- DMM Bitcoin lost 4,502.9 BTC to hackers, planning a significant buyback to cover losses.

- AMBCrypto analyzed the possible impact of this purchase on the Bitcoin market

On May 31st, DMM Bitcoin, a prominent Japanese cryptocurrency exchange, encountered a significant security breach resulting in the loss of approximately 48 billion yen ($305 million) worth of Bitcoin [BTC] .

The breach led to 4,502.9 BTC being illicitly transferred out of the exchange’s reserves, as reported by security analysts from Blocksec. Analysts noted that stolen funds were split into batches of 500 BTC across ten different wallets.

DMM Bitcoin’s plan to undo a hacker’s payday

In response to this substantial financial hit, DMM Bitcoin has initiated a comprehensive recovery strategy aimed at compensating affected customers without disrupting the broader Bitcoin market.

The platform disclosed plans to secure 50 billion yen ($321 million) to purchase Bitcoin lost. This move is part of a broader initiative to stabilize the exchange’s operations and restore user trust.

Notably, the hack, ranked as the seventh-largest crypto theft by Chainalysis, prompted immediate regulatory action.

Japan’s Financial Services Agency has required DMM Bitcoin to thoroughly investigate the incident. A report on both the breach’s origins and the company’s customer compensation strategy was also requested.

Meanwhile, Finance Minister Shunichi Suzuki has committed to bolstering preventative measures against future security breaches in the cryptocurrency sector.

So far, the company has secured a 5 billion yen loan. It is in the process of a significant capital raise amounting to 48 billion yen.

Possible impact

While it might seem noteworthy that a crypto exchange is set to purchase millions in Bitcoin, the reality is that DMM’s planned $320 million investment is unlikely to shake the market significantly.

This purchase will only account for about 4,500 BTC, a mere 0.023% of the current circulating supply of approximately 19.7 million coins, according to Coingecko data.

In comparison, U.S. spot Bitcoin ETFs are making purchases over $500 million, which genuinely influence Bitcoin’s price dynamics.

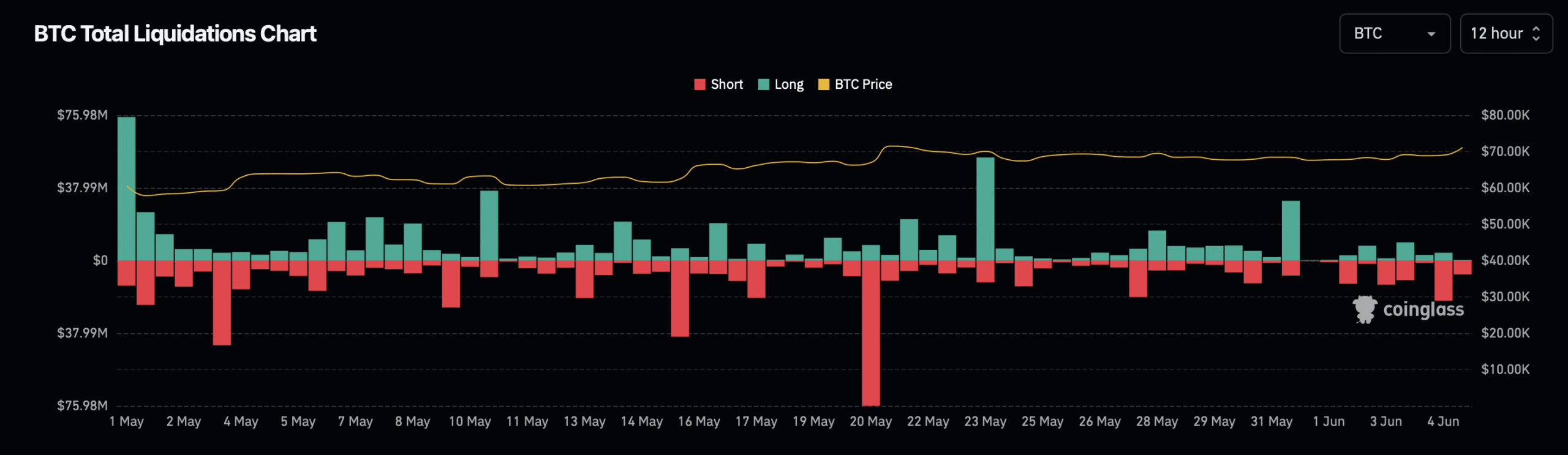

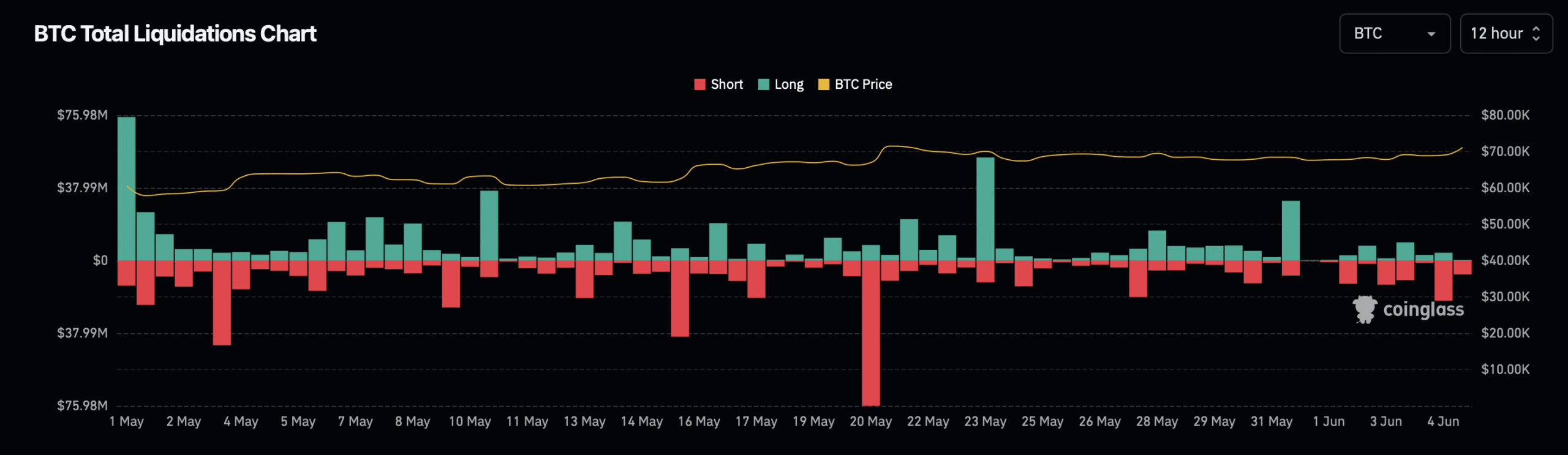

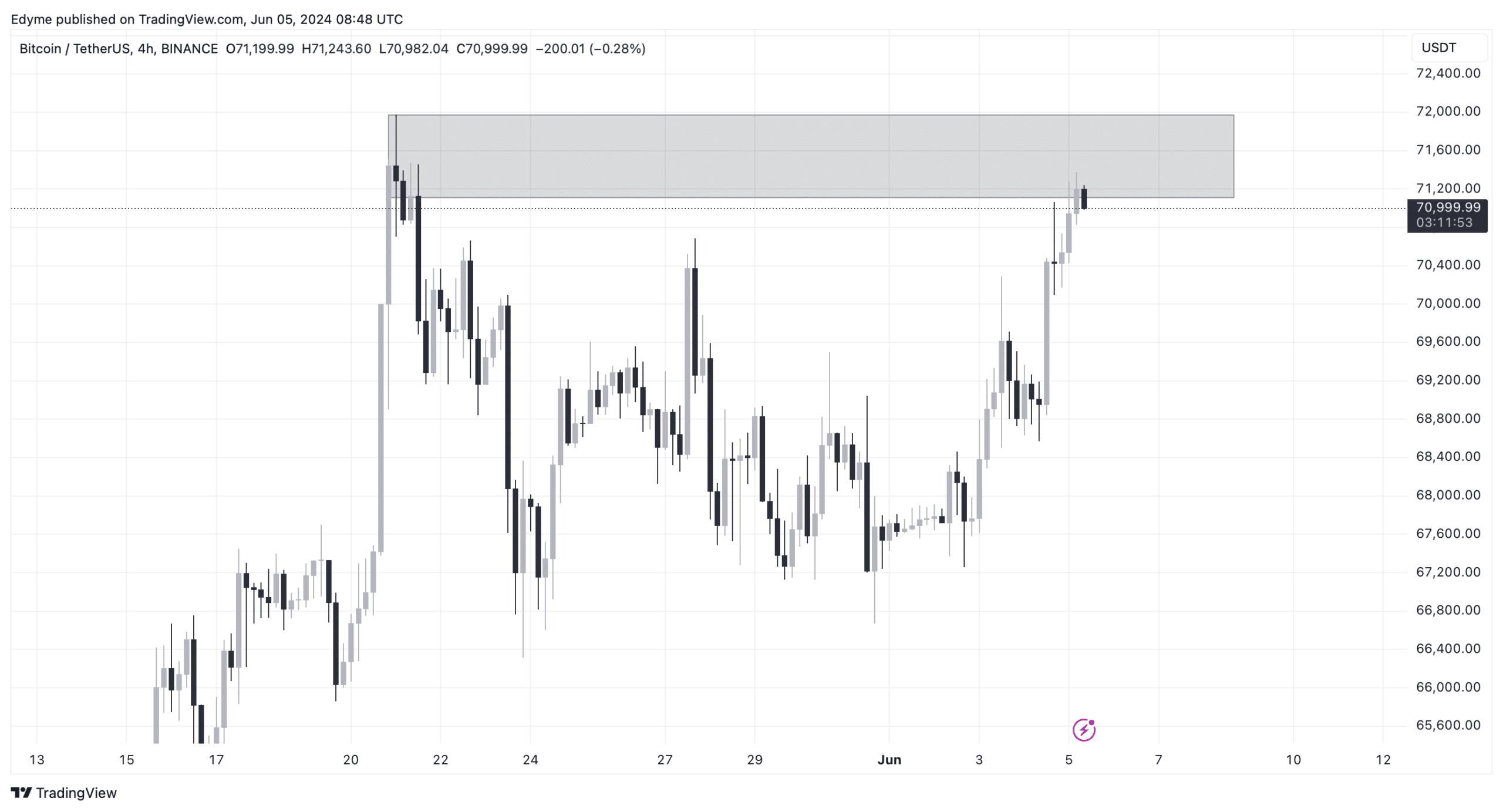

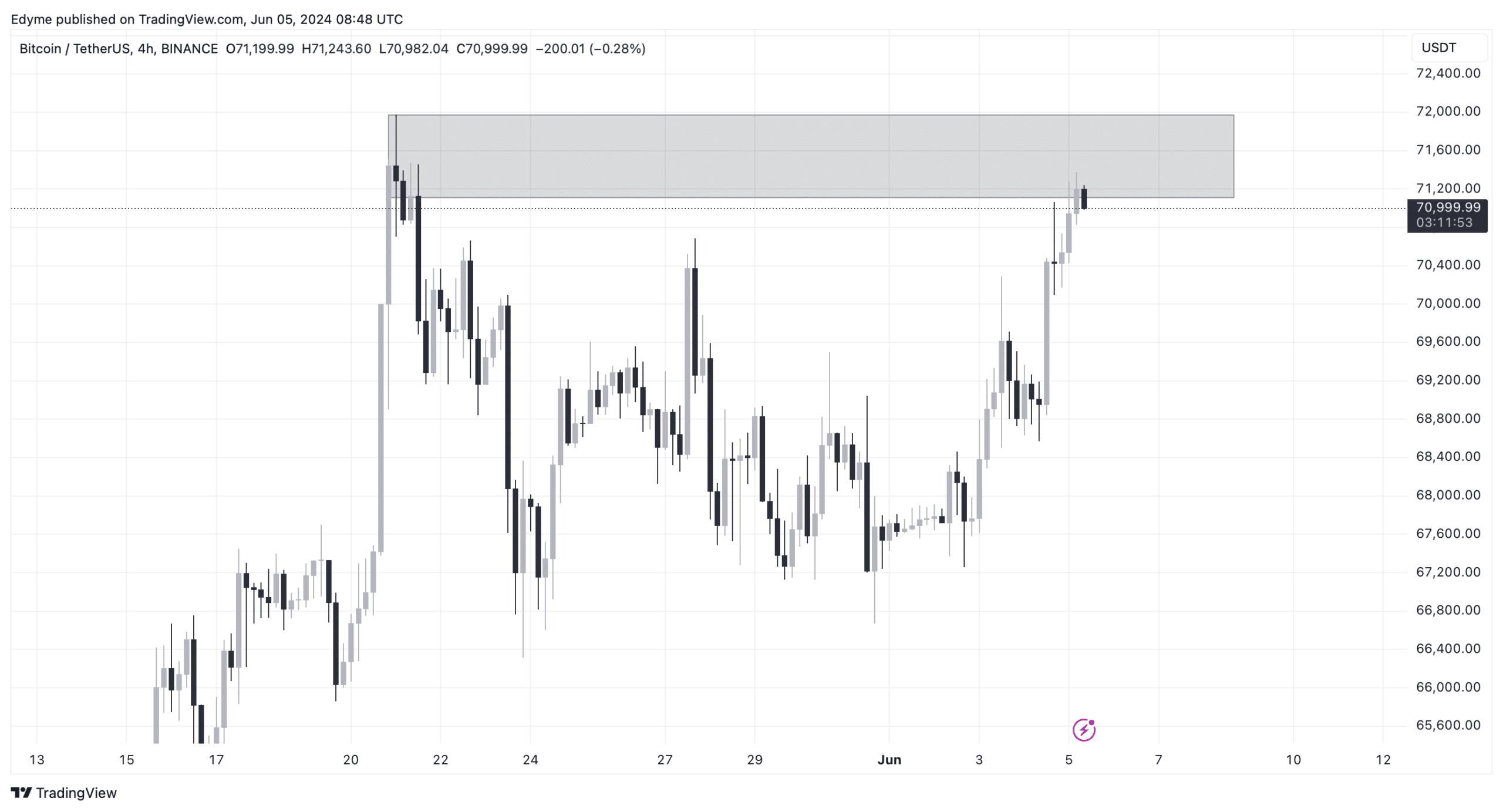

As of now, Bitcoin’s price is slightly above $71,000. BTC rose by 2.9% in the past day and 4.6% over the past week. Despite these gains, the increase has led to over $30 million in liquidations in the market, per Coinglass.

Source: Coinglass

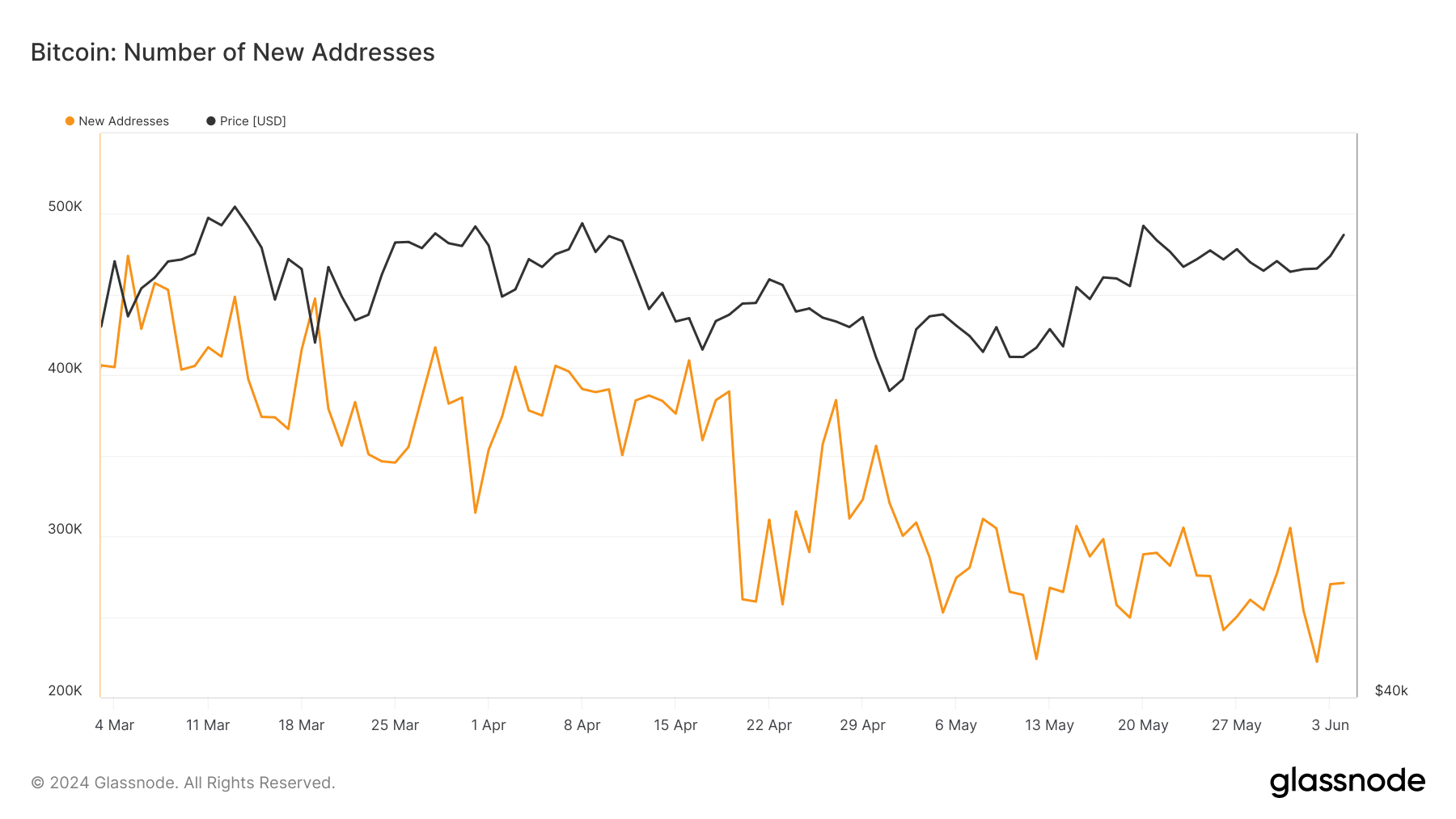

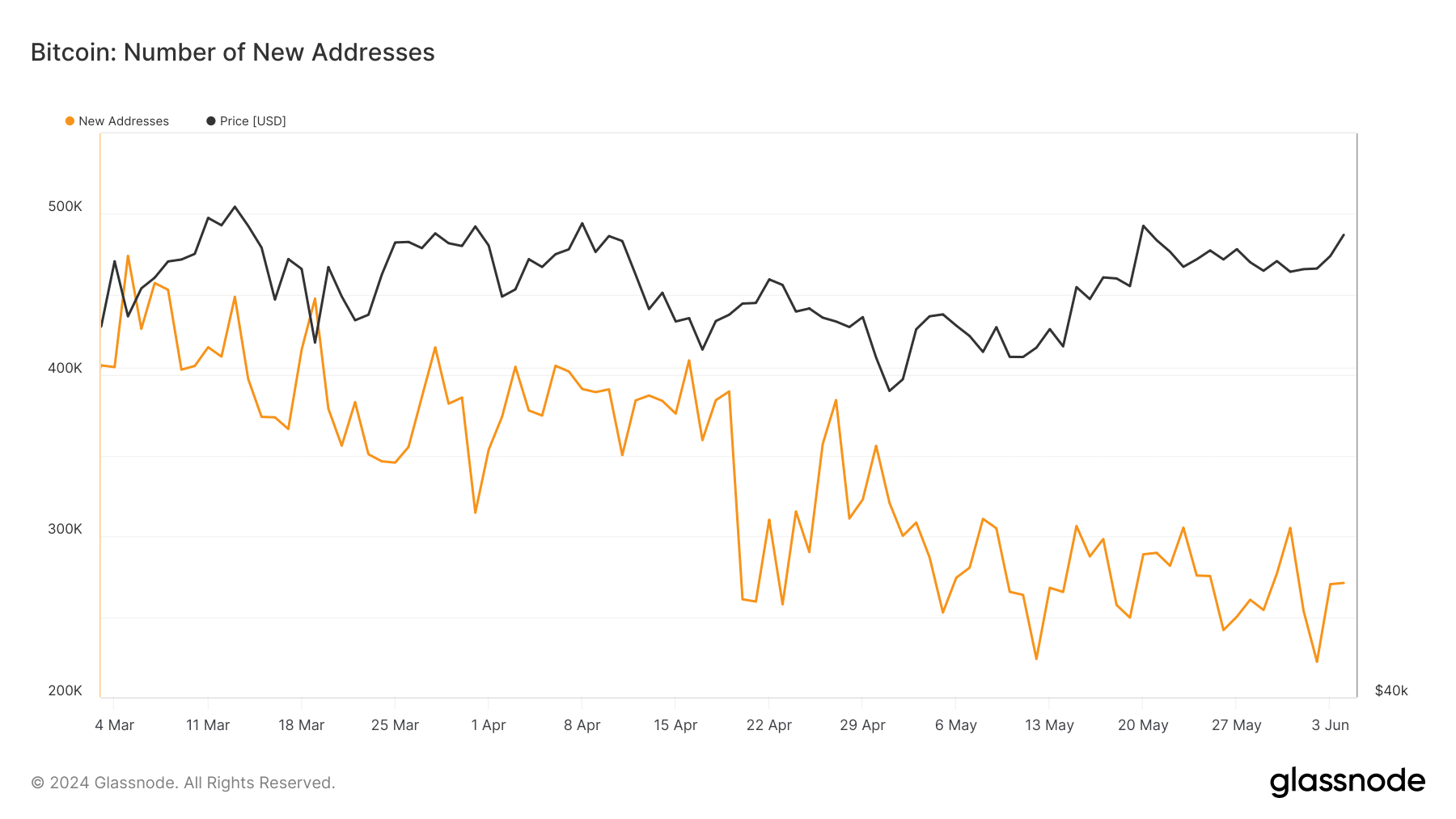

This price rise correlates with a noticeable uptick in the number of new Bitcoin addresses shown in data from Glassnode, suggesting a renewed interest and potentially higher future valuation.

Source: Glassnode

Moreover, current technical analysis indicates that Bitcoin is attempting to break through a significant resistance level on the daily chart. A successful breach could potentially initiate a major rally, catapulting the asset’s price to new heights.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In another analysis, AMBCrypto reports that the Network Value to Transactions ratio, which is the market capitalization divided by the transacted volume, has been trending higher.

This metric suggests that BTC might currently be overvalued based on its transaction capabilities.

Leave a Reply