On-chain analyst Willy Woo is expressing bullish sentiment about Bitcoin (BTC) for the upcoming months.

Woo tells his 1.1 million followers on the social media platform X that he expects Bitcoin to break out before October this year.

According to Woo the ensuing Bitcoin rally in 2025 will be “one for the record books”. The on-chain analyst says that the rally will be driven by an increase in global liquidity, which typically favors risk assets.

“Global liquidity forming a bullish ascending triangle.”

An ascending triangle typically forms when an area of horizontal resistance is continually tested while higher lows are consecutively being formed. A bullish ascending triangle is confirmed when a breakout above the horizontal resistance occurs.

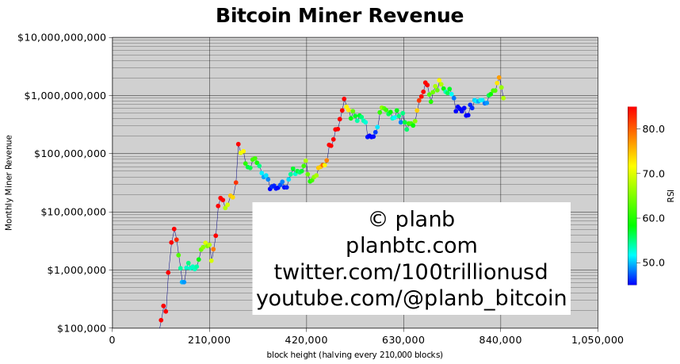

In response to a post by the pseudonymous quant analyst PlanB that the price of Bitcoin appreciates drastically between two to five months following the halving, Woo says that the four-year event triggers a reorganization among BTC miners leaving only the fittest to survive. The fourth Bitcoin halving took place on April 19th.

“Inefficient miners get culled at the halving.

They dump their BTC before dying.

Only the strong ones survive.

They operate on fatter margins so don’t need to sell.

Miner sell pressure gone.

Takes two to five months for the new supply/demand to reflect in price.”

According to PlanB,

“Historically, Bitcoin miner revenue recovers two to five months after a halving, and after that Bitcoin price goes vertical.”

Bitcoin is trading at $62,373 at time of writing, about 15% below the all-time high reached in March.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3

Leave a Reply