- TON began the month with an almost 1% increase.

- There has been more whale accumulation recently.

Toncoin [TON] has recently experienced positive price movements, bringing it closer to its all-time high. This upward trend has caught the attention of large-scale investors, or “whales,” who have been actively accumulating significant token volumes.

Interestingly, despite this active accumulation by whales, the overall volatility in Toncoin’s price has decreased over the past few weeks.

Toncoin starts strong

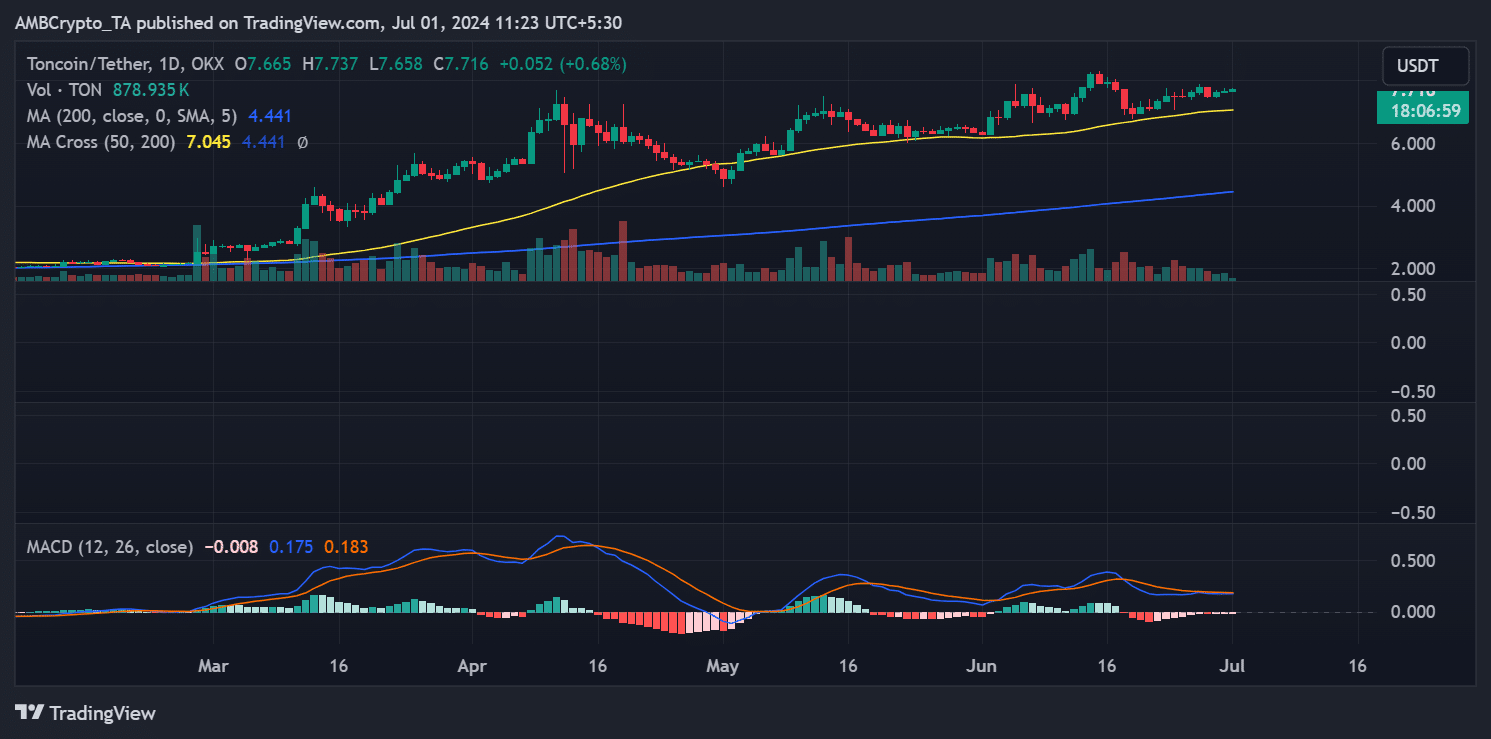

AMBcrypto’s analysis highlights a positive trend for Toncoin. The daily time frame chart showed that it closed the previous month positively at around $7.6, with a modest increase of less than 1%.

The trend continued into the new month, with TON trading at around $7.7, also showing a slight increase of less than 1%. This recent price action places Toncoin near its all-time high of about $8.1, signaling it is gradually approaching this peak.

The chart analysis indicates that Toncoin is on an uptrend, as demonstrated by the short moving average (yellow line), which has consistently provided strong support.

This line has allowed TON to maintain its upward trajectory, staying above this crucial support level.

Source: TradingView

Further technical analysis using the Moving Average Convergence Divergence (MACD) presents mixed signals; the MACD bars trend below zero, typically suggesting bearish momentum.

However, the MACD lines trend above zero, indicating underlying bullish sentiments.

This divergence might imply potential volatility or a decision point in the market where the trends could shift depending on broader market forces or internal developments within the Toncoin ecosystem.

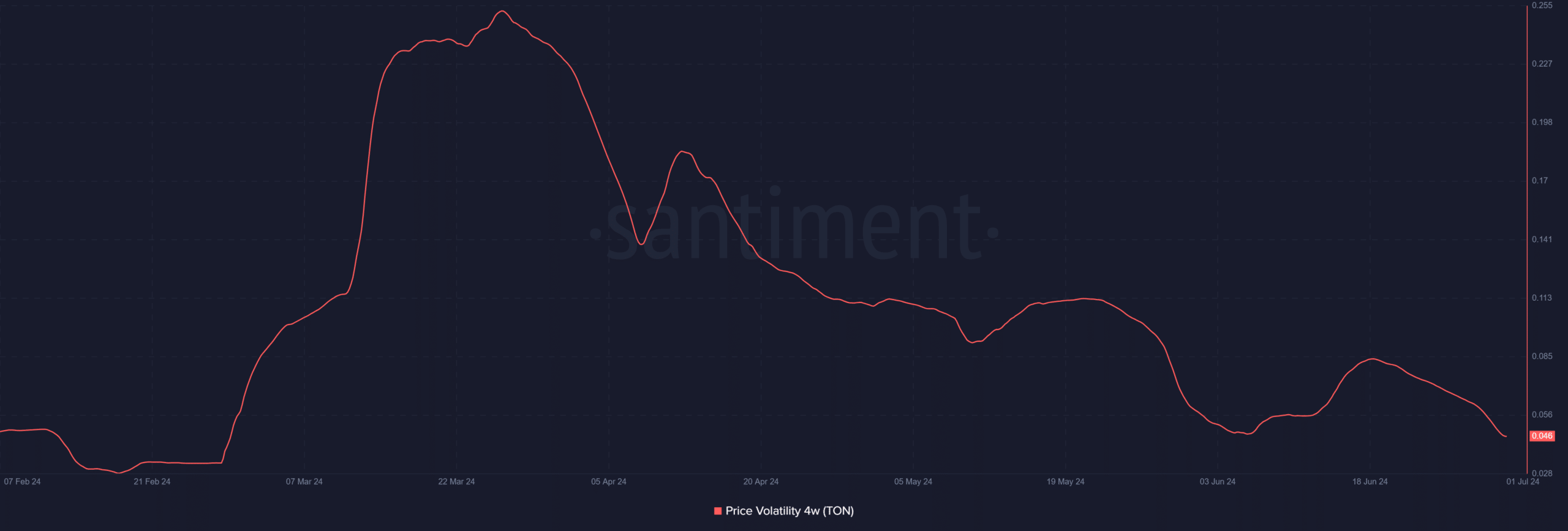

Toncoin’s volatility declines

The analysis of Toncoin’s price stability, especially given its proximity to its all-time high, indicates a notable reduction in volatility. The trend underscored a period of stability for the asset.

Historical data from Santiment revealed that the last significant spike in volatility occurred around March, when it reached approximately 0.25%.

Since then, there has been a marked decrease in volatility, with current levels at just 0.046%.

Source: Santiment

This low volatility is significant as it suggests that Toncoin has entered a phase of price stability. This could attract more long-term holders, reducing the likelihood of sudden price drops due to large sell-offs.

Also, the current stability in Toncoin’s price could indicate underlying confidence in its value and prospects, or it could result from balanced buying and selling pressures in the market.

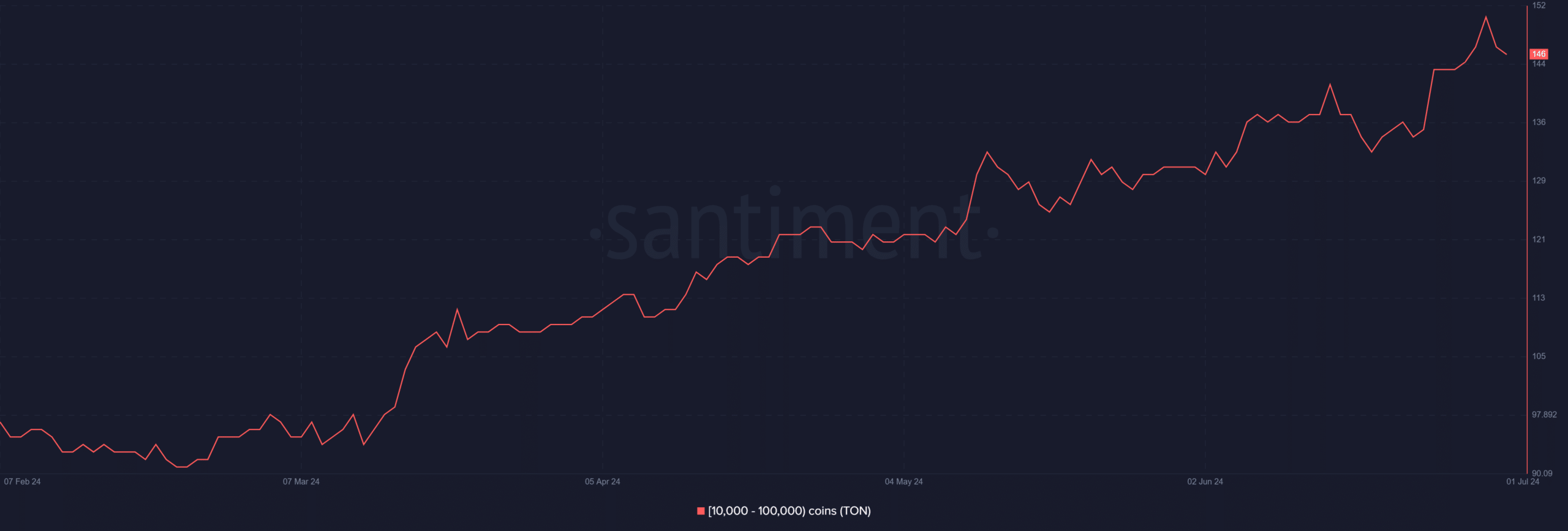

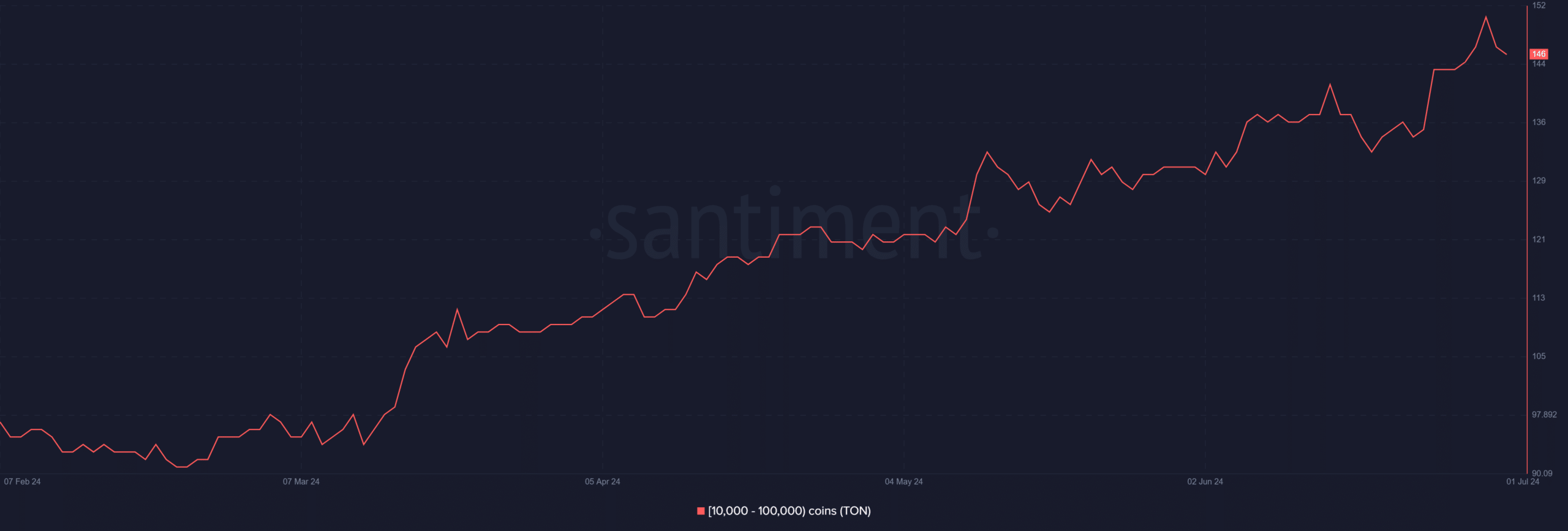

Whales accumulate a TON

The supply distribution analysis of Toncoin from Santiment provided some interesting insights. The analysis looked into the behavior of large-scale investors, particularly those holding between 10,000 and 100,000 TON tokens.

Towards the end of the month, the number of these “whale” wallets increased to over 150, marking one of the highest points observed.

This increase indicates significant accumulation by these investors, who collectively purchased over 45 million TON tokens valued at approximately $346 million.

Source: Santiment

Read Toncoin (TON) Price Prediction 2024-25

This behavior suggests that these large holders are capitalizing on the current price levels as TON approaches its all-time high (ATH).

Such strategic accumulation often implies a bullish outlook from these investors, who may believe that the asset has the potential to increase further in value.

Leave a Reply