- U.S. spot Bitcoin ETFs see net inflows, signaling growing confidence.

- Hong Kong ETFs experience outflows, U.S. spot Bitcoin ETF trading volume declines globally.

Today marks a significant moment for Bitcoin [BTC] enthusiasts, as U.S. spot Bitcoin exchange-traded funds (ETFs) have returned to net inflows.

After four consecutive weeks of outflows, the total inflows reached $116.8 million last week. This resurgence in investor confidence comes amidst a 1.98% price dip in the leading cryptocurrency over the past 24 hours.

Increased investor interest

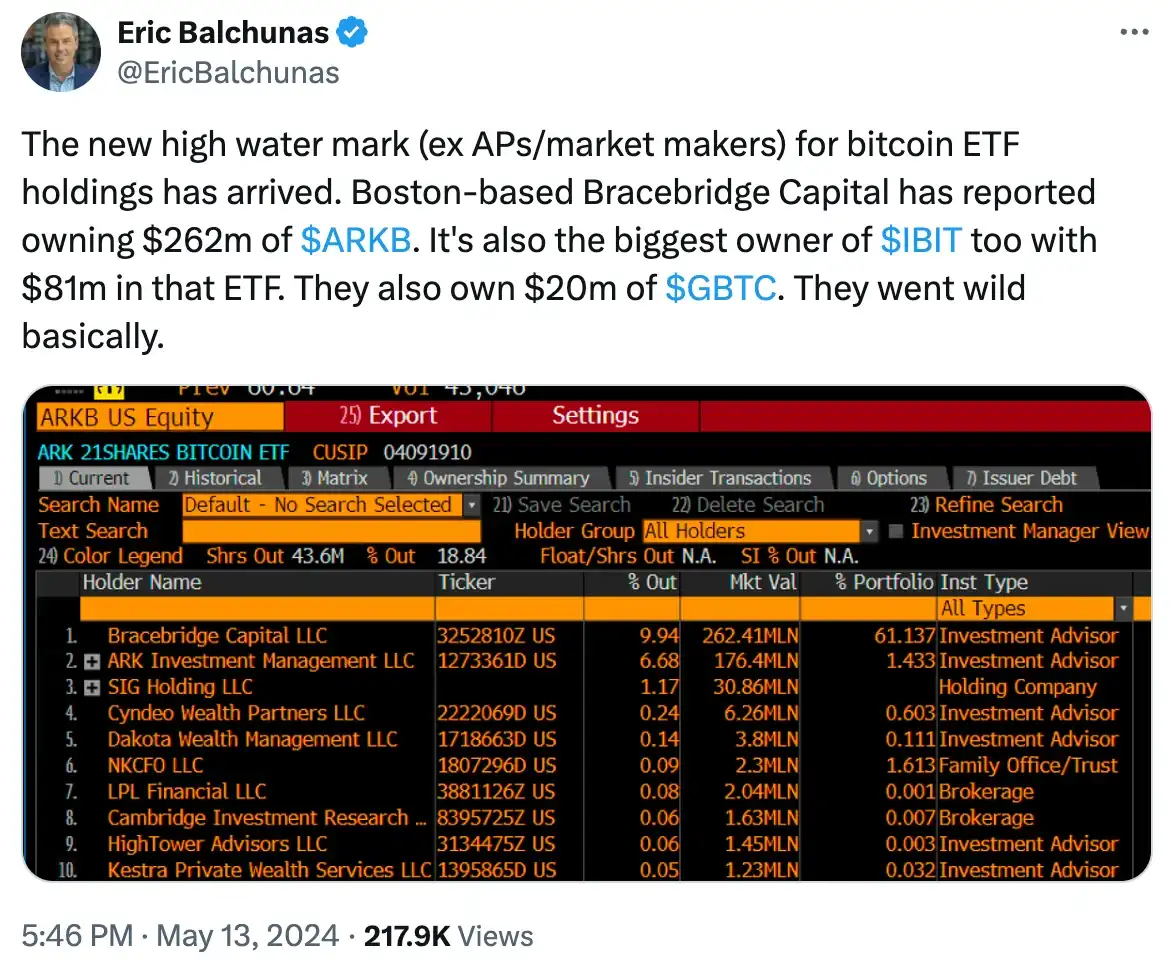

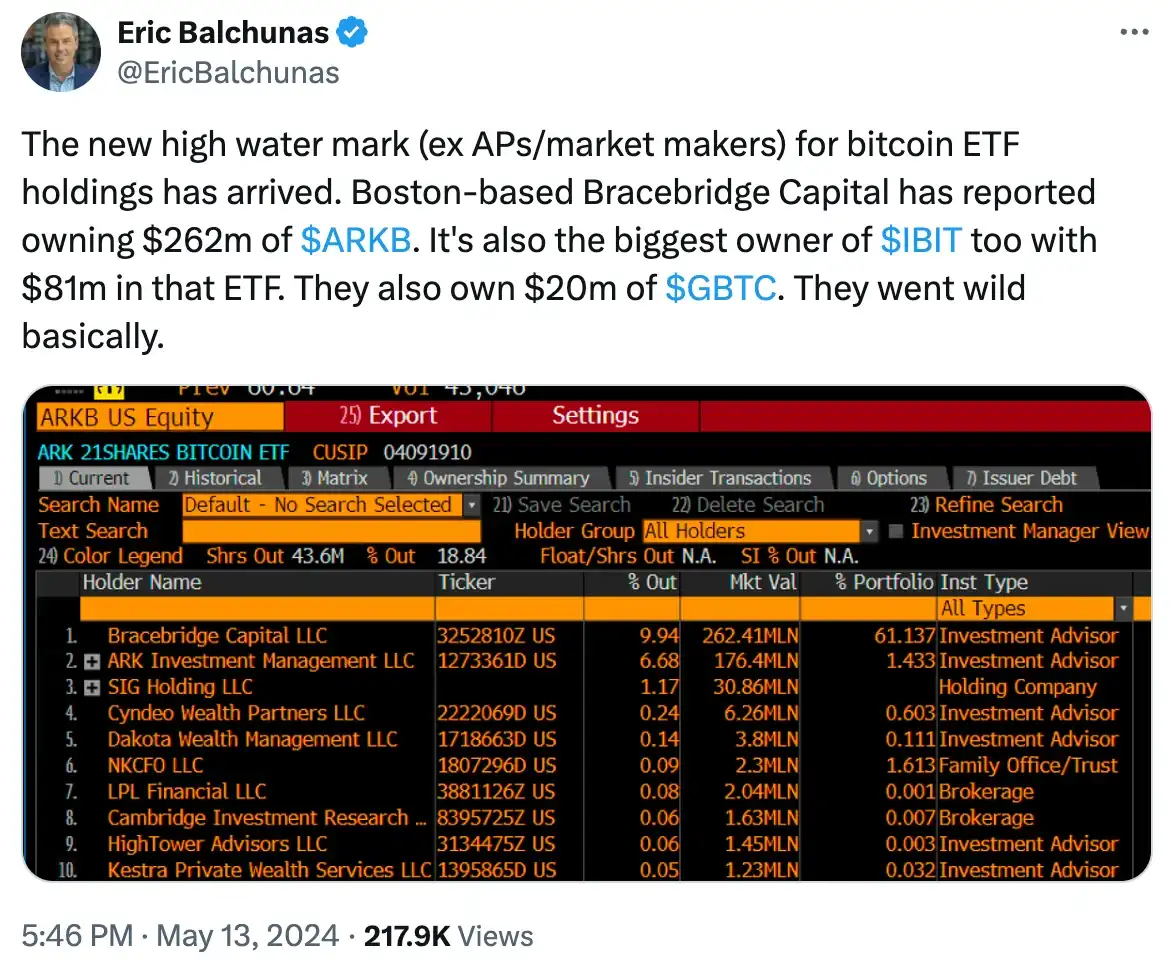

Despite the price uncertainty, there’s a notable uptick in investor interest, as evidenced by recent developments. Bracebridge Capital disclosed a $363 million investment in spot Bitcoin ETFs via an SEC filing.

Moreover, J.P. Morgan’s clients also recently invested $731,246 in spot Bitcoin ETFs, as revealed on the 14th of May.

Additionally, U.S. banking giant Wells Fargo entered the fray, holding 2,245 shares of GBTC valued at $121,207, and the list goes on.

Drawing insight on the same, Eric Balchunas, senior ETF analyst for Bloomberg, took to X (formerly Twitter) and noted,

Source: Eric Balchunas/X

Furthermore, BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has reached a significant milestone, surpassing its competitors in corporate holder count.

Since its inception till date, the BlackRock Bitcoin ETF has attracted 250 corporate holders.

Amidst the burgeoning investor interest, discussions have been widespread within the cryptocurrency community.

In a recent tweet, an X user @SirJonasz shed light on the Bitcoin ETF exposure of leading banks

“They FUD #crypto in public and buy in private.”

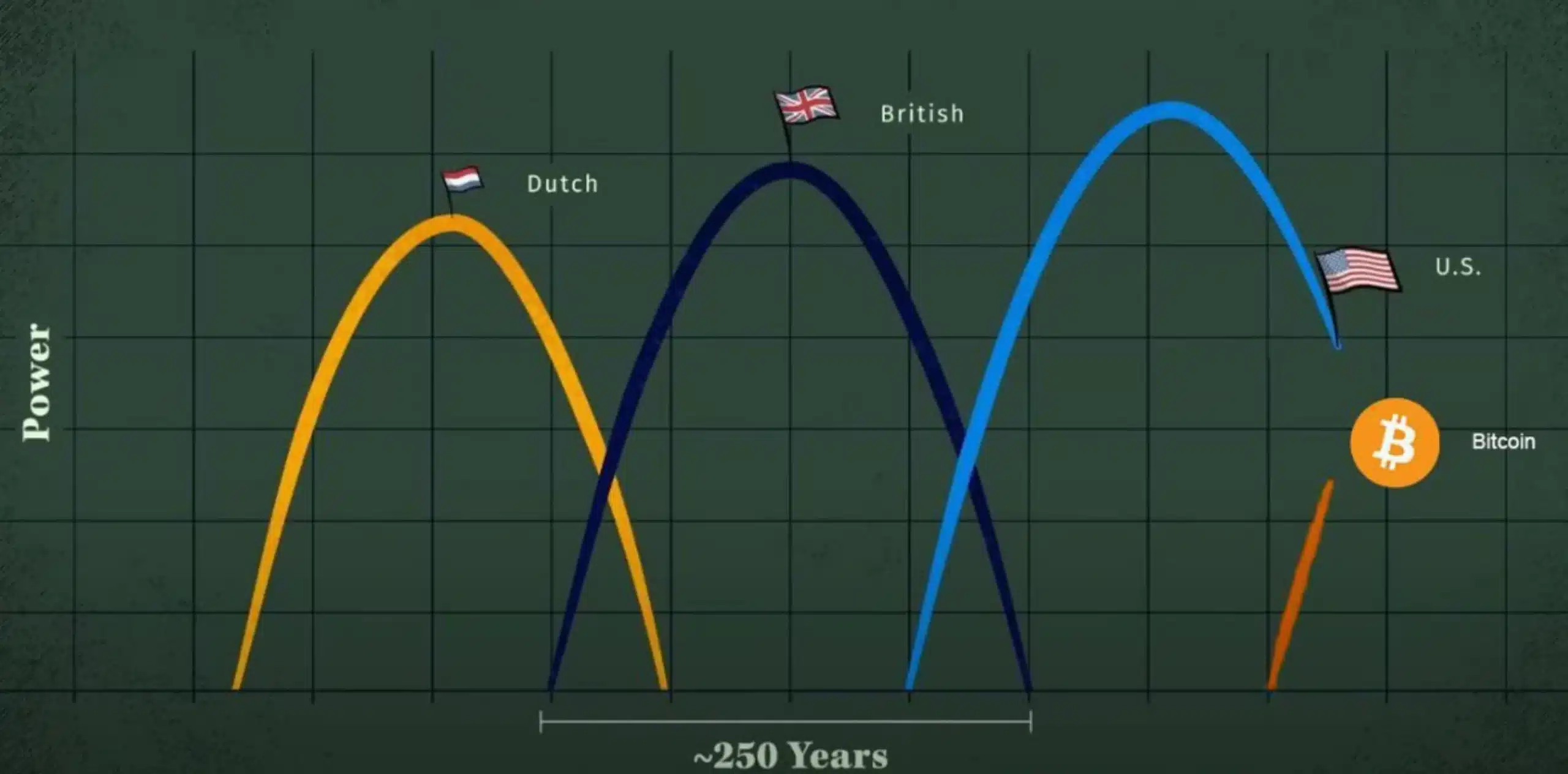

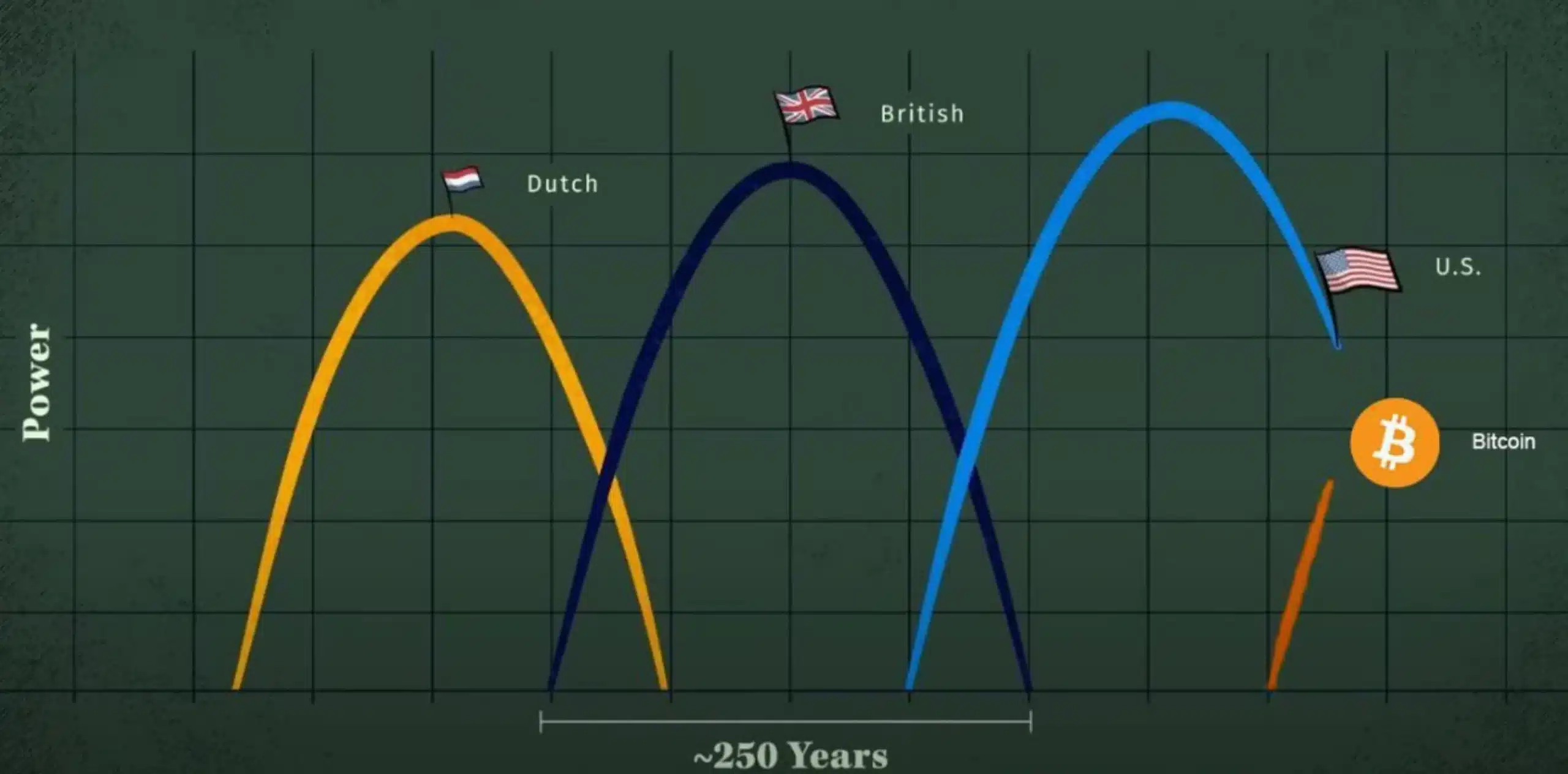

On similar lines, @Vivek4real_ added,

“We are entering a new era.”

Source: Vivek/X

According to the on-chain metric analysis The Block, Grayscale’s Bitcoin Trust saw $171.1 million outflows last week, contrasting with $63 million inflows on the 3rd of May.

Fidelity’s FBTC led with $111.3 million inflows, followed by ARKB with $82.8 million. BlackRock’s IBIT had $48.1 million in inflows, marking a slowdown from peak inflows in March.

Hold your horses

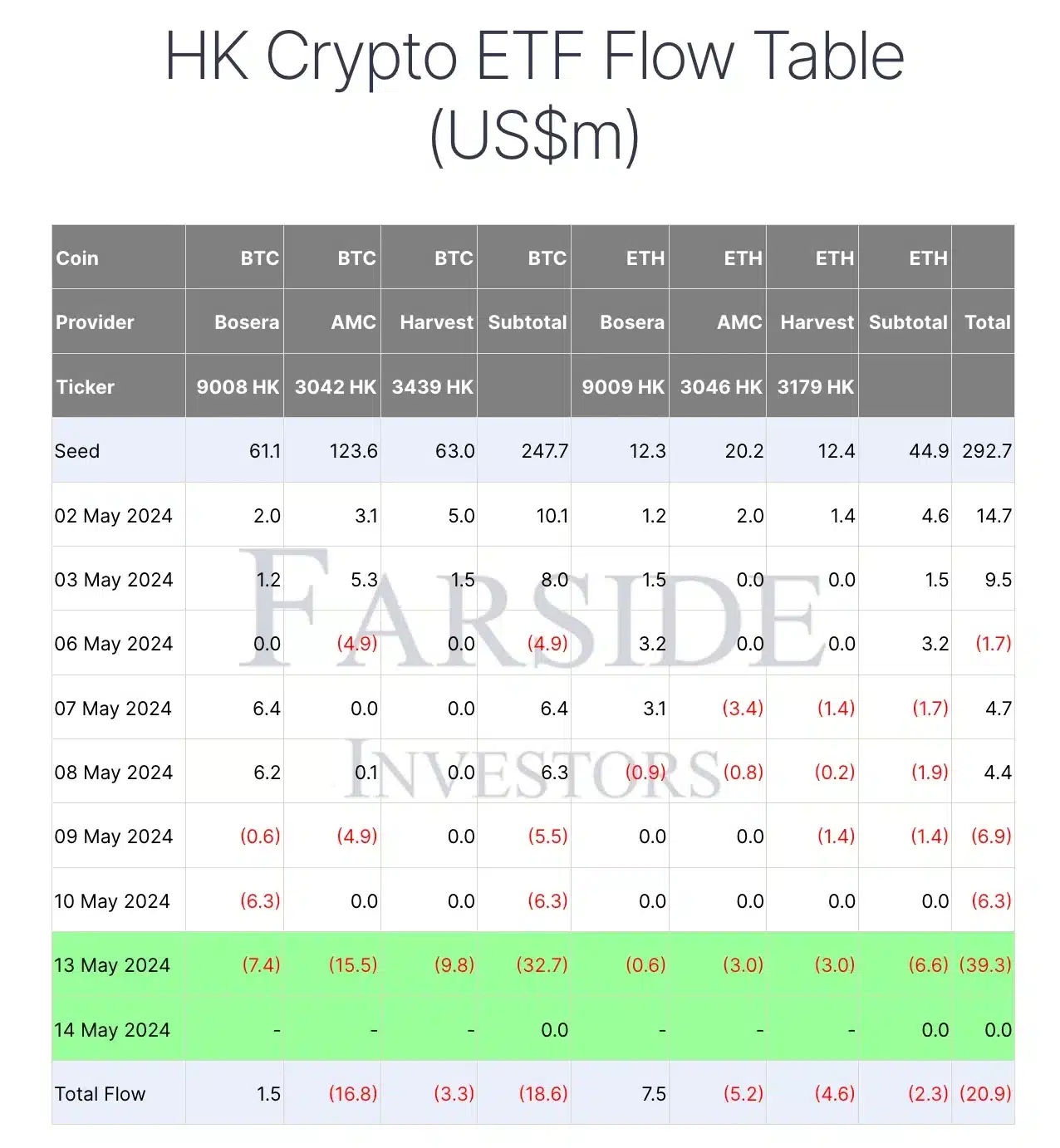

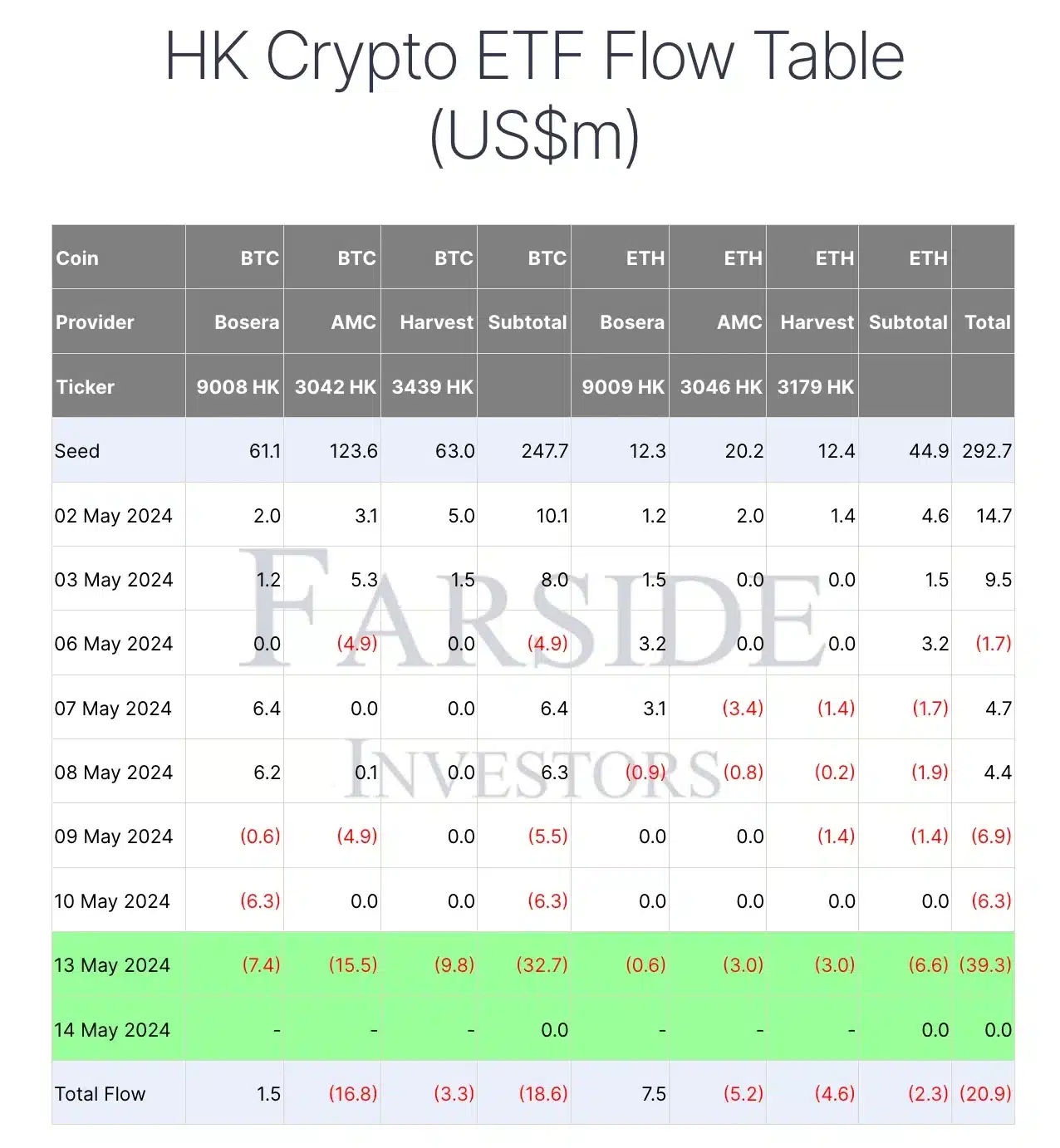

However, amidst such massive inflows, strangely Hong Kong ETFs experienced significant outflows on the 13th of May.

Data from Farside Investors indicates that spot bitcoin ETFs offered by ChinaAMC, Harvest Global, Bosera, and Hashkey collectively saw outflows totaling $32.7 million.

Source: Farside Investors

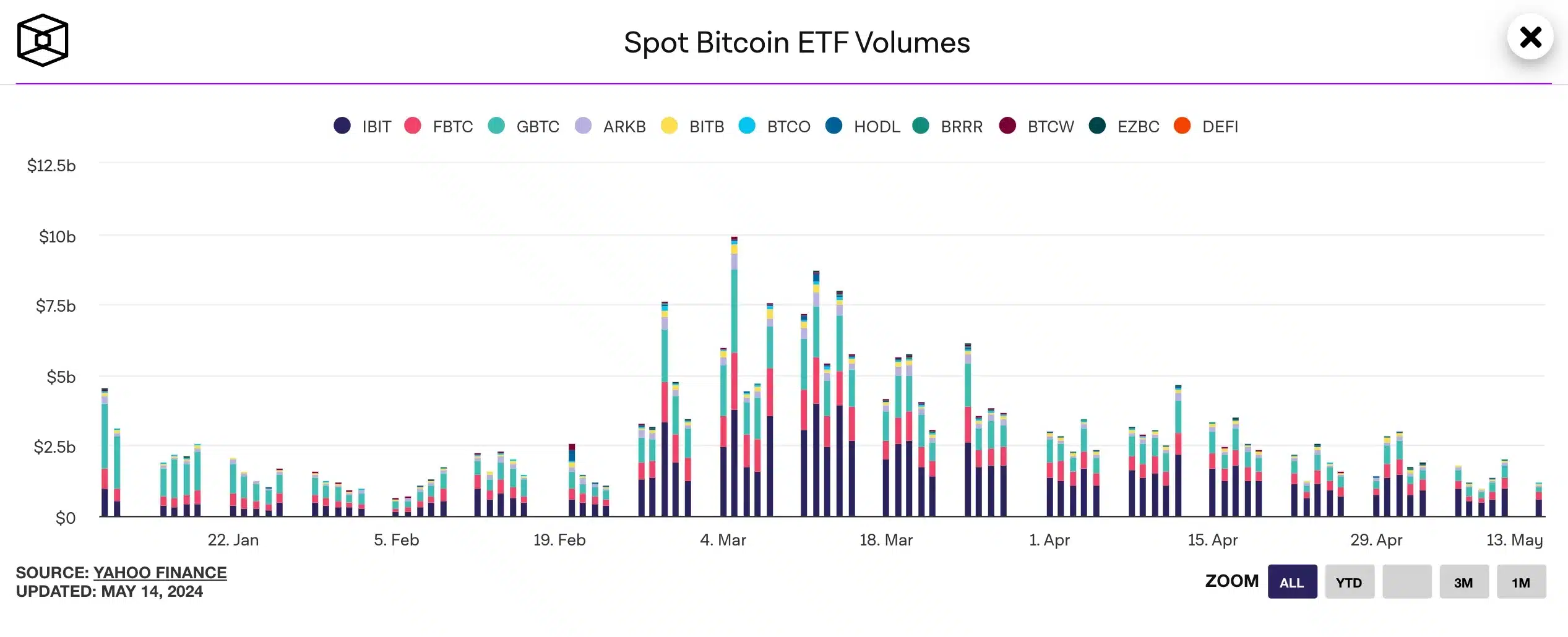

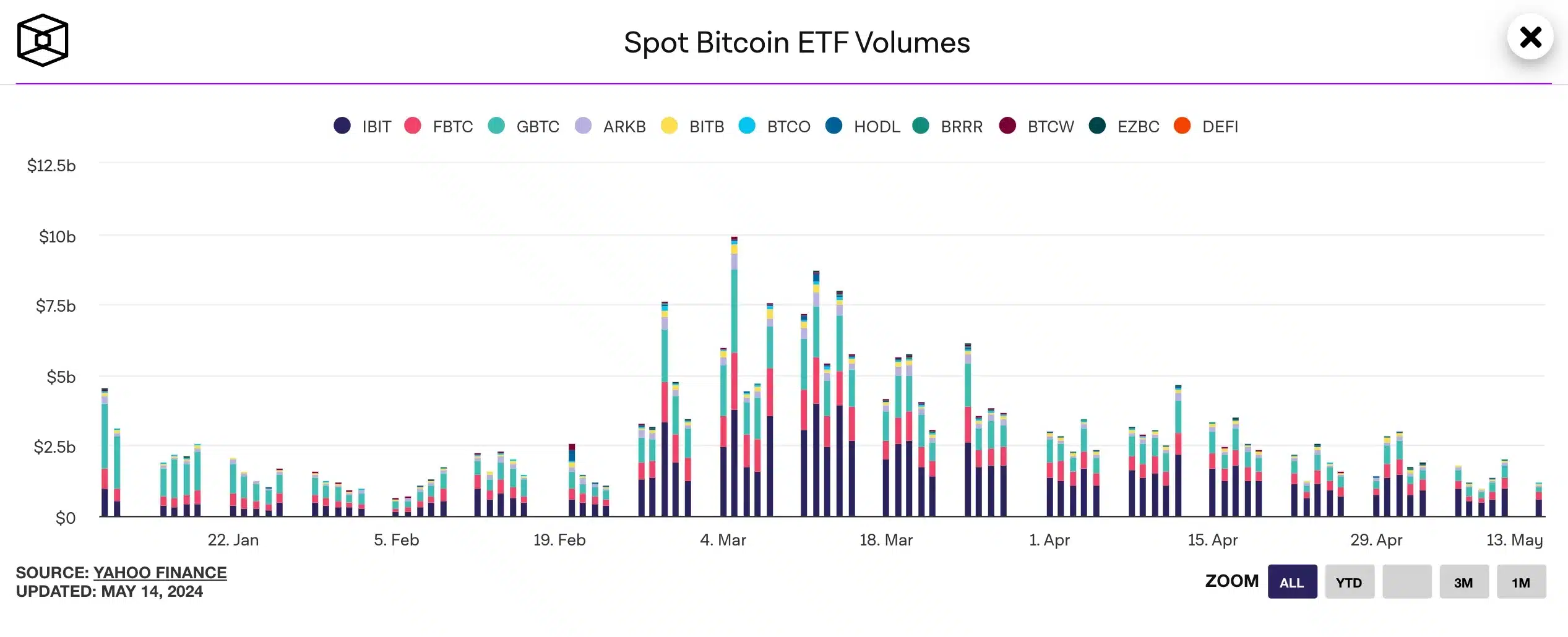

Additionally, despite a reversal in flows, trading volume for U.S. spot bitcoin ETFs declined to $7.4 billion last week, compared to the previous week’s $11 billion, as reported by The Block’s data dashboard.

Source: The Block

This decrease in volume was also reflected in the global crypto exchange-traded product market, which fell to $8 billion from an April weekly average of $17 billion.

Lastly, daily trading volume notably declined after hitting a record high of $9.9 billion on March 5, coinciding with bitcoin’s surge past its previous cycle peak of around $69,000.

Thus, as things evolve, the question remains unanswered — Could the increased institutional investment in Bitcoin ETFs reshape how people enter Bitcoin?

Leave a Reply