- Altcoin market has experienced a significant correction, with a 12.5% drop from its peak.

- Analyst predictions suggest a revival driven by new ETF listings and macroeconomic factors.

The altcoin market is currently undergoing a notable correction, with the overall market capitalization decreasing from a high of $1.2 trillion in March to $1.05 trillion now, marking a 12.5% decline.

This downturn has affected major altcoins significantly, with some experiencing drops of more than 40% in the last two weeks alone.

Michael Van De Poppe, a well-known cryptocurrency analyst, recently discussed the volatility of the altcoin market and its future prospects in his latest video analysis.

According to Van De Poppe, the altcoin market’s high volatility is not new and is characteristic of both significant gains and severe corrections.

The recent decline has prompted many to question the future of altcoins and whether the downward trend will continue. Van De Poppe attributes the current market instability to a couple of key factors, particularly affecting major players like Ethereum.

Factors influencing altcoin stability

One major factor contributing to the uncertainty in the altcoin market as highlighted by the analyst is the delay in the trading of the Ethereum spot ETF, despite its approval.

This delay has caused confusion and market instability, as traders and investors are unsure of when they will be able to participate in these regulated investment vehicles.

Van De Poppe suggests that once the spot ETF begins trading, it could lead to increased investor interest and potentially trigger a market upswing, similar to reactions observed with previous ETF launches.

Moreover, macroeconomic events such as the Consumer Price Index (CPI), Producer Price Index (PPI), and announcements by the Federal Open Market Committee (FOMC) also play significant roles in shaping market sentiment.

Recent data suggesting a potential easing of inflationary pressures could signal future rate cuts by the Federal Reserve, which historically benefits altcoins. These assets tend to perform well during periods of quantitative easing and low-interest rates when global liquidity is high.

Despite the current challenges, Van De Poppe is optimistic about a potential revival in the altcoin market.

He anticipates the downturn to end soon, spurred by the anticipated listing of the Ethereum spot ETF, which is likely to boost market confidence and interest significantly. This expected change could mark the beginning of recovery for altcoins.

Spotlight on Solana: A case study

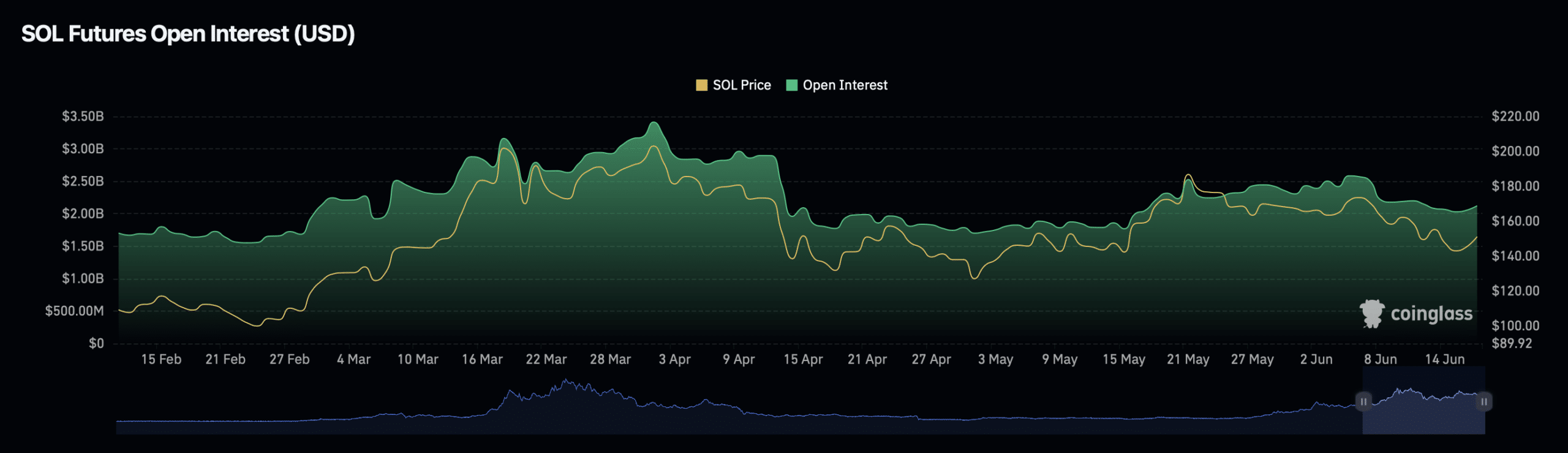

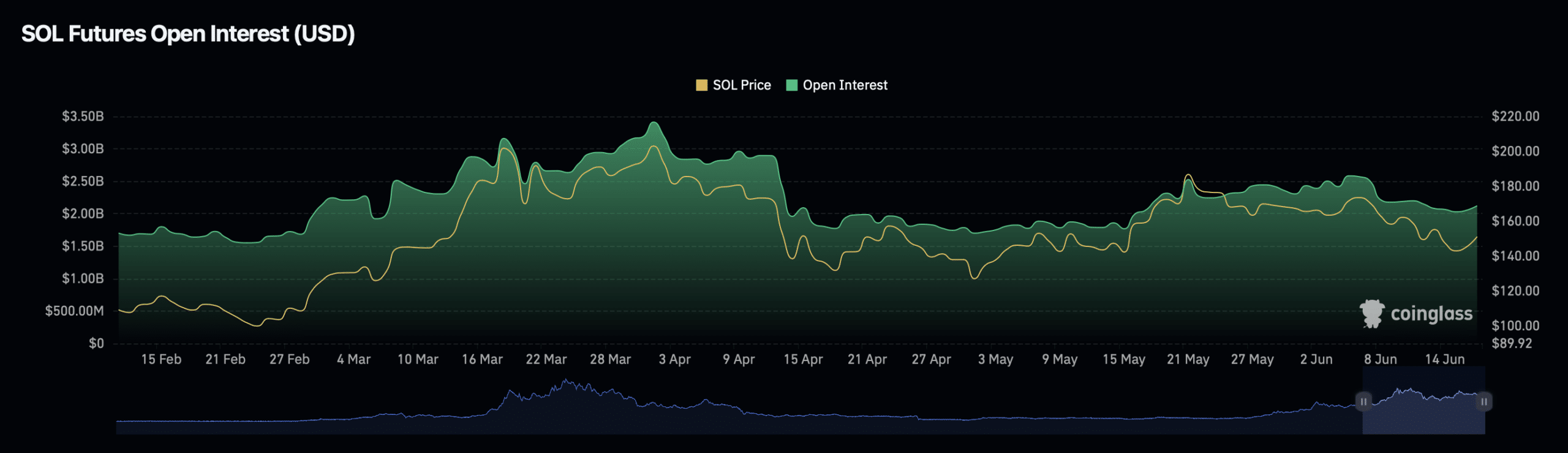

Taking a closer look at Solana [SOL], a major altcoin, it has experienced a significant drop of over 50% from its March peak this year, currently trading at $146.52. However, recent activities suggest a slight turnaround might be underway.

In the past 24 hours, Solana has seen an increase of 1.6% in its price.

Concurrently, its open interest has also risen by 0.36% in the same period, with a notable 68% surge in open interest volume at a valuation of $3.83 billion.

This positive trend coincides with SOL’s NFT transaction which recently surpassed that of Bitcoin and Ethereum, as reported by AMBCrypto.

Source: Coinglass

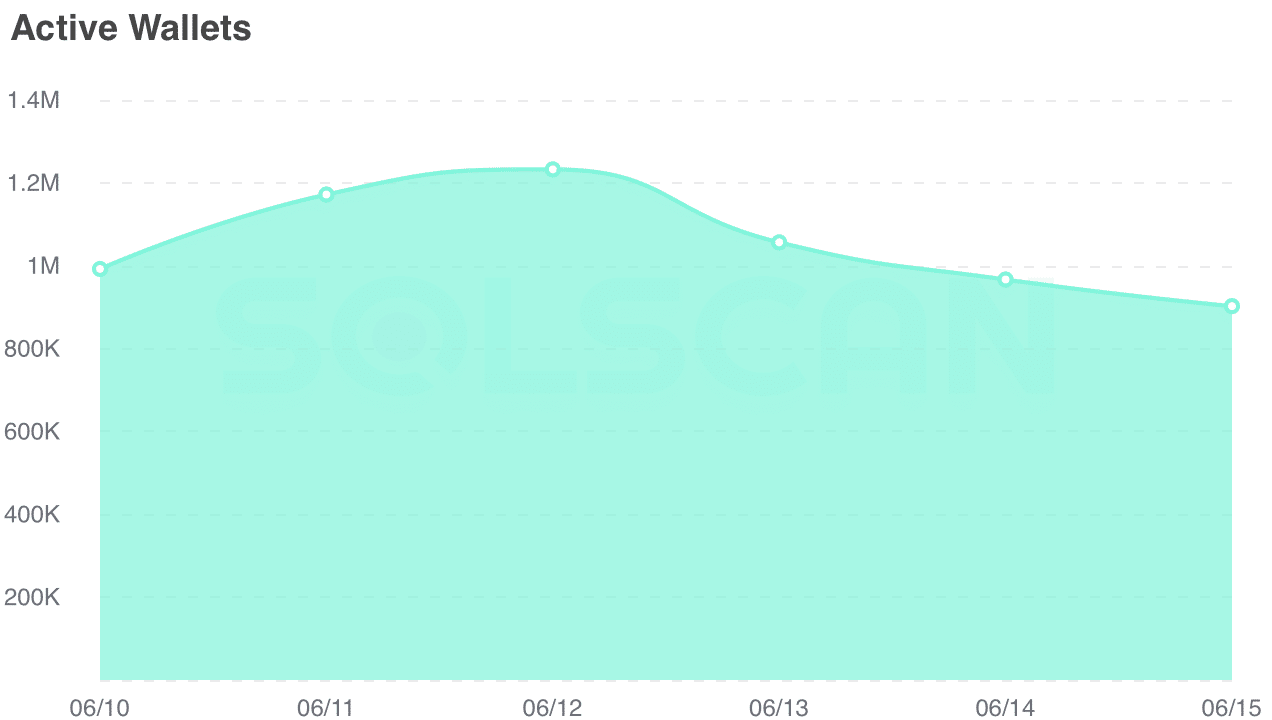

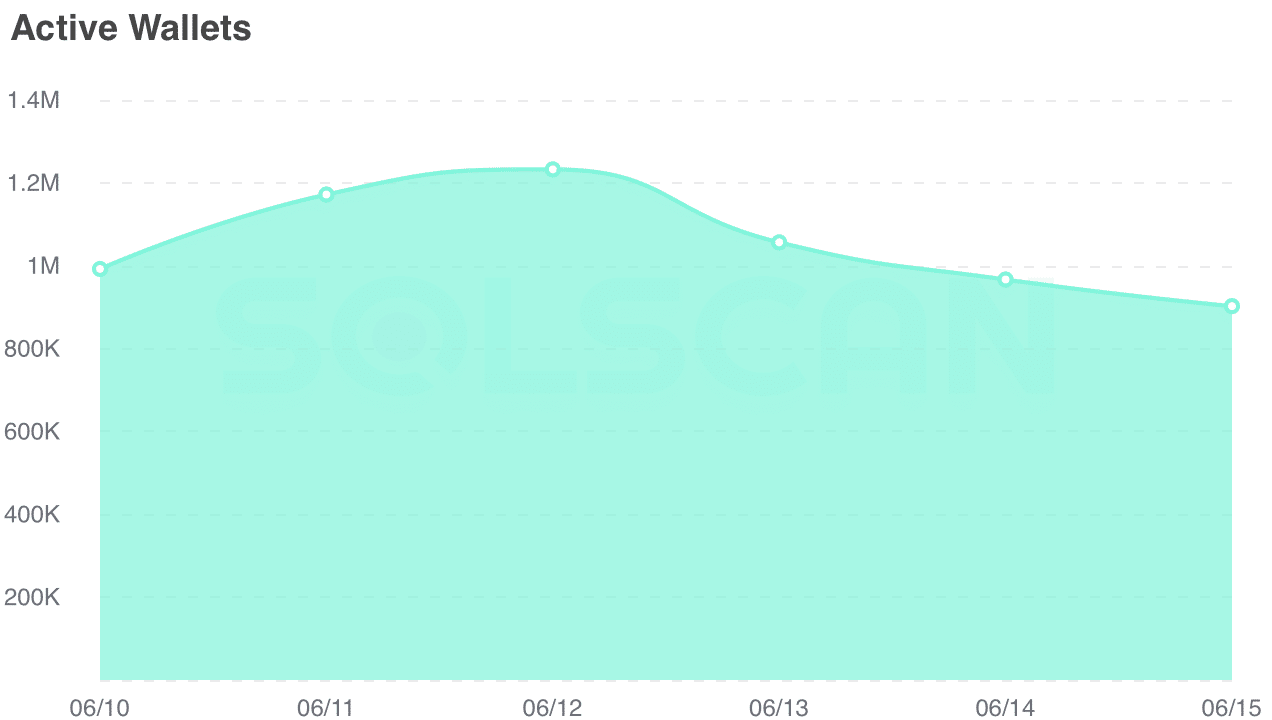

Meanwhile, despite a minor decrease in the number of active addresses from above 950,000 to 902,000 over the past week, indicating reduced network activity, the market sentiment might be shifting.

Source: Solscan

Read Ethereum’s [ETH] Price Prediction 2024-25

Ali, another prominent crypto analyst, highlighted a key support level for Solana at $141, noting a buy signal on the daily chart.

If this support holds, Solana could potentially rebound in the short term, suggesting that not all hope is lost for this altcoin.

Leave a Reply