- A hike in Open Interest is a positive for the cryptocurrency’s price

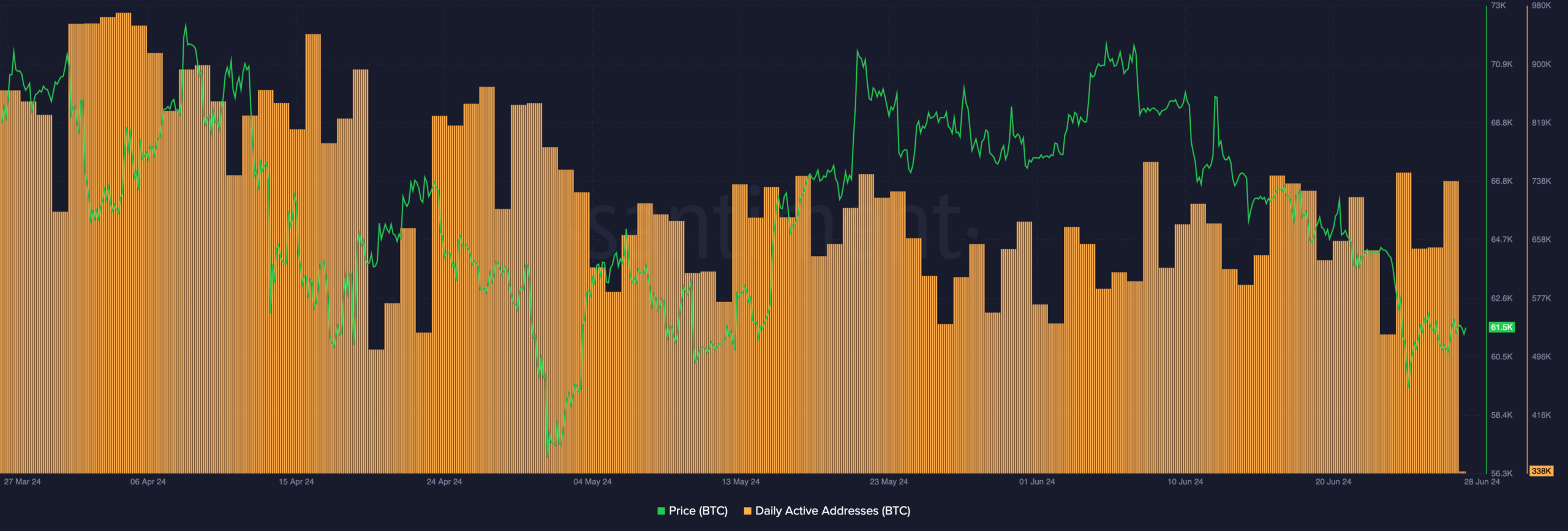

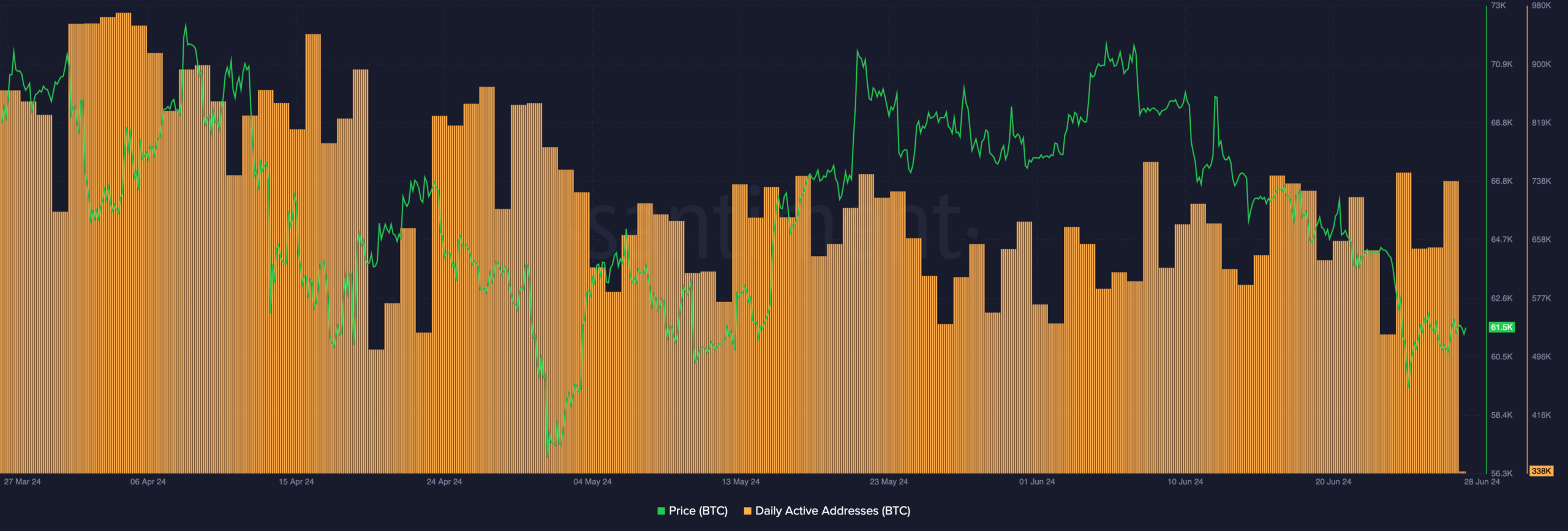

- Activity on the Bitcoin network fell materially over the last few days though

Bitcoin’s [BTC] recent decline in price contributed to a correction among most tokens. This, in turn, led to market sentiment falling across the board too.

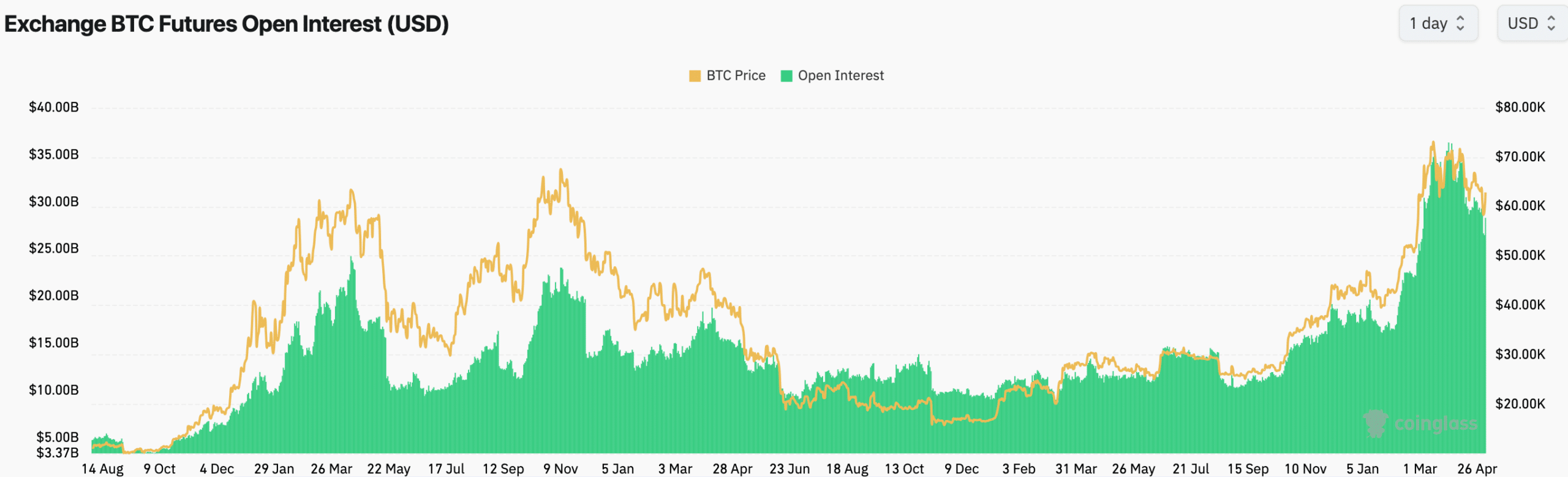

Despite the cryptocurrency’s falling price, however, the overall Open Interest in Bitcoin surged. This can be interpreted as a sign that traders are increasingly taking interest in the king coin. One of the reasons for the same could be that these traders are now anticipating significant price fluctuations in the future.

Open Interest on the rise

Another positive about the Open Interest in BTC is that it is an indication of institutional interest in trading Bitcoin. This might result in higher liquidity across the cryptocurrency’s Futures market.

Source: coinglass

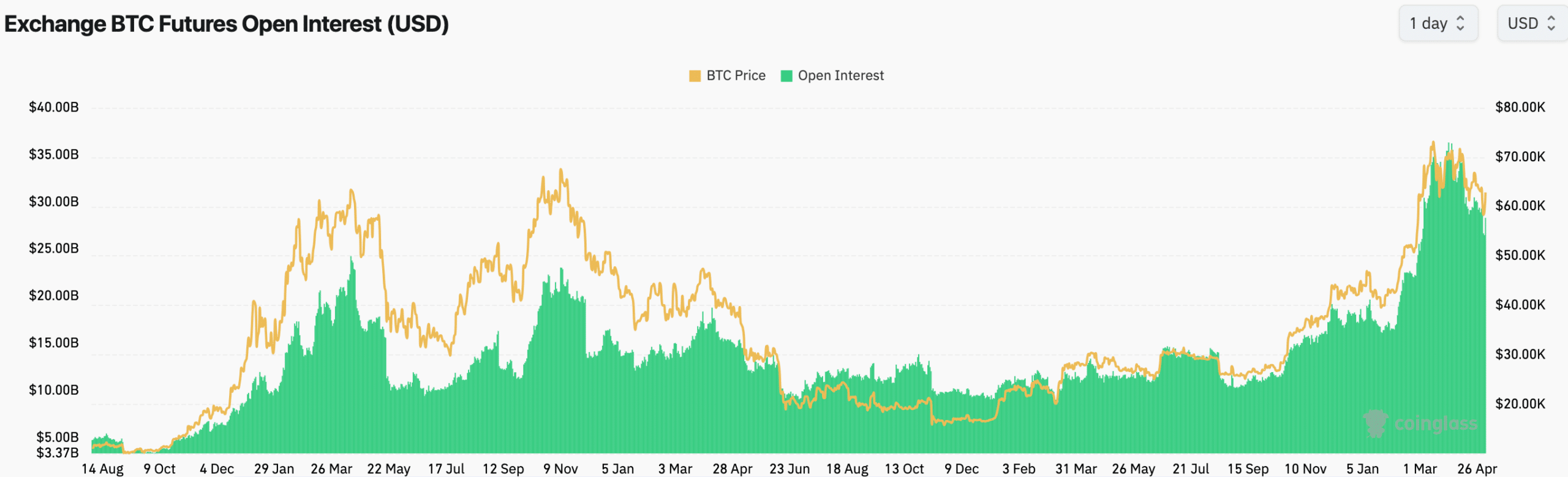

Short positions in BTC surged and outnumbered long positions too, according to Coinglass’s data. If a significant price drop actually happens, it can trigger a cascade of short covering. This happens when short sellers are forced to buy back Bitcoin to close their positions, which can further drive the price down in a self-fulfilling prophecy.

However, the high number of short positions also creates the possibility of a short squeeze. If the price of Bitcoin unexpectedly rises, short sellers will face mounting losses and be pressured to buy back Bitcoin to limit the damage. This buying frenzy can actually accelerate the price hike in a dramatic reversal.

Source: coinglass

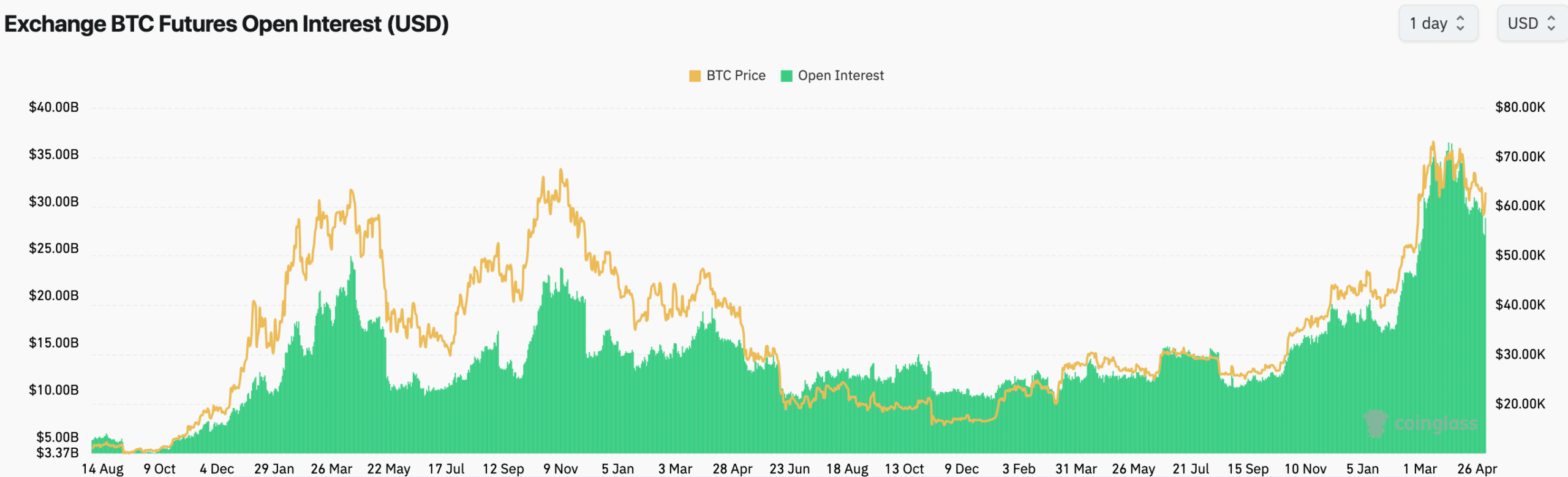

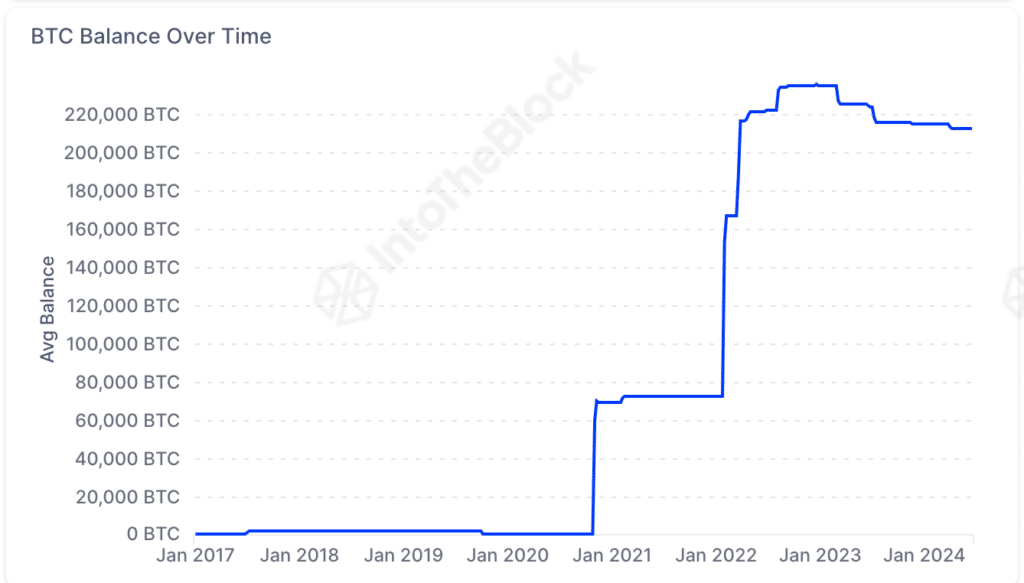

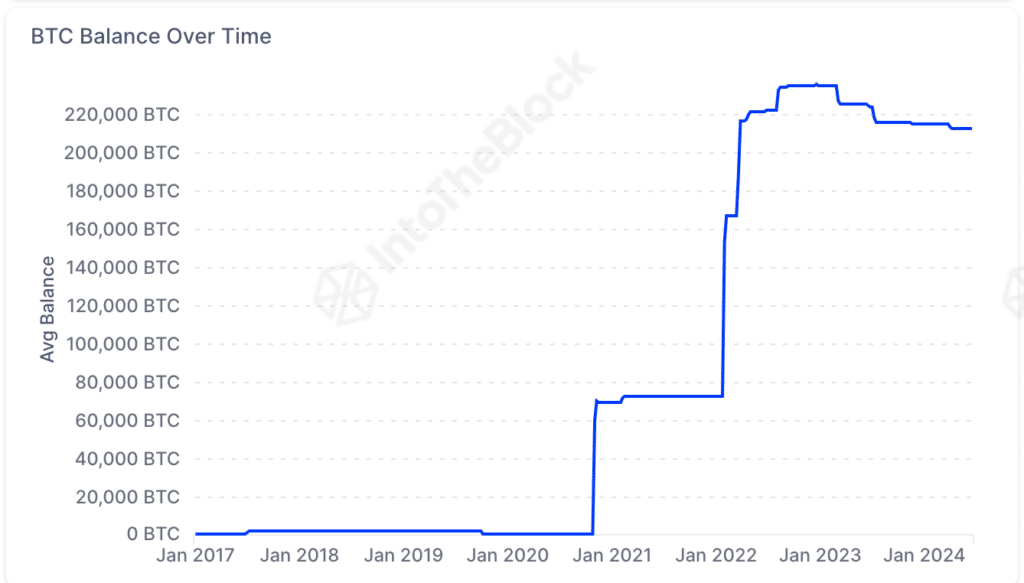

U.S government holdings might impact Bitcoin’s price on the charts too. Every single time the U.S government has sold its holdings, the price of BTC has been impacted negatively.

Currently, the U.S government holds 213,039 BTCs – Roughly $13.10 billion.

News of a potential government sale can trigger fear among investors, especially considering past instances where government sales coincided with price drops. This fear can lead to a sell-off, further pushing the price down.

Source: TheBlock

Activity on the network

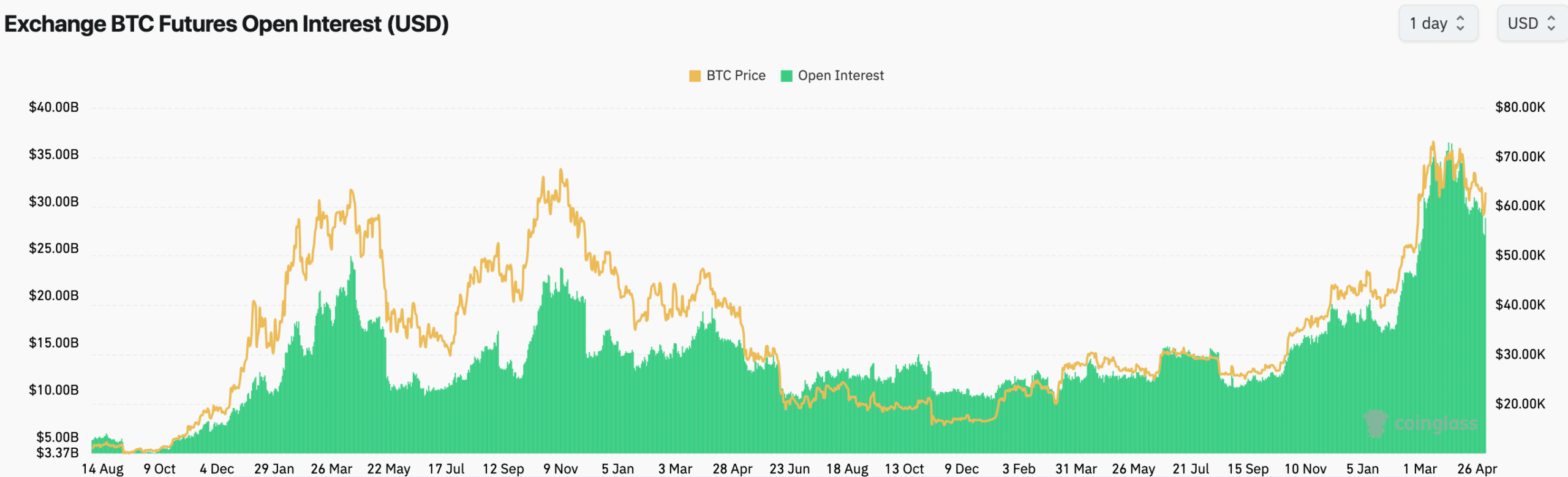

As far as the state of the network is concerned, the number of daily active addresses on Bitcoin’s network surged significantly over the past few days, indicating a massive decline in interest in its ecosystem.

This waning interest in the Bitcoin network may affect the price negatively too.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Source: Santiment

Leave a Reply