- Bitcoin ETF holdings declined across various financial institutions declined.

- The price of Bitcoin remained stagnant, and volumes surged.

Bitcoin’s [BTC] recent correction in price caused sentiment across markets to turn negative. But it wasn’t just the crypto traders that were affected, interest from Wall Street in the king coin diminished as well.

Bitcoin ETFs see growth

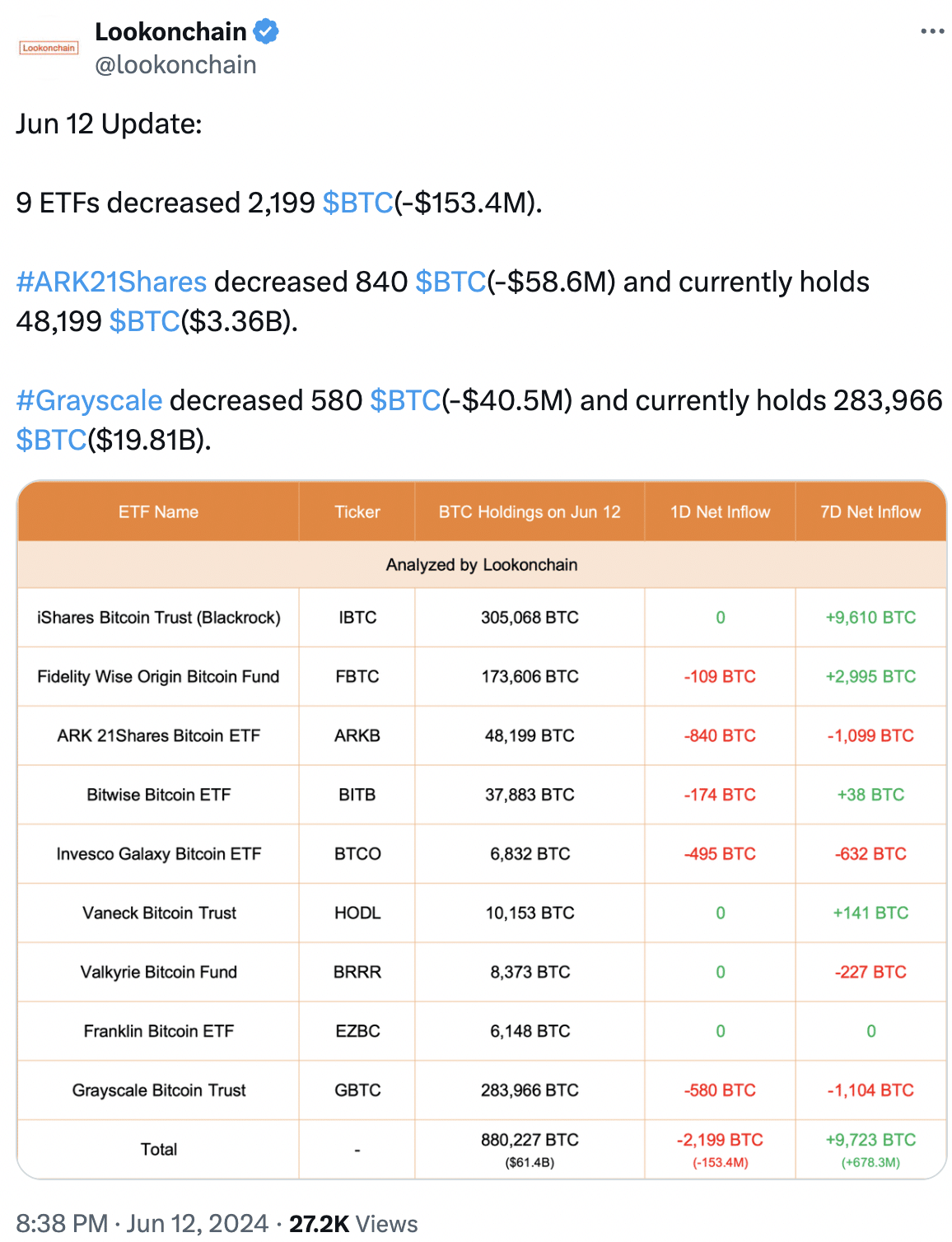

Across nine Bitcoin exchange-traded funds ETFs, there was a collective decrease in holdings of 2,199 Bitcoin, which translated to roughly $153.4 million.

This decline can be attributed to two major players — ARK21Shares and Grayscale. ARK21Shares witnessed a decrease of 840 BTC, which was approximately -$58.6 million.

On the 12th of June, they held 48,199 BTC, valued at around $3.36 billion. Grayscale also saw a decrease in its holdings, by 580 BTC, around $40.5 million. On the 12th of June, Grayscale held 283,966 BTC, valued at $19.81 billion.

If big players are losing faith and selling their holdings, it might signal a lack of confidence in the long-term potential of BTC, leading to a negative sentiment ripple effect throughout the market.

This could cause a broader sell-off as less risk-tolerant investors panic and follow suit.

Source: X

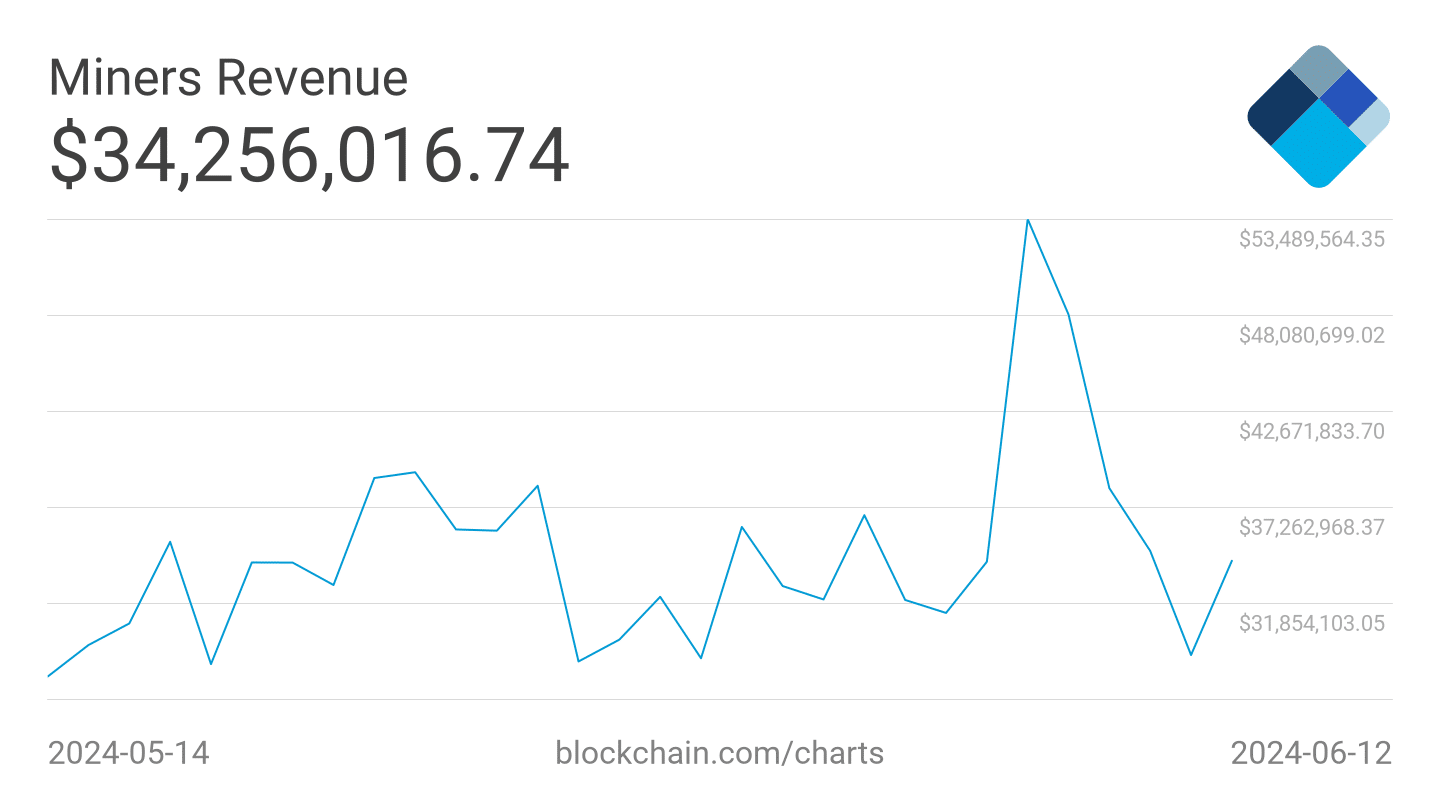

Data from this week indicated a two-month high in transfers from mining pools to exchanges, coinciding with BTC nearing its local peak of $70,000.

This suggested that miners were capitalizing on the surge in price, potentially through over-the-counter (OTC) desks.

This trend was likely driven by the recent Bitcoin halving, which reduced miner rewards and caused these miners to sell a portion of their holdings to maintain profitability.

On the 10th of June, 1,200 BTC were sold, representing the highest daily total in two months, highlighting a potential rise in selling pressure from miners.

Moreover, miner revenue declined. As miner revenue continues to plummet, the incentive for these miners to sell their holdings to remain profitable rises.

This decline in miner profitability can add further selling pressure on BTC.

Source: Blockchain.com

Read Bitcoin (BTC) Price Prediction 2024-2025

How is BTC doing?

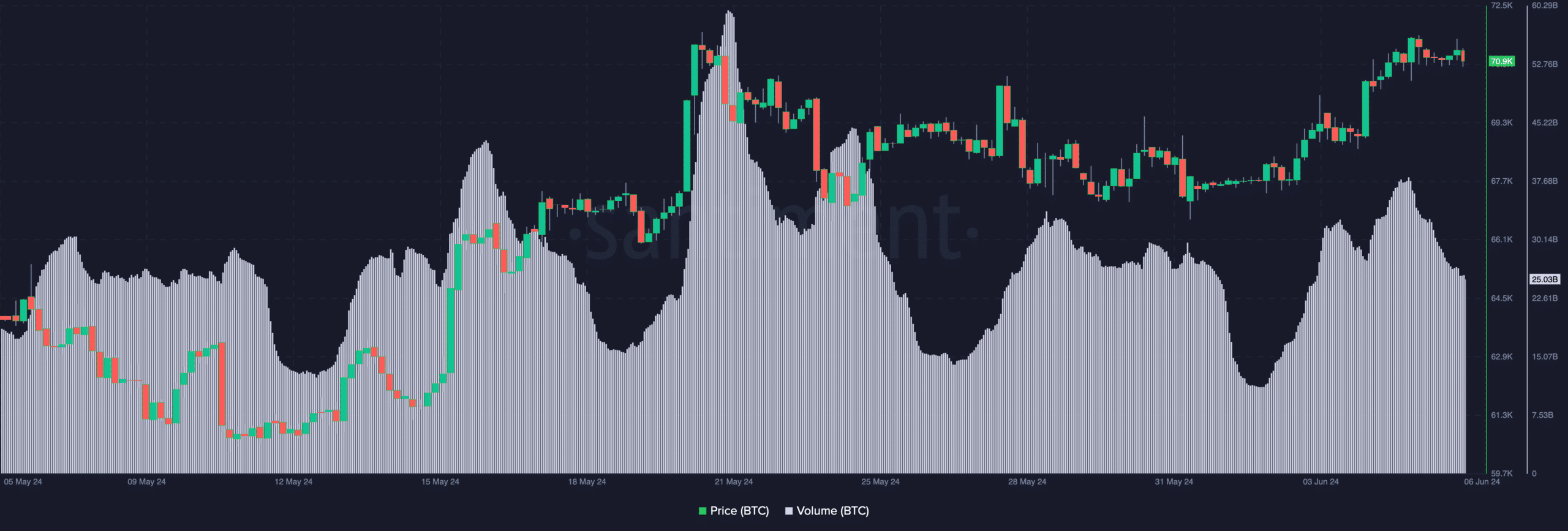

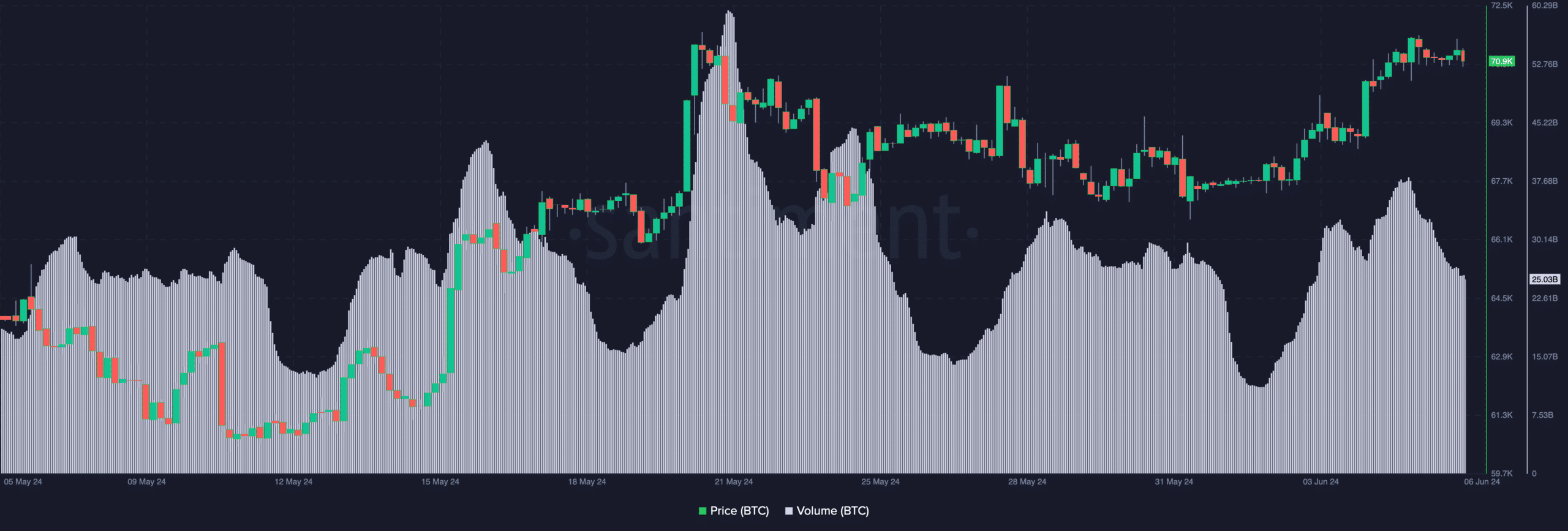

At press time, BTC was trading at $67,268.41. Over the past 24 hours, BTC’s price fell by 0.35%. Despite the decline in price, the volume at which BTC was trading at surged by 25.26%.

The resurgence of trading volume for BTC could be an indicator of renewed interest in the coin. If the volume continues to grow, a positive change could be reflected in the price as well.

Source: Santiment

Leave a Reply