- Ethereum popularity increased materially according to recent data.

- Staking participation was on the rise as prices remained stable.

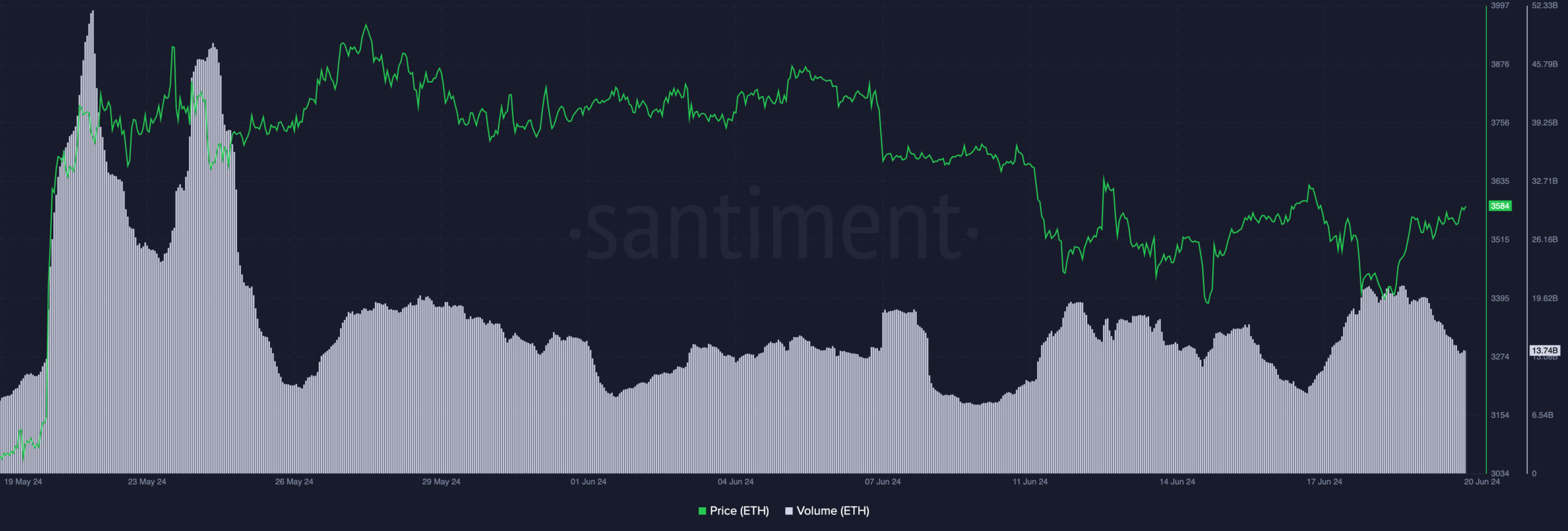

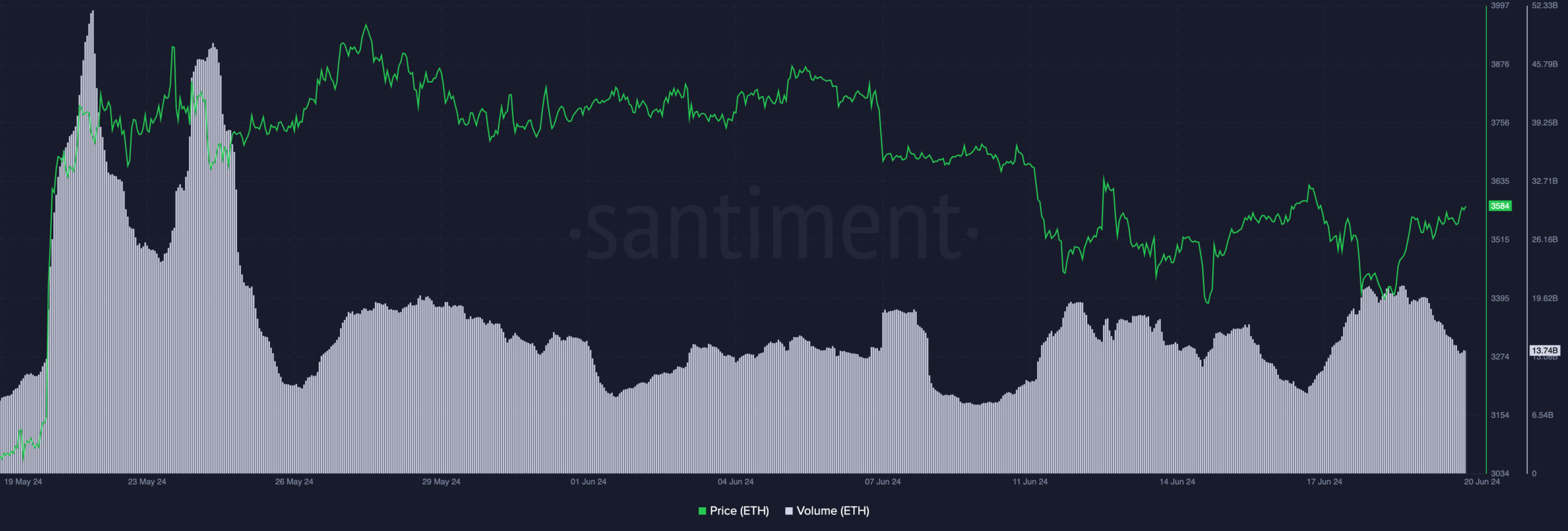

Ethereum’s [ETH] price has remained stagnant over the past few days. Despite this traders were showing interest in the altcoin.

Ethereum’s popularity grows

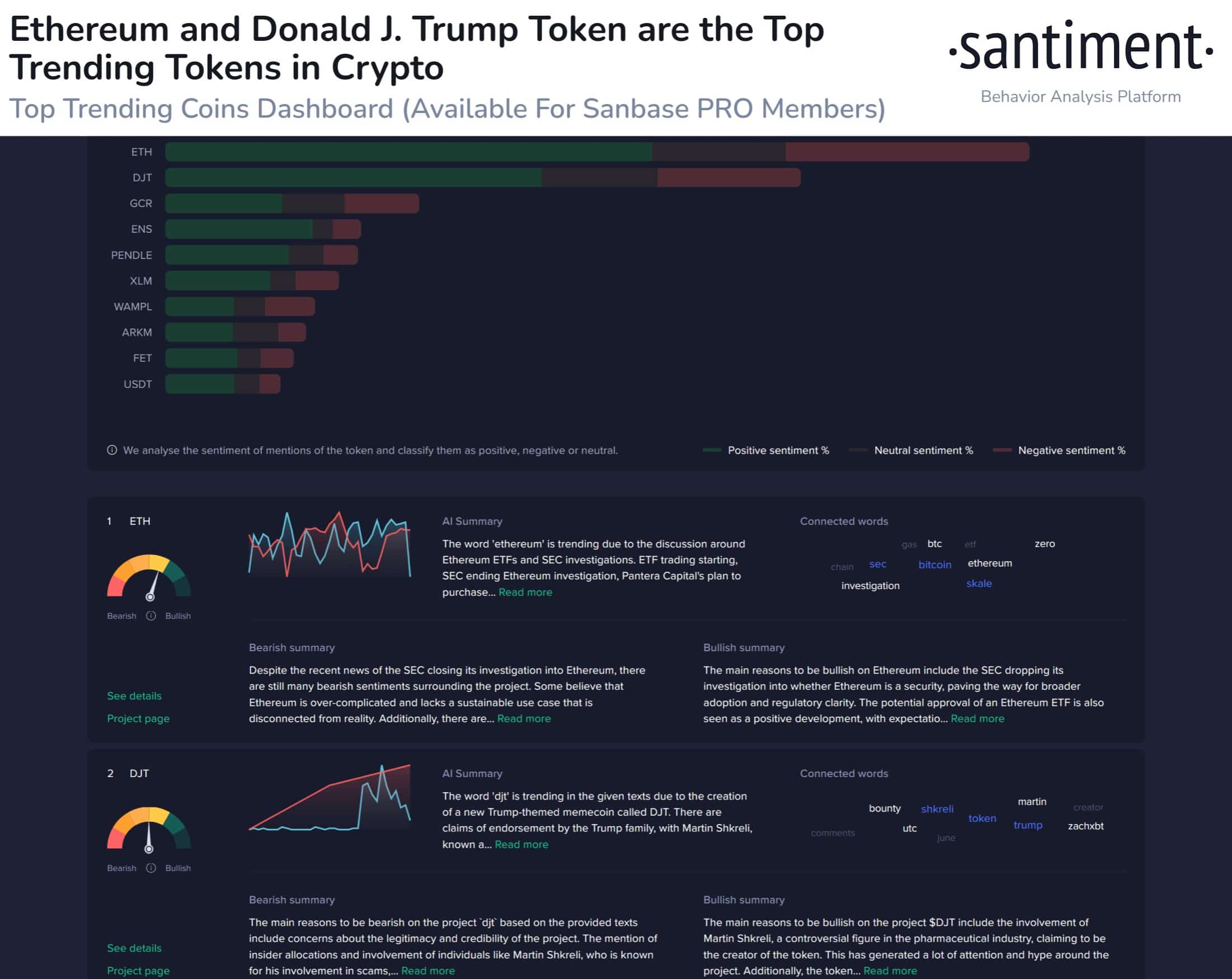

According to Santiment’s data, the popularity of ETH had soared significantly over the last few days.

The current discussions surrounding Ethereum ETFs, SEC investigations, regulatory developments, and Consensys’ advocacy efforts for Ethereum’s status are likely contributing to this increased attention.

There were both bearish and bullish perspectives that can be had around the popularity of the rising interest in Ethereum.

Santiment’s data suggested that the bearish concerns stemmed from the potential classification of Ethereum as a commodity by the SEC.

Despite SEC dropping the investigation, the fact that it is willing to go after the coin can cause problems for the network. It could also pose a hurdle for the approval of other Ethereum ETFs, a key driver of current interest.

Additionally, the ongoing regulatory battle between Ripple and the SEC casted a shadow, as similar actions against ETH could dampen market sentiment.

The uncertainty surrounding Ethereum’s regulatory status and its potential limitations act as headwinds for the project.

From the bullish perspective, there were a lot of points in favor of Ethereum. For instance, the SEC dropping its investigation, effectively clearing ETH sales of being securities, has been a major boost.

This news has led to a surge in ETH-related altcoins and a more stable market environment.

Furthermore, the development of cross-chain bridges connecting Ethereum to other blockchains showcased continued growth and adoption within the Ethereum ecosystem.

Source: Santiment

State of staking

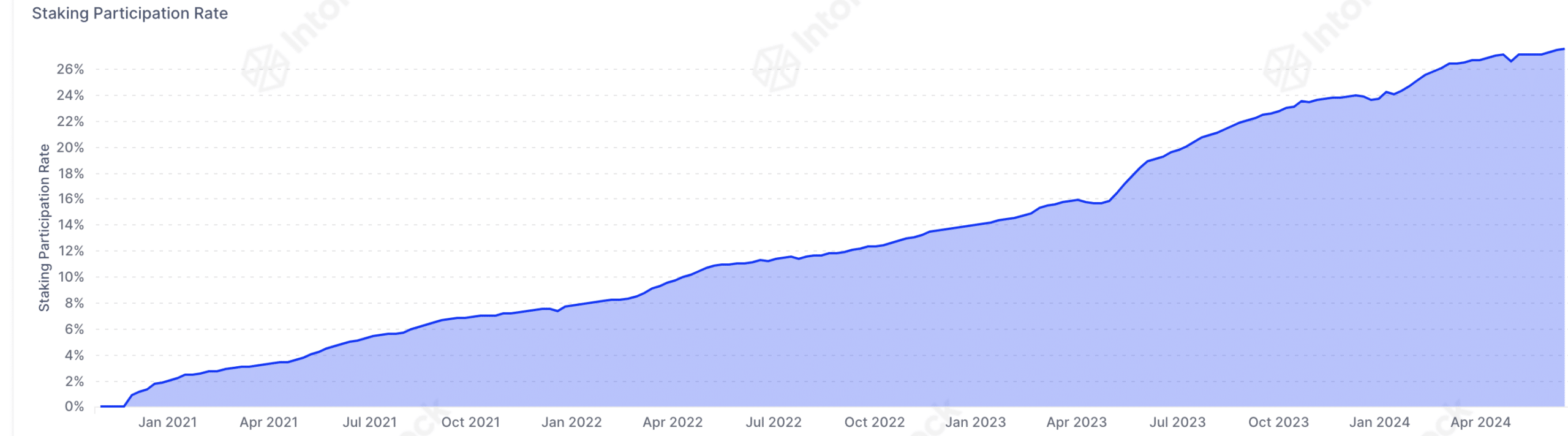

In terms of staking, it was observed that the staking participation rate increased significantly for ETH. However, staking yield volatility had surged materially.

While a higher participation rate is generally good, high volatility in yields can be a deterrent for some stakers seeking predictable returns.

Read Ethereum’s [ETH] Price Prediction 2024-2025

This volatility could be due to factors like fluctuations in network fees (MEV) or changes in the total amount of staked ETH.

Source: Intotheblock

At press time, ETH was trading at $3,587.52. Over the last 24 hours, the price of ETH grew by 0.67%. However, the volume at which ETH was trading at had fallen by 27% during the same period.

Source: Santiment

Leave a Reply