- ADA was caught in a tight supply region that could lead its price downwards.

- Open Interest and network activity fell, suggesting a decline toward $0.40.

Cardano [ADA] has erased 6.11% of its gains in the last 30 days. However, AMBCrypto found that the token could be on the brink of another decline.

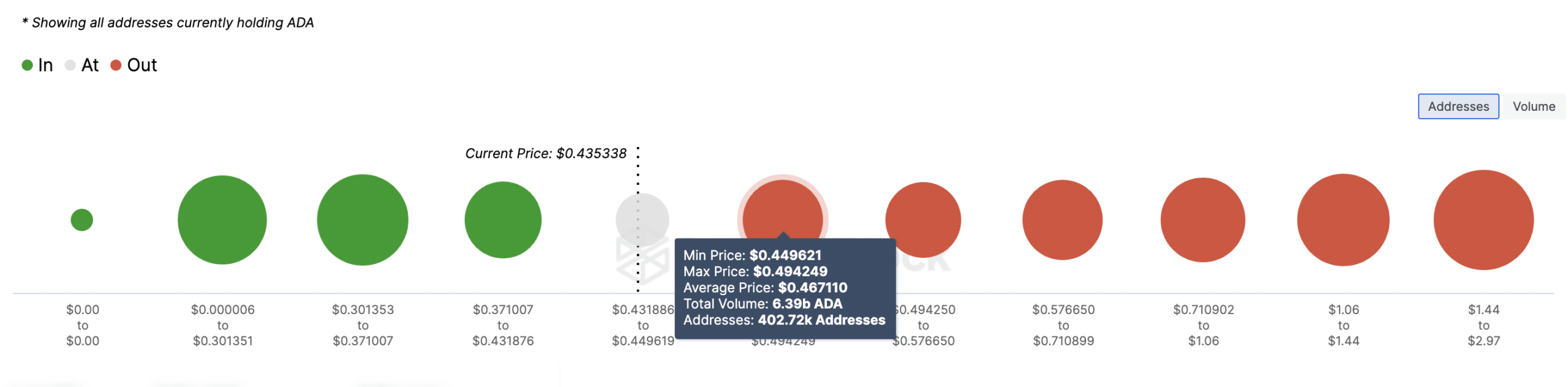

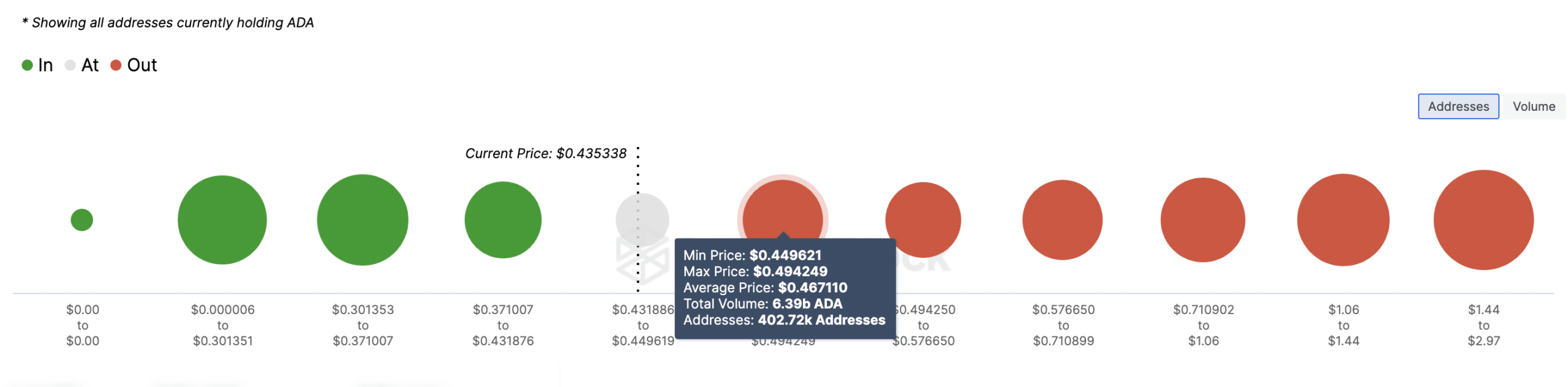

This assertion was backed by the Global In/Out of Money (GIOM) indicator provided by IntoTheBlock.

The GIOM classifies addresses based on those in profits, losses, and those at breakeven points. By showing these addresses, traders can ascertain potential support or resistance levels.

ADA bears wait to strike

At press time, we observed that 402,720 addresses accumulated 6.39 billion between $0.44 and $0.49. This cohort is out of the money.

As such, there is a high chance that most holders could look to sell once ADA hits these levels.

Therefore, this could be a resistance level for the Cardano native token. Should this be the case, ADA could retrace to $0.42. In a case where selling pressure is intense, the value could drop to $0.40.

Source: IntoTheBlock

As of this writing, the price of the token was $0.43. Despite the price decrease, the number of large transactions on the network increased by 11.32% in the last 24 hours.

However, a rise in large transactions does not necessarily imply a surge in buying pressure. Taking a cue from the price action, the increase might mean movement of tokens between wallets or some sell-offs.

Apart from the metric above, the 24-hour active addresses was another indicator supporting a possible retracement.

According to Santiment, active addresses on the Cardano network approached 35,000 on the 8th of June.

No new buyer in Cardano’s land

But at press time, the number had decreased to 32,100, indicating that the number of unique addresses participating in transactions had decline.

The attempted increase seemed like a false breakout for ADA’s price.

A look at the chart showed that the token’s value had a strong correlation with the network activity.

For instance, when the active addresses rose to 39,000 on the 7th of June, the price of the cryptocurrency jumped to $0.48.

Source: Santiment

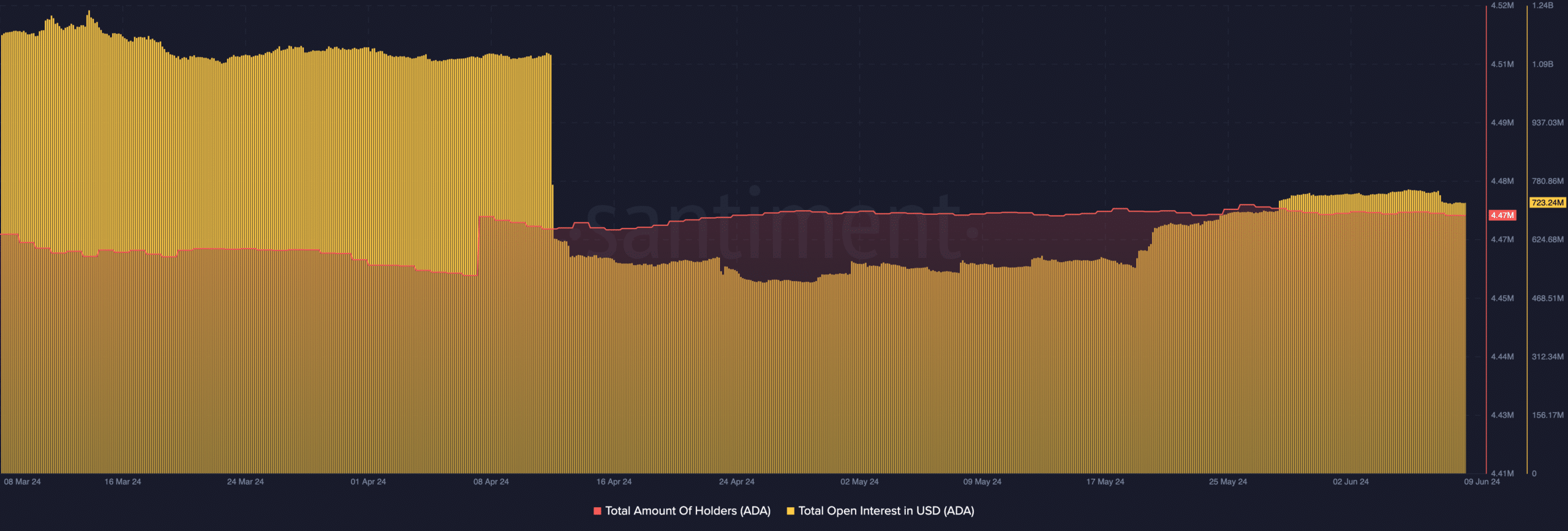

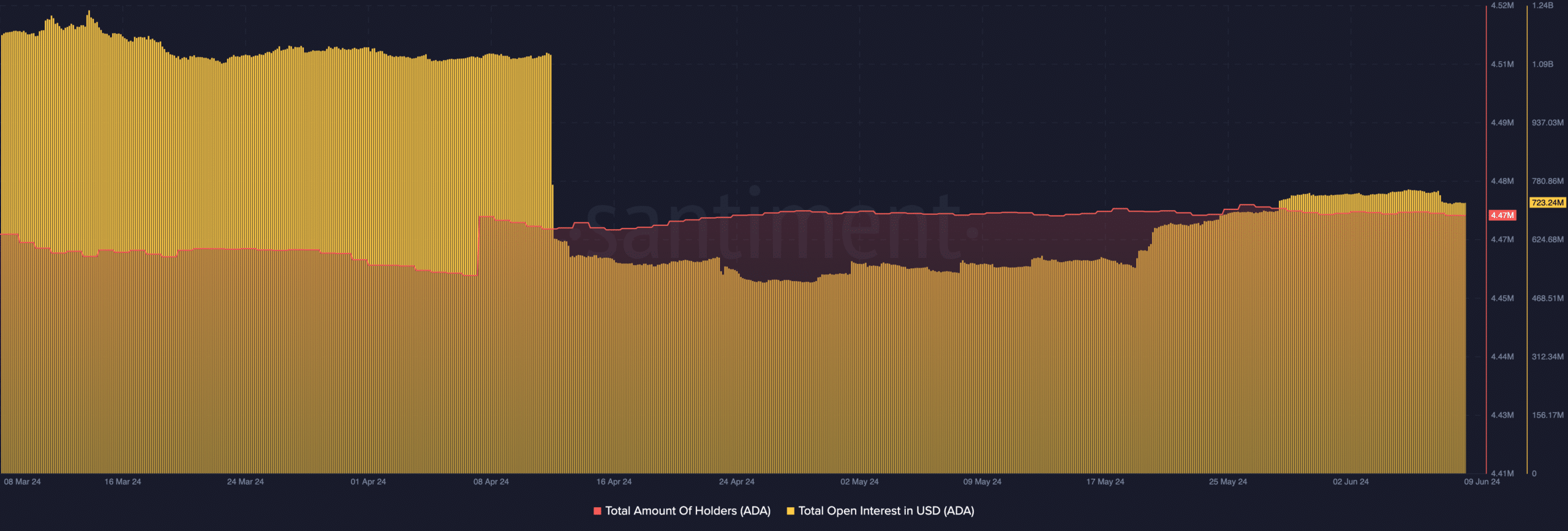

Therefore, a further decrease in the metric could send Cardano’s price trending downward. In addition to this, AMBCrypto checked the Open Interest (OI).

The OI tells if traders are opening more contracts linked to a cryptocurrency. An increase in OI signals an influx of money into the market, and this could help prices increase.

However, for Cardano, the OI decreased. This indicated that traders are increasingly closing their positions. Should this continue, ADA’s price might drop below $0.42.

Realistic or not, here’s ADA’s market cap in BTC terms

But it is important to note that invalidation might occur if interest starts to pick.

Source: Santiment

In conclusion, on-chain data showed that the total amount of ADA holders was 4.47 million. This was around the same figure it has was in April, suggesting that Cardano has failed in attracting new buyers.

Leave a Reply