CCData, authorized by the FCA as a benchmark administrator, stands as a global leader in digital asset data. It serves both institutional and retail investors by providing high-quality, real-time, and historical data. With a proven track record in data expertise, CCData offers thought-leadership reports and analytics that deliver objective insights into the digital asset industry.

The CCData Exchange Review meticulously tracks significant developments within the cryptocurrency exchange market. This review encompasses detailed analyses of exchange volumes, focusing on aspects such as crypto derivatives trading, market segmentation by exchange fee models, and comparisons between crypto-to-crypto and fiat-to-crypto volumes. It also includes examinations of Bitcoin trading across various fiat currencies and stablecoins, a ranking of top crypto exchanges by spot trading volume, and historical volume trends of top trans-fee mining and decentralized exchanges. Published monthly, the CCData Exchange Review is designed for a wide audience ranging from crypto enthusiasts seeking a comprehensive market overview to investors, analysts, and regulators looking for in-depth analysis.

April 2024 has marked a significant shift in cryptocurrency trading dynamics, as detailed in the latest edition of CCData’s Exchange Review. Following a robust period in March, the combined volume of spot and derivatives trading on centralized exchanges experienced a sharp decline of 43.8%, totaling $6.58 trillion. This downturn can be attributed to a confluence of factors, including unexpected macroeconomic data, increased geopolitical tensions in the Middle East, and negative net flows from U.S. spot Bitcoin ETFs.

Impact of Bitcoin Halving and Macroeconomic Factors

The report pinpoints the Bitcoin halving event as a pivotal moment that influenced trading behaviors significantly. Historically a catalyst for increased market activity, this year’s halving coincided with a drop in investor confidence and a decrease in market liquidity, contributing to the reduction in trading volumes. The geopolitical crisis and unsettling macroeconomic data further exacerbated the market’s retreat, reversing many of the gains seen in the previous month.

Specifics of Trading Volume Declines

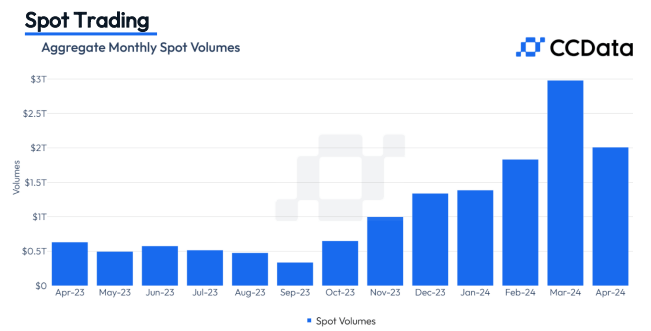

On centralized exchanges, monthly spot trading volumes fell by 32.6% to $2.01 trillion, marking the first decline in seven months.

Source: CCData’s April 2024 Exchange Review Report

Derivatives trading was hit even harder, with volumes plummeting by 47.6% to $4.57 trillion. Consequently, derivatives market dominance decreased to 69.5%, continuing a seven-month downward trend.

Binance’s Market Position

April was particularly challenging for Binance, one of the leading crypto exchanges. Its spot trading volume dropped by 39.2% to $679 billion, and derivatives trading volume decreased by 27.7% to $2.03 trillion. These declines led to a reduction in Binance’s overall market share by 2.41% to 41.5%, marking its lowest spot market share since January 2024 at 33.8%. The downturn for Binance also aligns with legal challenges faced by its founder, Changpeng Zhao, who was recently sentenced to four months in prison for violations of U.S. money laundering laws. Since appointing a new CEO in November 2023, the exchange had initially seen a growth in market share, indicating that leadership changes have had a mixed impact.

CME’s Trading Volumes and Market Share

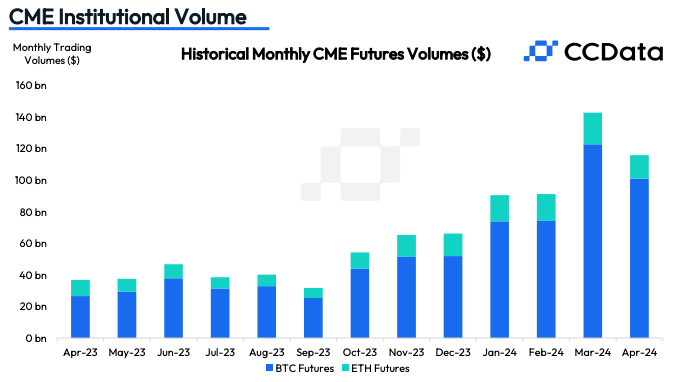

The Chicago Mercantile Exchange (CME) also recorded declines in trading volumes across its cryptocurrency futures products. The total derivatives trading volume fell by 19.8% to $124 billion.

Source: CCData’s April 2024 Exchange Review Report

Specifically, Bitcoin futures dropped by 17.7% to $101 billion, and Ethereum futures saw a more significant decline of 25.9% to $14.9 billion. Despite these reductions, CME’s market share in the derivatives sector marginally increased by 0.14% to 2.66%, benefiting from even steeper declines in other centralized exchanges.

The Broader Impact

The notable decrease in open interest on BTC instruments on CME, which fell by 35.3% to $7.59 billion, the lowest since February 27th, mirrors the retreat seen across the broader market. This decline in trading activity and open interest suggests that institutional traders are becoming more cautious, likely due to the cumulative effect of market uncertainties and regulatory concerns.

Featured Image via Pixabay

Leave a Reply