- Hayes tips a BTC break out as central banks start cutting interest rates.

- However, the Fed’s meeting on 12th June could help define the next BTC price direction.

Bitcoin [BTC] could be primed for a bullish breakout from its months-long range as major central banks start cutting interest rates, per BitMEX founder and Maelstrom CIO Arthur Hayes.

Hayes had earlier projected that the breakout could happen in August. However, he has adjusted his outlook following rate cuts by the European Central Bank (ECB) and the Bank of Canada (BOC).

‘The June central banking fireworks kicked off this week by the BOC and ECB rate cuts will catapult crypto out of the northern hemispheric summer doldrums’

This will mark the start of central bank ‘easing cycles’, and the US will forced to jump in, per Hayes. As a result, the executive nudged,

“Go long Bitcoin and subsequently sh*tcoins. The macro landscape has changed vs. my baseline. Therefore, my strategy shall change as well.”

Macro outlook and key catalysts

BTC has been holding above $70K for the past two days and was poised to flirt with $72K or the March ATH if key macro events in the next few days play out in its favour.

Most market watchers opined that Bitcoin could set a definite price direction after the Fed’s meeting next Wednesday (12th June).

Recently, Quinn Thompson, founder of crypto hedge fund Lekker Capital, summarized the macro outlook and stated,

‘The market needs conviction that Powell is going to cut in July. That could come from a weak jobs report Friday, weak CPI and/or dovish Fed next Wednesday.”

However, even if the Fed doesn’t cut immediately, the US mitigation against the massive fall in the Japanese Yen’s value could induce more money supply and lead to the same outcome, per Hayes.

Reacting to a reported Japan’s offloading of US treasuries to boost its Yen, Hayes noted that,

‘Uh oh, Bad Gurl Yellen got some work to do. $JPY must strengthen to prevent the UST apocalypse.’

Already, the surge in the US money supply has begun in earnest, and most analysts expect it to boost BTC and overall risk assets.

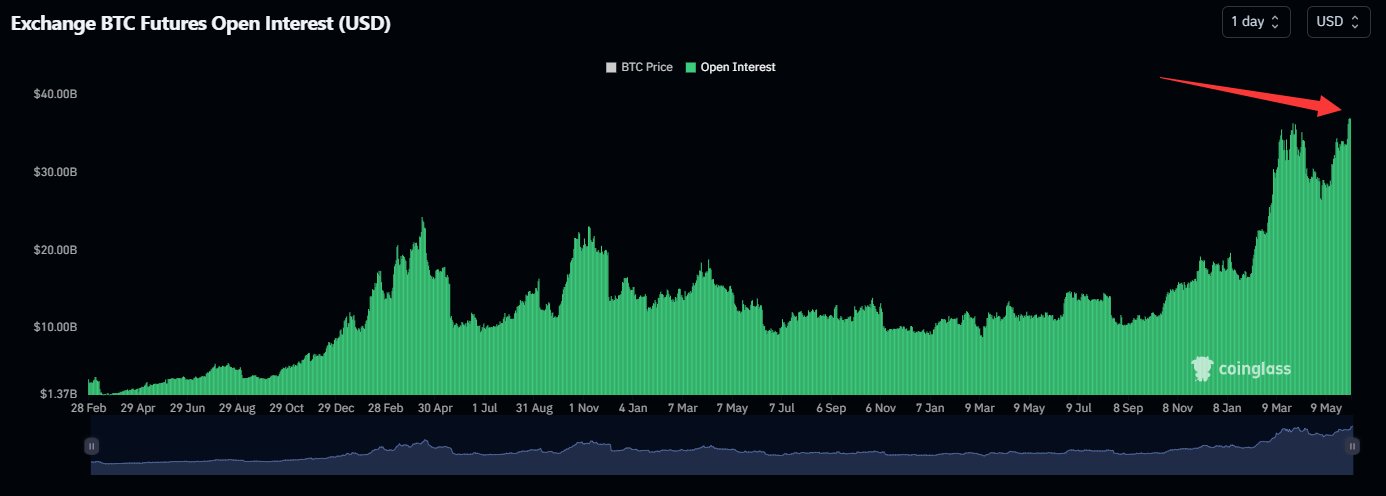

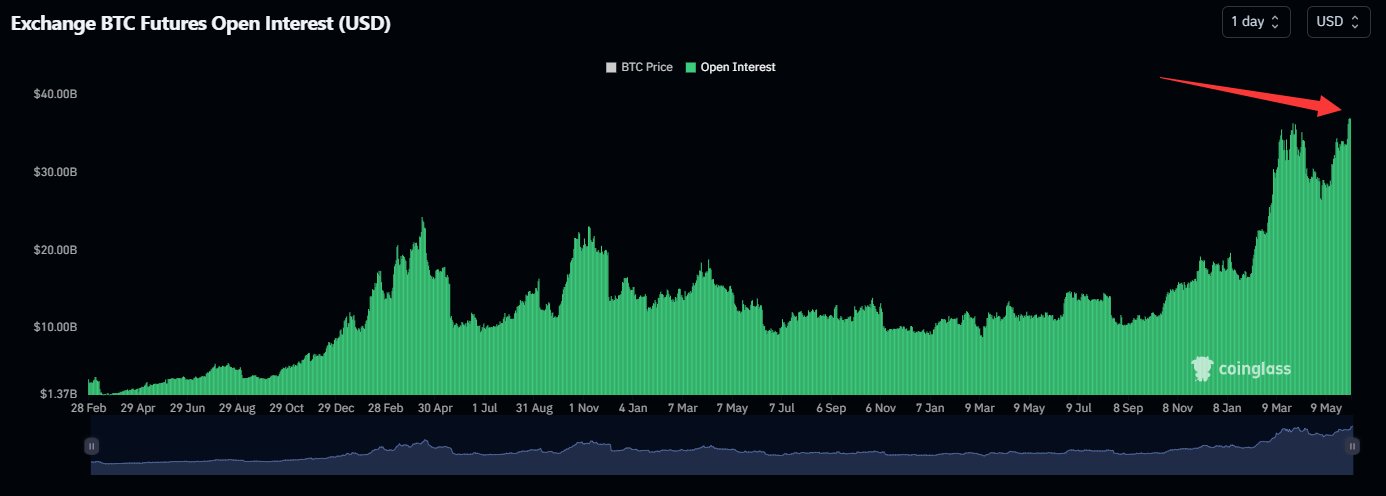

In the meantime, BTC Open Interest (OI) rates have spiked to a record high, demonstrating a massive influx of liquidity into the king coin. Crypto derivative tracking platform Coinglass noted,

‘#Bitcoin open interest hits all-time high of $37.66B’

Source: Coinglass

The OI spike underscores bullish expectations for the king coin. That said, more momentum and direction could be set next week after the Fed’s decision.

Leave a Reply