- A major whale sold part of its ETH holdings

- Altcoin’s price fell, while Ethereum’s network growth declined too

Ethereum [ETH]‘s price registered a massive hike over the last few weeks, one fueled by news of new spot ETFs for ETH. Despite the optimism around the network, however, a large whale recently decided to sell its holdings.

Whales shy away

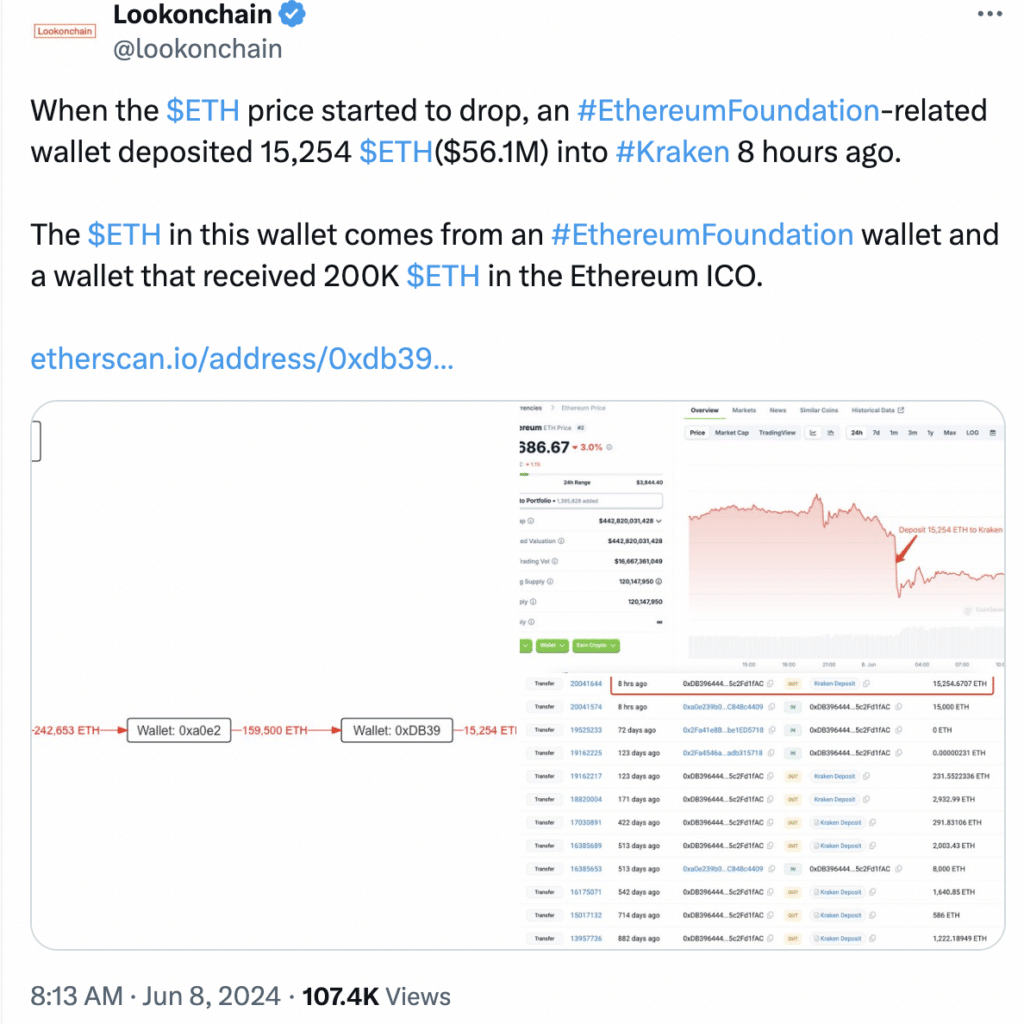

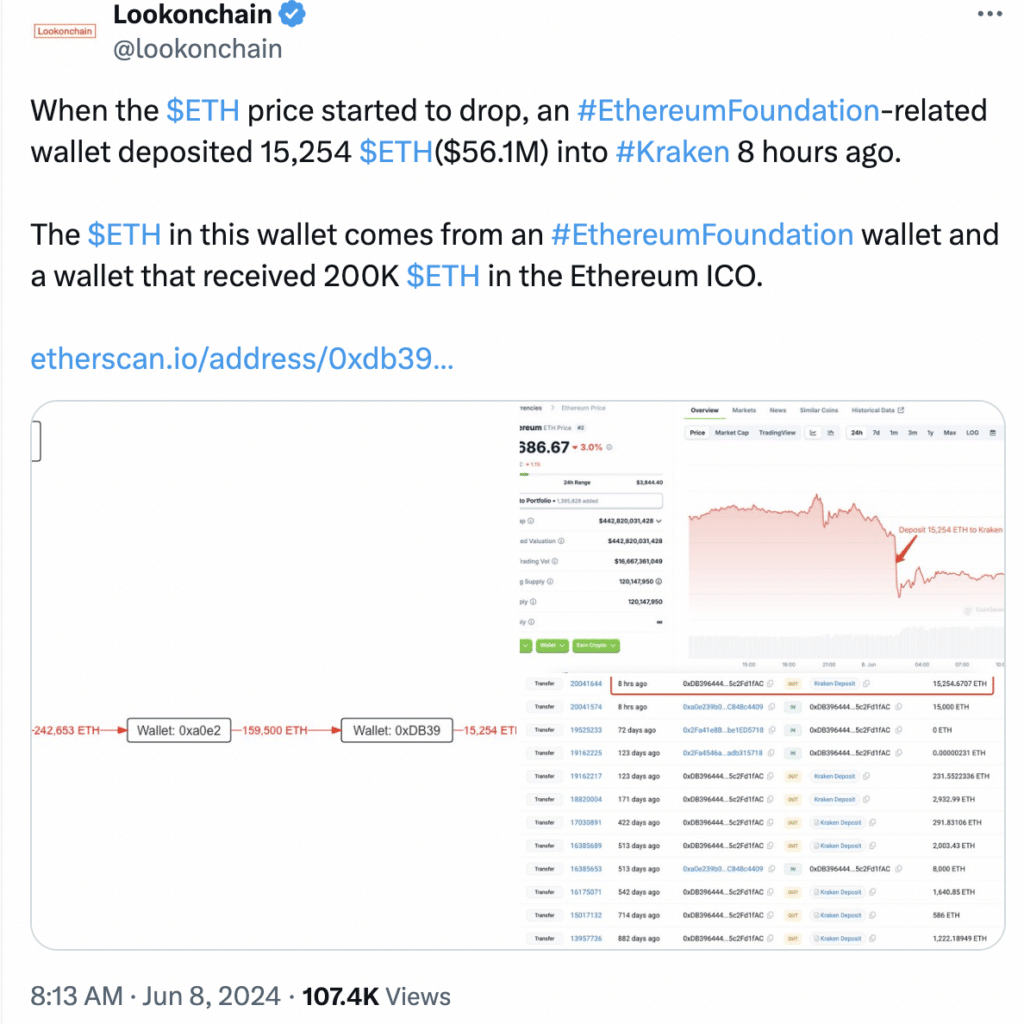

On 8 June, a significant transaction occurred on the Ethereum blockchain. A major whale transferred 15,200 ETH, worth approximately $56.47 million, to Kraken. This particular address received massive holdings of 67,000 ETH directly from the Ethereum Foundation. It is further believed that this same address also received an initial 200,000 ETH during the Ethereum Genesis block, likely signifying participation in the ICO (Initial Coin Offering) that launched the Ethereum network.

Here, it’s worth noting that despite this recent transfer, the wallet still holds a balance of 41,000 ETH – Valued at approximately $151 million.

This large transaction may be interpreted by some investors as a sign that the whale is losing confidence in Ethereum’s future, prompting it to sell its holdings. This fear-based selling could trigger a domino effect, driving the price down further.

Additionally, the unknown purpose behind the transfer can spur further uncertainty.

Source: X

How is ETH doing?

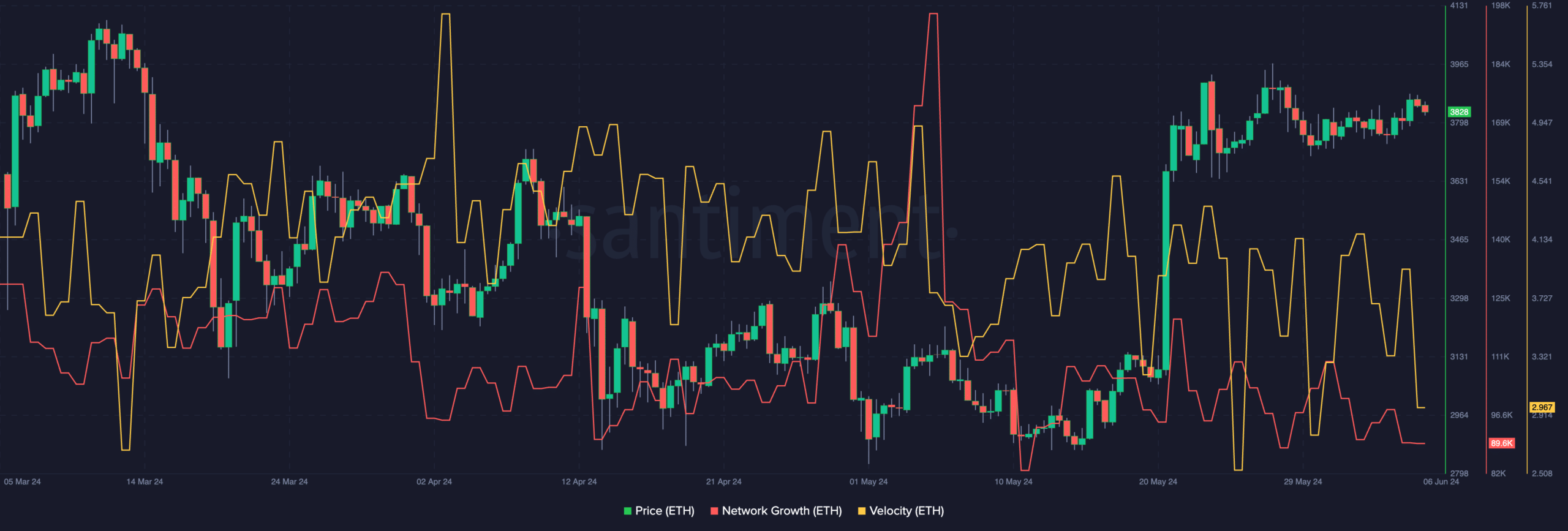

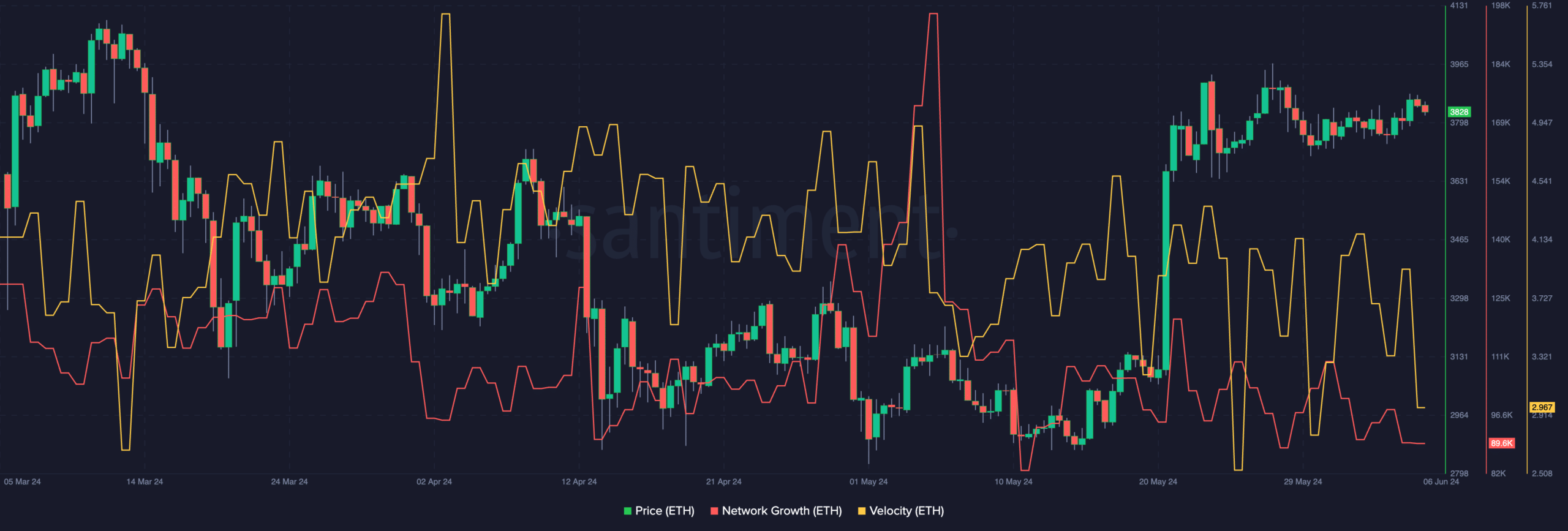

At press time, ETH was trading at $3,683.83, with its price down by 3.14% in the last 24 hours. Despite this sudden dip in ETH’s price, however, the overall trend of the price movement looked relatively positive.

And yet, the network growth for ETH declined significantly over the last few days, implying that new addresses were losing interest in ETH and were not ready to buy ETH at the current rate. If the price dips further, there may be a chance that ETH may begin to look lucrative to new investors in the future.

Coupled with the declining network growth, the velocity at which ETH was trading also fell materially.

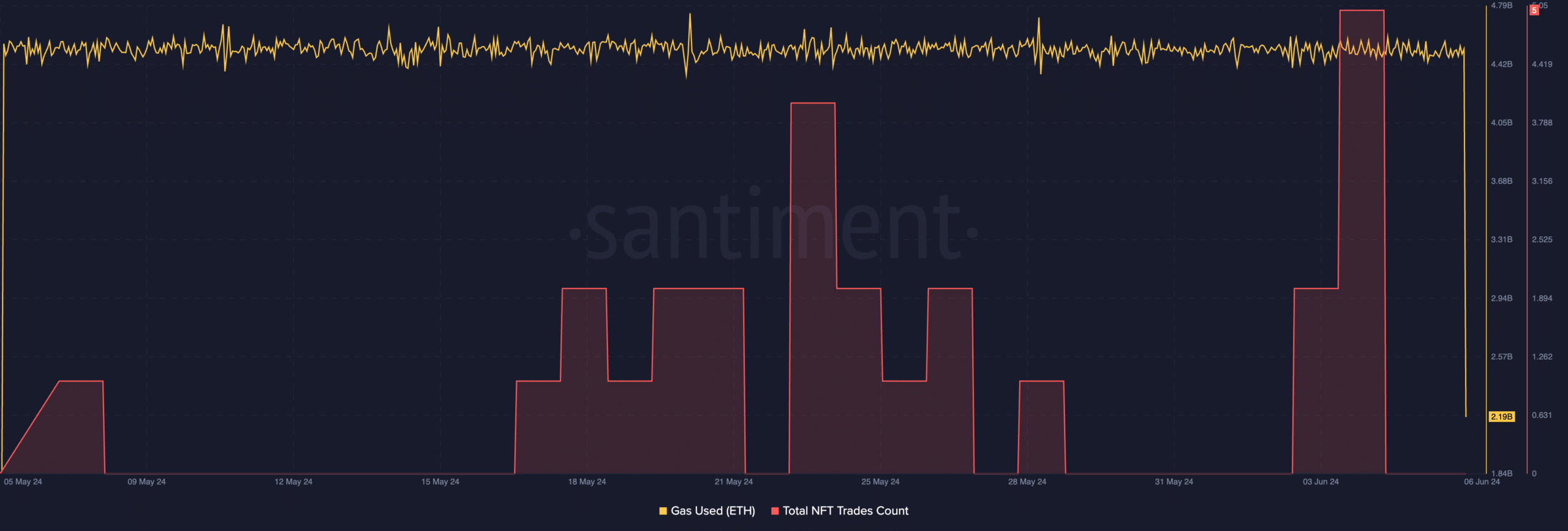

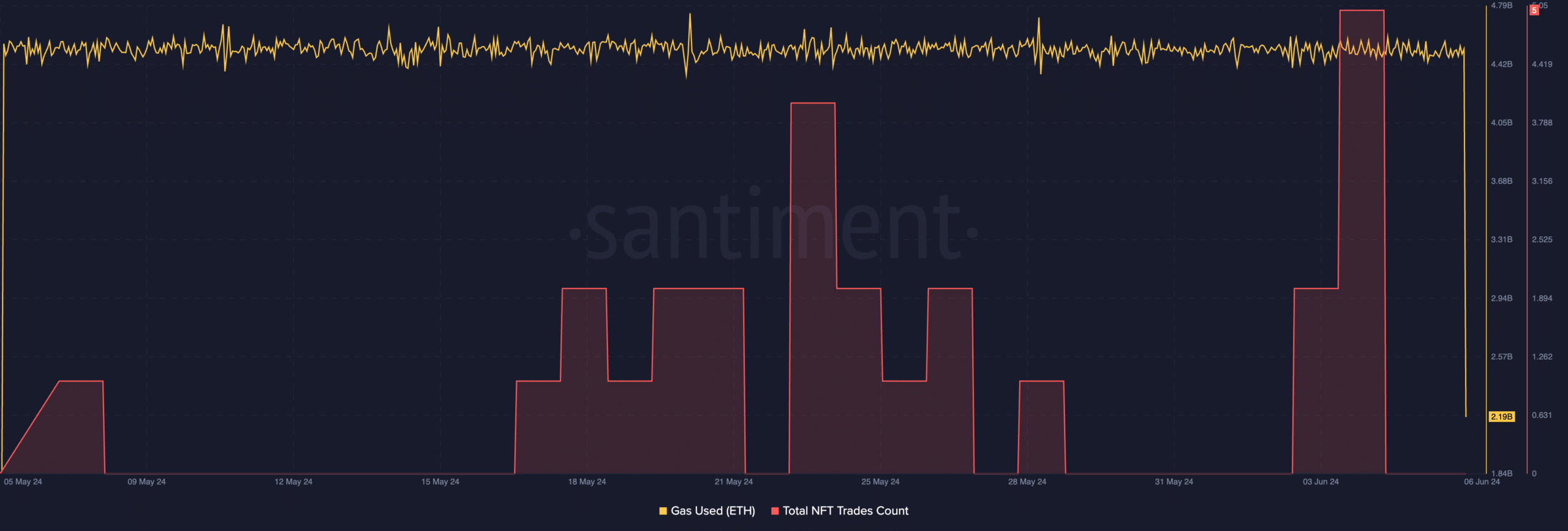

Source: Santiment

In terms of overall activity on the network, gas usage on the Ethereum network declined over the last few days. Additionally, the overall NFT trades on the network plummeted as well.

The lack of activity on the Ethereum ecosystem can be detrimental to both the the network and the price of ETH in the long run.

Is your portfolio green? Check the Ethereum Profit Calculator

Source: Santiment

Leave a Reply