- Solana’s price was stuck at press time, with a “death cross” and bearish dominance.

- Despite a bearish trend, SOL hints at the potential for recovery if bullish triggers emerge.

After staging a remarkable performance at the start of this cycle, Solana [SOL] seems to be caught in an odd loop at the moment. Its price has stagnated, and neither the bulls nor the bears seem to be in charge.

At a glance, it seems SOL doesn’t know what to do. Is there a recovery on the horizon? Or is it a crash?

Solana’s next move

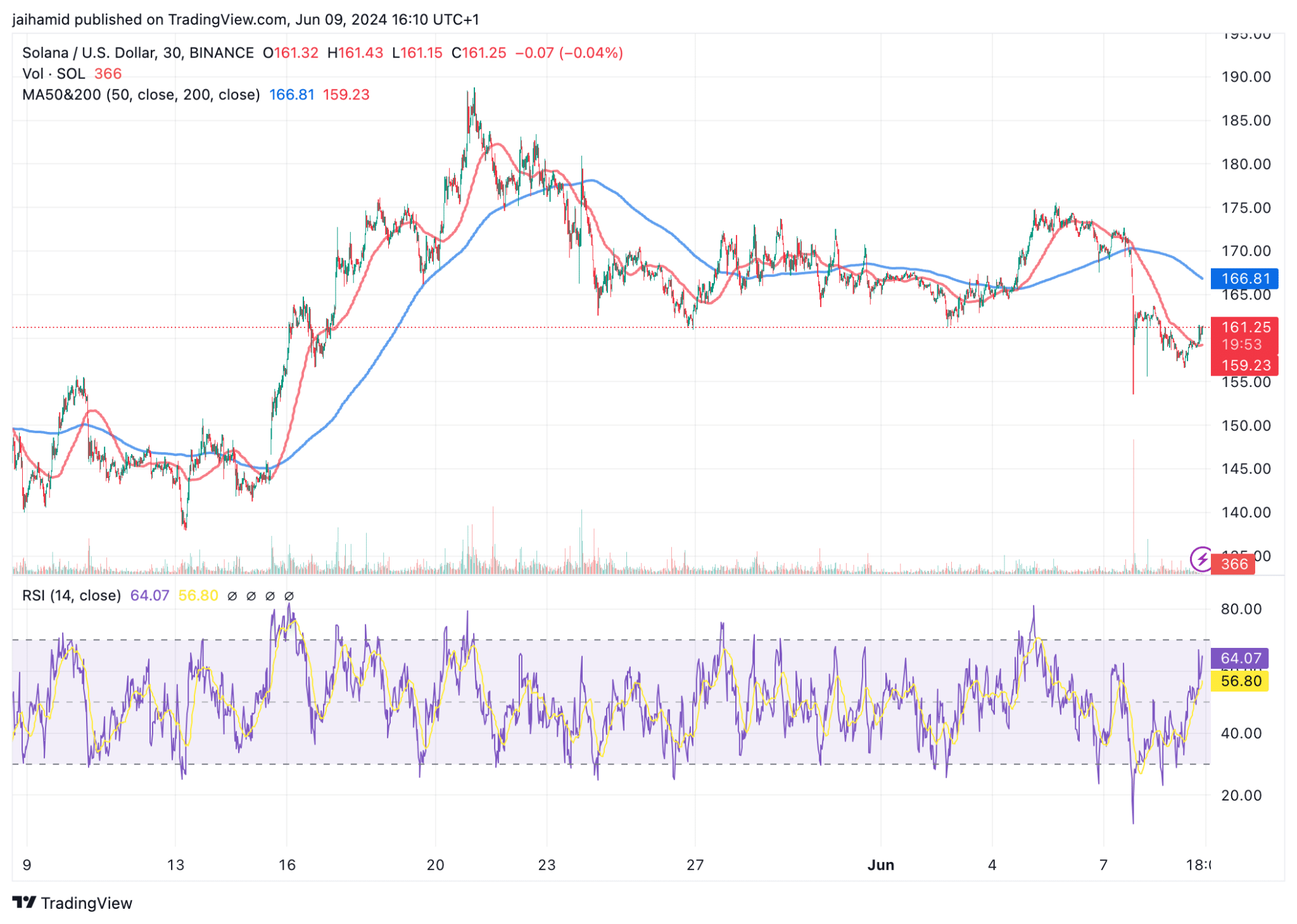

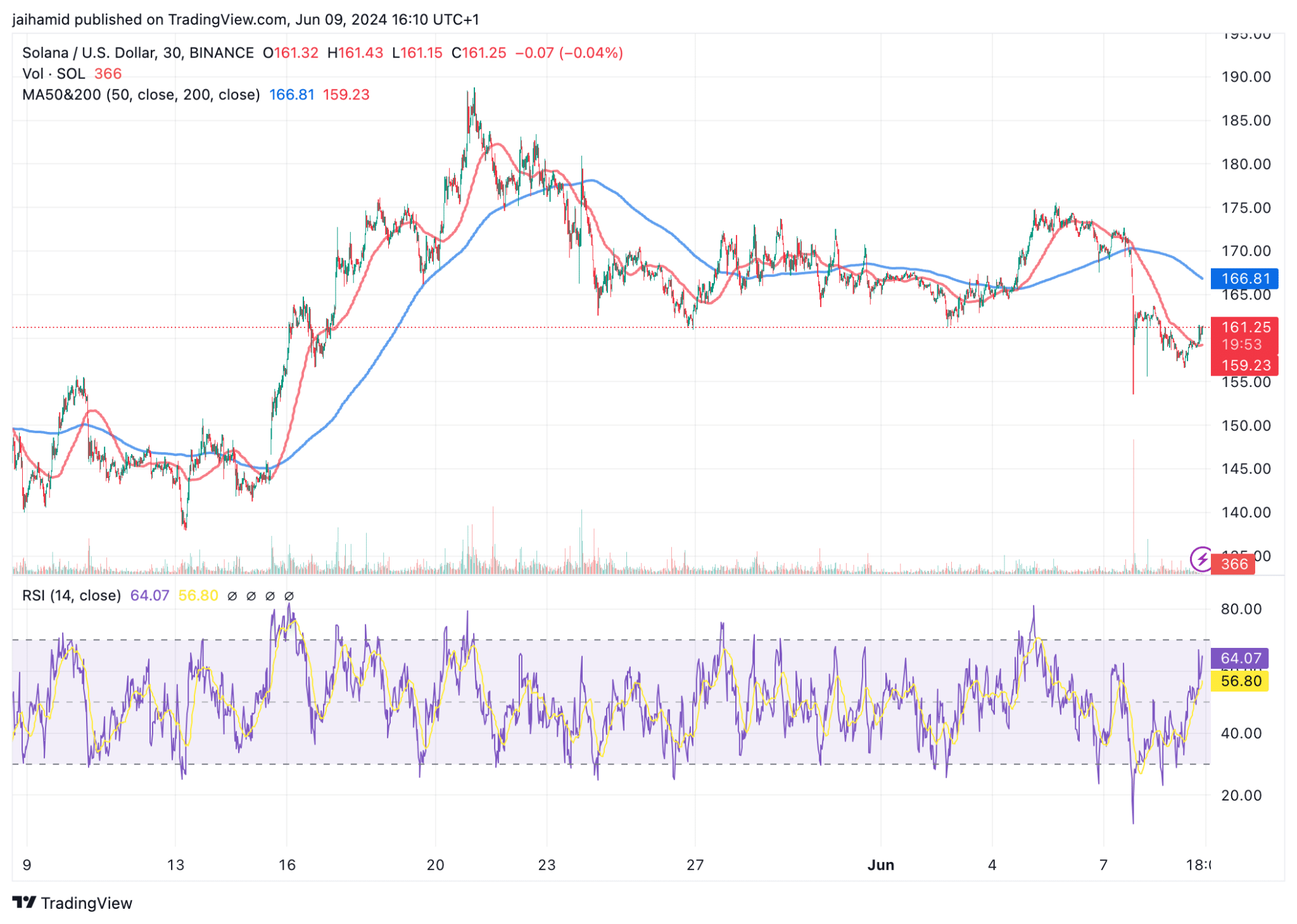

SOL has been caught between $158 and $173 for the past two weeks. Recently, the 50-period moving average crossed below the 200-period moving average, a classic bearish signal in technical analysis known as a “death cross.”

This means that in the short-term, unfortunately, the bears are prevailing.

Source: TradingView

The price action shoeds a sharp drop followed by intense consolidation. The RSI is currently around 64, closer to the neutral zone’s upper boundary but not yet in the overbought area (typically above 70).

So, there is still some buying momentum, though it is not strong.

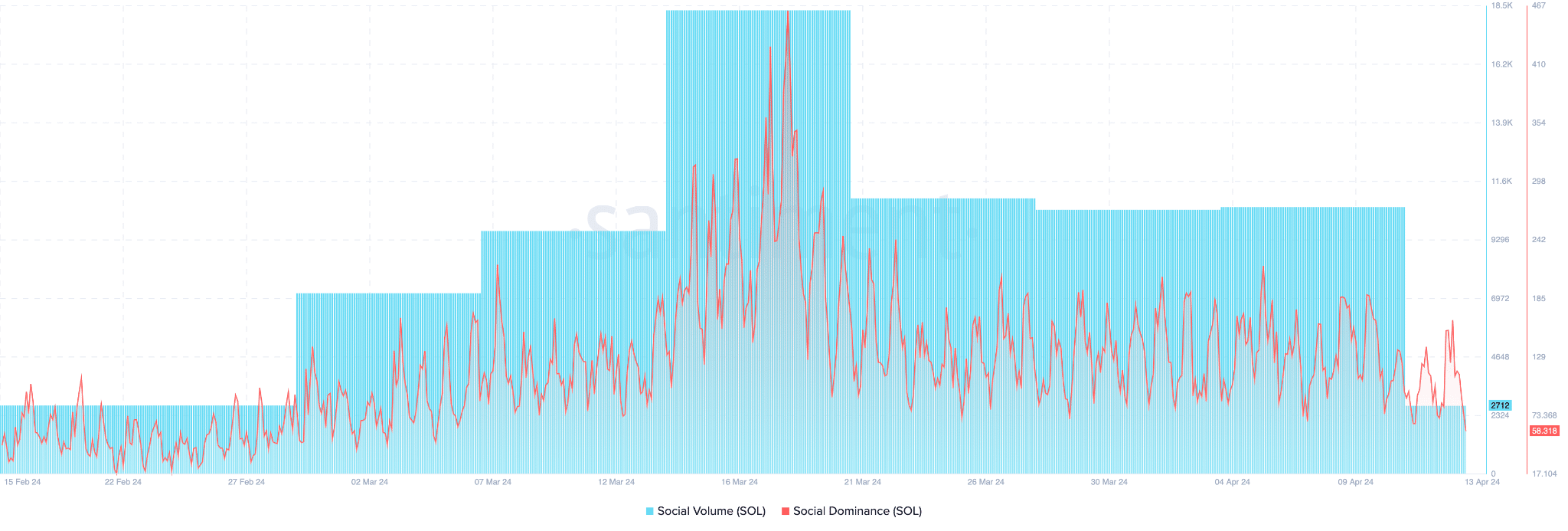

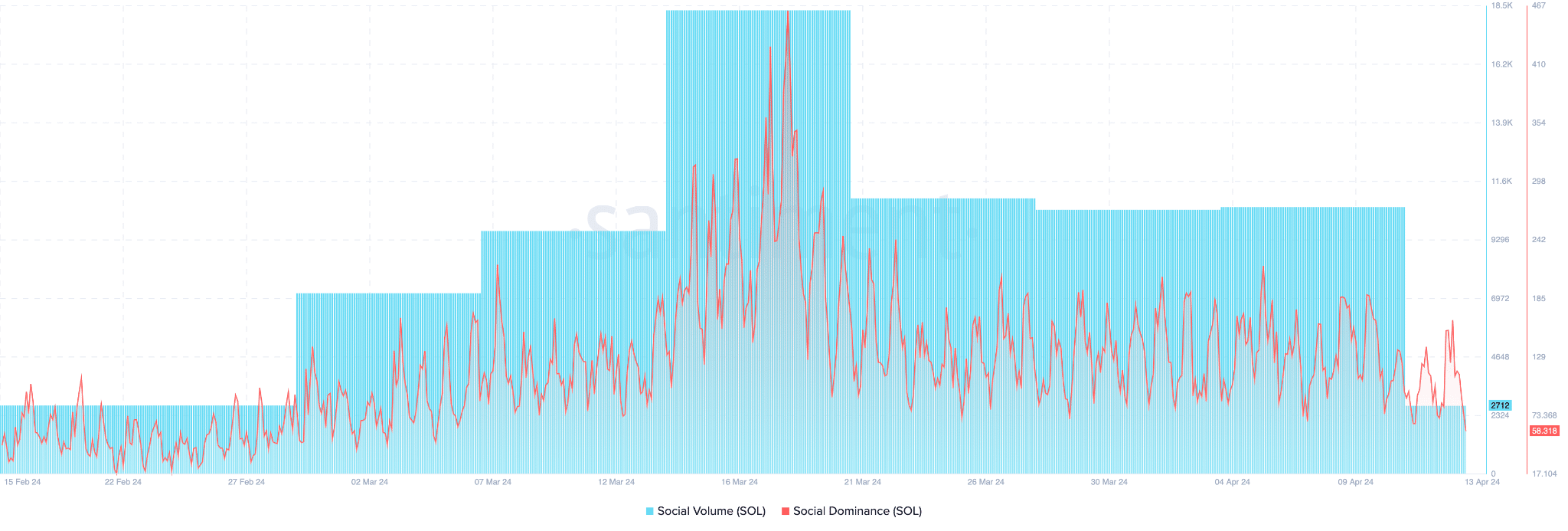

SOL’s social volume and social dominance are both on a noticeable decline, suggesting that the crypto community’s favorite altcoin is losing interest and social engagement.

Source: Santiment

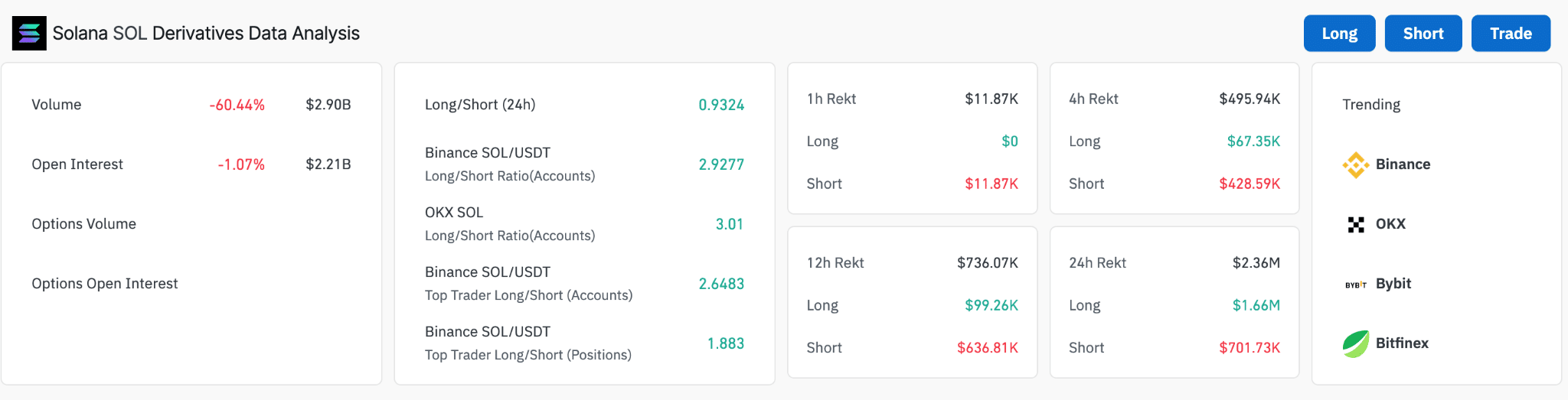

The derivatives market doesn’t offer any solace either. Trading volume has significantly decreased by 60.44% to $2.90 billion, a massive drop in trading activity.

The overall long/short ratio of 0.9324 on a 24-hour basis shows an almost equal preference for long and short positions, reflecting the market’s uncertainty about Solana’s next move.

Source: Coinglass

However, on Binance and OKX, the long/short ratios are notably higher (2.9277 and 3.01, respectively, for all accounts), suggesting a more bullish sentiment among traders on these exchanges.

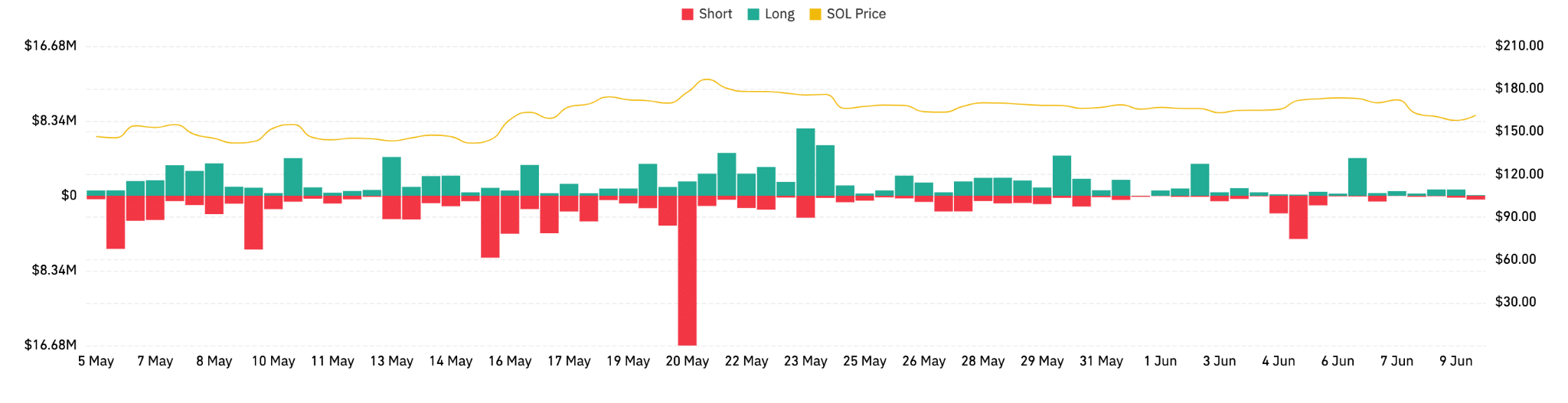

Source: Coinglass

Read Solana (SOL) Price Prediction 2024-25

The concentration of liquidations, particularly short liquidations during price spikes, implies a market that is somewhat prone to sudden bullish runs, which can aggressively squeeze short sellers out of their positions.

Overall, there might be room for a small rally if external factors or market sentiment can provide enough bullish momentum.

Leave a Reply