- Whales accumulated significant amounts of BTC over the last few days.

- Retail interest was high, open interest also surged.

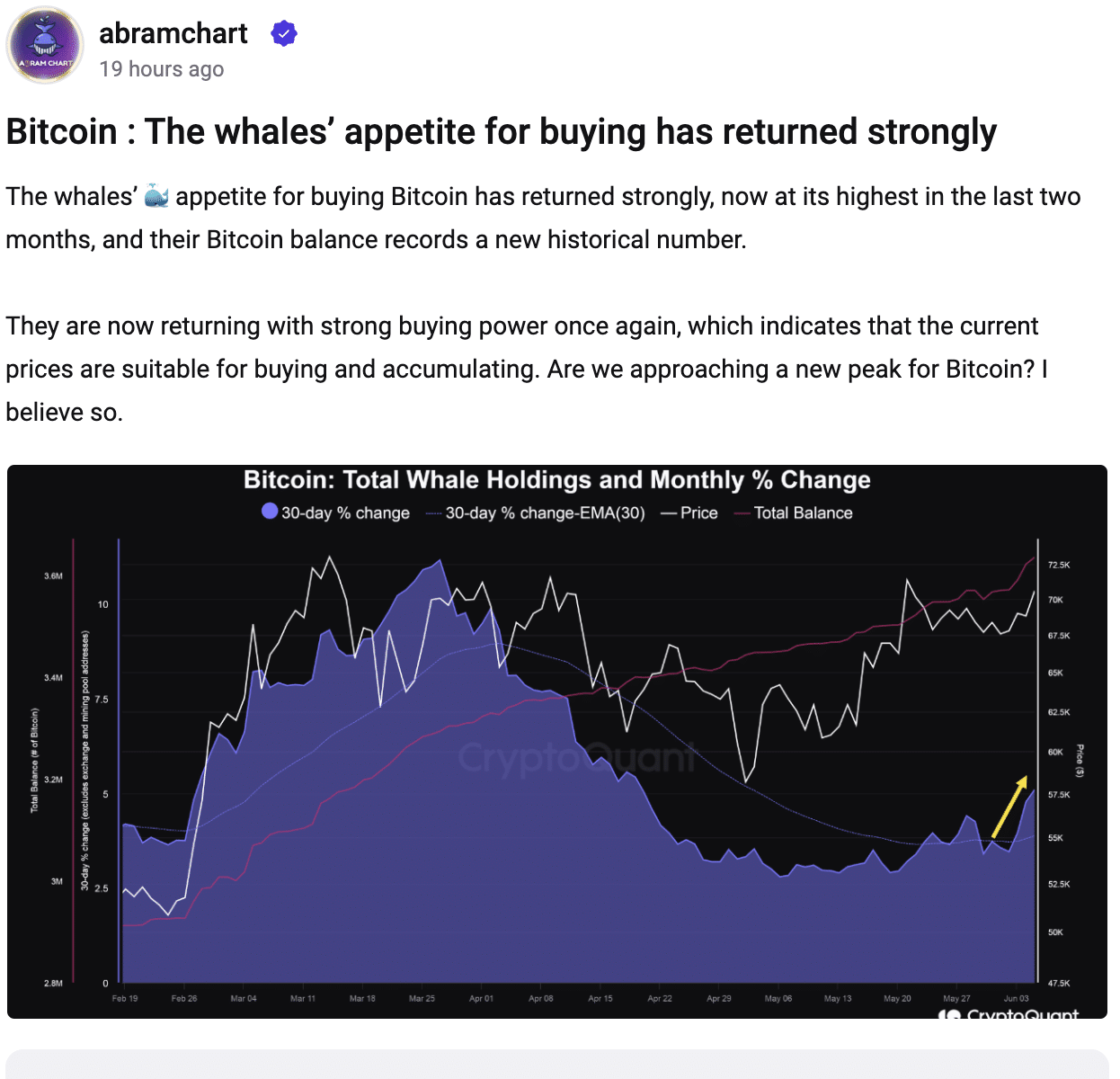

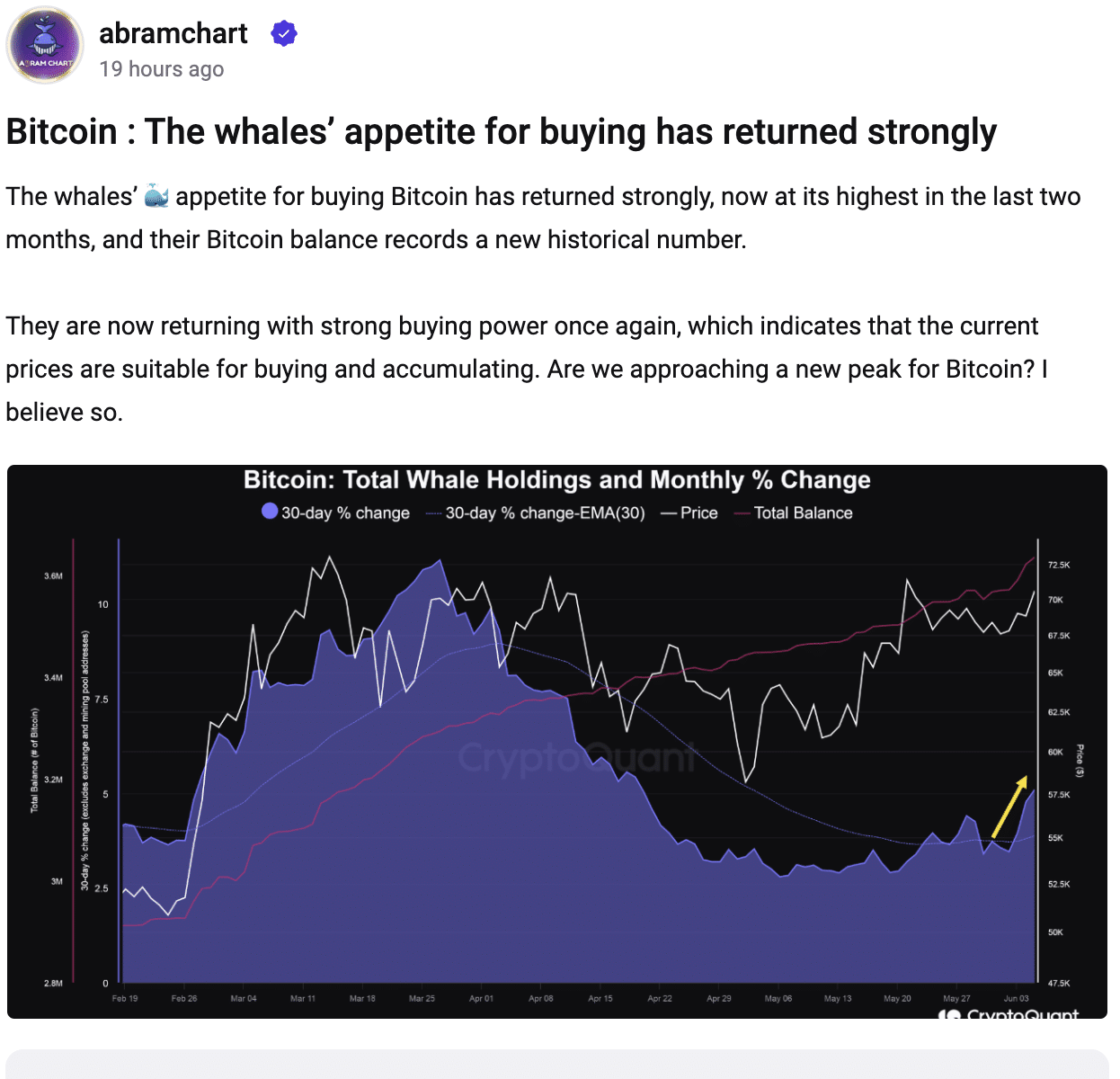

Whales accumulated a large amount Bitcoin [BTC] over the last few weeks. Data suggested a renewed surge in Bitcoin buying by whales, reaching a two-month high.

Their Bitcoin holdings have also hit a record peak. This renewed buying spree signifies that large investors perceive current prices, which are already extremely high, as an attractive entry point for accumulating Bitcoin.

While past performance is not necessarily indicative of future results, whales’ historical influence on the market suggests their buying activity could be a bullish indicator for Bitcoin.

Source: CryptoQuant

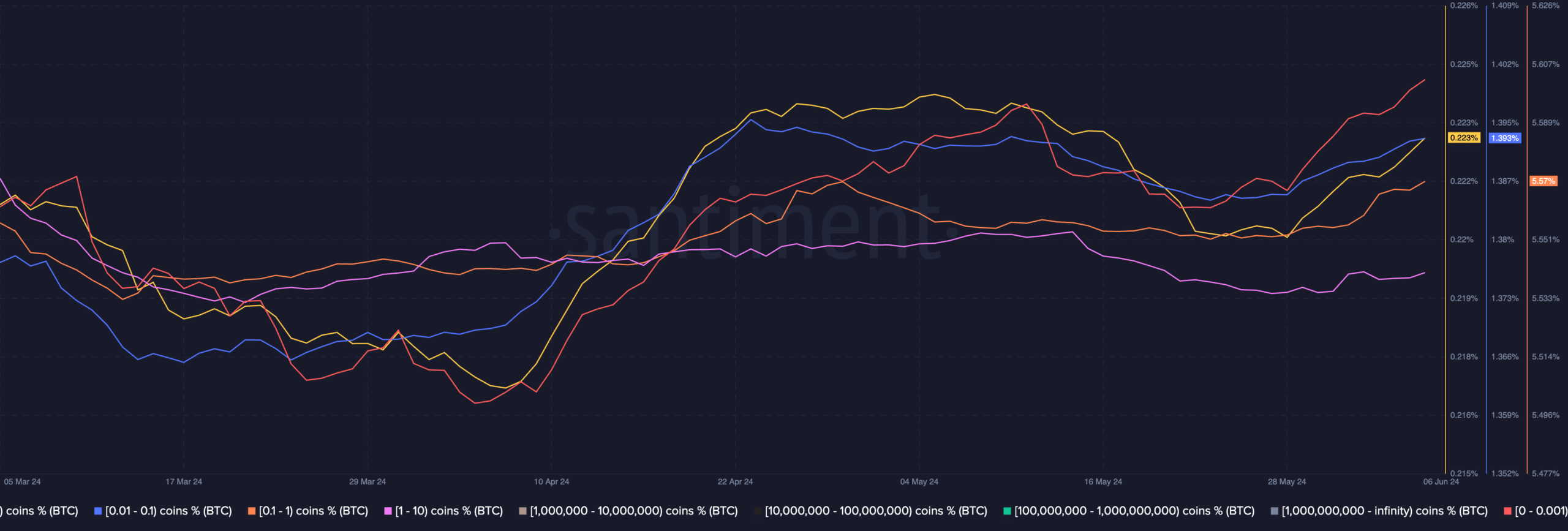

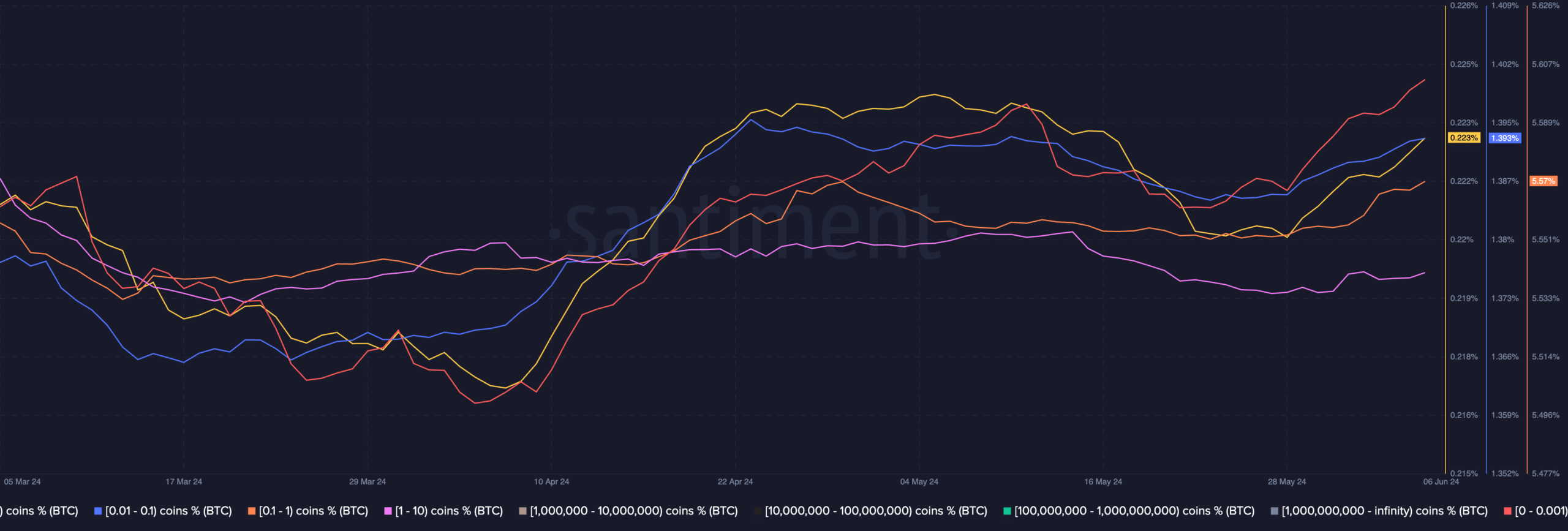

Retail investors also showed interest in BTC. AMBCrypto’s analysis of Santiment’s data revealed that the cohort of addresses ranging from 0.1 to 10 had showed interest in BTC.

Source: Santiment

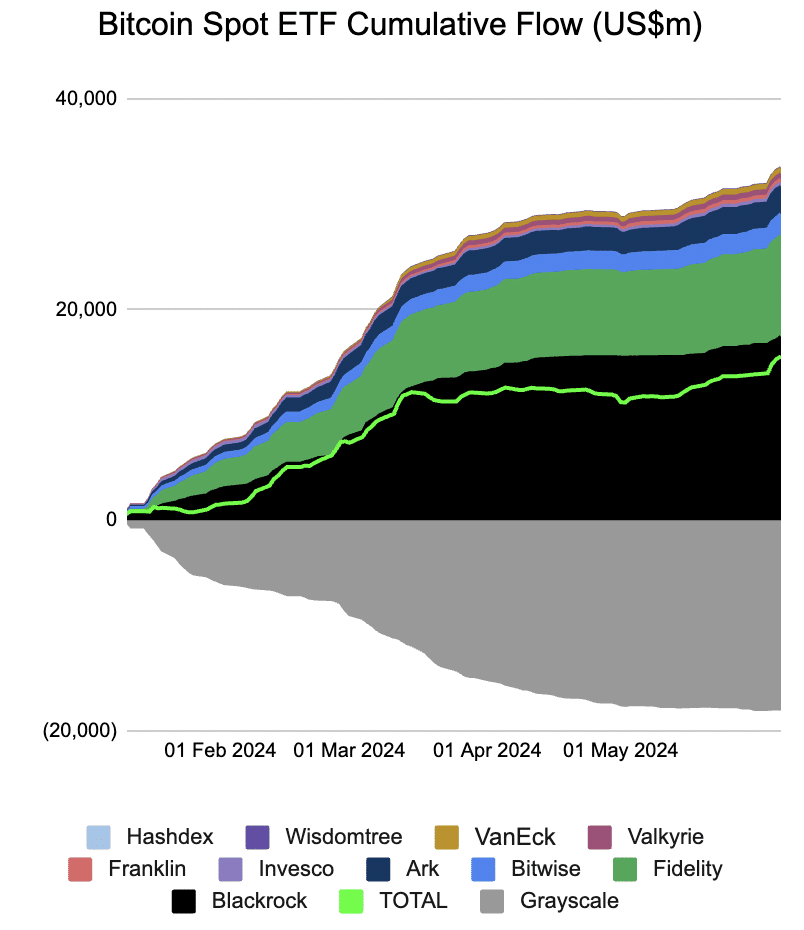

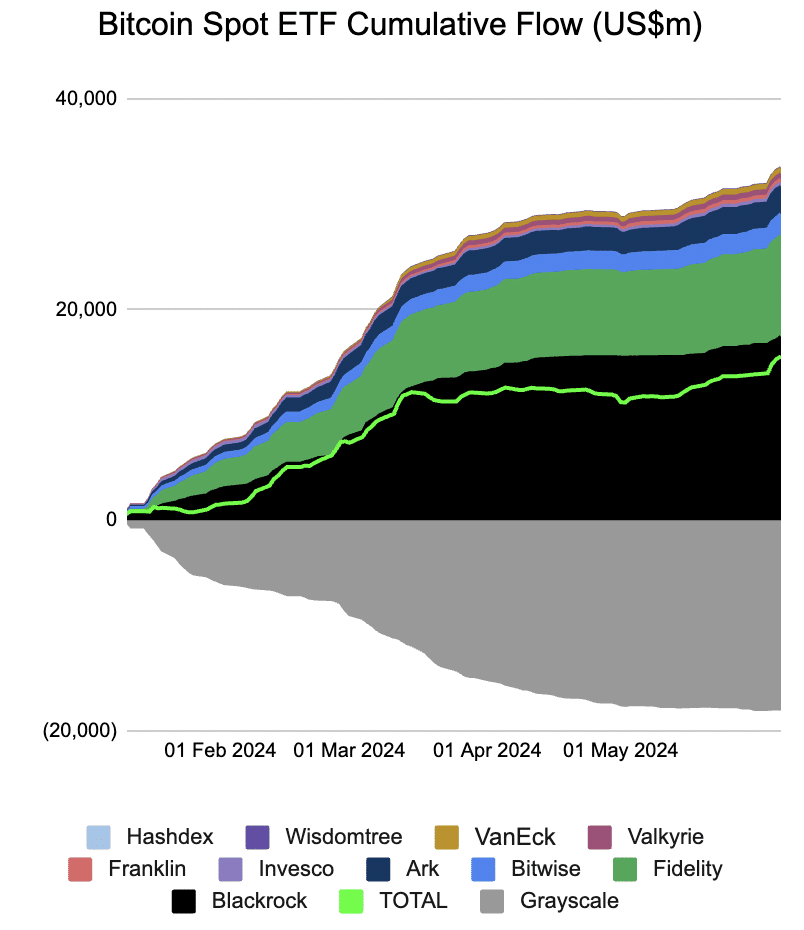

Interest in BTC ETFs was also growing

Despite a surge in interest for Bitcoin ETFs, with a record 19-day streak of inflows into US-based spot Bitcoin ETFs, there wasn’t a budge in BTC’s prices.

While holdings in spot Bitcoin ETFs globally have reached a significant level, with around 1.3 million Bitcoin or 5.2% of circulating supply as of 6th June, and a large portion concentrated in US-listed ETFs, the price hasn’t reacted as dramatically as some might expect.

Data from Farside showed inflows on June 6th alone reached $217.7 million. Total inflows since launch have surpassed $15.5 billion, but some traders believe this amount is still insufficient to significantly move the price needle until other markets open up.

Source: Farside

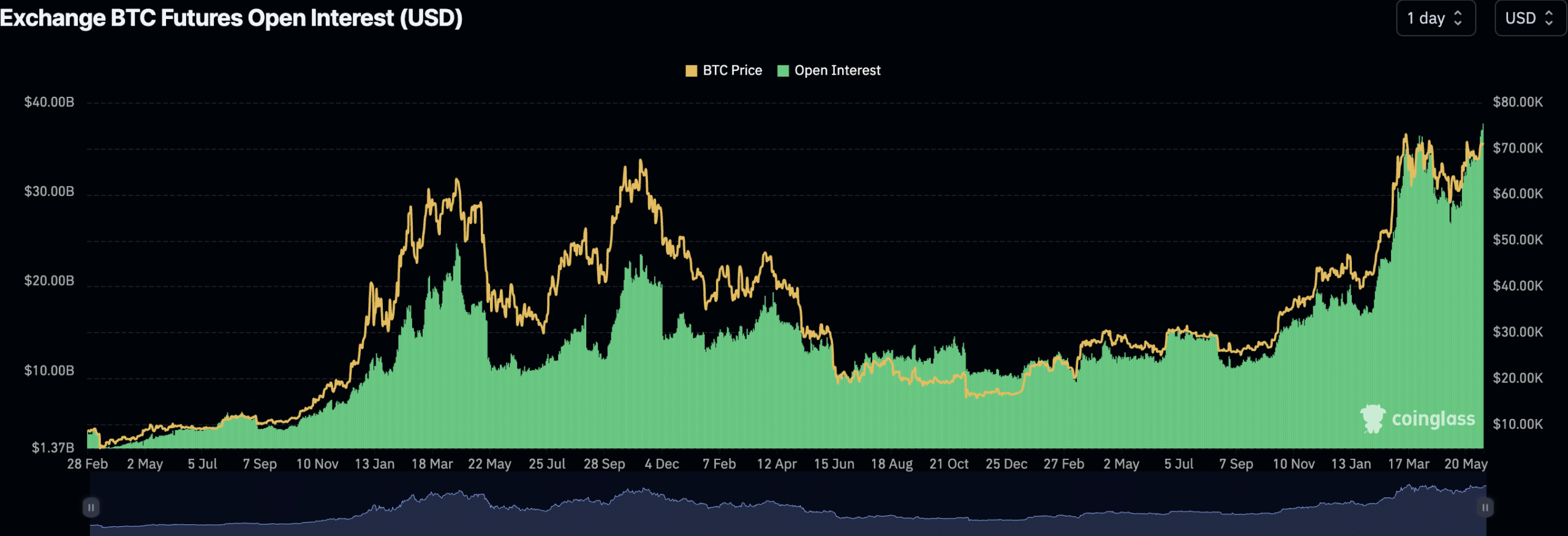

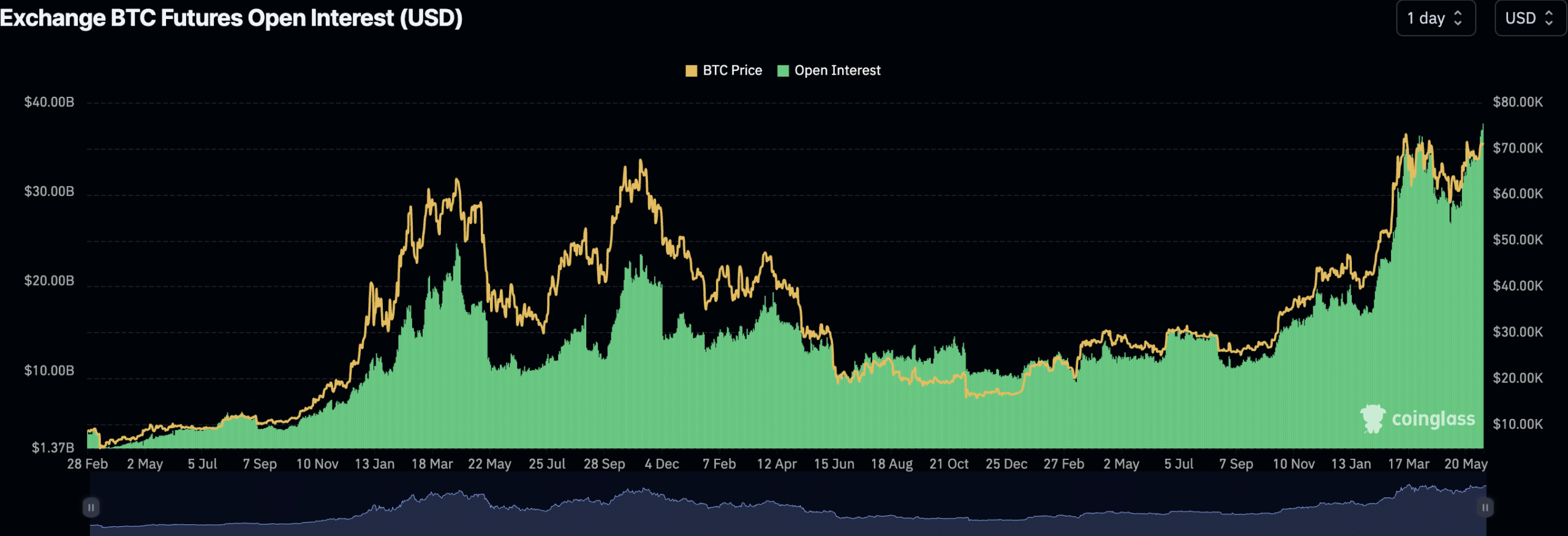

Open Interest surges

Apart from that, the Open Interest(OI) in BTC also grew.

Historically, high OI was marked by excessive leverage and speculation often precedes a price correction. However, this didn’t seem to be the case at the time of writing.

While funding rates which reflect the willingness of long and short positions to pay each other remained slightly positive, they were significantly lower compared to the highs seen in March.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated that bullish long positions were dominant and bulls were willing to pay bears to maintain their short positions. However, the market was not as heated compared to March.

At press time, BTC was trading at $71,138.10 and in the last 24 hours, it had grown by 1.09%.

Source: Coinglass

Leave a Reply