- CorgiAI had a bearish higher timeframe trend despite swift gains.

- The $0.0015-$0.0016 support zone could be vital in the next few days.

CorgiAI [CORGIAI] prices rallied 331% from its low on the 20th of May. The token retraced a good chunk of those gains, but still retained a bullish structure due to the enormous gains.

It remains to be seen whether the bulls can sustain this rally. Evidence suggested that buying pressure was not steady but had skyrocketed earlier this week.

If things revert toward the mean, this might be a temporary rally amidst a long-term downtrend.

Examining the past month’s trend

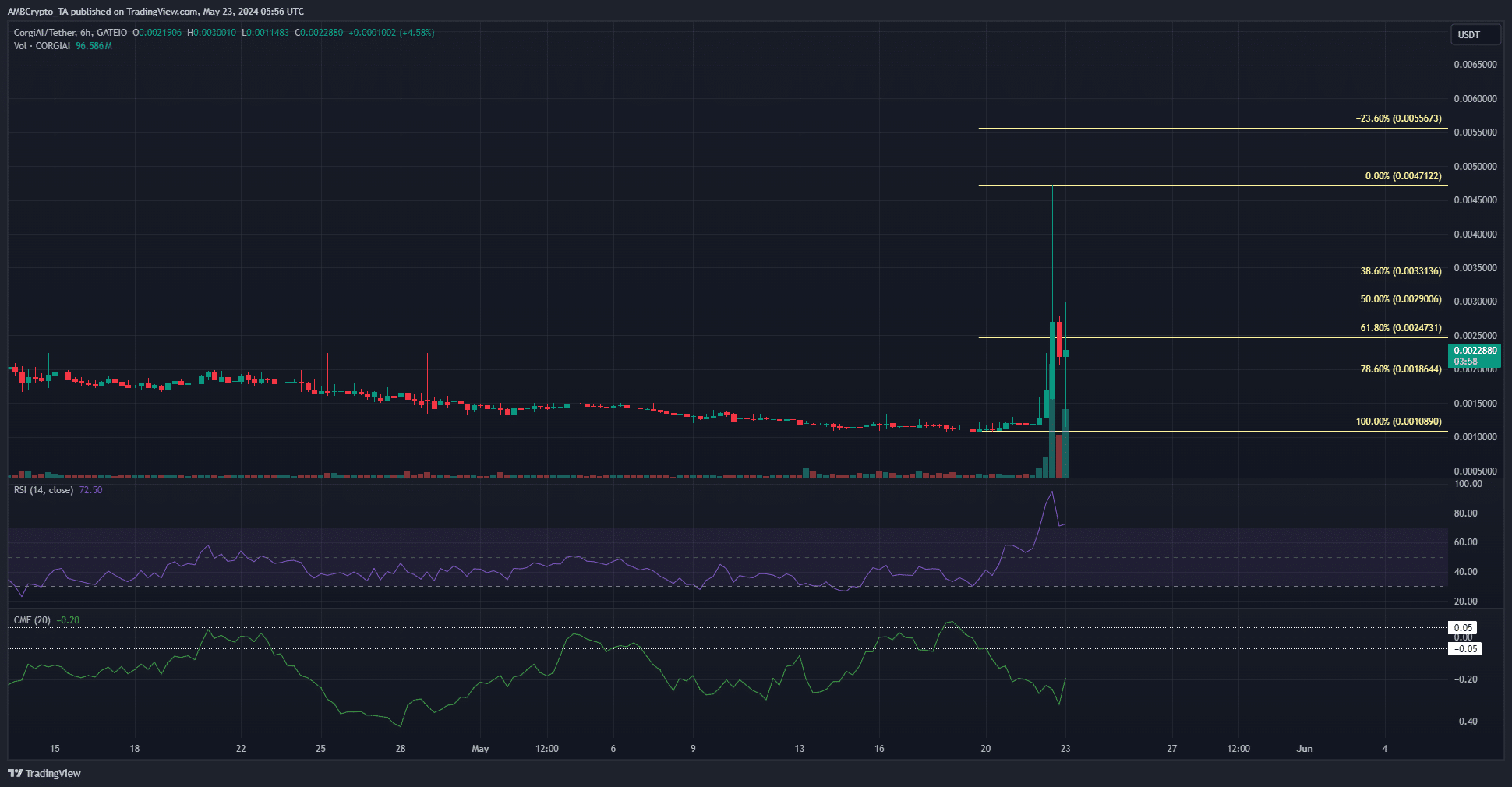

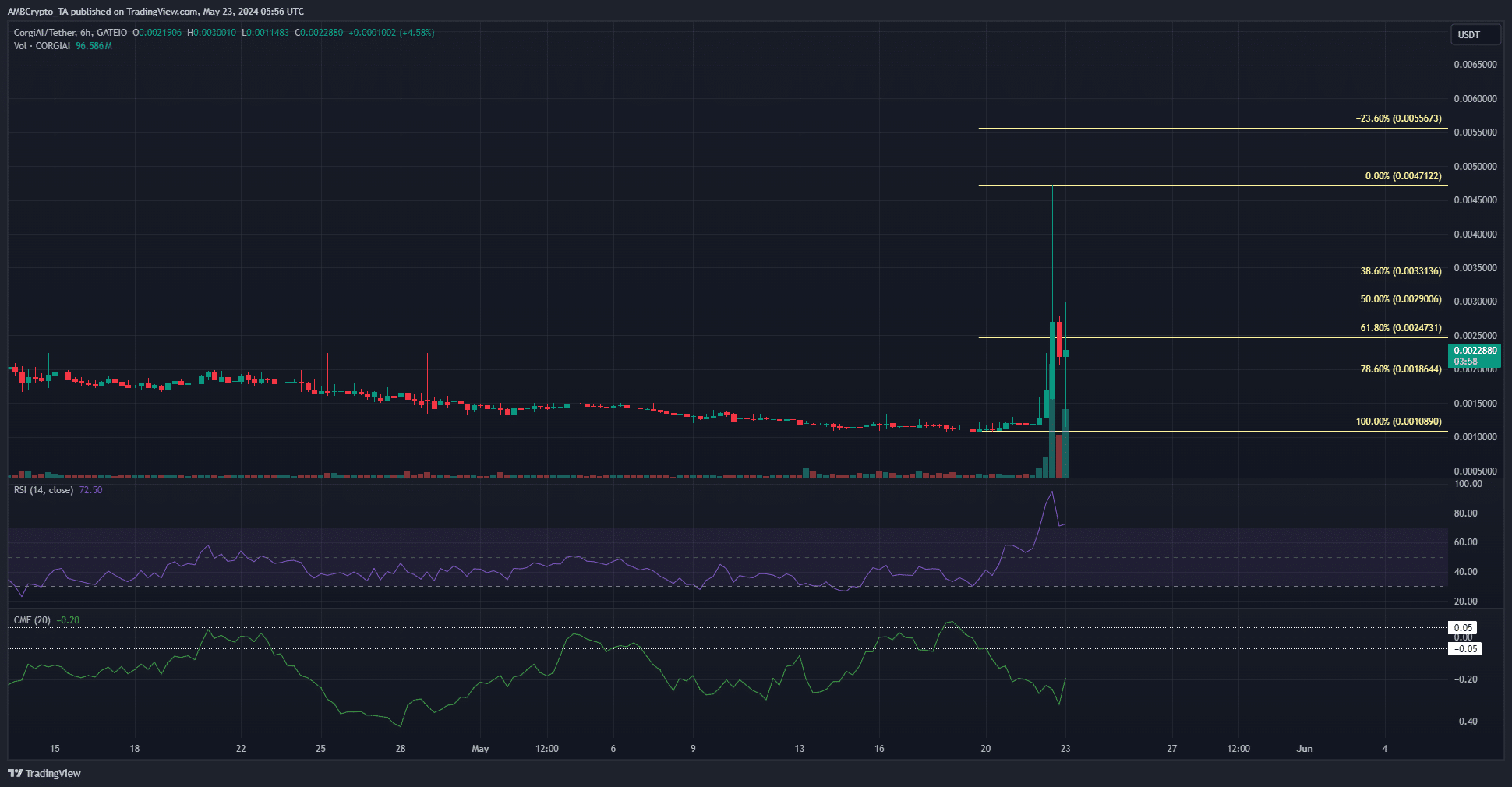

Source: CORGIAI/USDT on TradingView

The 6-hour chart showed that CORGIAI has soared above all the lower highs it set during the past month.

The RSI, which had been resolutely below the neutral 50 mark since the 12-of March, flipped the level to support and reached a value of 94.7 on the 22nd of May.

This was a positive sign for the bulls and could be an early sign of a shift in trend in favor of the buyers.

However, the CMF remained well below the -0.05 mark, showing sizeable capital flow out of the market and high sell pressure overall.

The spike in buying activity this week was not enough to counteract the selling pressure of the past twenty days.

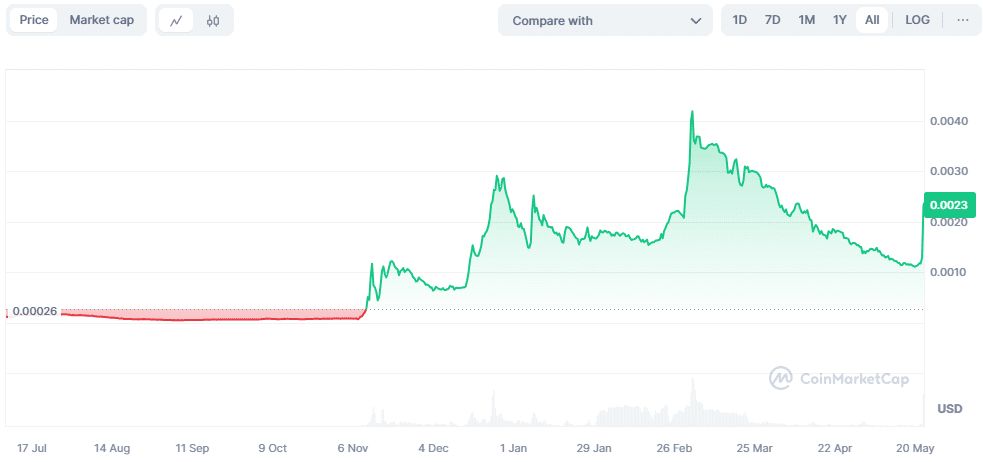

The higher timeframes show this could just be a bounce

The higher timeframe trend had been bullish as the price was setting higher highs and higher lows since early November 2023.

However, after the late February rally, the downtrend was severe enough to breach the higher low at $0.00158.

Read CorgiAI’s [CORGIAI] Price Prediction 2024-25

The recent 330% spike originated from $0.00108, which meant that it could be a bounce before the downtrend continues. Hence, it was likely that holders would sell into the current move.

Investors and traders would be persuaded that the trend has shifted bullishly if the price can defend the $0.0016 support zone during a retracement and push higher from there in the coming days or weeks.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply