- Global reach of BTC ETFs expand with the Australian Stock Exchange set for a new listing on 20th June.

- It remains to be seen whether the US spot ETH ETF approvals will increase demand for BTC ETFs.

Australian Stock Exchange (ASX), the largest exchange in Australia, has joined the Bitcoin [BTC] ETF party by approving its first BTC ETF product from asset manager VanEck.

The product, VanEck Bitcoin ETF (VBTC), will be listed on June 20th, marking the historical debut of an ETF involving the largest digital asset on ASX.

Andrew Campion, ASX’s general manager of investment products, told the Australian Financial Review (AFR) that the delay in approving BTC ETFs on the exchange was due to the 2022 crypto winter. Campion added,

“But with the recovery of cryptocurrency prices, we’ve had a fair bit of interest over the last 12 months, and that’s culminated in the approval.’

ASX signaled renewed interest after US and Hong Kong spot BTC ETFs went live.

Demand for Bitcoin ETF Australia

On his part, Arian Neiron, Asia Pacific managing director at VanEck, emphasized the growing investor demand for BTC.

‘Bitcoin has remained an emerging asset class that many advisers and investors want”

The ASX’s listing is a great signal for Australian investors looking for regulated avenues for trading and investing in BTC.

Similar products have also recently been launched on the second largest Australian exchange, Cboe Australia, a key competitor to ASX.

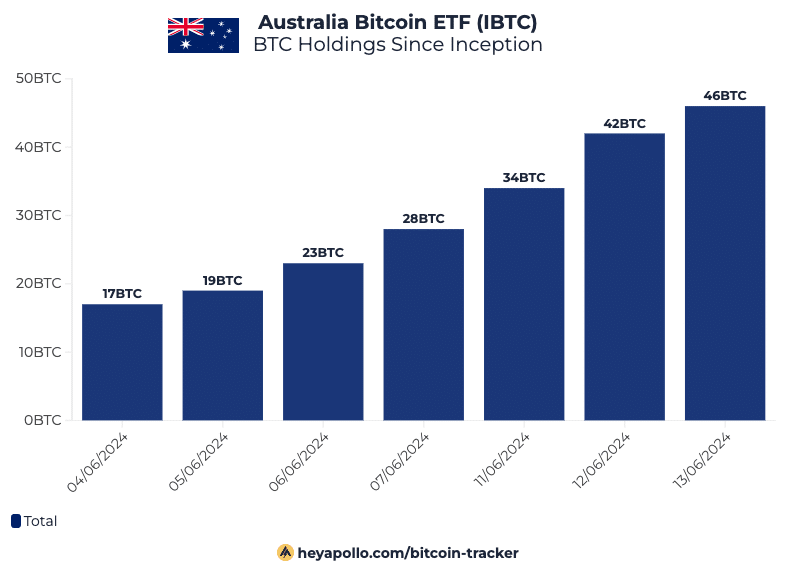

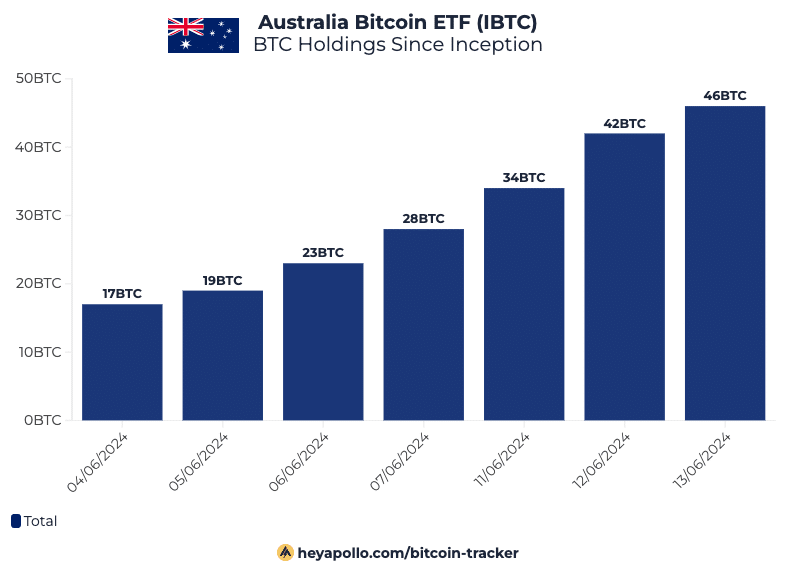

Notably, Monochrome Bitcoin ETF (IBTC) debuted and started operating on Cboe Australia on June 3rd. As of June 14th, the product had accumulated 46 BTC, Julian Farher, a Bitcoin analyst and investor, revealed.

Source: X/Julian_Farher

Interestingly, the ASX’s listing will start trading just a few days before US spot Ethereum [ETH] ETF approval. Many analysts view it as a catalyst for the overall market. Whether or not it will ramp up demand for the Australian BTC ETFs remains to be seen.

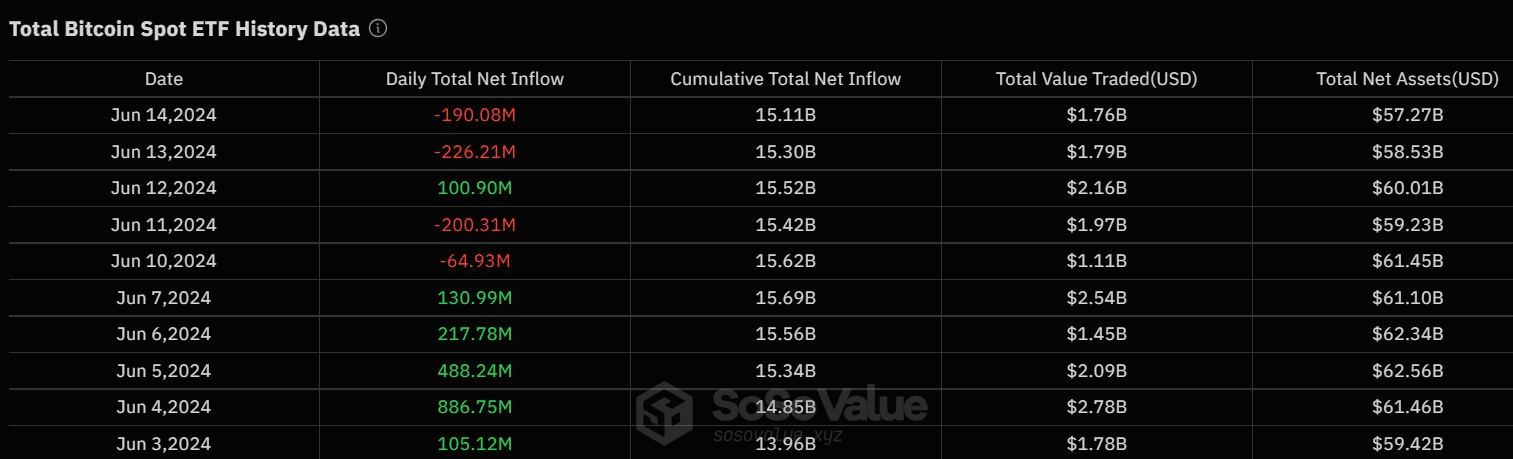

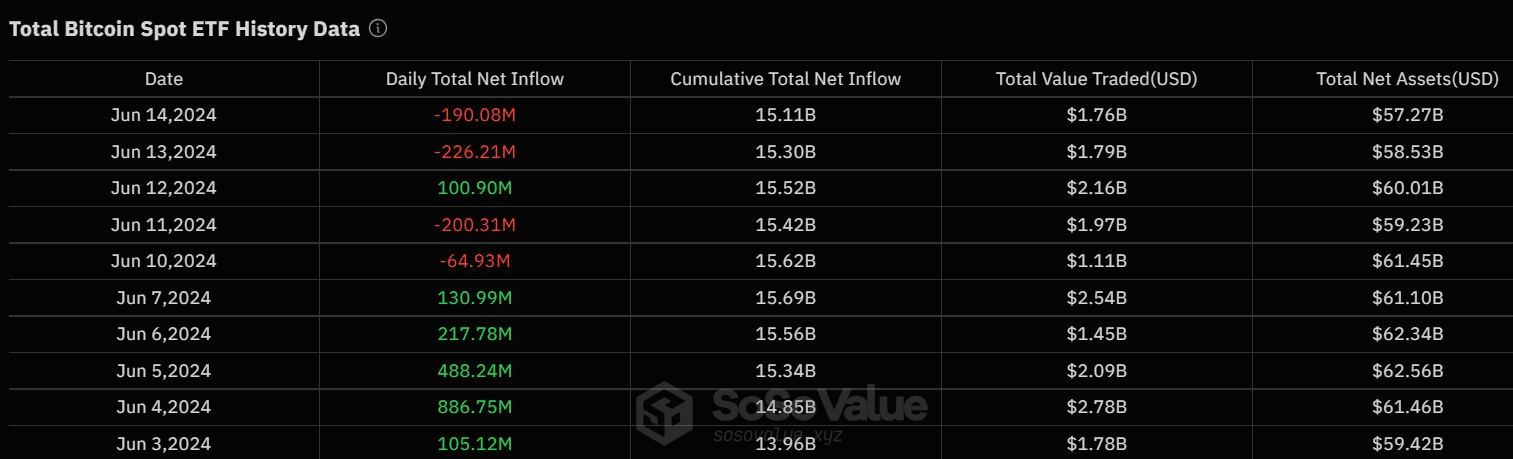

However, the spot US BTC ETFs recorded significant outflows last week as investors de-risked before and after the Fed’s decision to keep interest rates unchanged for the seventh time.

Source: Soso Value

Apart from 12 June, the rest of last week saw massive outflows worth over $680 million, underscoring US investors’ risk-off approach.

As of press time, the king coin slipped below $66K. It could trend lower to the range low if the bearish sentiment persists.

Additionally, per Coinglass data, the overall market’s Open Interest (OI) rates were red as of press time, indicating low liquidity in the derivatives market and reinforcing the bearish sentiment.

Leave a Reply