- Bitcoin Runes have seen increased activity in the past 24 hours.

- This has pushed the prices of a few of them to new all-time highs.

The past 24 hours have been marked by a surge in the values of a number of Bitcoin [BTC] Rune tokens. This comes amid the general decline observed in the memecoin market.

According to CoinMarketCap, the market capitalization of memecoins tracked has dropped by 2% in the past 24 hours.

However, during the same period, the prices of Bitcoin Runes tokens such as DOG•GO•TO•THE•MOON [DOG], MAGA•THE•DONALD•TRUMP, and CATS•IN•THE•SATS [CATS] have surged by 22%, 161%, and 127%, respectively, according to data from Runes Alpha.

At press time, DOG traded at $0.0078, logging a 15% price rally in the past 24 hours. During early trading hours on 31st May, the memecoin exchanged hands at an all-time high of $0.0084, according to CoinMarketCap’s data.

It now has a market capitalization of $787 million and ranks 105th largest cryptocurrency.

As for CATs, its price has been up 50% in the past 24 hours. As of this writing, the token sold for $1.20. Per CoinGecko, CATS had also climbed to an all-time high of $1.23 during the trading session on 30th May.

How has the protocol fared since launch?

On 30th May, the daily transactions involving Runes on the Bitcoin network totaled 534,471. It was up 38% from the 386,327 transactions recorded the previous day.

As of 31 May, 238,050 Runes transactions had been executed. This brings its total transaction count to 14,936,003 since it launched on 20th April following Bitcoin’s fourth halving event.

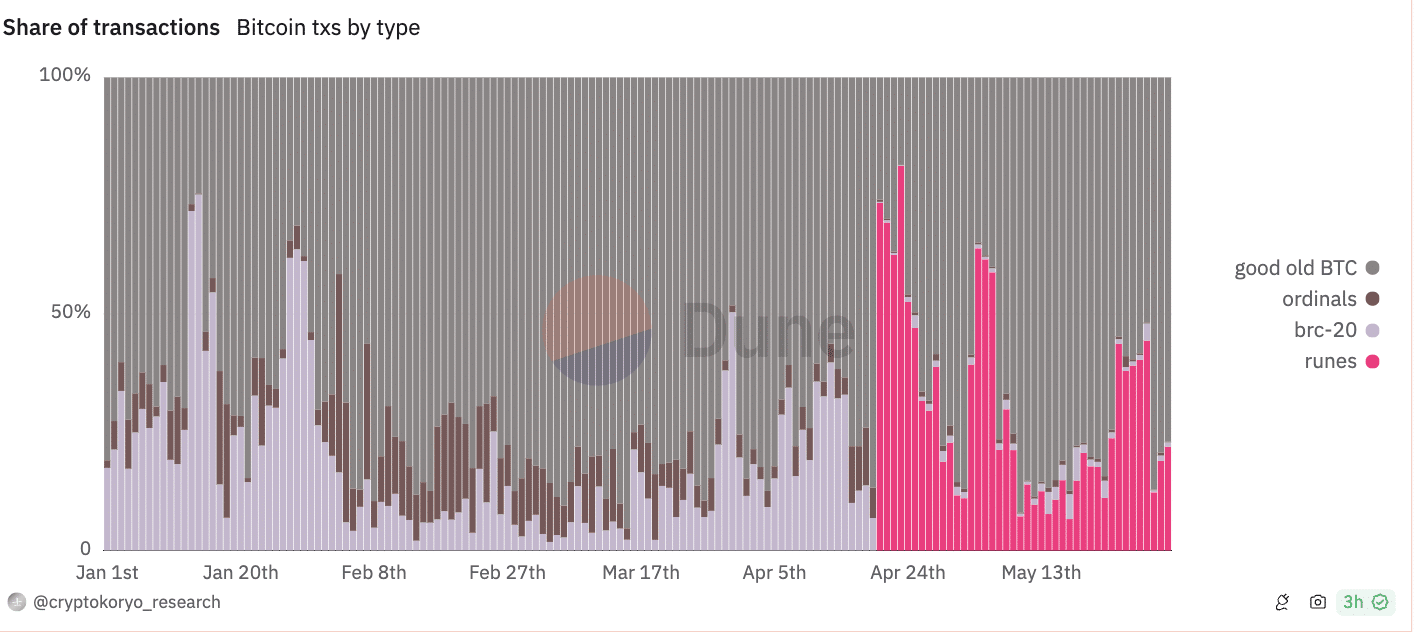

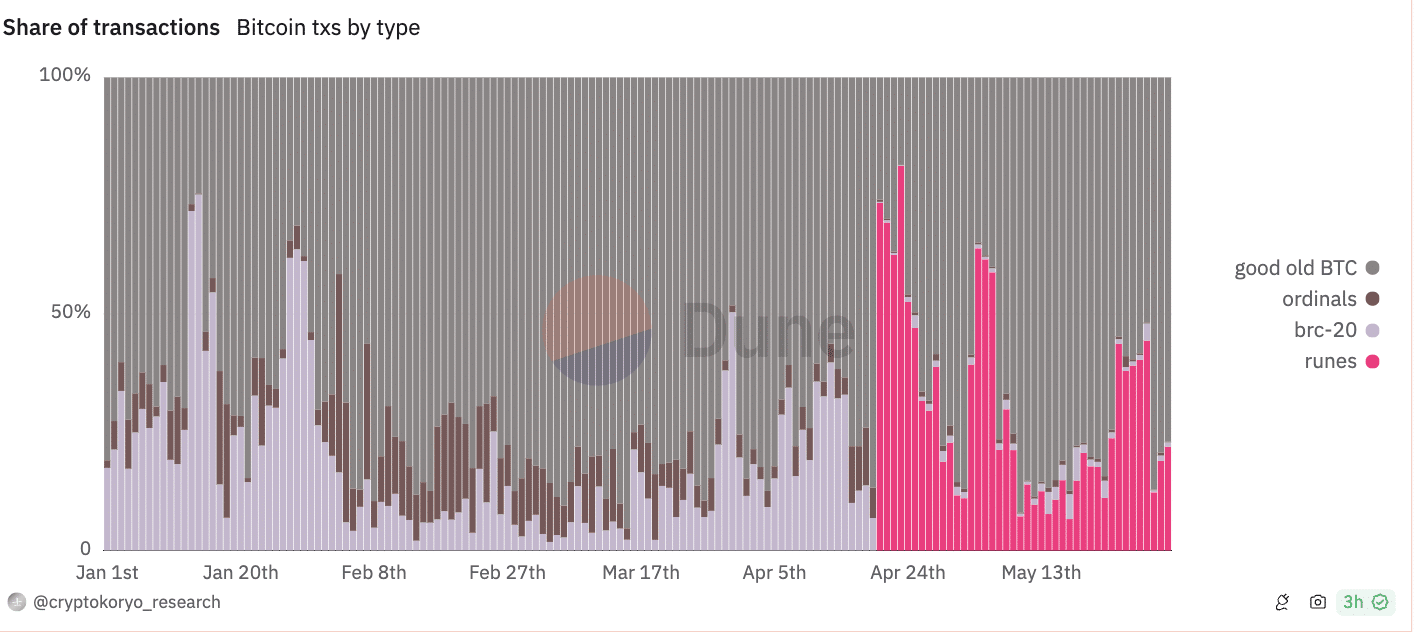

According to a Dune Analytics dashboard prepared by CryptoKoryo, on 30th May, transactions involving Runes made up 19% of all transactions completed on the Bitcoin network that day.

Source: Dune Analytics

When the Runes protocol went live on 20th April, it accounted for 58% of all transactions completed on the Bitcoin network that day. Due to increased interest in the protocol, daily transactions spiked.

According to the Dune Analytics dashboard, by 23rd April, its share of the total transactions count on the Bitcoin network on that day jumped to 78%. This was a 45% surge from the transactions completed towards the sale of BTC on the network by 45%.

Is your portfolio green? Check out the BTC Profit Calculator

However, this has declined gradually as the hype surrounding this new standard for creating fungible tokens directly on the Bitcoin blockchain waned over the past few weeks.

On 30th May, over 75% of all transactions on the Bitcoin network were towards the sales of BTC coins.

Leave a Reply