- Greed remained dominant as the price of crypto assets declined.

- BTC has sipped and stayed below its support levels.

The recent decline in major crypto assets like Bitcoin [BTC] and Ethereum [ETH] has sent shockwaves through the crypto industry.

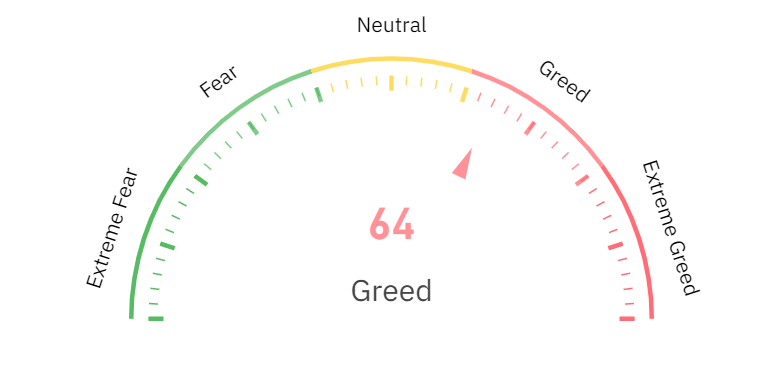

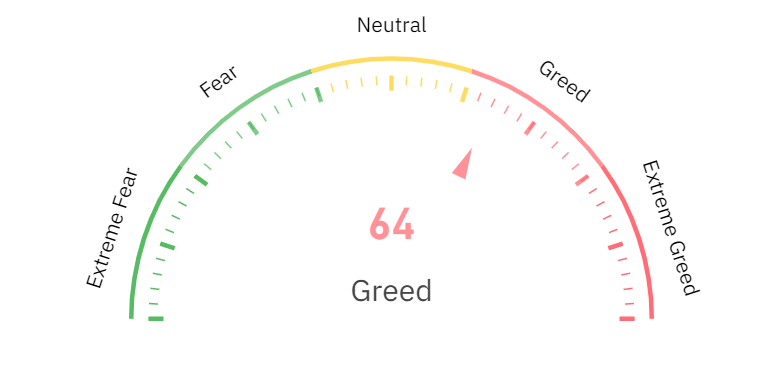

While traders closely monitored the price trends, the Fear and Greed Index indicated that sentiment remains positive for now.

Fear and Greed Index remains positive

An analysis of the crypto Fear and Greed Index showed that despite the decline in the prices of most cryptocurrencies, there remained a sense of optimism.

The index indicated a state of greed, with a current rating of around 64%.

However, an analysis of the chart on Coinglass showed that the level of greed was decreasing at press time. The previous day, the index was around 74.

This suggested that while the crowd’s sentiment remains positive, it was becoming less bullish.

Source: Coinglass

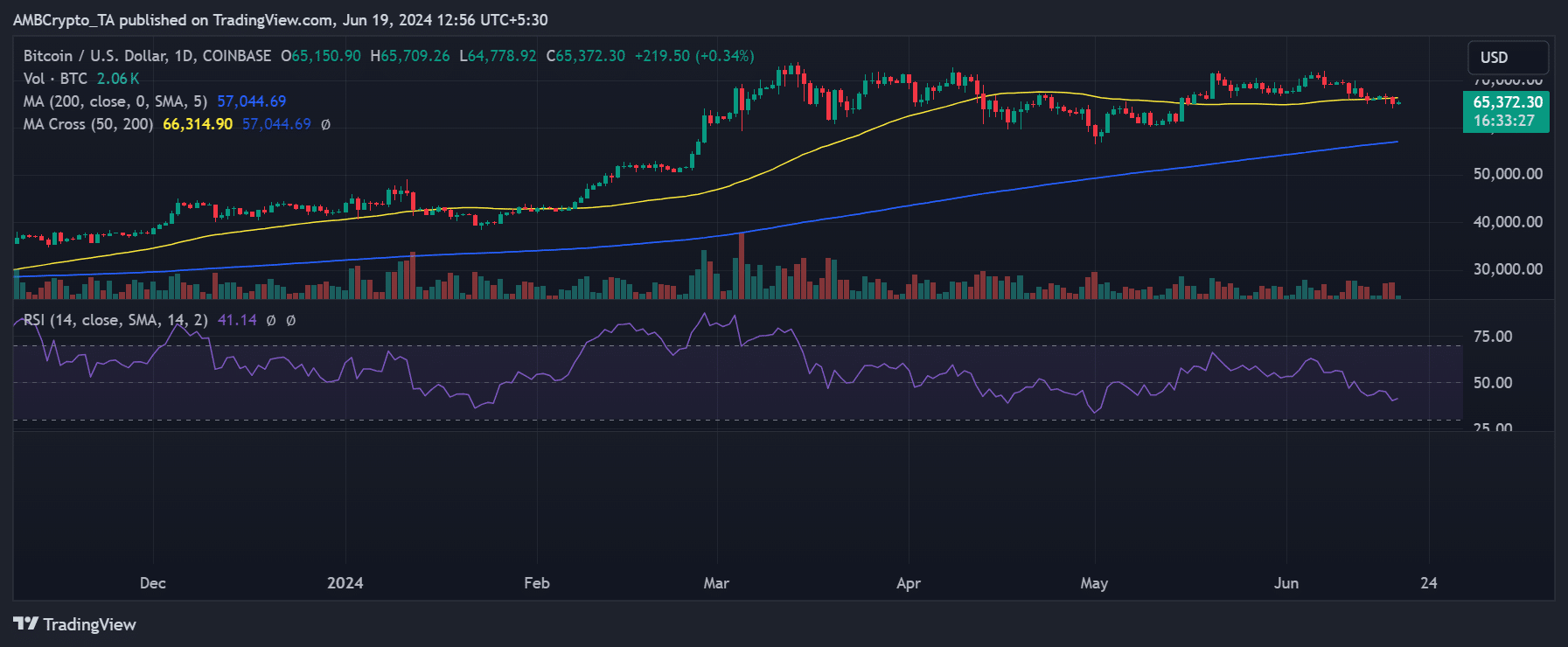

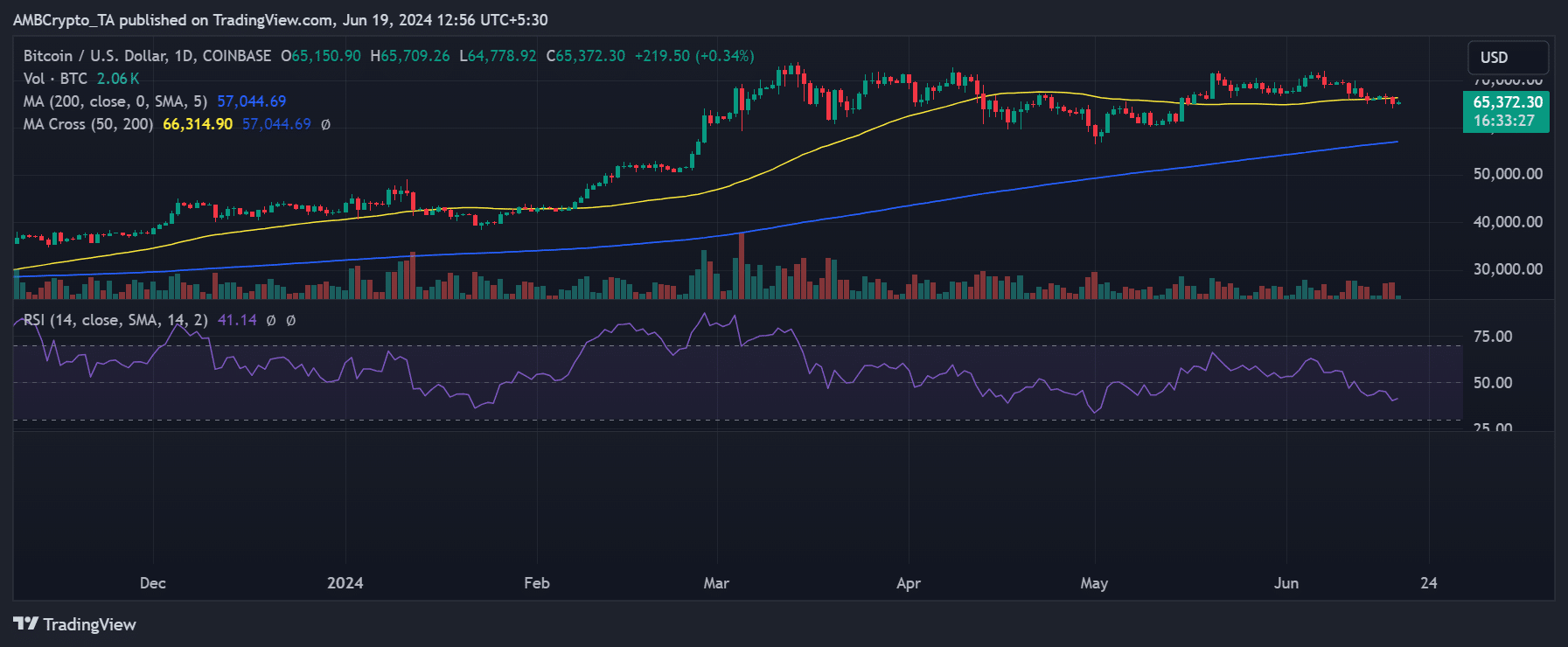

AMBCrypto’s analysis of the price trends of Bitcoin and Ethereum explained why the Fear and Greed Index has trended the way it has in the last few days.

How the Bitcoin affected the Index

Bitcoin’s price trend showed that the $65,000 price range had served as a long-term support level. However, the recent downtrend has broken this support.

The analysis indicated that Bitcoin finally broke below the support line on the 18th of June, when the price touched $65,152 after a 2% decline.

Source: TradingView

Its Relative Strength Index (RSI) also indicated that it remained stuck below the neutral line, suggesting a strong bear trend at the moment.

While the sentiment of the Fear and Greed Index remained positive at the current price, it could drop if Bitcoin’s price declines further.

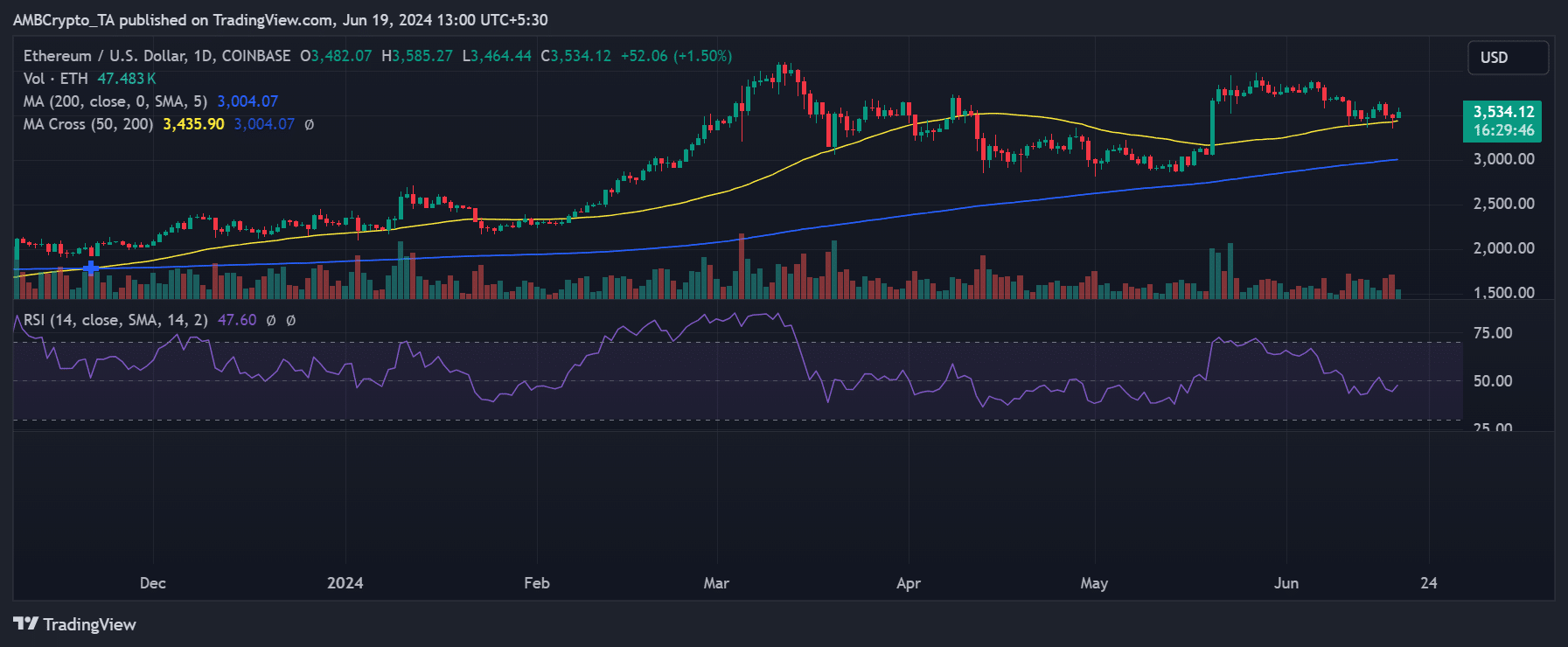

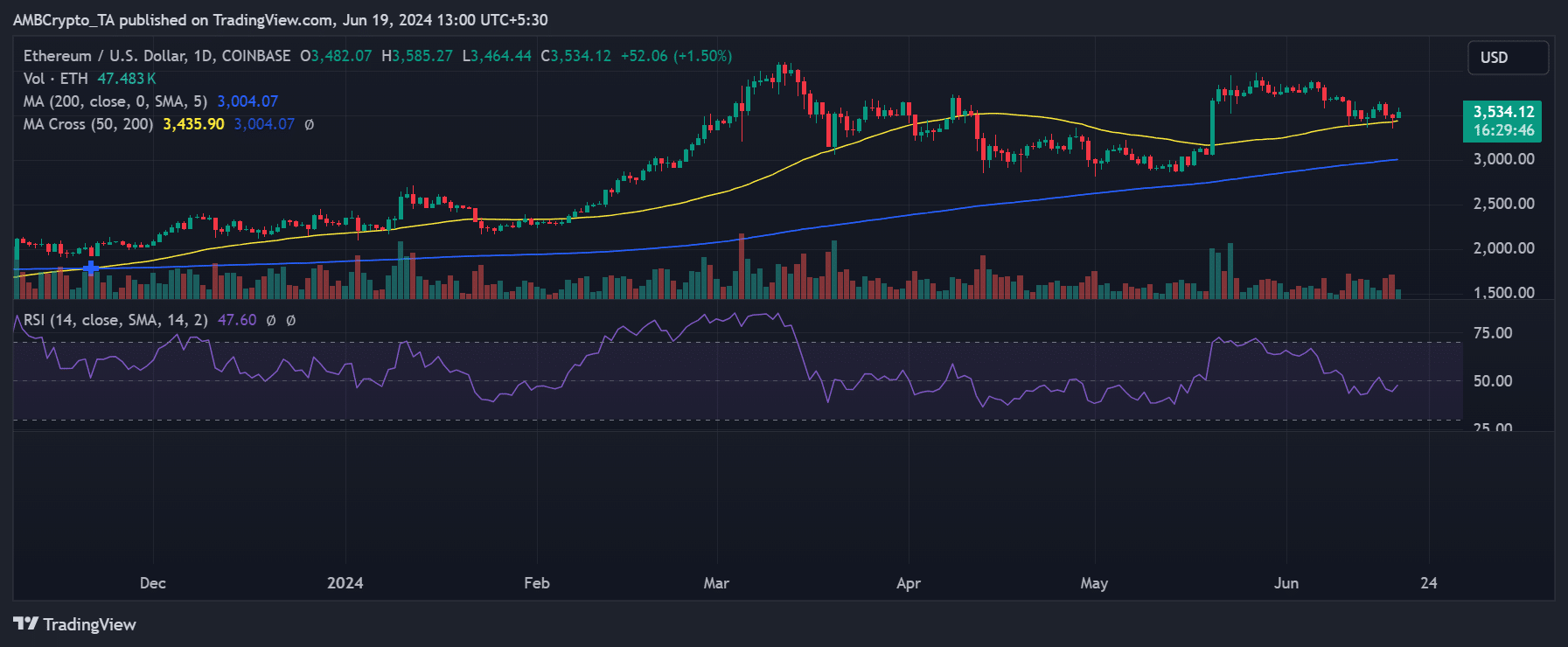

Ethereum’s effects on the Index

Ethereum’s price trend showed that it has declined in the last few days. However, unlike Bitcoin, its support level has held despite the declines.

The chart indicated that Ethereum declined by less than 1% on the 18th of June, with its price falling to around $3,482. As of this writing, it has increased by over 1% and was trading at over $3,500.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-2025

While the price of BTC has declined and could dip the Fear and Greed Index, the overall price trend has helped it stay balanced so far.

However, given BTC’s dominance, a further drop in its price could push the index into panic mode.

Leave a Reply