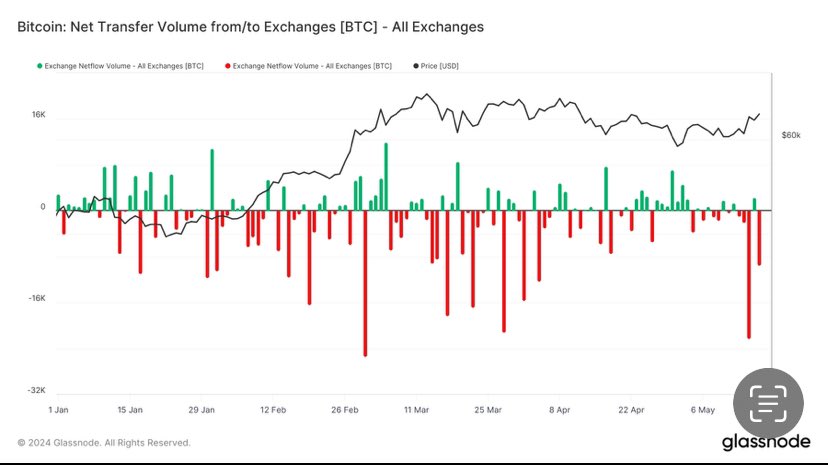

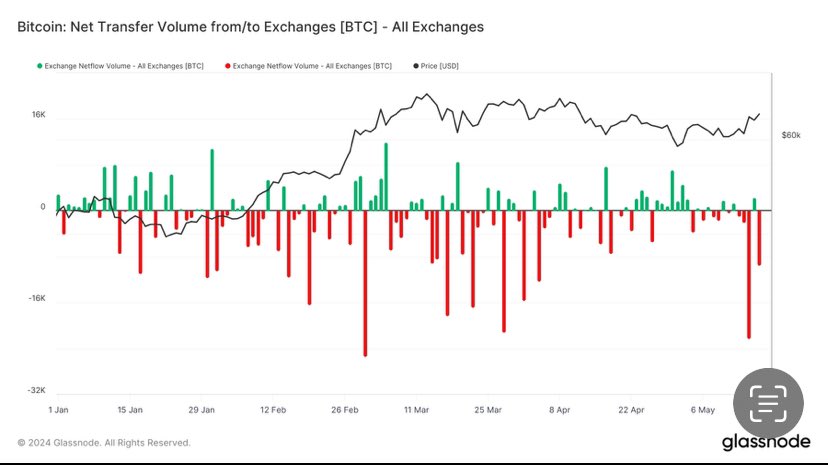

- Despite the massive price surge, BTC withdrawals from exchanges were relatively low.

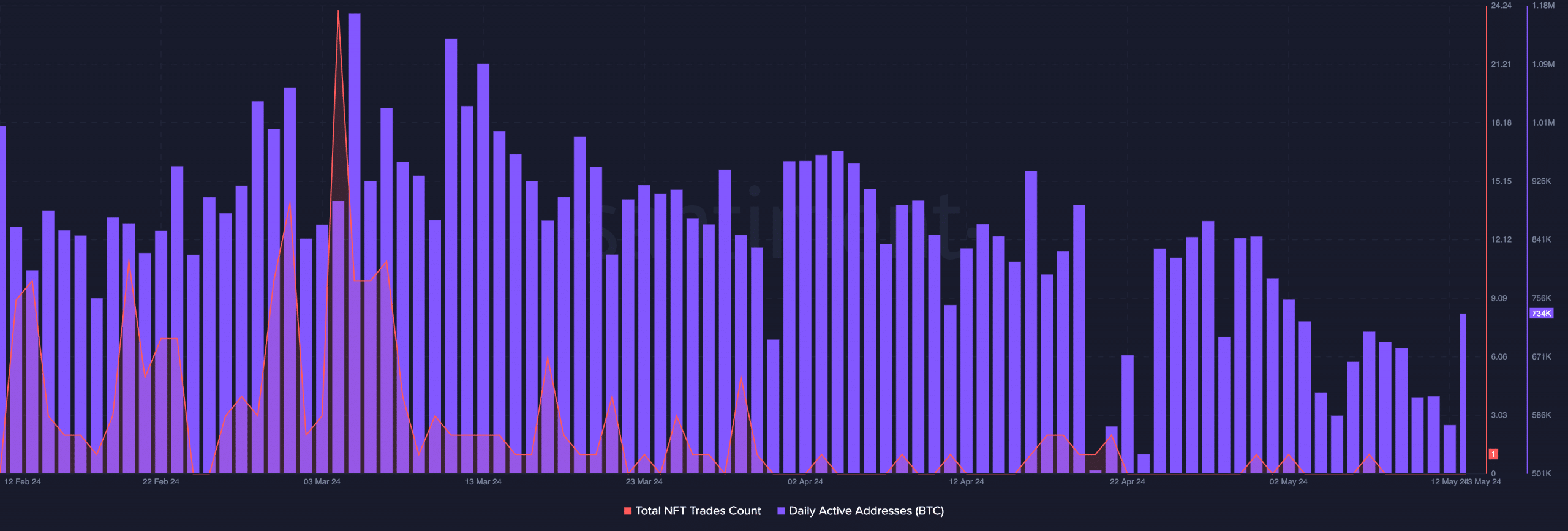

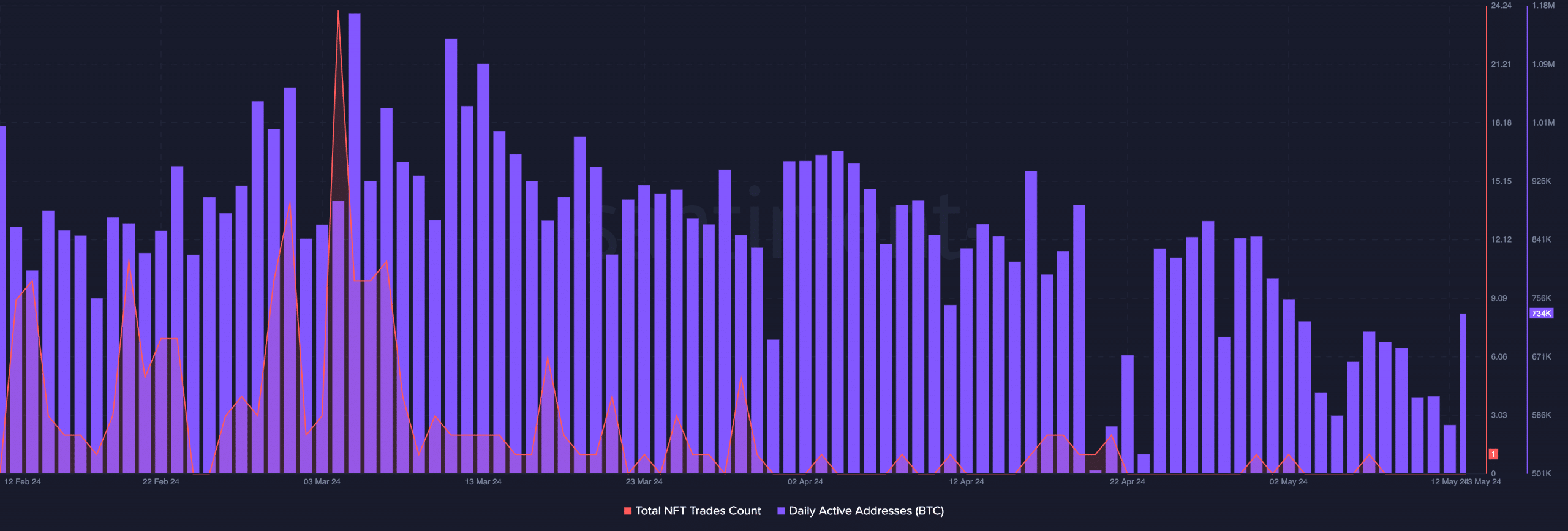

- Activity on the Bitcoin ecosystem continued to decline.

Bitcoin [BTC] has seen an unexpected surge in price over the last few days, which has inspired hope amongst traders and holders. Due to the surge in optimism, addresses have been holding on to your BTC.

Withdrawals decline

A minor withdrawal of Bitcoin occurred yesterday, with 10,000 BTC leaving exchange wallets. The total value of the withdrawn Bitcoin is estimated to be around $630 million.

This strong demand for Bitcoin suggests a potential resurgence of interest in the cryptocurrency market.

Analysts note that the level of consistent demand for Bitcoin hasn’t been this high since late 2020, marking a significant shift in investor sentiment.

Source: X

At press time, BTC was trading at $67,049.74 and its price had declined by 0.74% in the last 24 hours. Most holders of BTC were profitable, as BTC was just $6,000 dollars away from its all-time high.

The velocity at which BTC was trading at had declined. This meant that the frequency at which BTC was trading at had declined.

Even though this can be perceived as a negative sign for BTC, a declining velocity also meant that a lot of addresses were holding onto their Bitcoin and were refusing to sell.

Additionally, the total number of holders of BTC has also surged, indicating that a large number of addresses have accumulated significant amounts of BTC.

Coupled with the rising number of holders, there was an opposite pattern seen in miner holdings. AMBCrypto’s analysis of Santiment’s data revealed that the supply held by miners had significantly fallen.

This could prove to be positive for BTC in the long run. If miners fail to generate high amounts of fees, it becomes difficult for them to remain profitable.

To keep their business sustainable, they sometimes resort to selling their holdings, which ends up adding selling pressure to BTC.

A lower supply of BTC held by miners means that these sections of holders would have less of an impact on the price of BTC going forward.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

Activity on the decline

One of the reasons why miners fail to generate fees is due to inactivity on the network. Over the last few weeks, the number of daily active addresses on the Bitcoin network had fallen.

Coupled with that, the number of NFTs being traded on the network also declined. This suggested a waning interest in Bitcoin’s ecosystem.

Source: Santiment

Leave a Reply