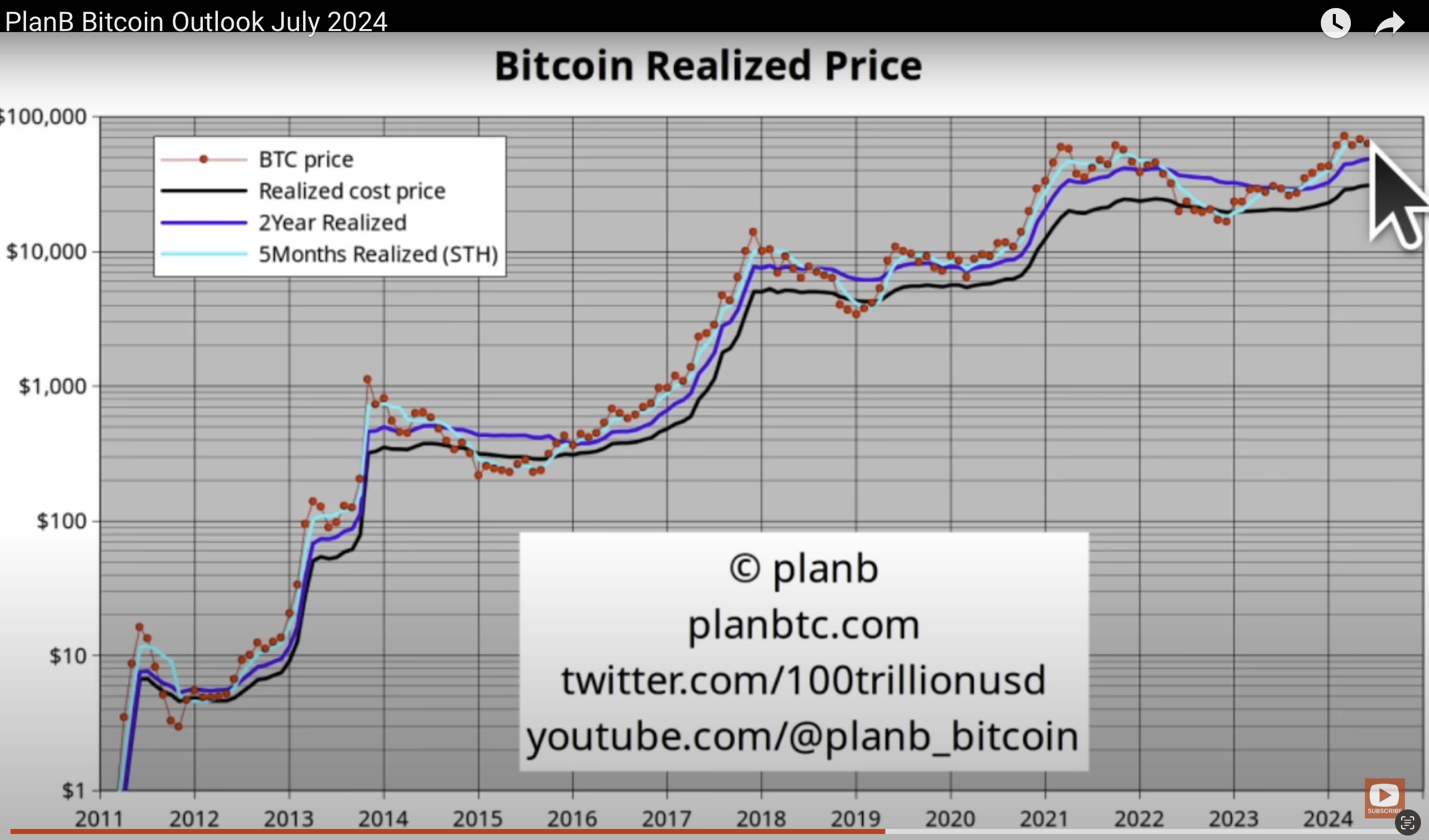

PlanB looks at the realized price metric, which records the value of all coins in a given time frame at the price they were last transacted on-chain, divided by the number of BTC in circulation. He says that he expects a bounce from the five-month realized price level, which currently sits at around $65,000.

“This light blue line, the five months realized price, has always served as a support line in bull markets. So Bitcoin rarely goes below this line. It sticks to that line actually. And the same has been true for the last couple of months. So right now Bitcoin sitting a little bit below that line is very interesting. I expect it to bounce from this five-month realized price up… I expect a bounce from that $65,000, but we’ll see.”

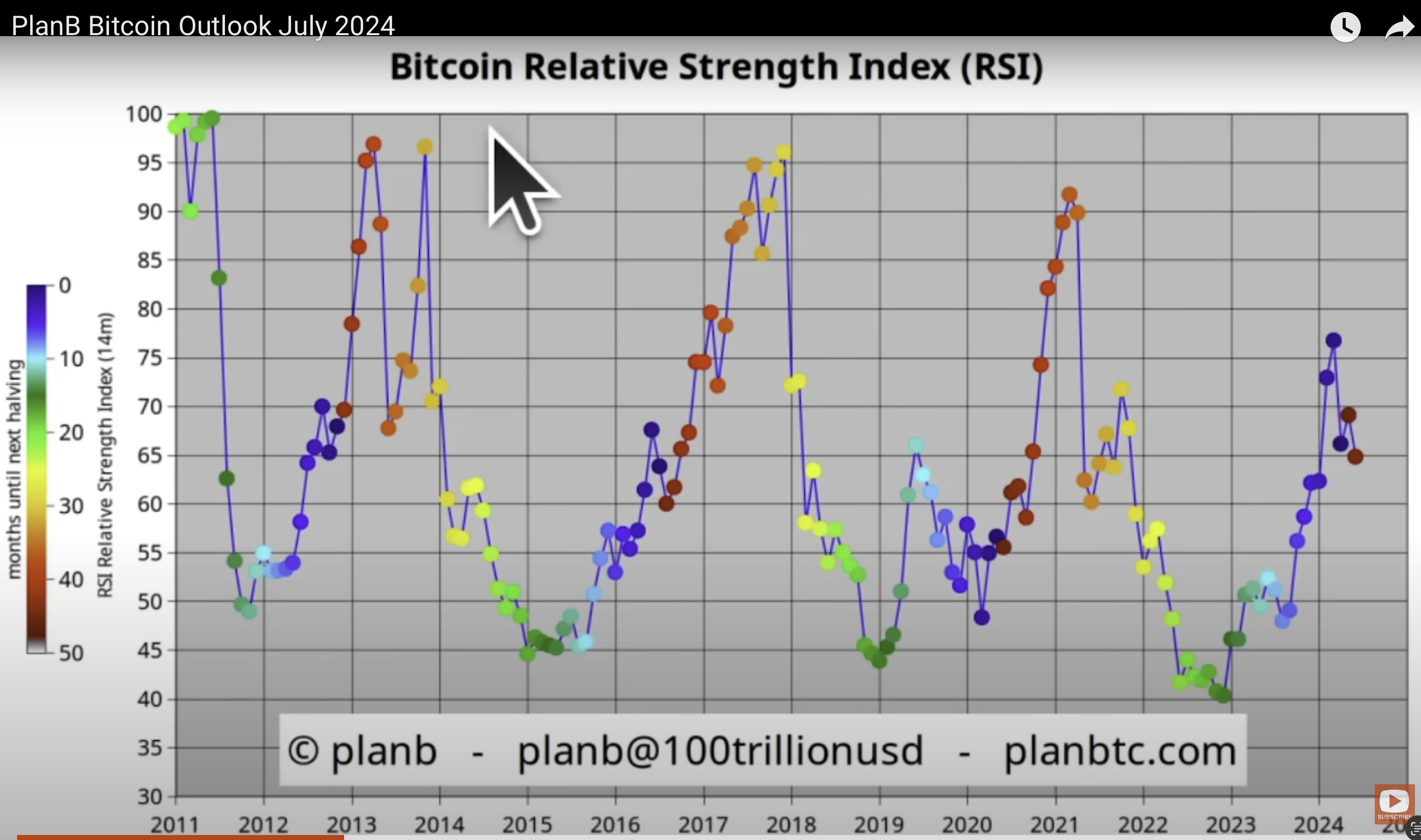

PlanB is also watching Bitcoin’s Relative Strength Index (RSI), a widely-used momentum indicator that aims to determine if an asset is overbought or oversold. He believes the RSI this cycle will reach the peak levels of prior cycles.

“In my opinion, there will not be diminishing returns. There’ll be exponential returns, and we will see RSI values above 80 again like in 2013, in 2017 and in 2021. So time will tell.”

Bitcoin is trading for $61,785 at time of writing, down more than 2% in the last 24 hours.

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Leave a Reply