- An analyst spotted a descending channel on Shiba Inu’s price chart, suggesting a 20% rally.

- Many SHIB tokens were taken off exchanges, reinforcing the prediction.

According to Ali Martinez, a crypto analyst, Shiba Inu [SHIB] might be set for a 20% rally. Martinez, who posted this on X, gave reasons for this thesis.

From his post, the analyst shared a 4-hour SHIB/USD chart which showed the token in a descending channel.

For those uninitiated, a descending channel appears when two downward trendlines are drawn above and below a price.

In this case, the upper trendline represents resistance while the lower one indicates a support level.

AMBCrypto observed that the Shiba Inu native token had formed lower highs and lower lows across five trendlines, confirming this bias that a breakout could be close.

Source: X

SHIB is undervalued

As of this writing, the memecoin changed hands at $0.0000236— a 7.42% increase in the last 24 hours. This increase suggested that SHIB might have begun the breakout journey.

Should this continue, then SHIB might hit $0.00002954 within a few days.

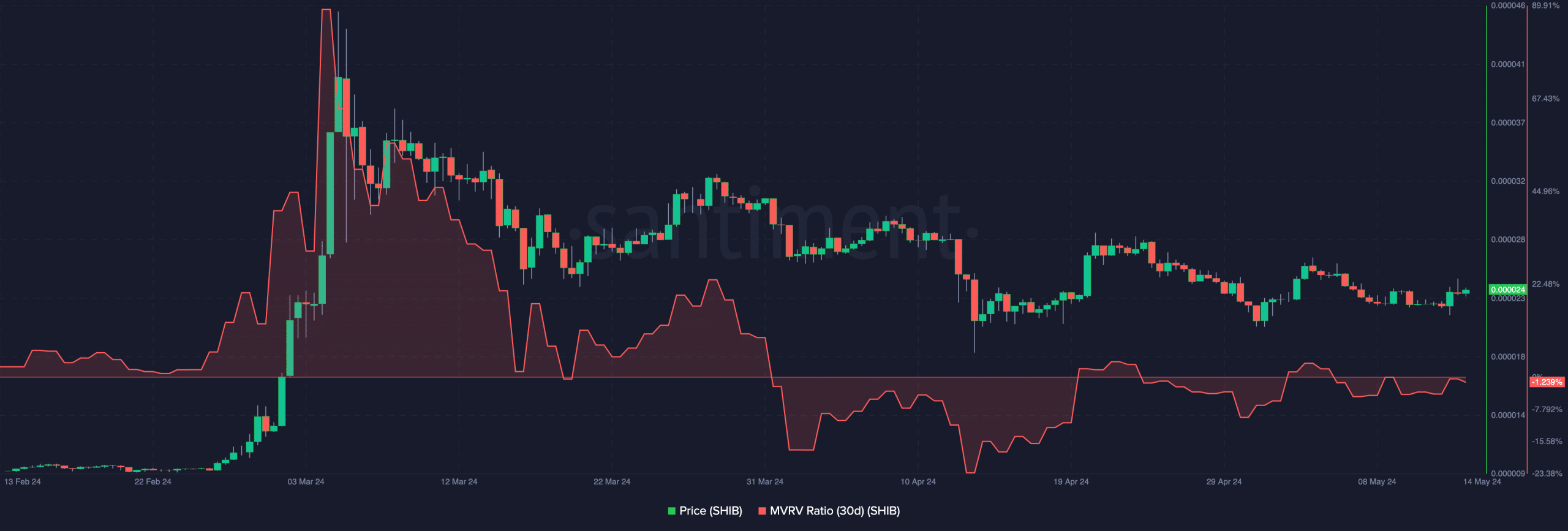

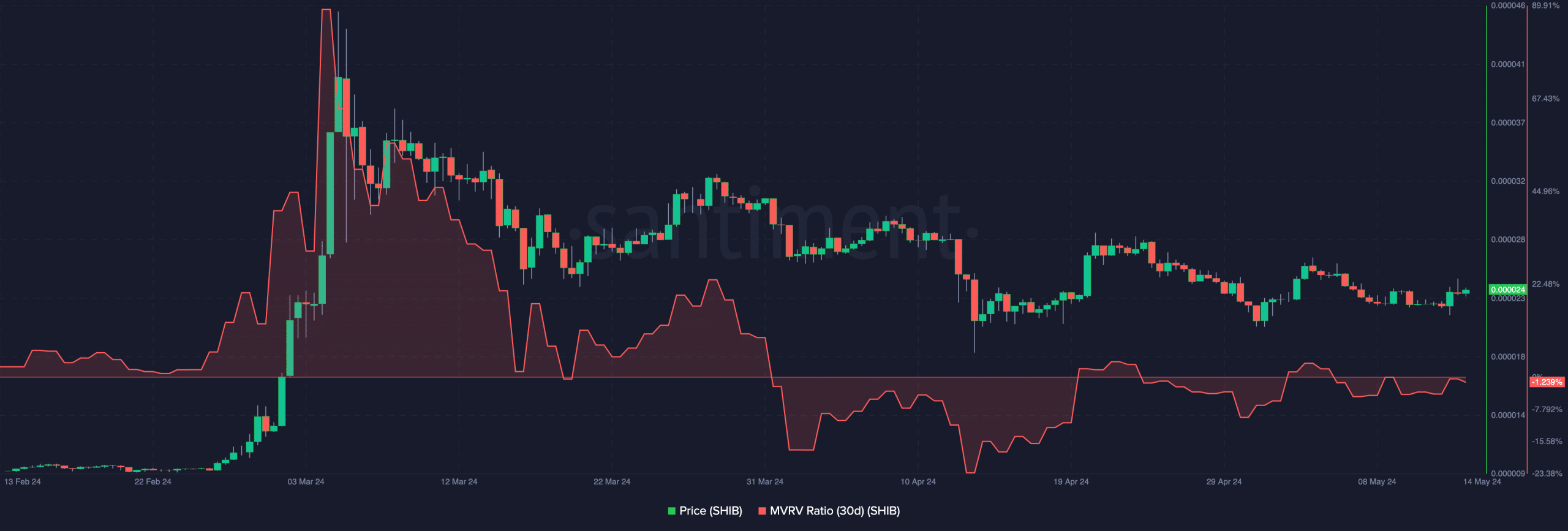

Furthermore, AMBCrypto’s on-chain analysis using the Market Value to Realized Value (MVRV) ratio suggested that this opinion could be valid.

The MVRV ratio metric measures profitability and tells if a cryptocurrency is undervalued or not.

At press time, Shiba Inu’s 30-day MVRV ratio was -1.239%, meaning that holders who purchased the token will get this average loss if they sell at the current price.

But that is not something most participants would do. Hence, SHIB could be tagged undervalued. Since the ratio is closing in on the positive region, the price might increase, and the bullish thesis might be validated.

Source: Santiment

HODL is the mantra

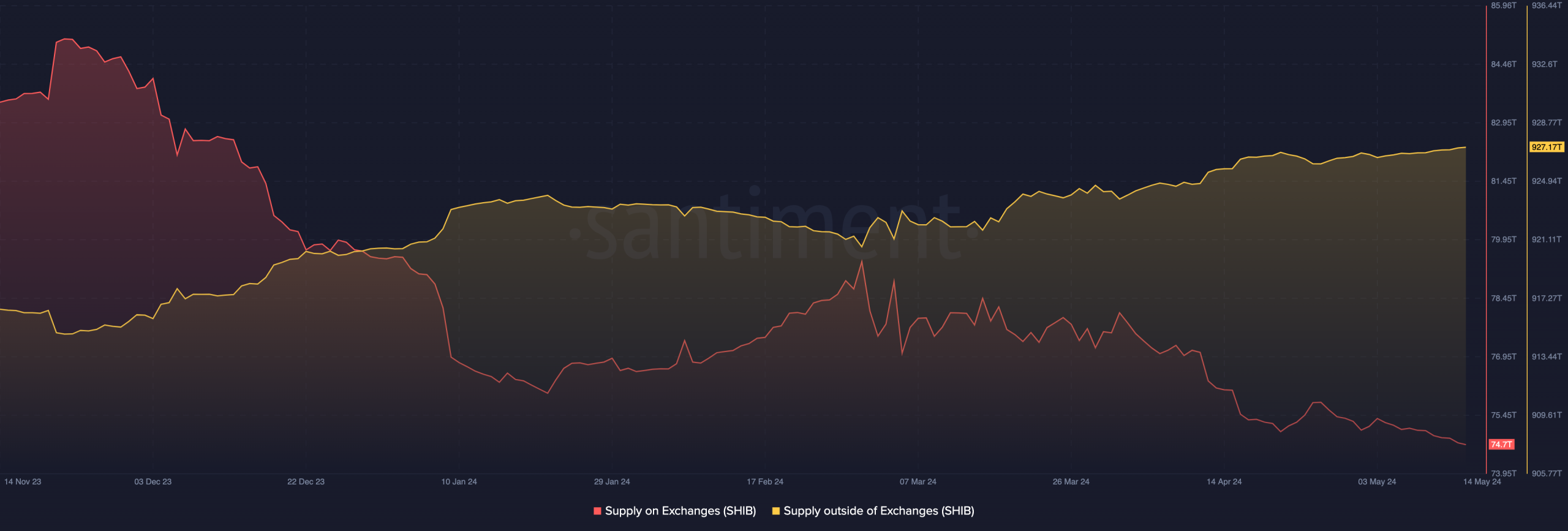

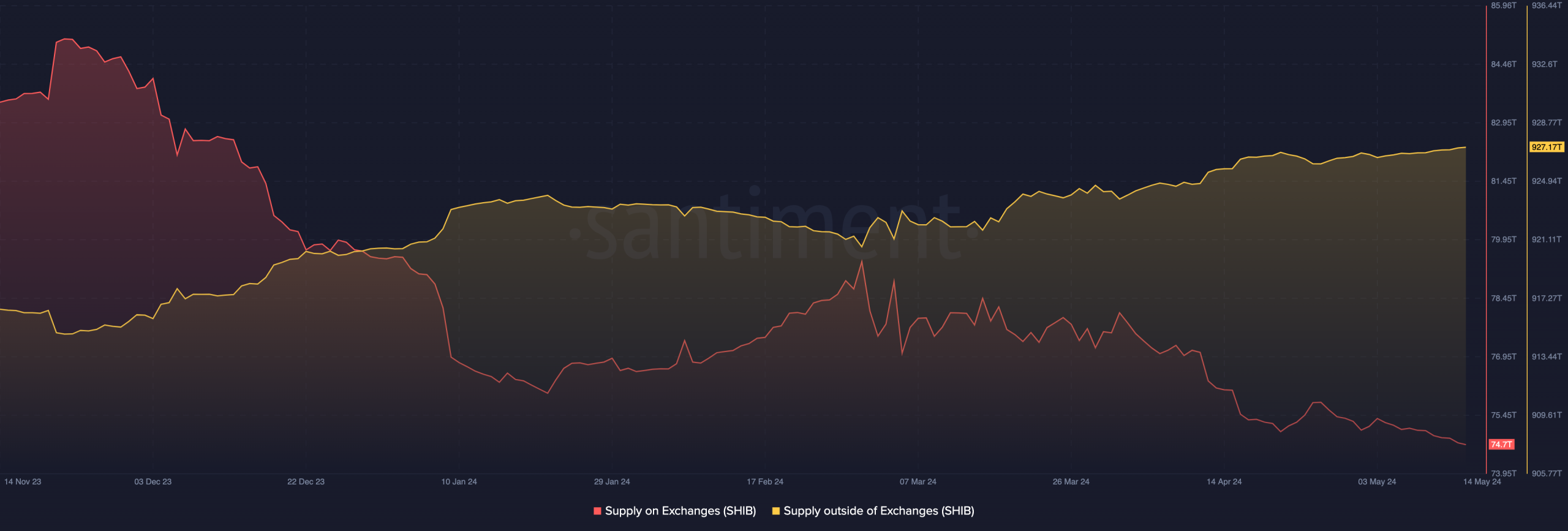

Apart from the metric above, AMBCrypto also looked at what is happening on exchanges. This time, we considered the token’s supply on exchanges and those outside of them.

An increase in exchange supply indicates that traders are holding Shiba Inu for the short term, and could pull the plug on the asset anytime. If it decreases, it means that a rise in the decision to HODL.

It’s the other way around for the supply outside of exchanges. At press time, SHIB’s supply on exchanges was down to 74.7 trillion. On the other hand, the supply outside had increased to 927.17 trillion.

Source: Santiment

The difference in the metrics was proof that many holders of the memecoin believe in its long-term potential. As such, the cryptocurrency might not experience major selling pressure in the short term.

Read Shiba Inu’s [SHIB] Price Prediction 2024-2025

Beyond that, the $0.00002954 prediction might come to pass, provided that the sentiment in the market does not change.

On a larger timeframe, SHIB’s price might rise much higher than this target. However, this would only be the case, if the exchange supply does not hit hundreds of trillions.

Leave a Reply