- PEPE social and transaction volume in profit metrics was a warning for the short-term bulls.

- The support levels to the south could offer a good risk-to-reward buying opportunity.

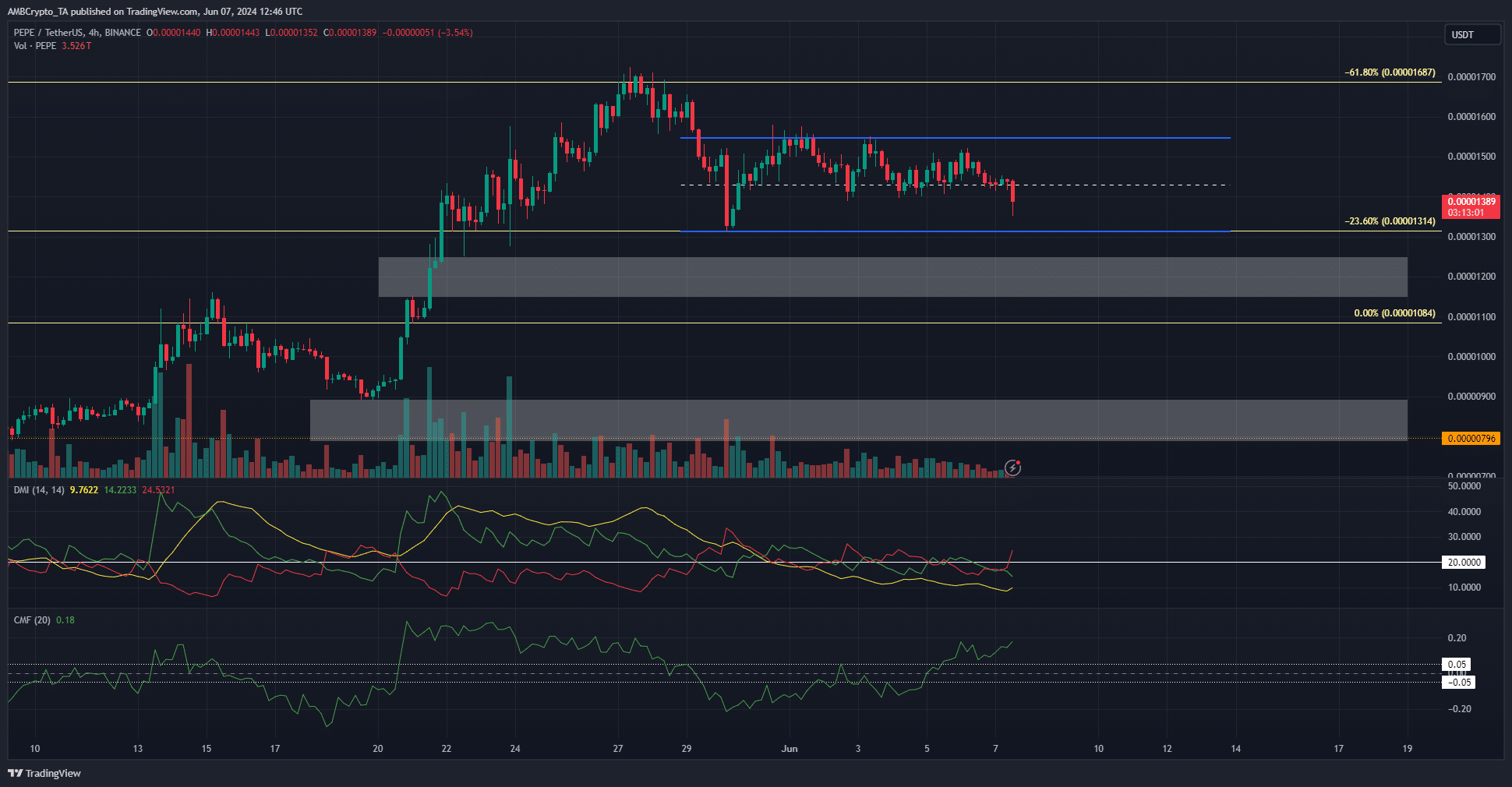

Pepe [PEPE] was trading within a short-term range from $0.0000131, the low of the 30th of May, to $0.0000154. At press time PEPE bulls were defending the mid-range support level at $0.0000143.

Their valiant efforts might be in vain. The technical indicators and order book showed that PEPE prices might be set for a 5% to 6% drop.

Here’s what traders can watch out for in the next few days. With the weekend almost upon us, two days of lowered volatility and volume is possible.

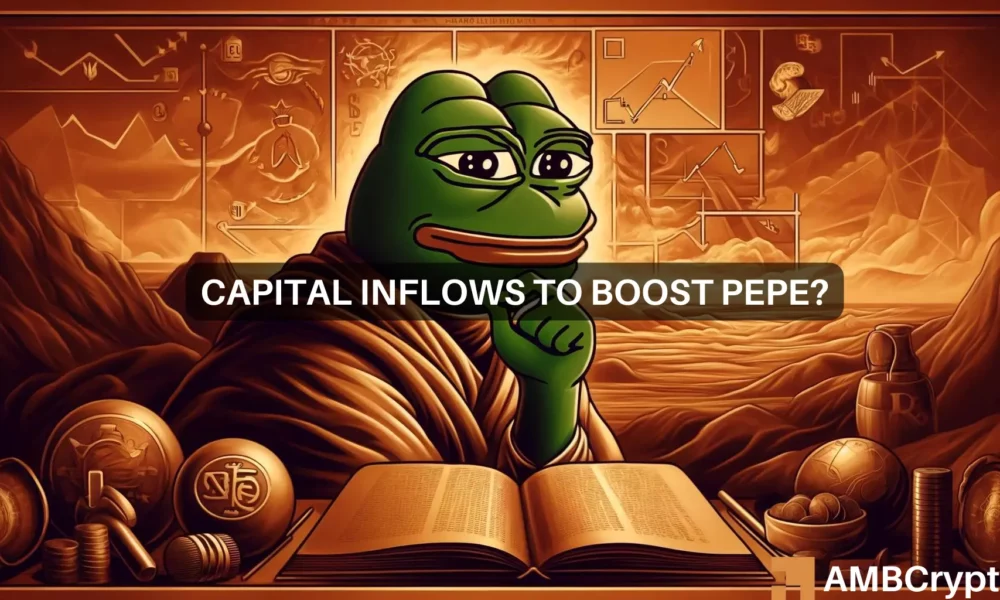

A large clump of limit buy orders might be hunted soon

Like liquidation levels, limit orders can also yield some hints about future price action. In this case, the PEPE data from MobChart showed limit buy orders worth $1.38 million at the $0.0000141 level and another $1.31 million at $0.000014.

The former order was opened recently, which suggested prices might climb higher without visiting these levels. There was another $995k worth of buy orders at $0.0000135, establishing these two levels as support.

Scalp traders might want to examine the lower timeframe market conditions for bullish triggers before buying a retest of either of these levels.

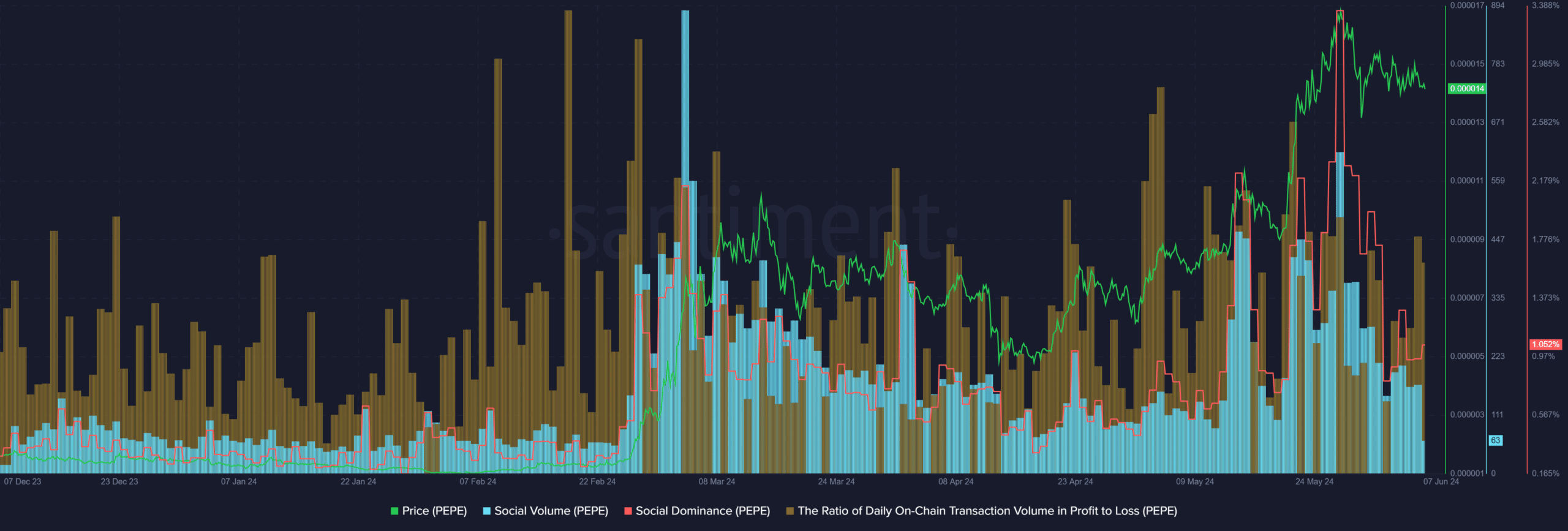

PEPE enthusiasm has receded slightly from late May

The ratio of daily on-chain transaction volume in profit to loss saw many spikes in May. These have fallen slightly in the first week of June as the memecoin got trapped within a range.

This indicated a decline in bullishness and could be a sign of bearishness and caution.

The social volume and dominance also trended higher in May as prices climbed higher, but over the past ten days the volume has fallen lower.

The drop in social media engagement underlined the downtick in PEPE hype.

Source: PEPE/USDT on TradingView

The price action of PEPE showed a sharp short-term drop below the mid-range support level laid out earlier.

The Directional Movement Index asserted the lack of a strong trend on the 4-hour chart with the ADX (yellow) below 20.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

However, the CMF was rising higher to indicate large capital inflows into the market. This buying pressure might be persistent enough to beat the bears backward and force PEPE to bounce toward the range highs.

Swing traders and investors can wait for a the $0.0000135-$0.000013 area to be tested before buying, targeting the range high.

Leave a Reply