- ADA declines with 7.43% in & days With a strong bearish trend.

- Key indicators suggest a continued bearish bias as ADA attempts to create another support level.

Cardano [ADA] has been reporting a decline in the last 30 days. Over the last seven days, it has reported a 7.43% price decline. ADA was trading at $0.4074 at press time with a 24-hour volume increase of 15.32% to $213 million.

According to coinmarketcap, ADA has a market cap of $14.5b, a 1.13% increase in 24 hrs.

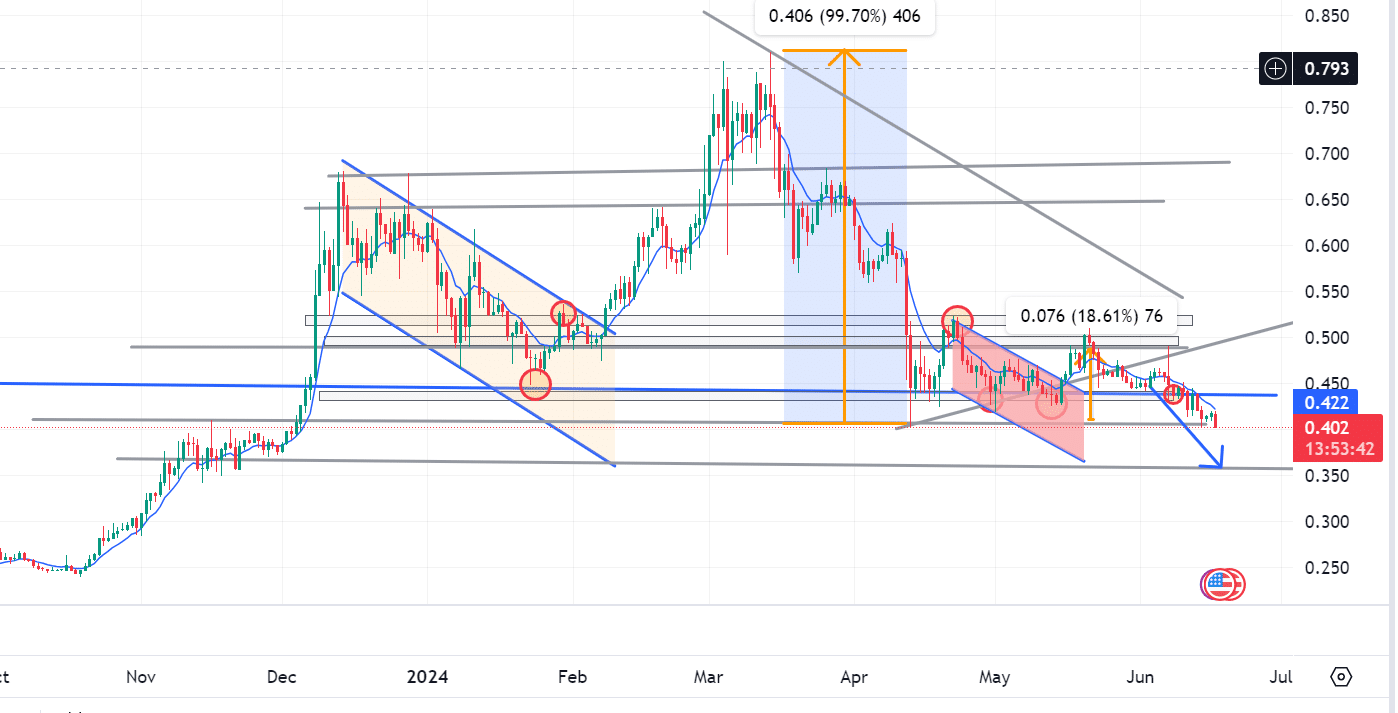

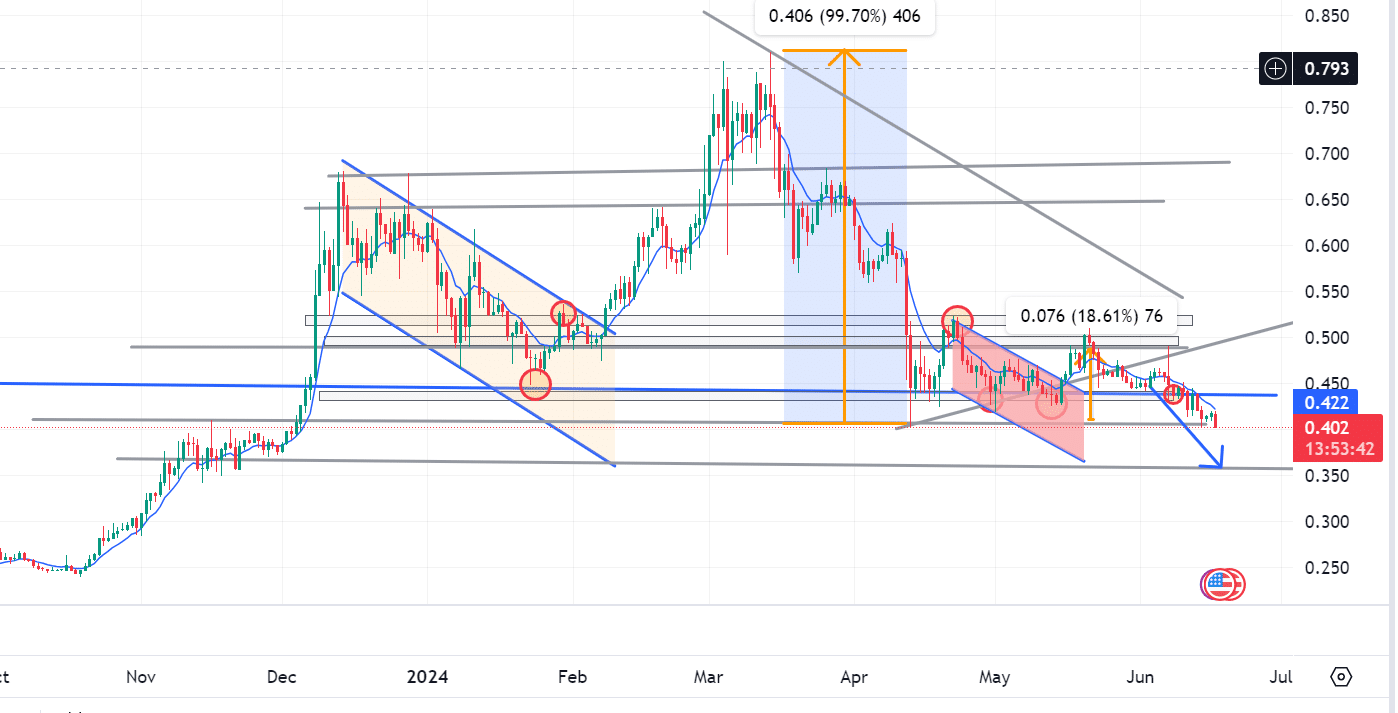

Source: Tradingview

AMBcrypto’s analysis showed that ADA is set to breakdown. The move below $0.406 will create another support level.

A bearish bias will persist until the structure changes or another strong support is established. Thus, the current trade shows the market has a sustained bearish bias, which will remain until a support downward emerges at around $0.356.

If a reversal occurs at $0.403, the shift will drive prices to $0.487. However, the current market trend is bearish and seems sustained to continue.

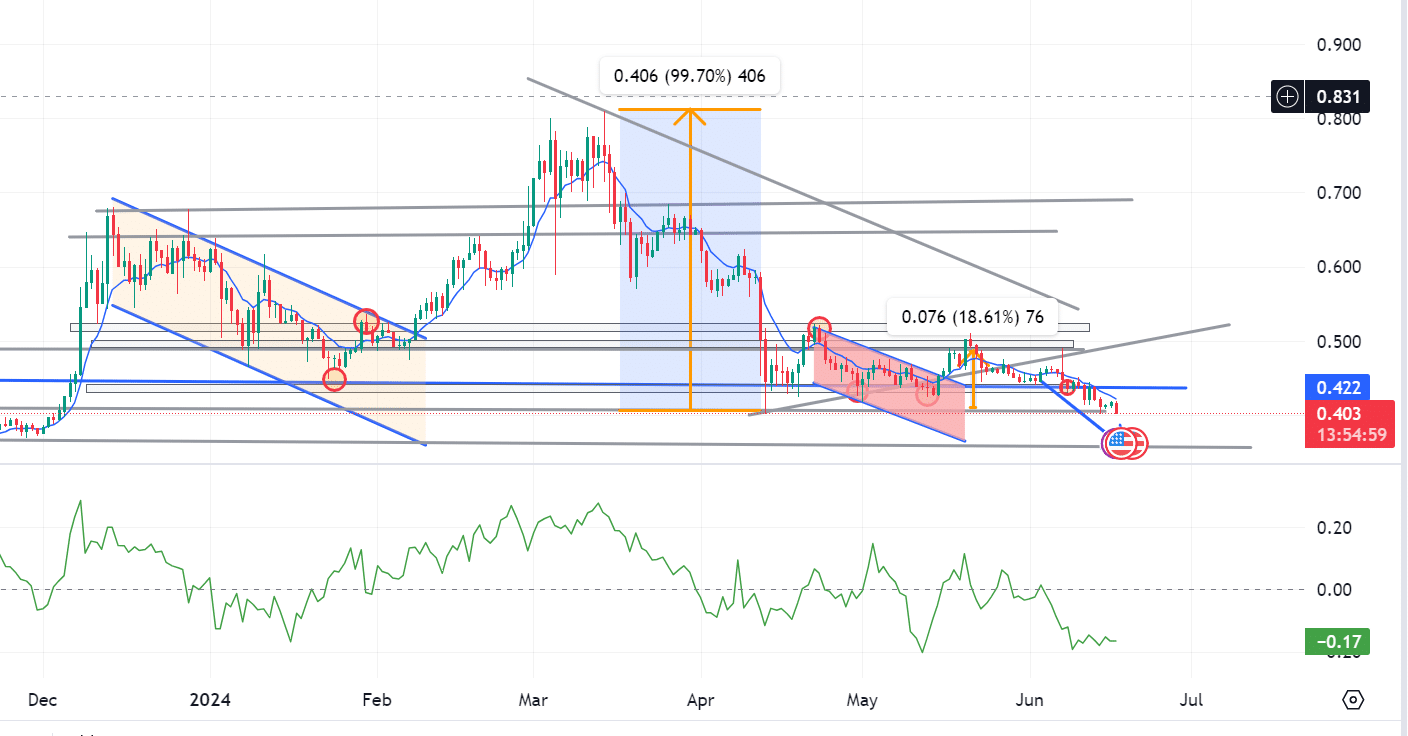

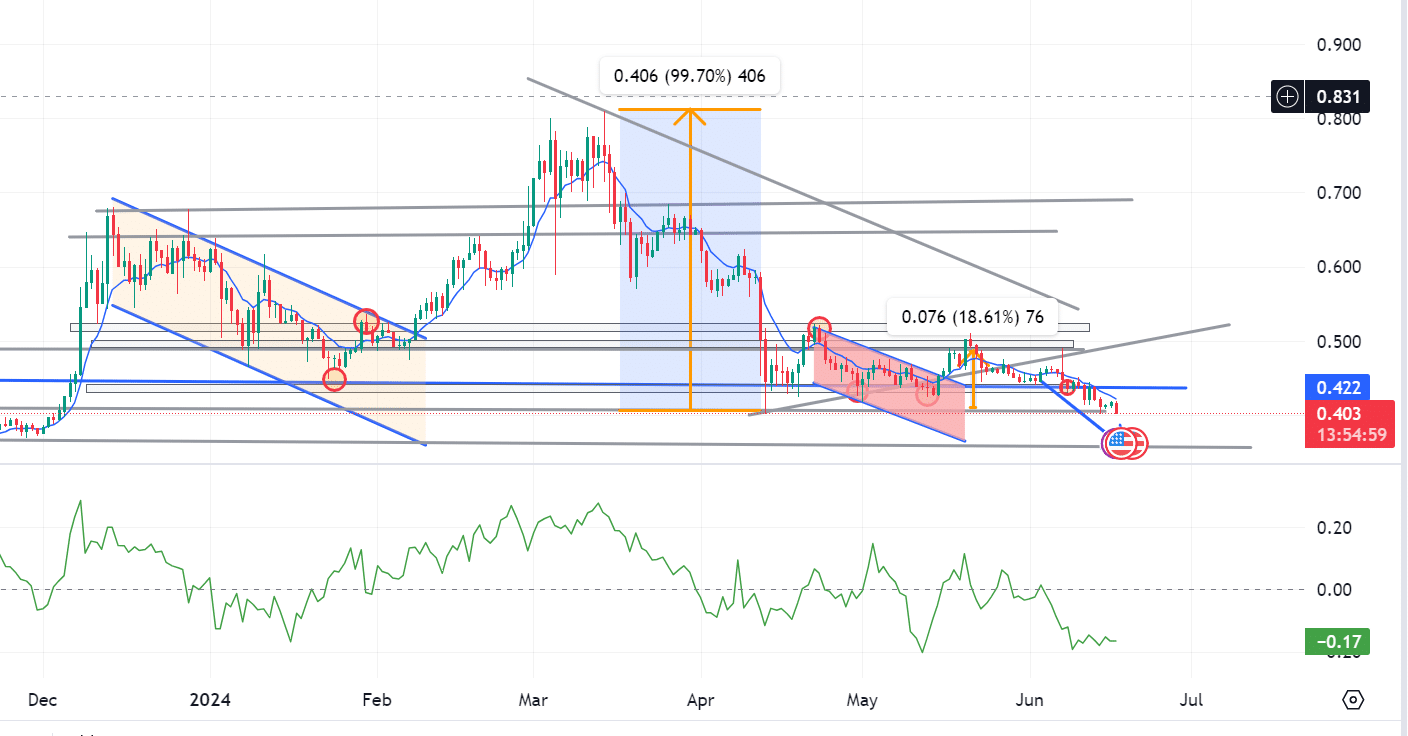

Source: Tradingview

In fact, ADA has a negative CMf of -0.15 at press time, showing increased selling pressure. Generally, when there is a negative CMF, it implies a solid bearish trend that might continue.

With a higher selling pressure, prices decrease as there are more sell-offs than buying.

ADA market sentiments

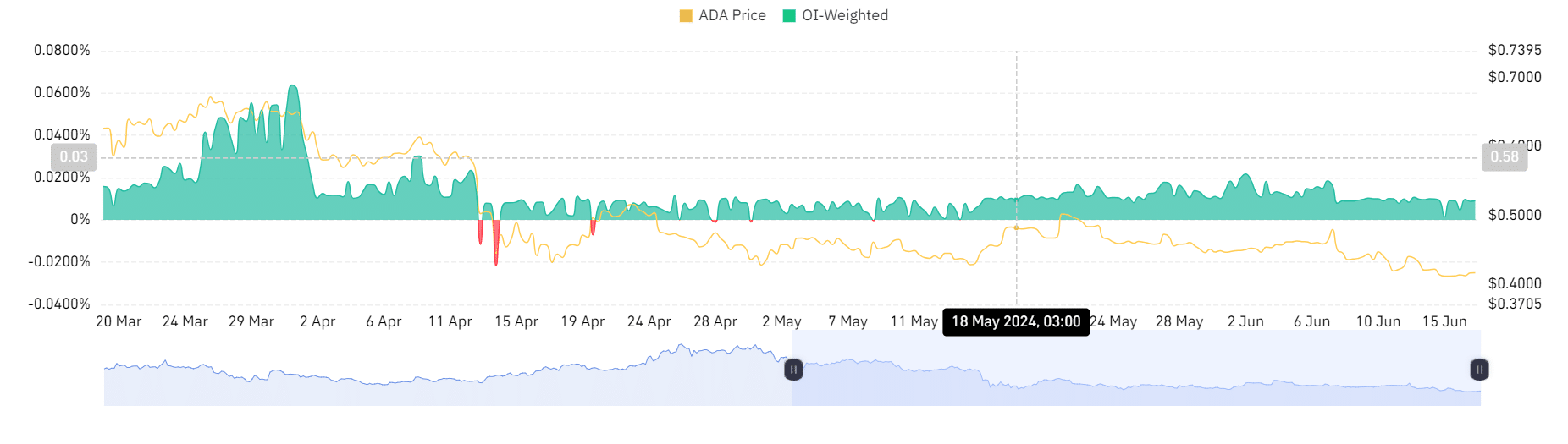

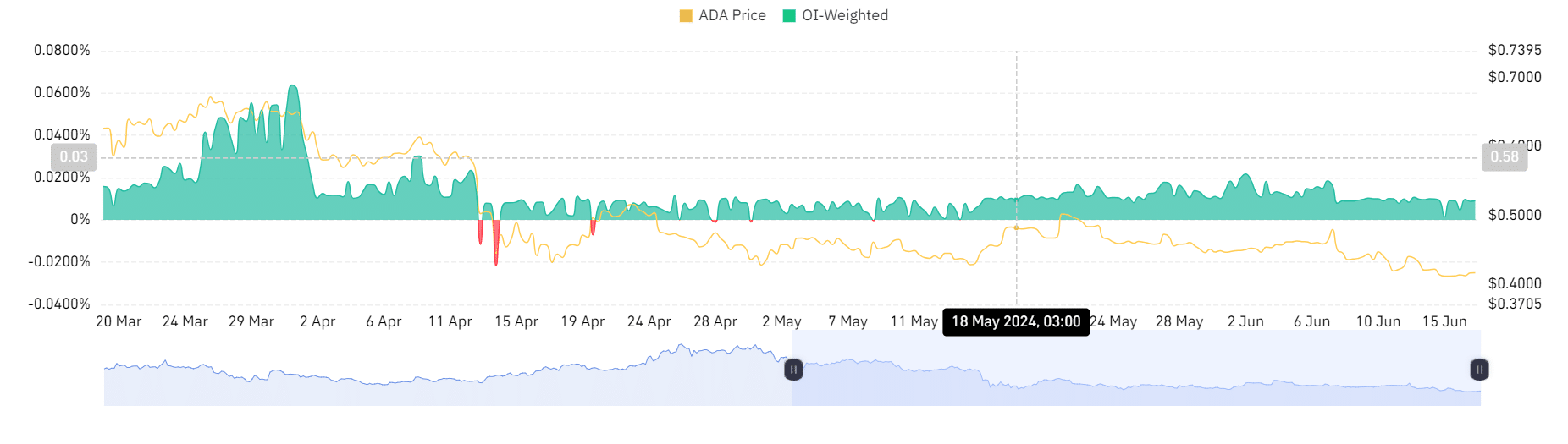

According to Coinglass, there is a reduced ADA-weighted funding rate. Generally, lower funding rates imply that shorts pay long positions, suggesting a bearish trend and sentiment.

When futures are trading at a discount to the spot, it puts downward pressure on prices.

Source: Coinglass

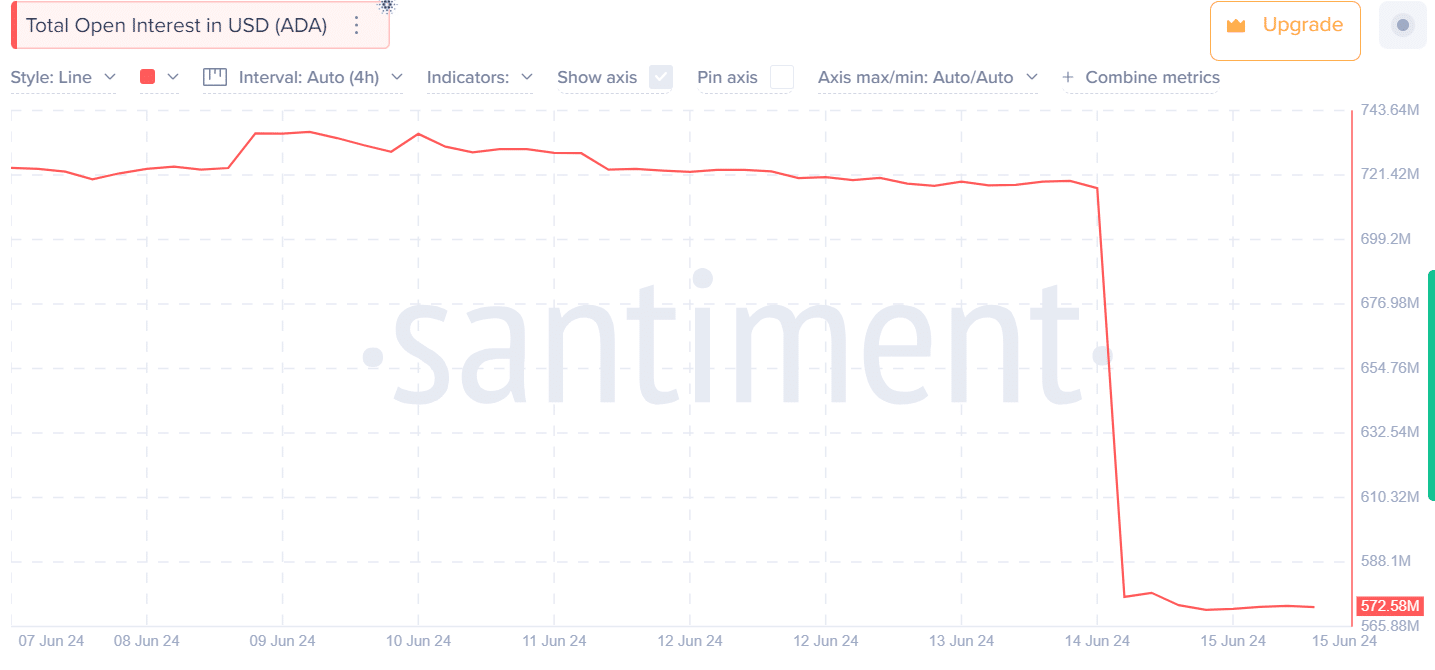

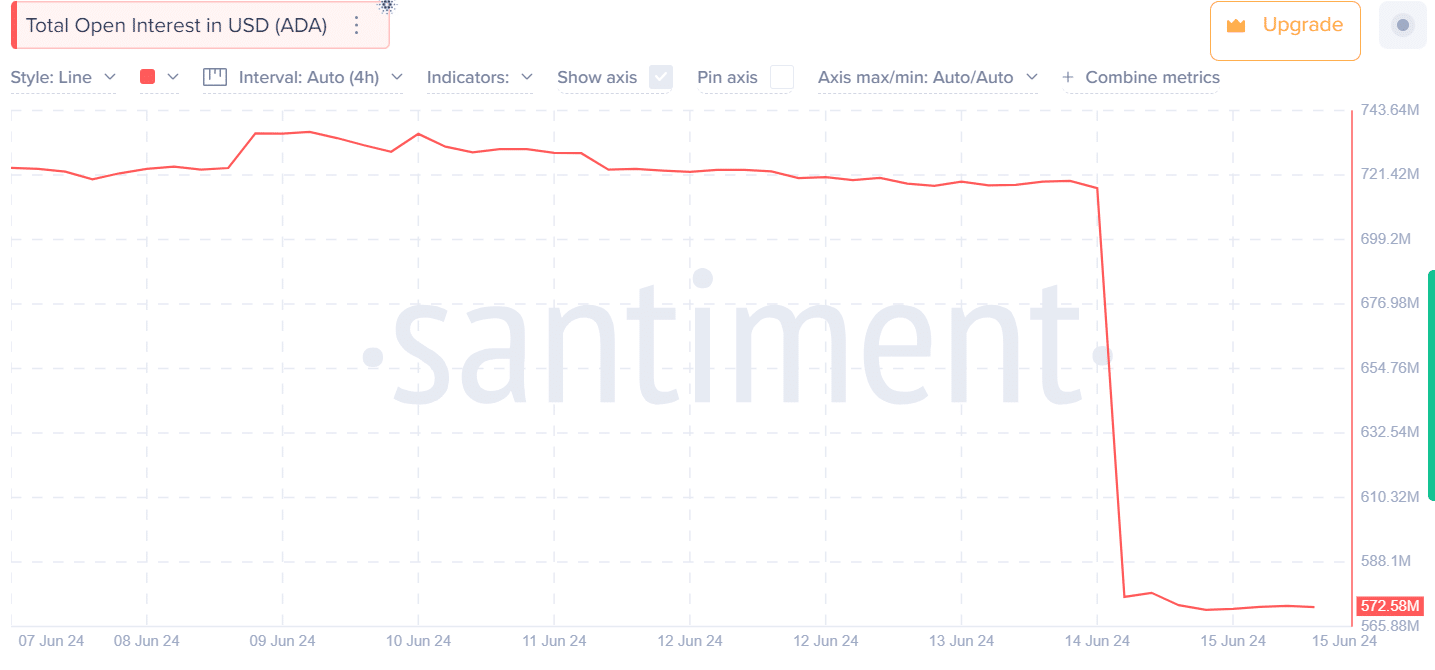

Equally, Santiment’s data on ADA”s total open interest in USD indicates reduced trading activity. Decreased open interest shows fewer trades in future markets, leading to thin order books.

Such a change in market sentiment leads to increased volatility in trading volumes. These changes imply a bearish trend as there’s forced liquidation.

How far can ADA fall?

Various indicators show that ADA is on a strong bearish trend. The breakdown below the local weak support level of $0.403 will cause the bearish bias to persist.

Is your portfolio green? Check out the ADA Profit Calculator

However, with a structure change or establishment of a new level, the market will experience a reversal.

In this sense, a potential reversal can push the market to $0.489 while creating a new resistance level of $0.505. However, until the structure changes, the trend will remain bearish.

Leave a Reply