The CEO of blockchain analytics firm CryptoQuant says that Bitcoin’s (BTC) on-chain market structure looks similar to 2020 before its bull market finale.

Ki Young Ju tells his 346,000 followers on the social media platform X that Bitcoin’s current price action is reminiscent of four years ago when BTC consolidated for over half a year while on-chain activity rose rapidly.

Ju says that $1 billion in BTC has been added to whale wallets, which is most likely headed off-market to cold storage.

“Same vibe on Bitcoin as mid-2020.

Back then, BTC hovered around $10,000 for six months with high on-chain activity, later revealed as OTC (over-the-counter) deals.

Now, despite low price volatility, on-chain activity remains high, with $1 billion added daily to new whale wallets, likely custody.”

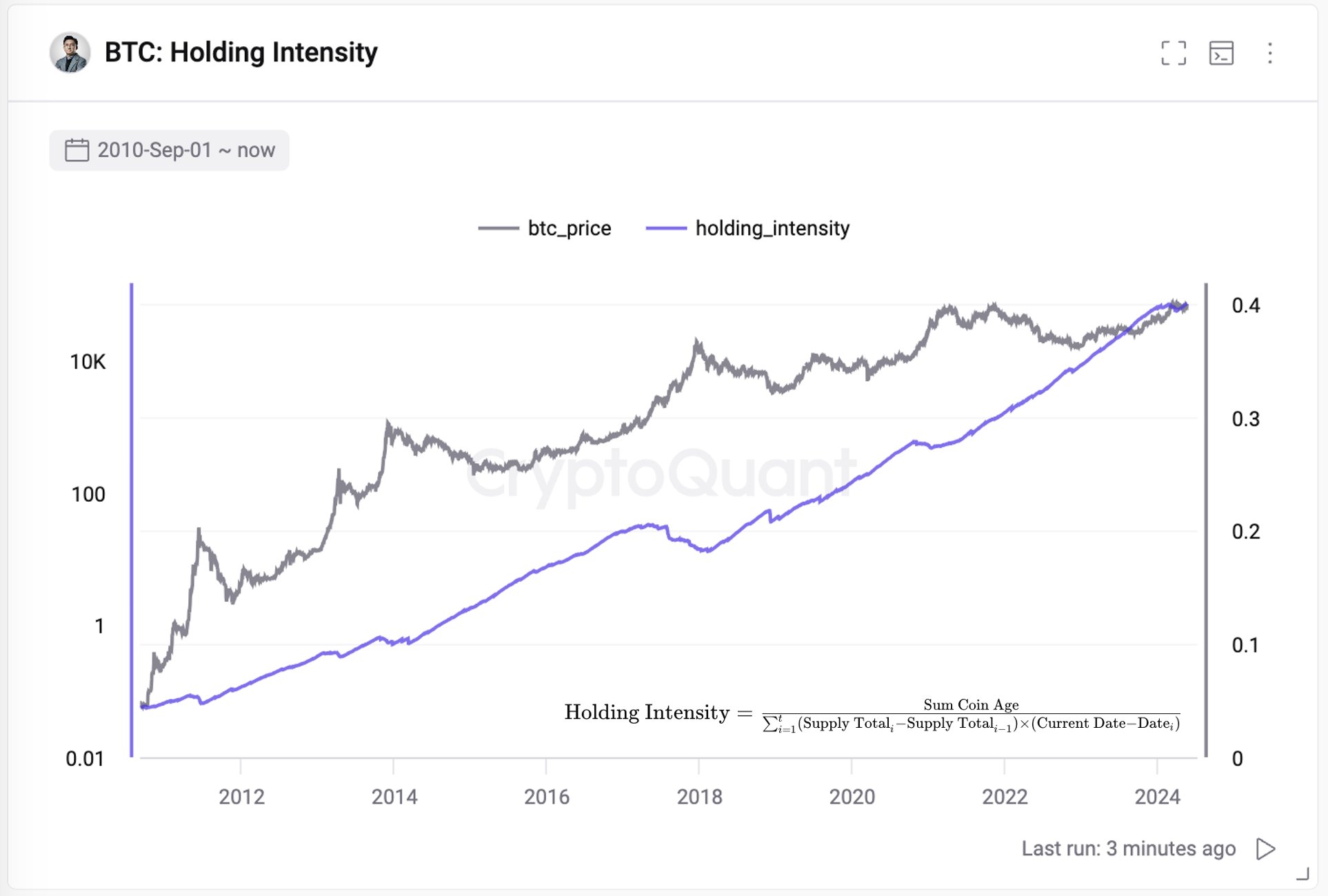

Ju also shares a chart showing the “holding intensity” of Bitcoin holders. He says the metric aims to indicate how closely the holding behavior of Bitcoin matches the scenario where every coin remains unmoved.

The chart shows a steady uptrend of holding intensity over the last 14 years, which the analyst says is a reflection of how investors increasingly look at BTC as a long-term store of value.

“Bitcoin holders are increasingly inclined to hold rather than sell. This suggests Bitcoin is now viewed more as a store of wealth than a trading asset.”

At time of writing, Bitcoin is trading at $69,113.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Leave a Reply