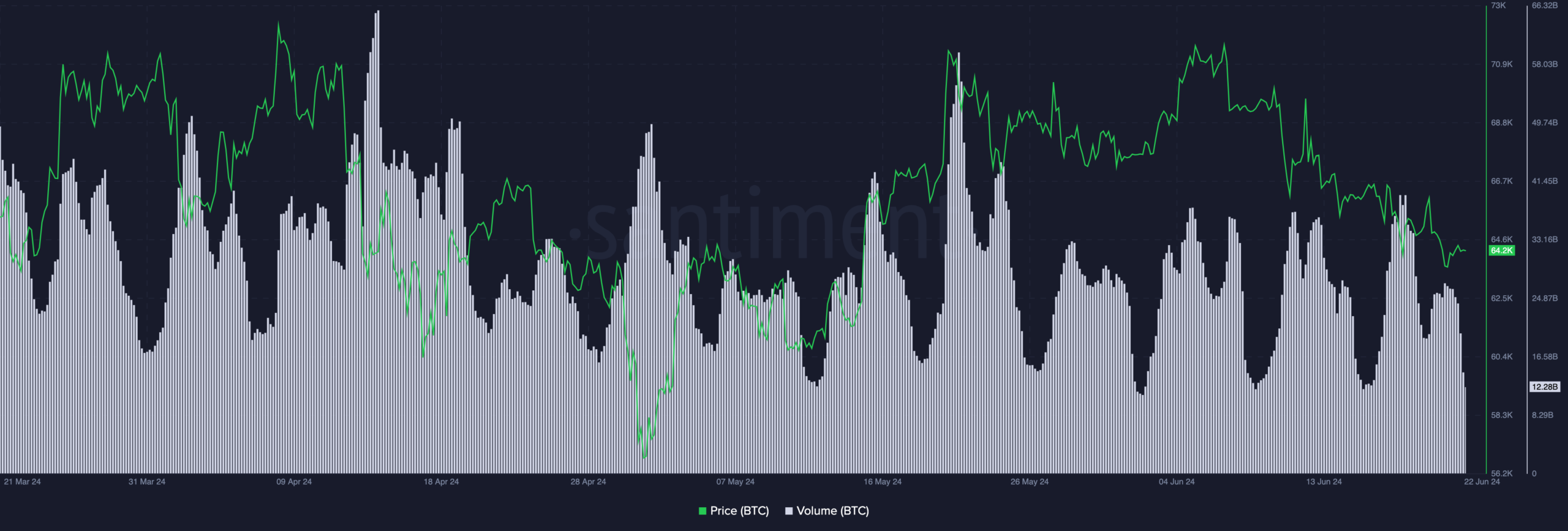

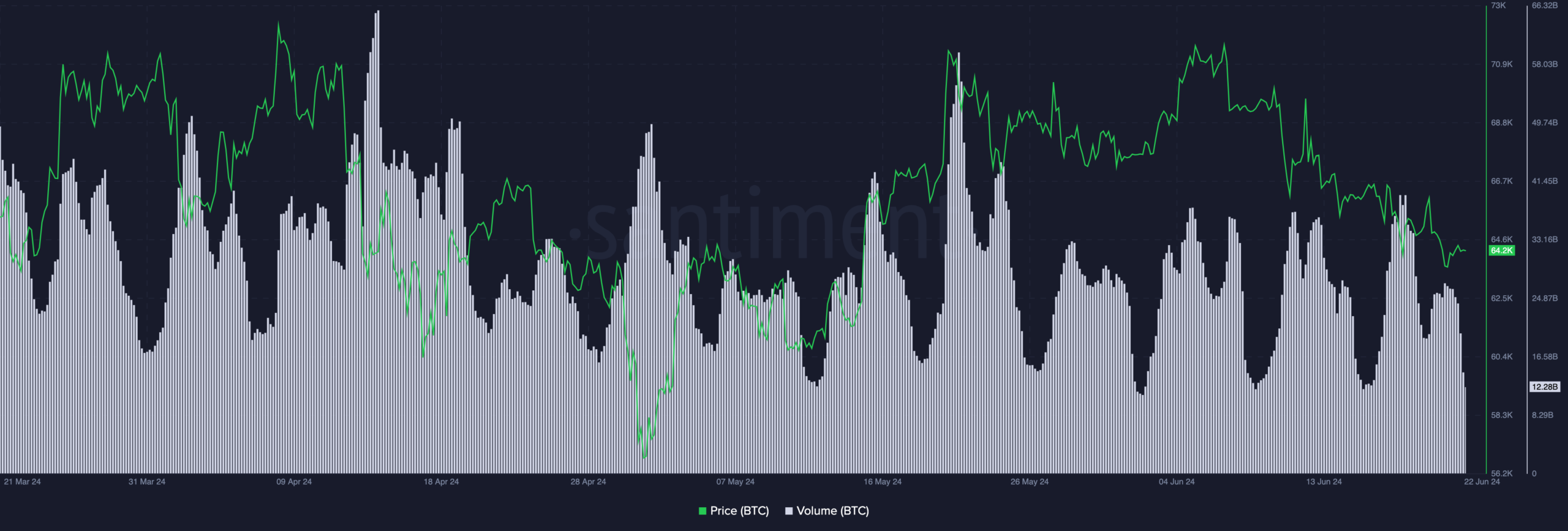

- MSTR did better in terms of price performance compared to BTC year to date.

- BTC’s price movement remained stagnant and did not see much growth.

Michael Saylor’s Microstrategy [MSTR] has notoriously been famous for its bullish stance on Bitcoin [BTC].

Of late, MicroStrategy’s stock performance has been a hot topic among investors, particularly due to its significant outperformance compared to Bitcoin itself.

While Bitcoin has risen around 40% year-to-date, MicroStrategy’s stock has surged over 115%.

MicroStrategy beats all odds

Investors are currently bullish on MicroStrategy, potentially due to a broader trend of interest in companies with significant Bitcoin exposure.

Maxim Group initiated research coverage on MicroStrategy shares with a Buy rating and a healthy $1,835 price target. This represented more than 20% upside from the last close of 1,495.

The bullish stance from Maxim is fueled by MicroStrategy’s aggressive Bitcoin play and its transition into the future with a focus on AI-driven cloud services.

MicroStrategy’s association with Bitcoin has been part of its identity for quite some time now. At the time of writing, MicroStrategy held an extensive portfolio of 226,331 bitcoins.

This bold move has proven to be lucrative, as it is estimated that Bitcoin investments amount to about 55% of MicroStrategy’s stock value, presenting a shift in the company’s financial profile.

What’s behind MSTR’s growth?

MicroStrategy acts like a leveraged fund, using both debt and equity to acquire Bitcoin. This leverage is seen as a key driver of the stock’s outperformance.

This strategy could be adopted by more corporations, nonprofits, and even nation-states, especially with favorable changes in tax regulations.

MicroStrategy’s stock price surged 5% after Maxim Group initiated coverage on the company, likely due to investor optimism surrounding their Bitcoin holdings and AI integration plans.

The company’s financial results for 2023 showcased a positive transformation, particularly in their cloud business. Subscription services revenue experienced a substantial 33.6% year-over-year increase, reaching $81 million.

Although product license and support revenue saw declines, the cloud segment’s gross margin rose significantly, climbing from 59.2% in 2022 to 60.9% in 2023.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These signs point towards a successful shift for MicroStrategy’s business model and may have contributed to it outperforming BTC.

At the time of writing, BTC was trading at $61,152.44 and its price had fallen by 0.35% in the last 24 hours.

Source: Santiment

Leave a Reply